💡 WTF is an ETF?

The low-cost funds taking over investing

Welcome to the Free edition of How They Make Money.

Over 170,000 subscribers turn to us for business and investment insights.

In case you missed it:

Warren Buffett said that when he dies, 90% of his wife’s inheritance will go into a single investment. He explained in his 2013 shareholder letter:

“My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund.”

That low-cost index fund? It will likely be an Exchange-Traded Fund (ETF).

ETFs have exploded in popularity, holding over $13 trillion1 in assets worldwide.

Think of an ETF as a basket of investments. 🧺

Inside, you’ll find stocks, bonds, or other assets bundled together into a single package. You get the benefits of diversification without the hassle of picking individual investments.

In this guide, we’ll visualize the biggest ETFs and explore more specialized options.

Ready to dive in? Let’s go.

1. The ABCs of ETFs

Instead of buying individual stocks or bonds, an ETF allows you to buy an entire basket. Inside, you’ll find a collection of assets that track a specific index, sector, or asset class.

Whether you’re looking to invest in a specific country or get exposure to an entire industry, there’s likely an ETF for that.

Why ETFs are so appealing:

Diversification: Instead of looking for a needle, you buy the entire haystack. It guarantees you won’t miss big winners in the category.

Easy to trade: Like stocks, ETFs can be bought and sold throughout the trading day.

Transparent: Most ETFs disclose their holdings daily, so you always know exactly what you invest in.

Total assets invested in ETFs have surged 5X in the past decade as investors increasingly shift from active investing—where managers pick stocks—to passive investing, which tracks market indices with lower costs and higher transparency.

Low costs, big impact:

ETFs make our investing lives much easier, but they are not free.

They charge an annual percentage fee called the expense ratio. Whenever approaching a new ETF, it’s the first thing to consider. Even small differences in fees can add up over time.

For example, if you invest $100K in an ETF with a 0.50% expense ratio, you’d pay $500 annually. While it may not sound like much initially, these fees can eat away at your returns over time. Let’s assume the invested $100K compound at 10% annually over 20 years. The portfolio will turn into $673K.

Let's explore how different fees affect the outcome:

0.05% expense ratio will cost the investor $6K.

0.50% expense ratio will cost the investor $59K.

1.00% expense ratio will cost the investor $112K.

As you can see, the 1.0% fee results in a 19% haircut in the portfolio’s returns.

Even slight differences in fees can dramatically impact returns over time.

Just like returns, costs compound.

As greatly put by the late Jack Bogle:

“In investing, you get what you don't pay for. Costs matter.”

That’s why low-cost ETFs are often the smarter choice for long-term investors.

What’s “low cost”?

This is a bit subjective, but here’s a good rule of thumb:

Low cost: Under 0.10% is generally considered very low. Funds that match popular indices like the S&P 500 charge as little as 0.03%.

Affordable range: 0.10% to 0.25% is still cost-effective compared to mutual funds. This range typically includes ETFs focusing on specific categories (like emerging markets) or strategies (like growth or value).

High cost: Anything above 0.50% may require a closer look to ensure the potential returns justify the fees. These are usually niche or actively managed ETFs, such as thematic funds (like ARKK for disruptive innovation) or leveraged/inverse ETFs (such as TQQQ) used by high-frequency traders.

2. The Heavyweights of the ETF industry

Behind every ETF is a fund provider—the company that creates, manages, and markets these funds. A few giants dominate the industry, managing trillions of dollars across their ETFs.

Let’s take a closer look at the largest ETF providers by Asset Under Management (AUM) as reported by ETF Database:

⚠️ Misconception Alert: ETF providers like BlackRock and Vanguard often appear as the largest institutional holders of major companies, leading to the belief that they “own” these firms. In reality, individual shareholders—people like you—own fractional stakes through ETFs. Providers act as custodians, managing shares and voting in corporate elections as fiduciaries, not owners.

The Biggest Players by AUM

BlackRock (iShares):

AUM: $3.2 trillion in ETFs.

Funds: 452.

Average expense ratio: 0.30%.

Differentiator: Offers the largest variety of ETFs. Caters to both retail and institutional investors. BlackRock is a public company (BLK), and the visual below shows how they make money.

Vanguard:

AUM: $3.0 trillion in ETFs.

Funds: 86.

Average expense ratio: 0.09%.

Differentiator: Known for its investor-owned structure, ensuring profits are reinvested to lower fees. Flagship funds include VOO (S&P 500) and VTI (Total US Stock Market).

State Street Global Advisors (SPDR):

AUM: $1.5 trillion in ETFs.

Funds: 158.

Average expense ratio: 0.27%.

Differentiator: Pioneered ETFs with SPY, the first US-listed ETF, and offers sector-specific offerings like XLK (Technology).

The Largest ETFs by AUM

Not all ETFs are created equal. Some dominate the market with hundreds of billions of dollars in AUM. These heavyweights are popular for a reason: they’re simple, reliable, and offer exposure to popular assets.

Let’s take a look at the giants of the ETF world:

S&P 500 index funds: SPY, IVV, and VOO. They offer a market-cap-weighted exposure to the largest US companies.

Total US Market: VTI covers the entire US stock market, including small, mid-cap, and large-cap stocks. It’s also a market cap-weighted index, so the largest companies still dominate. The performance is very similar to the S&P 500 index.

Growth/Value: VUG and VTV are Vanguard’s largest thematic funds focused on growth and value, respectively.

Nasdaq 100: QQQ tracks the 100 largest non-financial companies on the Nasdaq Stock Market. It’s heavily weighted toward large-cap technology companies.

Bond ETFs: BND and AGG represent the US investment-grade bond market.

Why these ETFs stand out:

Proven performance: These funds have a track record of delivering returns that match their benchmarks.

Low expense ratios: Their size often allows them to charge rock-bottom fees.

These ETFs are foundational building blocks for many investors. Whether you want broad exposure to the US market, a tech-heavy focus, or a safe bond allocation, these funds have you covered.

3. Increasing US Concentration

The US stock market is increasingly concentrated, with a few dominant companies driving a significant portion of market performance. This trend is especially visible in the S&P 500 and Nasdaq 100:

SPY’s top 10 holdings make up 39% of the fund, while QQQ’s top 10 holdings account for a staggering 52%.

The “Magnificent Seven” (Apple, Microsoft, Amazon, NVIDIA, Alphabet, Meta, and Tesla) now represent 34% of the S&P 500’s value.

The visual below explains why we regularly write about these companies. Their performance alone moves the market.

According to Goldman Sachs Research, the current concentration level has not been seen since the Great Depression. That said, Goldman highlighted that today’s market leaders exhibit better margins, higher returns on equity, and lower valuations than previous bubbles.

High concentration can amplify both risks and rewards:

Upside: Concentration has historically driven strong returns during bull markets. The top 10 stocks contributed over a third of market gains in the past five years. A big benefit of indexing is that you don’t miss the rise of a company like NVIDIA.

Downside: Concentrated markets may be more vulnerable to downturns. If a few top stocks falter, they can pull the entire index lower. But it ultimately comes down to the fundamentals and expectations reflected in valuations.

Critically, the Mag 7 are diversified businesses in their own right. As illustrated through our visuals all year round, most of these market giants have a wide range of segments and are diversified businesses in and of themselves. It makes comparisons to prior decades somewhat misleading.

As the top-performing stocks outperform others, they gain even greater weight in the index, creating a self-reinforcing cycle. But remember, investing in a broad index still implies a large exposure to all the laggards, which could rebound if the market shifts.

4. Beyond the basics

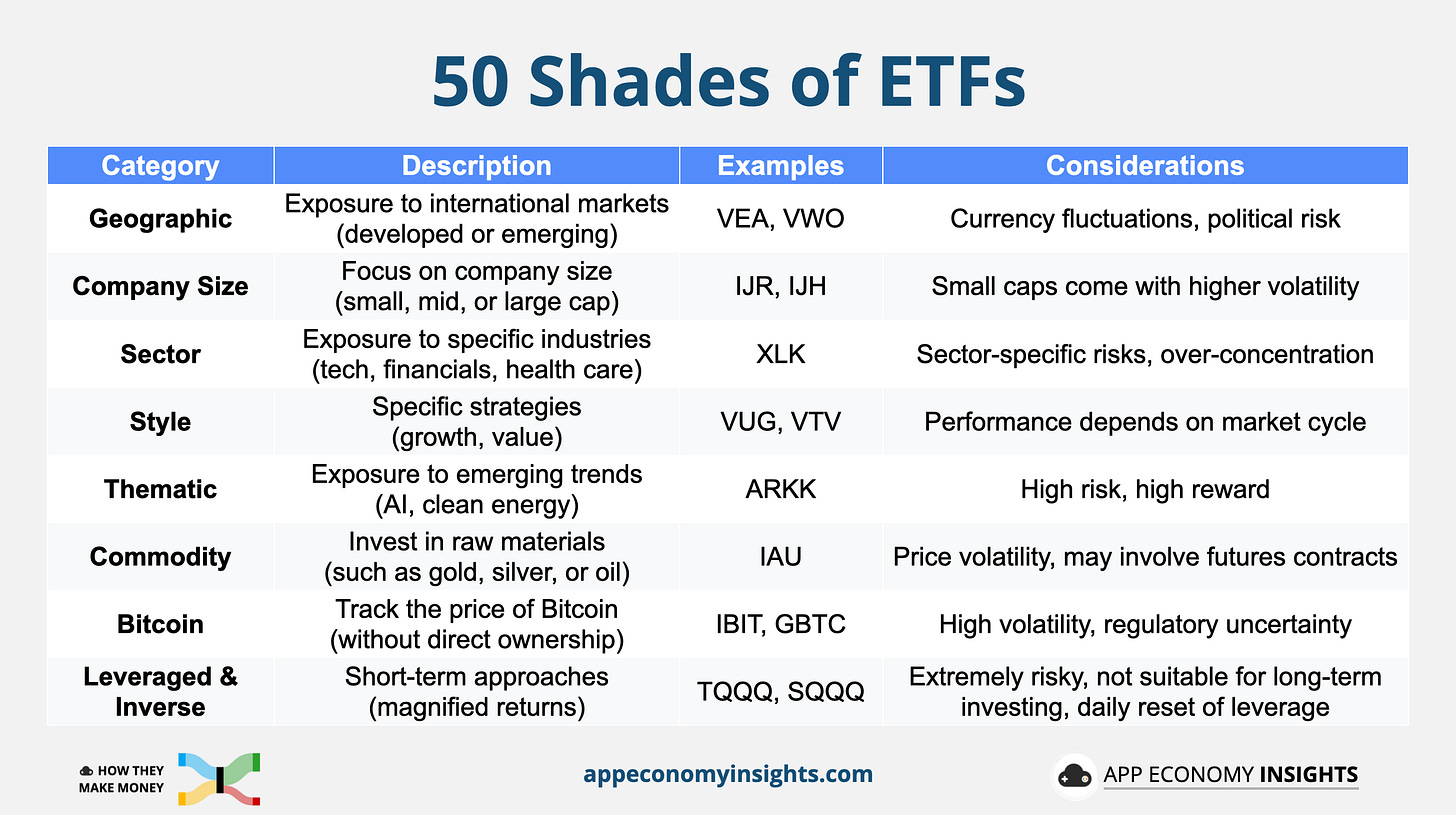

While broad market ETFs like SPY and VTI are great starting points, the ETF universe offers a vast range of specialized options to fine-tune your portfolio. You can target specific regions, company sizes, investment styles, and even alternative assets.

Let's explore some of the most common ETF categories:

Choosing the right ETF mix

With over 10,000 ETFs available, selecting the right ones can feel like navigating a Cheesecake Factory menu—overwhelming! The most important factors are your investment goals, time horizon, and risk tolerance. Know what you are looking for.

There's no need to overcomplicate things. Uncle Warren would stick with a simple S&P 500 index fund. If you desire broader exposure, a total world stock market ETF like VT provides a market-cap-weighted portfolio that's globally diversified (and only charges a 0.07% expense ratio).

Key Takeaway: Specialized ETFs can be valuable tools, but they require careful consideration. Always do your research, understand the risks and costs involved, and keep it simple.

Bottom Line:

ETFs have revolutionized investing, making it easier than ever to build a diversified portfolio. With their low costs, transparency, and simplicity, ETFs are powerful tools for both beginners and seasoned investors. The key is understanding what’s inside the basket and how it fits into your overall strategy.

Ready to take the next step? Elevate your investing game with our guides on How To Analyze a Stock and why you should Let Your Winners Run.

That’s it for today!

Stay healthy and invest on.

Use our visuals for your organization

Interested in licensing our visuals for a report or presentation? Are you looking for custom visuals for your business or brand? Let's collaborate! Complete the form here, and we'll get in touch.

Disclosure: I do not own any stock discussed in this article in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Source: J.P. Morgan Equity Derivatives Strategy (October 2024)

Good article! I do suggest that you add a few lines (or a short article) about CEFs, which are much less risky than the highly leveraged ETFs you mention. CEFs, like ETFs, vary widely in topical coverage and safety, but they can offer a good alternative to ETFs and provide similar coverage

Im interested in what happens as ETFs become more popular. The saying goes 'the market will find a way to screw over as many people as possible'.

For those with a lot riding on ETFs - especially going into an increasingly trust and faith based business scene - what happens if there is a massive market crash? Are ETFs generally safe or could growth products result in a massive loss for everyday people?