🚖 Waymo: Rideshare Revolution

Can Google outmaneuver Uber and Lyft? What about Tesla?

Welcome to the Premium edition of How They Make Money.

Over 170,000 subscribers turn to us for business and investment insights.

In case you missed it:

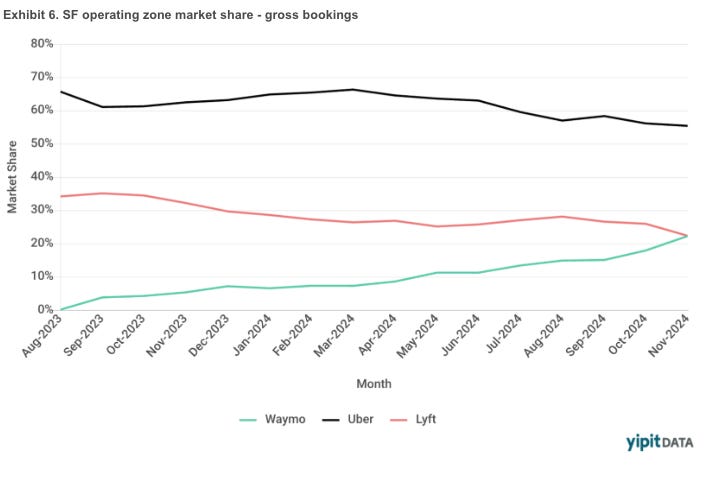

Waymo—Google’s autonomous driving service—has surged to a 22% market share in San Francisco in just 15 months, shaking up the ridesharing landscape.

That’s according to data shared by Alex Immerman, partner at a16z, featuring insights from market research firm YipitData. The visual ignited debate: Is Waymo’s rapid growth a glimpse of autonomous vehicles (AVs) dethroning Uber and Lyft—or just a temporary blip unique to San Francisco’s conditions?

According to the visual, Waymo’s rise came at the expense of Uber and Lyft, whose market shares each fell by double digits.

Yet a closer look reveals a more nuanced picture.

Lyft CEO David Risher has disputed the data, calling the analysis misleading. Novelty and tourism likely play a significant role—after all, riding a self-driving car in SF has become a must-try experience for visitors.

But beyond the headlines, Waymo’s success raises critical questions about the challenges ahead, which could determine whether this momentum is sustainable.

One thing is clear: AVs are no longer a distant fantasy. Waymo’s gains in SF hint at a broader shift in ridesharing's future. But before Google’s subsidiary can claim victory, it must prove that this early success can scale and compete sustainably.

In this article, we’ll explore the implications of Waymo’s rise and other key players, including Tesla, Uber, and Lyft. We’ll also unpack GM’s decision to abandon its Cruise Robotaxi project and what it means for the future of AVs.

Today at a glance:

Waymo’s rise.

Tesla’s timeline.

Uber’s resilience.

Lyft’s challenges.

Why GM killed Cruise.

1. Waymo’s rise

Incubated at Google in 2009, Waymo became part of Alphabet (GOOG) in 2016 and launched the world’s first fully driverless service on public roads in 2019.

At the heart of Waymo’s success is its advanced autonomous driving system, Waymo Driver. Combining cutting-edge LiDAR, cameras, radar, and machine learning, Waymo Driver creates a 360-degree, real-time map of its surroundings to navigate complex urban environments. Waymo’s AI is trained on billions of simulated miles, constantly improving its ability to predict and respond to real-world conditions, from pedestrians to unpredictable traffic.

Fast forward to today, Waymo’s momentum is undeniable. The initial data points have been extremely encouraging, with Waymo Driver reducing crash rates and demonstrating improved safety relative to human drivers.

Waymo’s model relies on its own fleet, where AVs operate in small, highly mapped geographic areas. This approach prioritizes reliability and safety but comes with significant costs: each vehicle requires expensive hardware like LiDAR and radar to operate autonomously. Waymo’s co-CEO Dmitri Doglov previously said on a podcast the equipment costs up to $100,000 per vehicle.

The upside? Fleet operators like Waymo can achieve higher utilization rates in dense, urban areas—assuming demand matches supply.

The downside? Scalability. Mapping new cities and maintaining a fleet is capital-intensive, limiting how quickly Waymo can expand.

Key facts you should know about Waymo:

150,000+ paid rides weekly across San Francisco, Los Angeles, and Phoenix.

New markets like Austin and Atlanta are set to launch in 2025.

BofA estimated Waymo’s 2024 revenue to be $50 to $75 million, with a loss of up to $1.5 billion based on its employee count of 2,500 to 3,000.

$10+ billion raised from investors to date.

Alphabet committed $5 billion in July 2024, and Waymo raised $5.6 billion in October 2024 in a round including a16z—yes, the same firm as Alex Immerman, whose post sparked the recent debate.

Immerman added:

“Network effects is one of the best sources of defensibility. But it's proven to be not that important in ridesharing. […] Once wait times hit that acceptable threshold, the incremental driver doesn't improve the rider experience.”

The data suggests Waymo is making waves, but the hype deserves more context.

A nuanced picture

Waymo’s rise in San Francisco is remarkable but comes with caveats:

San Francisco is a unique market: At 7x7 miles, SF trips are short, so price sensitivity is lower. Waymo’s success in this confined geography may not scale to larger, sprawling cities where cost and trip length are factors.

Novelty factor: Lyft CEO David Risher argues that much of Waymo’s growth can be attributed to tourism, with riders eager to try AVs for the first time. Waymo is exclusively available in SF, LA, and Phoenix, further amplifying this factor.

Data accuracy: Risher also disputes the accuracy of the visual from YipitData. For example, Uber’s app allows users to book Waymo rides. How many Uber rides are attributed to Waymo? Are they double-counted?

If anything, Waymo’s growth in SF validates a broader truth: The world is ready for AVs. But we already knew that, didn’t we?

The critical challenges

The key hurdles boil down to three questions: Can Waymo scale its fleet? Can it manage idle costs? And will riders stick to standalone apps like Waymo over platforms like Uber?

Fleet size: Waymo requires its fleet to meet demand year-round to recoup its costs. Can it justify the heavy Capex to serve most use cases, including peak demand during holidays and major events?