📱 AppLovin: The Next Ad Tech Giant?

AI and e-commerce fuel a 700% rally

Welcome to the Premium edition of How They Make Money.

Over 170,000 subscribers turn to us for business and investment insights.

In case you missed it:

Last week, I asked you to name your favorite investment for 2025.

One stock stood out: AppLovin (APP).

After a blockbuster IPO in 2021 and a rough 2022, AppLovin has staged a spectacular 700% rally in 2024, pushing its valuation past $100 billion.

While AI hype played a role, AppLovin’s business transformation is the true catalyst. Once focused on helping app developers grow, AppLovin has become a digital advertising powerhouse. After dominating mobile gaming, it’s now expanding into e-commerce—a far bigger prize.

But is this remarkable surge sustainable, or is it a case of inflated expectations?

Today at a glance:

From gaming to ad tech.

What caused the 2024 rally?

How AppLovin makes money.

The expansion into e-commerce.

Is the rally sustainable, or is it a bubble?

1. From gaming to ad tech

Early Days (2012-2016):

Co-founded in 2012 by Adam Foroughi, AppLovin started as a bootstrapped startup focused on user acquisition, analytics, and marketing tools for mobile app developers. Instead of relying on venture capital, Foroughi chose debt financing to maintain control, an unconventional move that shaped the company’s financial strategy.

The Gaming Pivot (2016-2018):

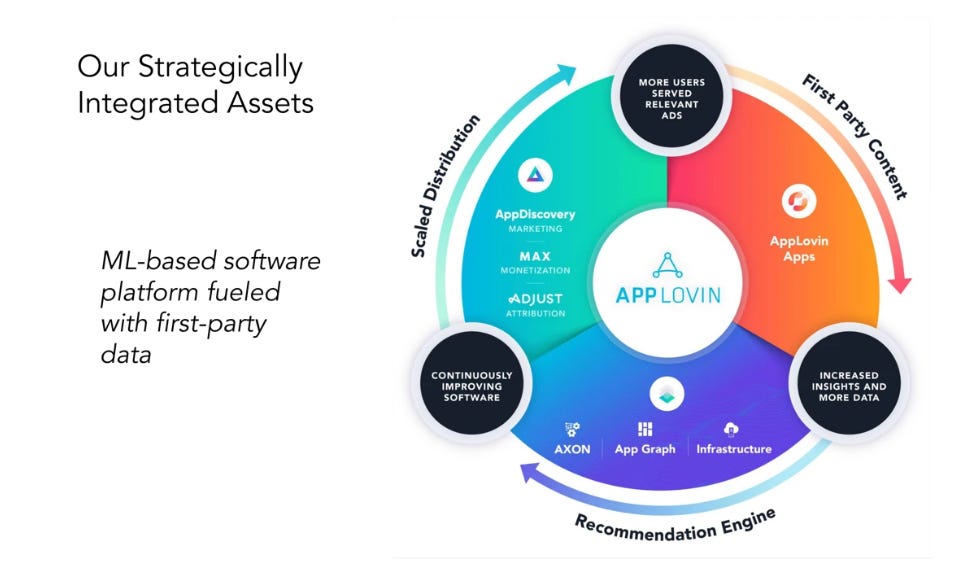

Recognizing mobile gaming’s rapid growth, AppLovin launched its own game publishing division in 2018, Lion Studios, and acquired game studios like Machine Zone and PeopleFun, building a diverse portfolio of games. While this raised concerns about conflicts of interest with software clients, the move provided valuable first-party data, crucial for improving its ad targeting capabilities.

Ad Tech Focus (2018-2021):

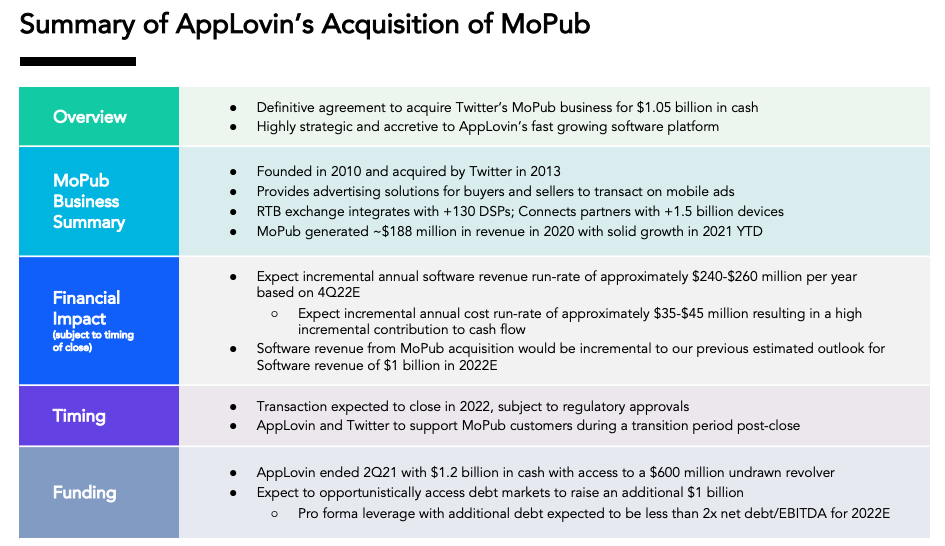

AppLovin launched a powerful in-app bidding platform called MAX in 2018. In 2021, it acquired Adjust, a leading mobile measurement partner (MMP), further strengthening its ad tech offering. The same year, AppLovin acquired MoPub from Twitter to consolidate its dominance in the mediation market. This acquisition provided a vast trove of data on ad network bidding behavior in a post-IDFA world (after Apple’s privacy changes).

The AXON Era and AI Focus (2021-Present):

The introduction of AXON, AppLovin’s AI-powered ad engine, marked another turning point. The company leveraged machine learning (ML) for ad targeting to improve campaign performance and efficiency.

Recognizing the diminishing strategic importance of its portfolio of games, AppLovin announced in early 2022 that it would start running it as a standalone ‘Apps’ division. The company began exploring options to sell or divest pieces of the Apps business, allowing it to streamline operations and focus on its core strength: the rapidly growing Software Platform (more on this in a minute).