☕️ Can Starbucks Be Saved?

How Brian Niccol plans to revive a troubled icon

Welcome to the Premium edition of How They Make Money.

Over 170,000 subscribers turn to us for business and investment insights.

In case you missed it:

Starbucks has been grappling with declining sales, employee unrest, and fierce competition in China. In July, we explored the coffee giant’s brewing crisis.

In a bold move to steady the ship, Starbucks poached Brian Niccol from Chipotle in August, banking on his proven track record. During his tenure as CEO, he doubled Chipotle's revenue and led an 800% stock price surge, earning him a reputation for revitalizing struggling brands.

Niccol’s arrival sparked optimism, sending Starbucks’ stock soaring 25% in August and adding $20 billion to its market value. But turning around a business weighed down by union clashes, boycotts, and margin compression is no small feat.

So, can Niccol’s leadership save Starbucks?

Let’s break down his turnaround plan and assess whether it’s enough to overcome the challenges ahead.

Today at a glance:

Starbucks Q4 FY24.

Niccol’s turnaround plan.

Boycotts & strikes.

Traffic challenges in the US.

China’s race to the bottom.

1. Starbucks Q4 FY24 Earnings

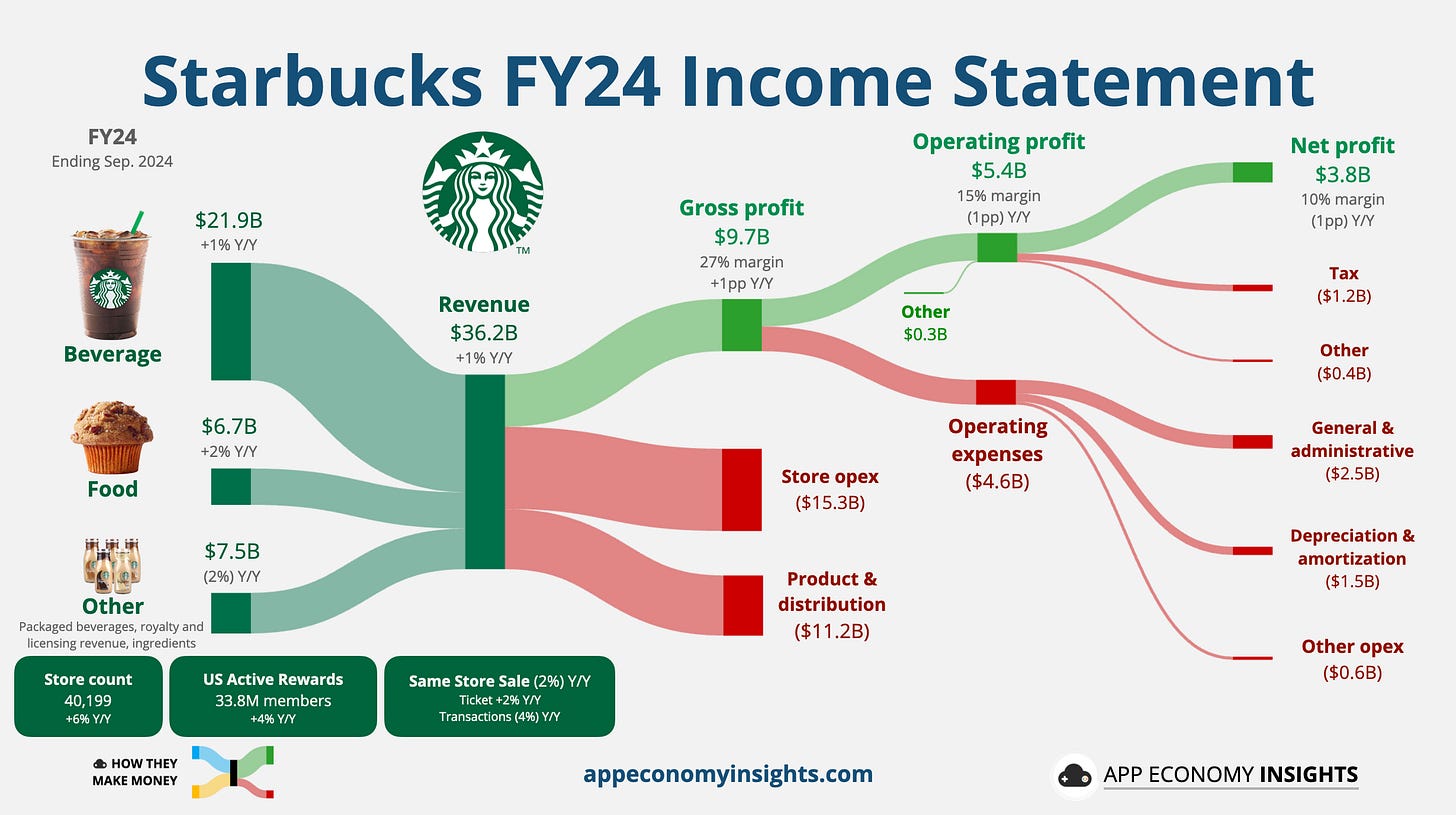

Starbucks closed FY24 on a disappointing note, missing revenue and earnings expectations for the fourth consecutive quarter. Let’s break down the numbers:

Key Metrics

Global store count grew 6% Y/Y to 40,199.

52% company-operated, 48% licensed

61% of stores are in the US (42%) and China (19%)

North America grew +3% Y/Y to 18,424 stores.

China grew +12% Y/Y to 7,596 stores.

Q4 comparable store sales fell by 7% Y/Y.

North America: -6% (Average ticket +4%, Transactions -10%).

International: -9% (Average ticket -5%, Transactions -4%).

China alone: -14% (Average ticket -8%, Transactions -6%).

As you can see, North America has a foot traffic problem, while China has a pricing problem. More on this in a minute.

Below is a look at the fiscal year 24 that ended in September.