🍔 Fast Food Economics

A race against time, tech, and tastebuds

Welcome to the Tuesday edition of How They Make Money.

Over 120,000 subscribers turn to us for business and investment insights.

In case you missed it:

Fast food is facing a race against time, technology, and tastebuds.

McDonald’s CEO Chris Kempczinski recently explained:

“It’s a street fight. Everybody is fighting for fewer consumers. We have to make sure we have that street fighting capability.”

With nearly a trillion dollars in annual sales worldwide and four million people employed, the QSR (quick-service restaurant) industry is undergoing a shift, from viral TikTok trends to robotic kitchen assistants and plant-based alternatives.

To understand how these giants navigate a landscape of soaring inflation, labor shortages, and ever-changing consumer tastes, you need to know the lingo:

Same-Store Sales: Measures growth at existing locations, revealing a brand's health and popularity.

System Sales: Total sales across all restaurants, including franchised ones, showing a brand's overall revenue.

Franchise Mix: The percentage of franchised restaurants. In this model, independent operators own and run the locations, paying fees to the parent company.

Digital Sales Mix: The proportion of sales from online channels, reflecting digital penetration and customer convenience.

Average Restaurant Sales: Average annual sales per restaurant, a key efficiency indicator.

Loyalty Program Membership: Number of enrolled customers, showcasing brand loyalty and engagement.

Let’s visualize the four largest QSR companies and their latest quarter.

Today at a glance:

🍟 McDonald: Expansion Mode.

🌯 Chipotle: Can Robots Boost Profits?

🌮 YUM! Brands: Taco Bell to the Rescue.

🍔 Restaurant Brands: Burger King's Royal Reset.

1. 🍟 McDonald: Expansion Mode

Global comparable sales: +1.9% (vs. +2.1% expected).

US comparable sales: +2.5% (vs. +2.6% expected).

Digital sales mix: 35% of total systemwide sales (+5pp Y/Y).

Loyalty program: 150 million 90-day active users.

Restaurants: 42K at the end of 2023 (95% franchised).

What to make of all this?

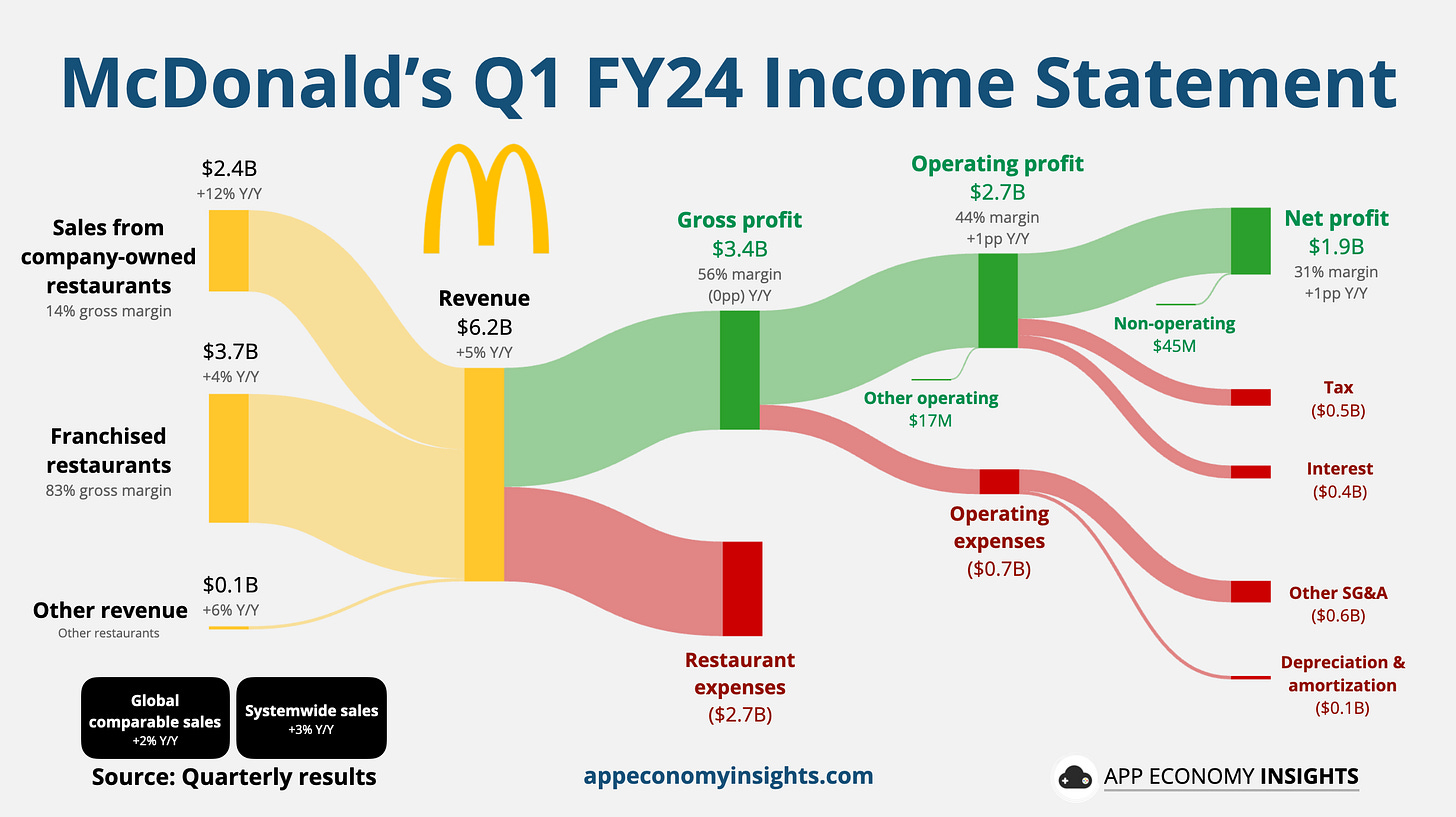

Remember, McDonald’s is primarily a real estate company, with the majority of revenue coming from franchised restaurants paying rent and royalties.

The franchise OG is feeling the heat from inflation and geopolitical tensions. The Golden Arches are facing challenges and opportunities on multiple fronts.

🍟 Value Proposition Under Pressure: Higher menu prices deter some budget-conscious consumers, especially those with lower incomes. McDonald's is scrambling to offer more compelling value deals to win them back.

🌍 Middle East Turmoil: Boycotts related to the conflict in Gaza are impacting sales in the region. While the company is taking steps to address the situation, a full recovery could take a while.

🍔 Big Mac Attack? McDonald's is betting on menu innovation, including an improved burger recipe and its biggest burger yet, to entice customers and justify higher prices.

📲 Digital Drive: Digital sales are booming, with mobile ordering, delivery, and the MyMcDonald's Rewards program driving significant growth. This highlights the increasing importance of convenience and personalization for consumers.

🏗️ Expansion Mode: Despite current challenges, McDonald's remains committed to its ambitious growth plan, aiming to reach 50,000 restaurants globally by 2027 and double the sales from its loyalty program.

McDonald's faces short-term headwinds, but its investments in digital, loyalty programs, and ambitious expansion demonstrate a commitment to long-term growth. The company's ability to leverage these strengths, along with its ongoing menu innovation, will be crucial for navigating the current challenges and solidifying its position as a global QSR leader.

2. 🌯 Chipotle: Can Robots Boost Profits?

Chipotle owns and operates all its restaurants in North America and Western Europe, making it a very different model compared to McDonald’s.