📊 PRO: This Week in Visuals

AVGO, COST, MDB, RBRK, GME, HQY, AI

Welcome to the Saturday PRO edition of How They Make Money.

Over 170,000 subscribers turn to us for business and investment insights.

In case you missed it:

📧 Free members get our Friday articles and sneak peeks.

💌 Premium members receive monthly reports with 200+ companies visualized, one extra weekly article, and access to our archive.

💼 PRO members enjoy everything in Premium, plus our Saturday timely coverage of the most important earnings of the past week.

Today at a glance:

📈 Broadcom: $1 Trillion Club

🛒 Costco: Consumer Shifts

🌱 MongoDB: Leadership Transition

🔷 Rubrik: Surpassing $1 Billion ARR

🎮 GameStop: Cash Rich But Revenue Poor

🏥 HealthEquity: Asset Growth Acceleration

🧠 C3 AI: Microsoft Alliance

1. 📈 Broadcom: $1 Trillion Club

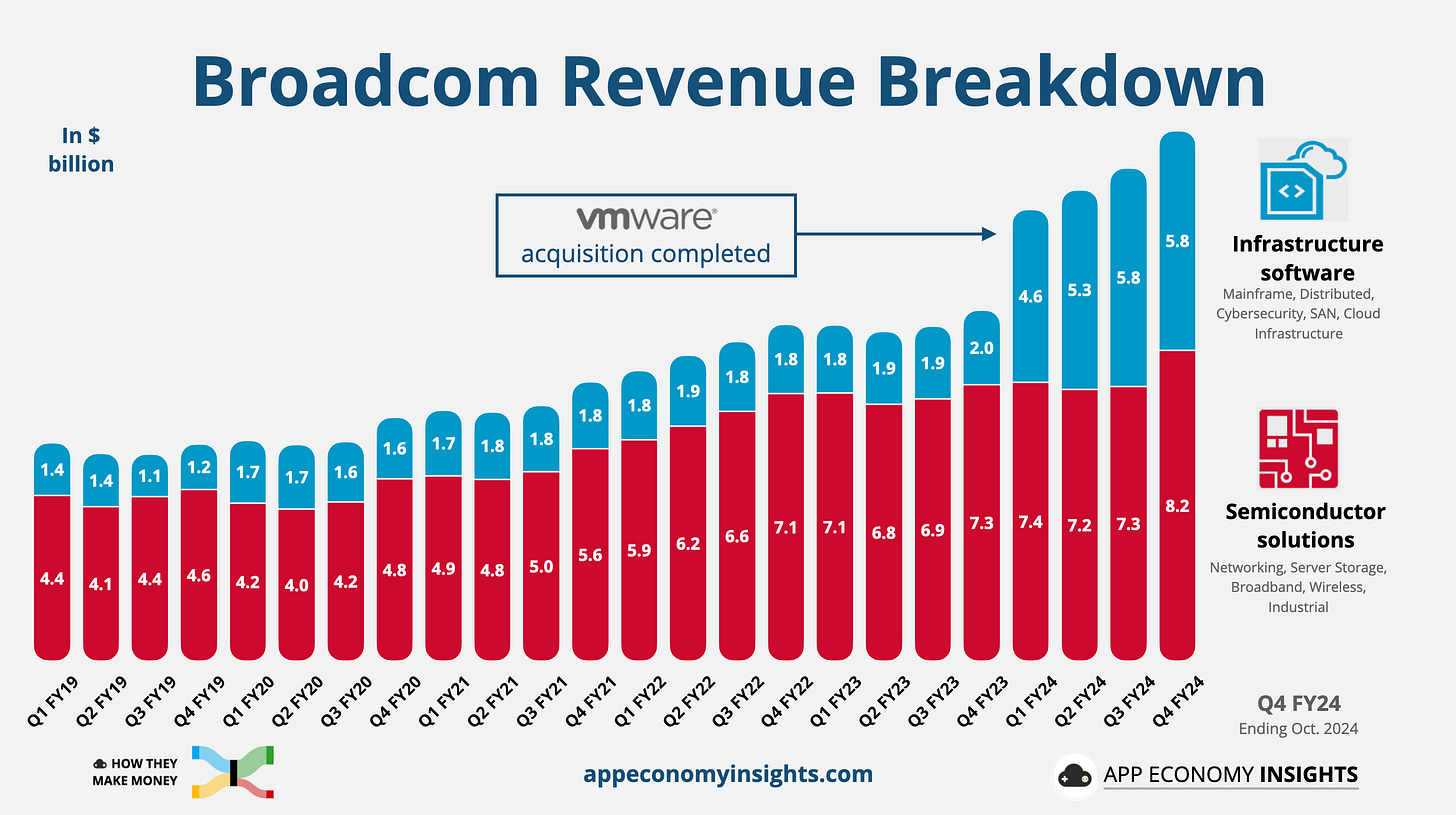

Broadcom’s revenue rose 51% Y/Y to $14.1 billion, in line with expectations, with an adjusted Earnings Per Share (EPS) of $1.42 ($0.03 beat). Semiconductor solutions revenue grew 12% Y/Y to $8.2 billion, while infrastructure software tripled to $5.8 billion, driven by the VMware acquisition completed in November 2023.

FY24 revenue grew 44% Y/Y to $51.6 billion, including $12.2 billion in AI-related revenue, surging 220%. Management guided Q1 FY25 revenue to grow 22% Y/Y to $14.6 billion ($0.5 billion beat), fueled by robust demand for AI XPUs and Ethernet networking.

CEO Hock Tan highlighted Broadcom’s massive opportunity in AI, forecasting an AI semiconductor market of $60–$90 billion by FY27. While non-AI semiconductor revenue faces headwinds, AI revenue is set to rise 65% Y/Y to $3.8 billion in Q1 FY25. VMware’s integration has been a standout success, achieving an impressive 70% operating margin in the software segment.

With a leadership position in AI and strategic partnerships, Broadcom is well-positioned for sustained growth, even amid challenges in non-AI markets. Investors also welcomed an 11% increase in the quarterly dividend. After the report, the stock surged over 20%, propelling Broadcom above a $1 trillion market cap, making it the 10th largest company globally.