🏆 Top Articles of 2025

You didn't want to miss these posts

Welcome to the Free edition of How They Make Money.

Over 260,000 subscribers turn to us for business and investment insights.

Today, we revisit some of the most popular articles published by App Economy Insights in 2025.

I publish articles across two services:

How They Make Money (via Substack):

Weekly business breakdowns for visual thinkers.

Over 200 companies visualized quarterly for Premium members.

Weekly earnings updates on 200+ market leaders for PRO members.

App Economy Portfolio (via Seeking Alpha):

Popular investing group where I share my entire stock portfolio.

Monthly deep dives, live trades, and watch lists.

Timely quarterly updates on 70+ holdings.

Stock ratings (BUY, SELL, or HOLD).

It’s the last post of 2025. So, it’s time to reflect!

It’s been another incredible year for App Economy Insights:

216 articles published, including:

52 free posts on How They Make Money.

56 posts on How They Make Money Premium.

48 posts on How They Make Money PRO.

60 posts on App Economy Portfolio.

A partnership with Fiscal.ai to empower our readers to make charts.

Over 50 million views across posts and social media.

Over 600,000 followers & subscribers across all our channels.

How They Make Money has been a best-selling Substack newsletter.

Our growth has been primarily through word-of-mouth, so thank you for putting the word out! We made it even easier to get rewarded for sharing our content through our referral program.

I cannot say this enough. Your support means the world to me and allows me to do this full-time!

Most popular posts in 2025

Before we start 2026, here are 12 of the most popular posts of 2025.

Best and worst investments of 2025

2025 was another great year to be an investor.

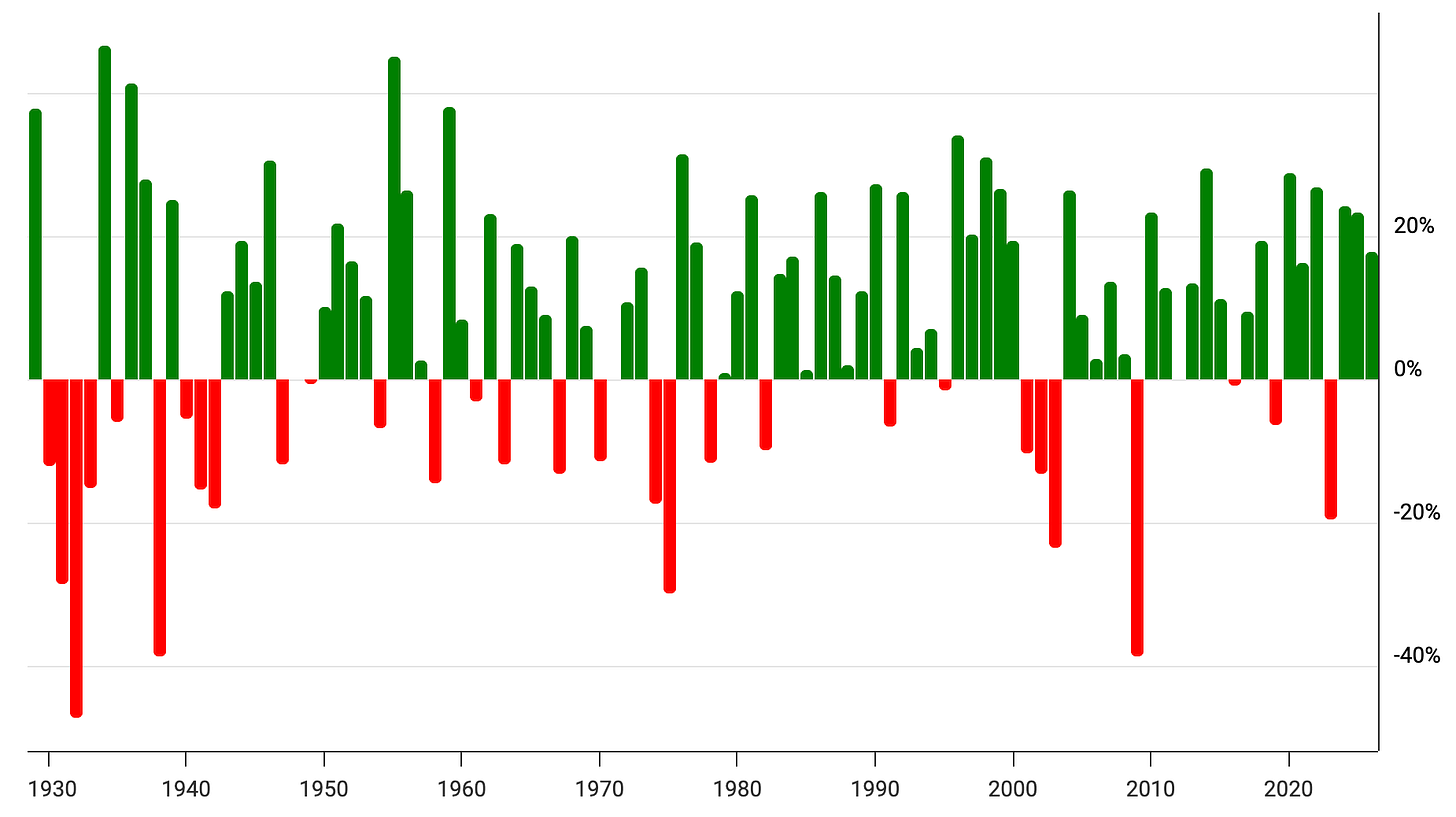

Chances are, you are pretty happy with your portfolio today. After a catastrophic 2022, the market rose over 20% in 2023 and 2024, and now 18% in 2025.

The S&P benchmark returned an average annual 10% from 1926 to 2024, and 74% of years were positive. The longer the time horizon, the higher the chance of positive returns. If you want to stack the deck in your favor, the easiest step by far is to trade less and ignore the doomsayers.

“Pessimists sound smart. Optimists make money.”

I share my stock portfolio with a community of long-term-focused investors. So I wanted to share the best and worst-performing investments this year:

📈 Best investment: AppLovin (APP): In March 2025, I wrote: “Several short reports have targeted the company, but they generally come from low-level analysts or content creators with no reputation or research teams. Conversely, hedge funds like Baillie Gifford, Coatue, and Sands Capital have invested in APP.” The market has been underestimating the leverage within AppLovin’s software platform. As the AI-driven AXON engine continues to optimize ad matching, we are seeing a decoupling of revenue growth from operational costs, leading to a massive repricing. The stock has nearly tripled since then, dramatically outperforming the market.

📉 Worst investment: The Trade Desk (TTD): I added to my existing position in February 2025, aiming to capitalize on what appeared to be a reasonable entry point. Since then, the stock has struggled with sentiment shifts in the ad-tech category and a slowdown in revenue growth, partially explained by tough comps from US political spending in 2024. The stock is down 50% from that specific purchase, making it our worst investment this year. TTD has also been the worst performer in the S&P 500. But consider this: TTD has been a holding since 2017, and despite the recent drawdown, the stock price remains over 10x our initial purchase price. It's another great reminder, if you needed one, that zooming out and keeping a long-term view is critical in investing.

You can expect How They Make Money to expand even more in 2026.

What business or topic do you want to learn about?

Let us know in the comments or reply to any of my emails. I read everything!

Thank you for tagging along!

I wish you and yours a wonderful 2026. ✨

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Disclosure: I am long AAPL, AMZN, GOOG, META, PLTR, UBER, and TSLA in the App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members here.