🚖 Tesla vs. Uber: Collision Course?

Bill Ackman’s new Uber stake reignites the autonomy debate

Welcome to the Premium edition of How They Make Money.

Over 180,000 subscribers turn to us for business and investment insights.

In case you missed it:

Billionaire investor Bill Ackman just announced a $2.3 billion stake in Uber, acquiring 30 million shares through Pershing Square—his hedge fund known for high-conviction bets. He called Uber a “highly profitable and cash-generative growth machine,” fueling a rally in the stock and sparking a heated debate among investors.

Autonomous Vehicles (AVs) split Uber investors into two camps:

📈 Bull case: If ridesharing is a winner-takes-most market, Uber looks unstoppable. With a growing network of drivers and AV partners, global reach, and an expanding Uber One subscription base offering cross-product discounts, Uber is becoming the Amazon Prime of rideshare. Its ability to aggregate all use cases gives it a moat that AV-only competitors may struggle to match.

📉 Bear case: What if Tesla’s robotaxi fleet changes everything? Elon Musk has promised a fully autonomous Cybercab network that could undercut Uber’s cost structure. It would offer the same capital-light model but without driver costs. If Tesla can scale a fleet of AVs owned by individuals, Uber and its AV partners may lose pricing power, eroding their core business.

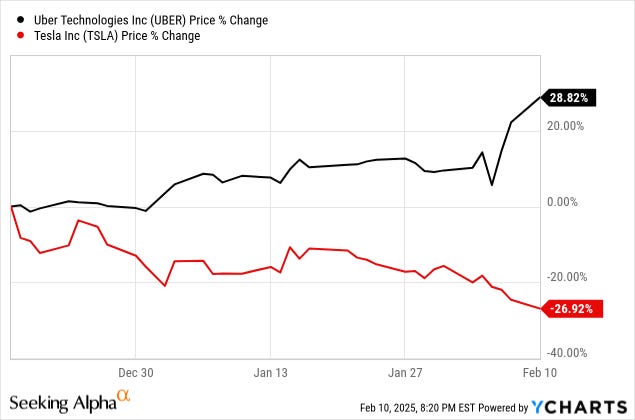

Ackman’s bold bet triggered a wave of bearish takes on X, with some arguing that Uber’s long-term value in a driverless world is zero. It’s a provocative claim—but is it really that simple? The reality is far more nuanced, and the market doesn’t seem to agree with Tesla bulls in the past two months.

What’s next?

Uber and Tesla just released their latest earnings reports, offering key insights.

Today at a glance:

Uber’s AV strategy.

Tesla’s autonomy timeline.

1. Uber’s AV strategy

Reminder on Uber’s lexicon:

🙋♀️ MAPC (Monthly Active Platform Consumers): End-users completing a ride or delivery (called a "trip") during the month.

💵 Gross Bookings: Total dollar value consumers spend on Uber apps (excluding tips). It illustrates Uber’s scale.

Uber operates three core segments:

🚗 Mobility (ridesharing): 52% of gross bookings.

🛵 Delivery (food, groceries, and more): 46%.

🚚 Freight (logistics): 3%.

Uber makes money by taking a cut of gross bookings (the “take rate”). Its asset-light aggregator model allows supply to match demand dynamically without the need for massive fleet investments. While switching costs are low, Uber benefits from brand power, scale, and network effects:

🚖 Supply: 17 million drivers and couriers in 2024.

🙋🏼♀️ Demand: Monthly users up 14% Y/Y to 171 million.

Now, Uber is applying the same aggregation model to AVs, partnering with autonomous vehicle companies that would struggle to scale alone due to massive capital investments and high utilization needs.

💡 It’s the ultimate win-win-win:

✅ AV companies get more utilization, boosting profitability

✅ Uber increases gross profit, even with a lower AV take rate

✅ Riders get lower prices from a larger supply pool

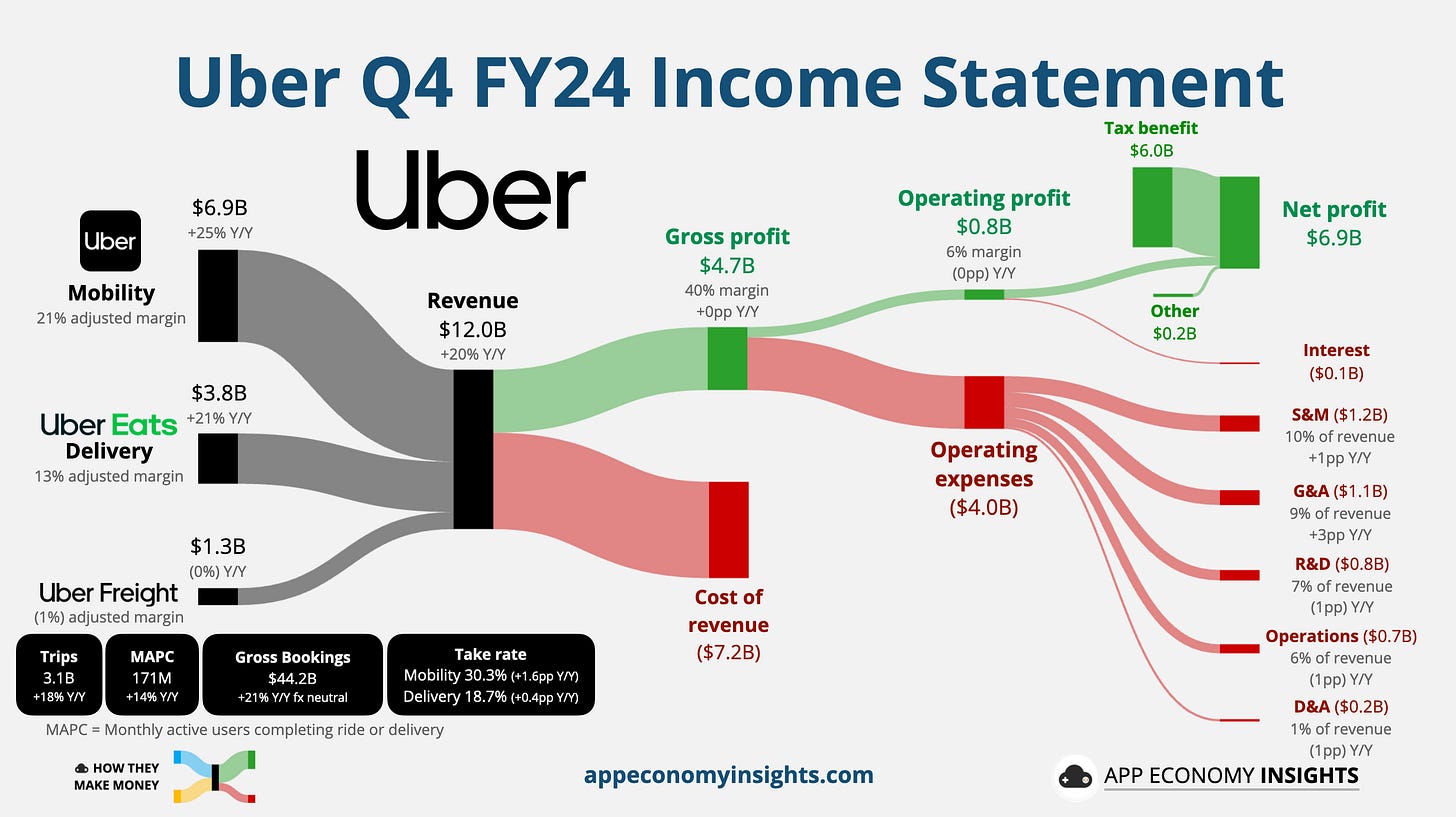

Uber’s Q4 FY24

All comparisons are year-over-year.

Platform growth:

🚗 Trips grew +18% to 3.1 billion.

🙋♀️ MAPC rose +14% to 171 million.

💵 Gross bookings grew +21% fx neutral to $44 billion ($0.7 billion beat).

Revenue and profitability:

Revenue grew 20% to $12.0 billion ($190 million beat).

Adjusted EBITDA expanded to a record 4.2% of gross bookings.

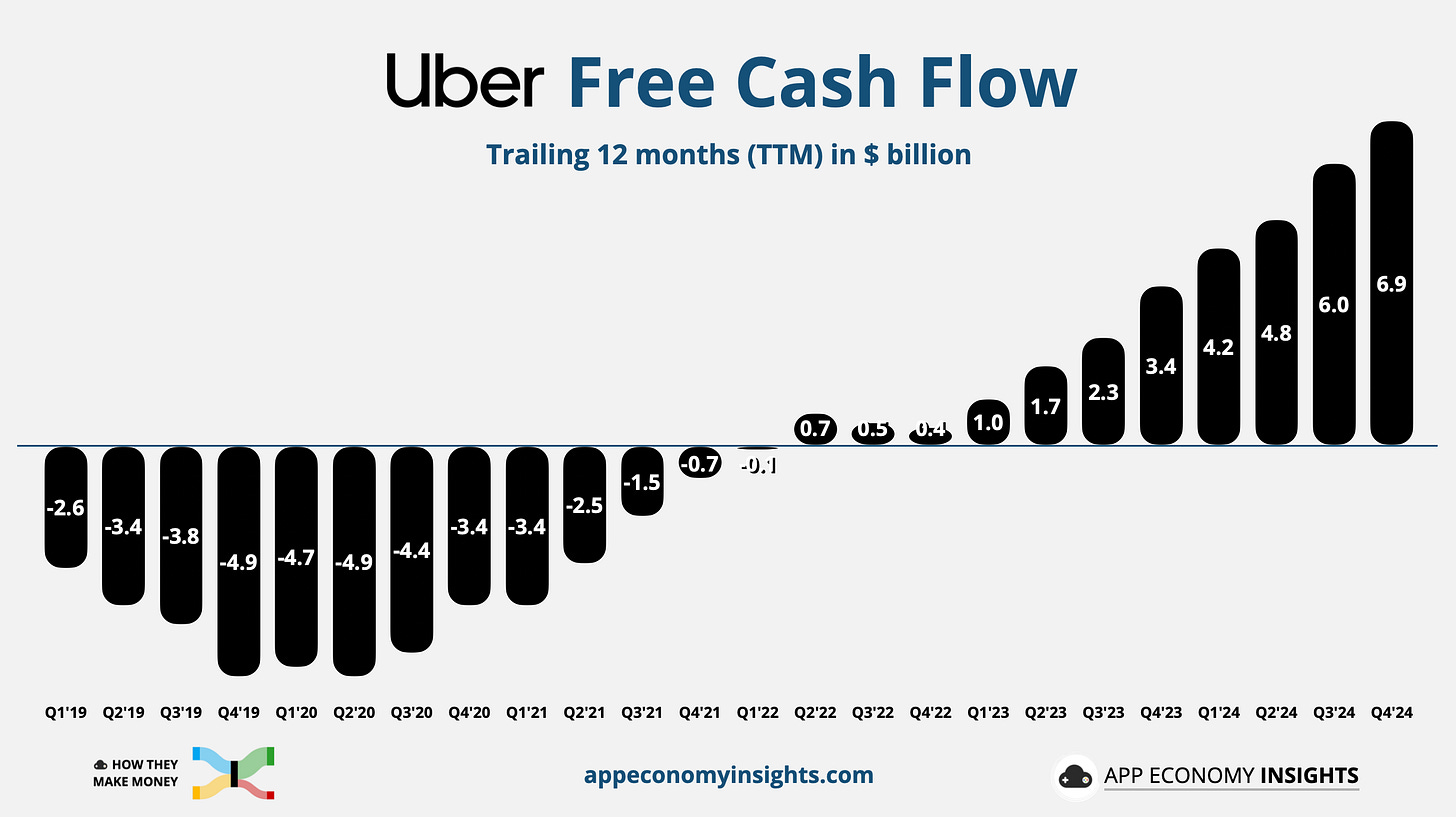

Free cash flow soared 122% to $1.7 billion (14% margin).

Segment performance:

🚗 Mobility: Gross bookings grew +24% fx neutral, driven by Uber for Teens (+50% Q/Q trip growth), premium offerings (Uber Business Black +50% Y/Y), and airport-focused products (UberX Share at 10 major hubs).

🛵 Delivery: Gross bookings accelerated to +18%, crossing the $20 billion mark for the first time. Growth was fueled by higher Uber One adoption, grocery expansion (Home Depot, Wegmans, Stew Leonard’s), and merchant-funded offers ($1 billion redeemed, +60% Y/Y).

🚚 Freight was flat, facing ongoing macro headwinds.

Key takeaways:

📊 Strong execution, but profit miss: Adjusted EBITDA soared 44%Y/Y to a record $1.8 billion yet fell just shy of expectations. Operating income of $0.8 billion missed sharply ($1.2 billion expected) due to $0.5 billion in legal/regulatory costs impacting profitability.

📈 Profit rise: Adjusted EBITDA reached a record 4.2% of gross bookings, thanks to a higher take rate and operating leverage.

📱 Uber One membership surged 60% Y/Y to 30 million, driving engagement and spend (members spend 3x more than non-members).

🌍 Geographic expansion: Uber is expanding into lower-density areas, seeing 1.5x faster growth outside major metros. Investments in supply incentives, taxi integrations, and flexible pricing models (like Uber Reserve) are driving demand in suburban & international markets.

🛫 Expanding partnerships & offerings: New Delta Air Lines integration (300K+ waitlist for SkyMiles rewards), Uber Shuttle scaling in NYC, UberX Share expanding to airports, and a potential $2.99/month commuter pass.

💸 Stock buybacks continue: Uber has become a cash machine and repurchased $550 million in Q4 and launched a $1.5 billion accelerated share repurchase program, bringing total buybacks to $2.8 billion in 12 months.

🔮 Q1 FY25 guidance slightly missed expectations, with Gross Bookings expected to grow +17% to +21% Y/Y fx neutral and adjusted EBITDA projected to rise +30% to +37% Y/Y. Currency headwinds (-5pp impact) and January’s extreme weather were cited as key drags.