🏆 Let Your Winners Run

Great long-term investing is 1% buying and 99% waiting.

Greetings from San Francisco! 👋🏼

A warm welcome to the recent additions to our community!

Over 58,000 How They Make Money subscribers turn to us weekly for business and investment insights. Glad you're here.

Great long-term investing is 1% buying and 99% waiting.

Many investors feel the urge to tinker, trim, or rebalance a portfolio regularly. Yet, the greatest outcome usually requires sitting on your hands.

Don’t take it from me, but from Charlie Munger:

“It's waiting that helps you as an investor, and a lot of people just can't stand to wait. If you didn't get the deferred-gratification gene, you've got to work very hard to overcome that.”

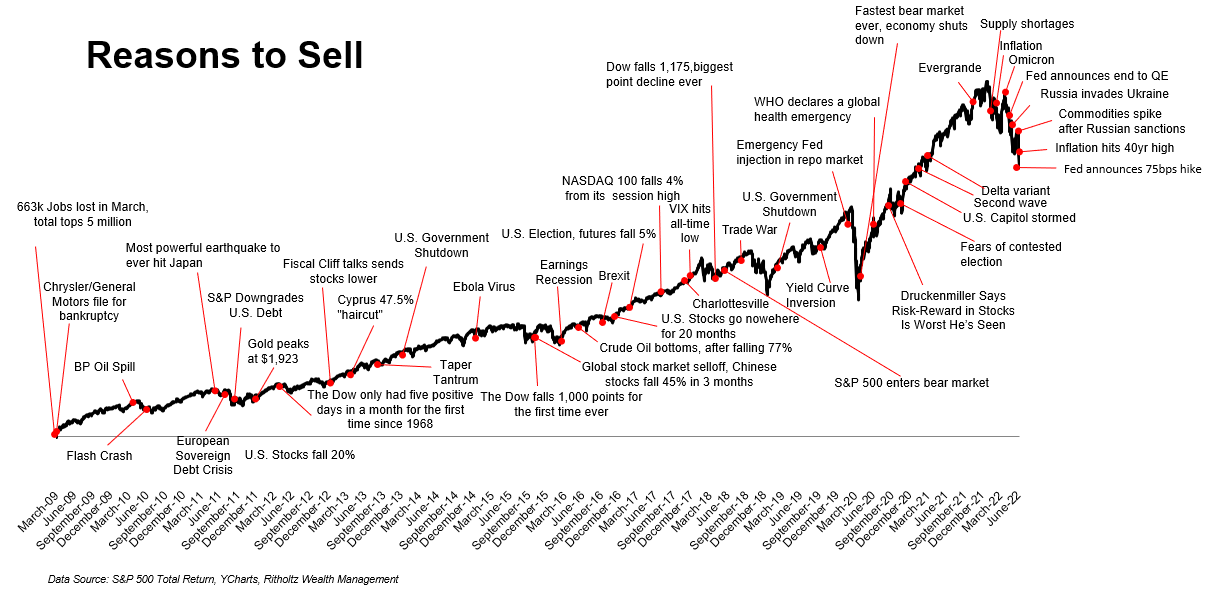

The news cycle is always about a potential recession, a bear market, or a bubble ready to burst. I love this illustration that shows the many reasons to sell. It’s a great reminder that time in the market trumps timing the market.

You’ll never hear me talk about macro forecasts in this newsletter because:

Forecasts are wrong half of the time and, therefore, useless.

Even with perfect information, stock movements remain unpredictable.

People focus on when they should buy or sell when the real needle mover is to define how long they will hold. Selling makes sense when you need the money. That’s why money invested in long-duration assets should be money you don’t need anytime soon.

Whether it’s an individual stock or an index fund, as long as you follow basic diversification principles, your worst investing decisions will likely be decisions to sell too soon.

Don’t believe me?

Let’s review key numbers to illustrate what happens when you don’t sell.

Today at a glance:

Compounding.

Pareto and the Power Law

Coffee Can Portfolio.

What Are The Odds?

A Real-Life Example.

1. Compounding

The S&P 500 index returns approximately 10% per year on average, including dividends, before adjusting for inflation.

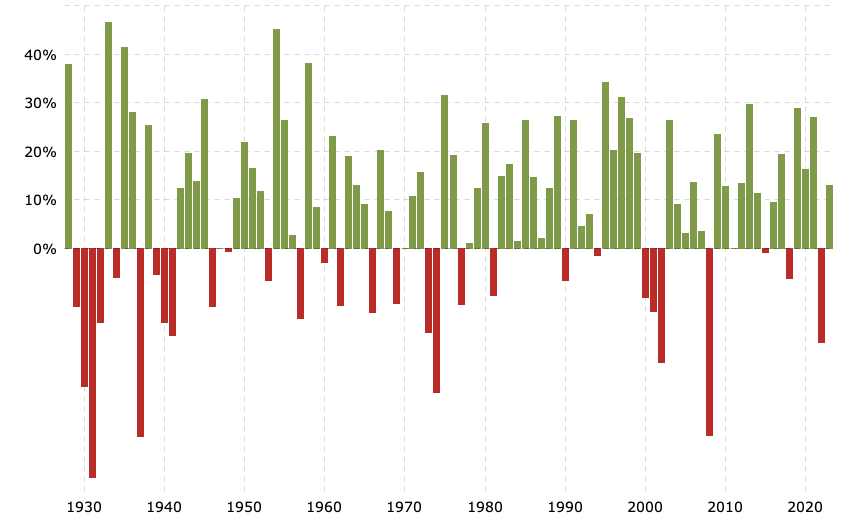

McKinsey recently showed that it’s been true for the past 200 years as well as the past 25 years (despite three bear markets). Of course, 10% is an average, and you’ll rarely find a year that’s just average. The past century looks more like this:

At an annual rate of 10%, the market doubles every seven years:

2X in 7 years.

4X in 14 years.

8X in 21 years.

16X in 28 years.

The power of compounding becomes ever more compelling when you find an investment that can deliver above-average returns. Thomas Phelps, author of the book 100 to 1 in the Stock Market, wrote about 100-baggers—stocks that return 100 times your initial investment (turning $10,000 into $1 million).

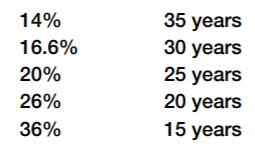

How long does it take to have a 100-bagger? Phelps has a table in his book that lists the annual returns and how many years it would take to get a 100-bagger

If you hold a stock compounding at 20% annually for 25 years, you return 100 times your money. But if you hold it for 10 years, you only return 5 times your money.

Let’s assume there is such a stock in your portfolio. You would still need decades to see the story come to fruition. What are the odds that you will let the story play out over 20 years or more? Probably thin.

Long holding periods are not simply a preference. They are an absolute necessity to achieve truly life-changing returns. The main barrier to outstanding returns is your patience, not your investment selection.

As best put by Bill Gates:

“Most people overestimate what they can do in one year and underestimate what they can do in ten years.”

The same is true of expectations for your portfolio.

2. Pareto and The Power Law

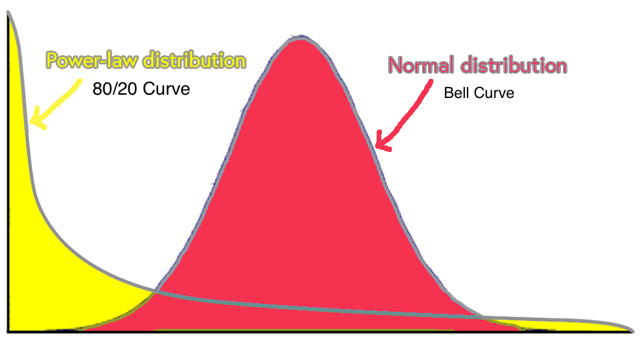

Two classic distributions shape the world around us:

Normal distribution: Also known as the Bell Curve, a great example is rolling two dice, where outcomes center around the number seven. The further you move from seven, the less probable the result.

Power-law distribution: Recognized as the 80/20 Curve or Pareto Principle, this distribution sees a small number of occurrences having a significant impact. Think of it like viral videos: a few garner millions of views while countless others remain unseen.

In the realm of investing, the power-law distribution reigns supreme. It dictates that around 20% of your investments could represent 80% of your returns. This means a handful of stellar investments can shape the trajectory of your entire portfolio. Prematurely selling these investments could drastically diminish your long-term gains.

For example, Buffett often points out that his entire investing career is attributed to a handful of investments like Geico and Apple. Yet, he's poured funds into hundreds of companies over his career.

In his book Zero to One, Peter Thiel explains:

“The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined.”

The key insight here? Expect a few outliers to drive most of the growth in a portfolio or index fund. As a result, in the words of Peter Lynch:

“Selling your winners and holding your losers is like cutting the flowers and watering the weeds.”

3. Coffee Can Portfolio

In 1984, Robert G. Kirby introduced the Coffee Can portfolio. He explains:

“The Coffee Can portfolio concept harkens back to the Old West, when people put their valuable possessions in a coffee can and kept it under-the mattress. That coffee can involved no transaction costs, administrative costs, or any other costs. The success of the program depended entirely on the wisdom and foresight used to select the objects to be placed in the coffee can to begin with.”

He preached a “buy and forget” approach by being passively active:

Active: The initial selection of investments, chosen with care and foresight.

Passive: Once chosen, these investments are left untouched, allowing them to grow without interruption.

Assets are picked for their inherent quality and left alone over an extended period.

Two primary advantages arise from the Coffee Can approach:

Thoughtful Selection: With the intention of holding for many years, you will likely be more discerning about what you add to your portfolio.

Uninterrupted Compounding: By committing to hold, you allow your investments to compound, harnessing the power of time and patience.

Kirby illustrates the positive results of this strategy with the portfolio of a client he had worked with for over a decade. The client invested around $5,000 in his wife's portfolio for each of Kirby's purchase recommendations without ever selling.

The result, after decades? A portfolio with:

Several small positions of around $2,000.

A few large ones that had grown to $100,000

One jumbo position that had returned over $800,000.

Over the long haul, this approach naturally leads to a few standout investments dominating the portfolio. Kirby's friend would have never generated such returns if he had regularly re-examined and rebalanced his portfolio, as taught in most modern corporate finance classes.

The key takeaway? It's possible to dramatically outperform the market by merely letting winners run. No constant monitoring, no incessant trading, just thoughtful selection and the patience to let time work its magic.

4. What Are The Odds?

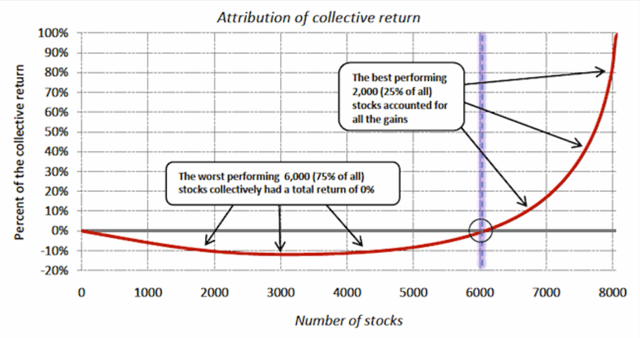

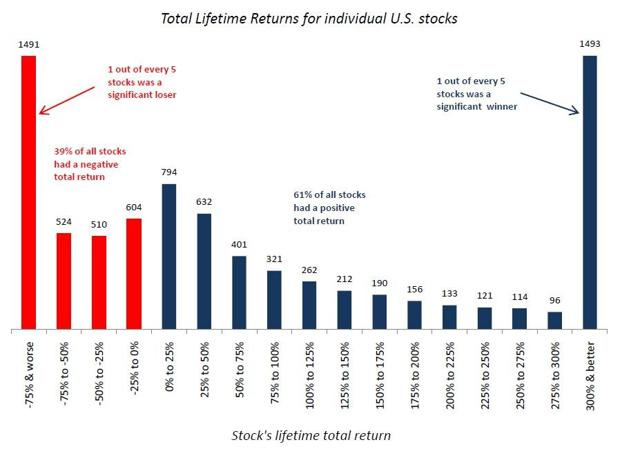

Blackstar Funds (via Meb Faber) delved into the historical performance of 8,000 stocks across NYSE, AMEX, and NASDAQ over 23 years (1983-2006)—a period punctuated by market upheavals like the 1987 crash and the Dotcom bubble.

Their findings? A mere 25% of stocks accounted for all the gains.

The takeaways are fascinating:

2 out of every 5 stocks are money-losing investments.

1 out of every 5 stocks is a terrible investment (losing 75% or more).

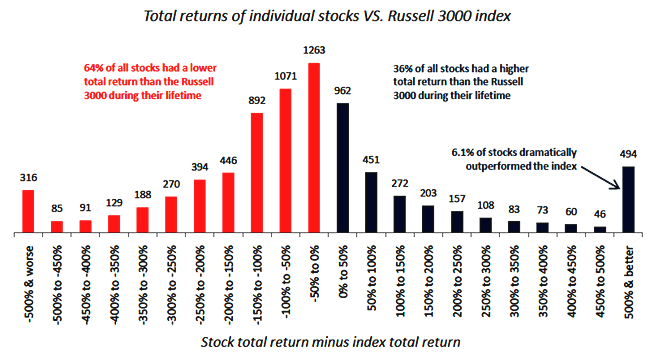

Comparing individual stocks to the Russell 3000 index

64% under-performed the index.

6% of stocks dramatically outperformed the index (by 500% or more).

The outliers—the stocks that beat the market by 500% or more—are the core drivers behind the indexes' returns. They compensate for the losses generated by the majority of the market. Missing them can lead to dramatic underperformance.

Such findings underscore why many investors gravitate towards passive investing, leveraging low-cost mutual funds or diversified ETFs to mitigate the risks of underperformance. In my own strategy, I allocate my retirement savings to index funds because these savings are too critical to risk underperformance.

The probability of finding truly outstanding performers is relatively thin at 6%. In a portfolio of 20 stocks, that would be only one stock.

These data-driven insights drive my investment philosophy:

Alpha comes from a handful of standout performers.

Losers are a fact of life. They’ll make up roughly 2/3rd of your portfolio.

Diversification is the greatest tool to tilt the odds in your favor.

Don't sell your winners. Instead, add to them over time.

These are things I hold true about investing, and it has helped me focus on high-quality businesses and expand my time horizon.

Such principles, rooted in the power law and the inherent unpredictability of discerning true winners, echo the venture capital approach to investing: a broad net of start-ups, betting on the few that will soar, and committing for the long haul.

5. A real-life example

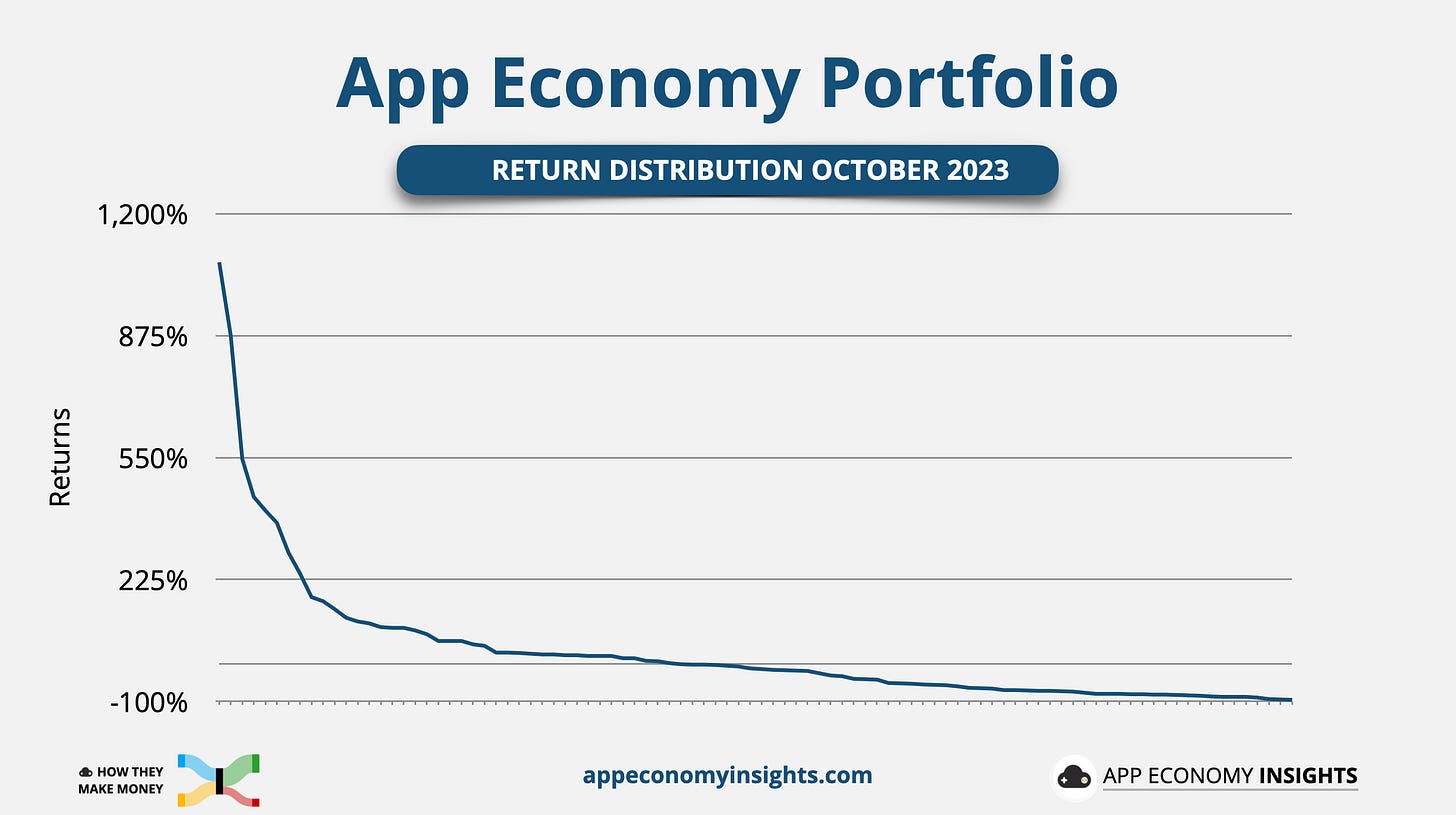

To drive home the value of long-term holding, I decided to open the books on my own portfolio. I started my portfolio in 2014, and I’ve built it in public since 2018 through my Investing Group 'App Economy Portfolio' on Seeking Alpha.

The approach:

Buy great businesses diligently.

Hold on to them tenaciously.

Four critical rules:

Rule 1: An automated, fixed monthly investment.

Rule 2: A commitment to diversification—no hefty bets on one stock.

Rule 3: Don’t add to your losers (keep underperformers small).

Rule 4: Don’t sell your winners (let outperformers get big).

Like Robert Kirby, I embraced a passively active approach by letting the story play out without interruption. I only occasionally sell underperforming investments, mostly for tax-loss harvesting.

So, how is it going so far?

My largest investment is 3% of the starting funds.

My portfolio has 93 holdings with international exposure.

18 of them have doubled or more, while 17 of them dropped over 80%.

Some of the winners have returned more than 10X my initial investment, matching the power law and Kirby’s story.

Today, the top 10 holdings account for 50% of the portfolio’s value.

The largest holding makes up 13% of the portfolio after appreciating 12-fold.

And the final metric of success? Despite some growth stock volatility over the years, my portfolio has still managed to outpace the S&P 500 (though past performance doesn’t guarantee future success).

This journey hasn't been without its moments of doubt, but it's a testament to the value of patience in investing. It underscores everything we’ve discussed—the importance of time, the inevitability of many losers, and the disproportionate impact of a few big winners.

Bottom Line

Investing shouldn’t be a constant battle with the sell button or an ever-looming fear of market downturns. Instead, consider it a lifelong commitment, a bond forged with patience and foresight.

Throughout history, we've weathered wars, health crises, economic downturns, and other calamities. Yet, markets have consistently demonstrated their resilience. The lesson? While near-term concerns always exist, the long view should be optimistic, especially with a diversified strategy with international exposure.

The two main takeaways:

Patience is power: It's not just about waiting; it's about holding your nerve, letting go of short-term anxieties, and trusting in the larger process.

Trust in winners: We often sabotage our portfolios by intervening too soon. Letting your winners run might feel counterintuitive, but it's where the magic happens.

As I've witnessed with my portfolio, our instincts often urge us to act when inaction might be the wisest course. True investment success lies not just in the choices we make but in our commitment to see them through.

That’s it for today!

Stay healthy and invest on!

Unlock our Stock Portfolio

My Seeking Alpha investing group, App Economy Portfolio, is five years old.

Once a year, I update a list of 12 stocks that make for a great foundation for a well-diversified portfolio. These are the stocks I would buy today if I started a portfolio from scratch. I call them the Starter Stocks, and I just updated the list.

Joining App Economy Portfolio gives you access to:

📊 Earnings Reports: Compelling earnings visuals & thesis updates for 70+ stocks, plus a steady flow of research on disruptive tech.ama

🎯 Actionable Ideas: New stocks on the first of the month, best buys mid-month, and live trade alerts twice a month.

🔐 Portfolio Tracker: Access to my real-money portfolio, practical spreadsheets, and templates.

👥 Active Community: A network of investors that regularly shares updates, company earnings, innovative ideas, and engaging discussions.

Apply to Sponsor Us

We're offering new sponsorship opportunities for B2B and B2C brands to get in front of our audience of investors and business leaders. Click here to learn more.

Get Your Business a Custom Chart

Interested in custom charts for your organization or brand? Complete the form here, and we'll get in touch.

Disclosure: I am long TTD, MDB, AAPL, HUBS, AMD, MTCH, AMZN, GOOG, SHOP, and MELI in the App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members here.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

This is a brilliant article

Do ETFs like VGT or SCHG outperform your portfolio? (: