📐 The Rule of 40 Explained

The essential growth-vs-profitability metric for software stocks

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

📣 Tariffs. Trade wars. Headlines are getting louder.

Markets are reacting—but should you?

With all the noise swirling, it’s easy to get distracted by the macro.

But investors who win over the long term focus on what really matters:

Company fundamentals.

💻 Software stocks can deliver explosive returns.

But not all growth is good growth.

Some companies scale quickly but burn through cash. Others print profits but stall out on expansion. As an investor, how do you know which ones are building something sustainable?

That’s where the Rule of 40 comes in. It’s a simple formula that blends revenue growth and profitability into a single, powerful signal. And it’s become one of the most widely used benchmarks for evaluating software companies.

This guide breaks it all down:

What the Rule of 40 is.

How it’s calculated.

Why it matters.

What pitfalls to avoid.

How to apply it across growth stages.

We’ll also look at three companies—GitLab, Palantir, and Salesforce—each at a different phase in the software lifecycle to see how the Rule of 40 plays out in the real world.

📌 What is the Rule of 40?

The Rule of 40 is a quick way to gauge the financial health of a software company—especially one prioritizing growth over near-term profit.

Here’s the formula:

Revenue Growth Rate (%) + Profit Margin (%) ≥ 40%If the combined number is above 40, the company is generally considered to be in good shape—balancing growth and profitability. If it’s below 40, it may be growing too inefficiently or not profitable enough to justify slower growth.

Profit margin can mean something different depending on the investor, sometimes excluding certain expenses or focusing on cash flow. More on this in a minute.

FROM OUR PARTNERS

To scale your company, you need compliance. And by investing in compliance early, you protect sensitive data and simplify the process of meeting industry standards—ensuring long-term trust and security.

Vanta helps growing companies achieve compliance quickly and painlessly by automating 35+ frameworks—including SOC 2, ISO 27001, HIPAA, GDPR, and more.

And with Vanta continuously monitoring your security posture, your team can focus on growth, stay ahead of evolving regulations, and close deals in a fraction of the time.

Start with Vanta’s Compliance for Startups Bundle, with key resources to accelerate your journey.

Step-by-step compliance checklists

Case studies for best-in-class examples from fast-growing startups

On-demand videos with industry leaders

🌱 Where did this come from?

The Rule of 40 was popularized by venture capitalist Brad Feld, who introduced it as a quick health check for SaaS businesses. Feld emphasized its value in balancing aggressive growth with disciplined financial management, helping investors quickly spot companies on sustainable trajectories.

Recent studies highlight its importance:

McKinsey & Company research found that only about one-third of software companies consistently hit this mark between 2011 and 2021.

Bain & Company said that even fewer (16%) sustain this performance for more than five years.

This reveals that achieving sustained growth combined with profitability is both challenging and valuable, offering significant insights for investors.

📊 Why the Rule of 40 Matters

The Rule of 40 is a balancing act. It helps answer a critical question:

Is this company growing fast and efficiently enough to be worth the risk?

But here’s the catch: growth and profitability don’t weigh equally at every stage of a company’s life. A startup burning cash for growth might be perfectly healthy. A mature software giant doing the same? Not so much.

That’s why context matters.

A slowing, mature software business can generate exceptional returns to shareholders if margins expand significantly.

A company in hypergrowth with margins deep in the red might still pass the test.

The key is knowing what phase the company is in—and which lever it should be pulling. The Rule of 40 is less of a hard threshold and more of a diagnostic lens. It tells you if the company is striking the right tradeoff between expansion and discipline.

🧭 Use it to track evolution. A Rule of 40 score improving over time signals that a company is maturing well—scaling revenue while tightening operations. A declining score might suggest growth is slowing without profitability catching up, potentially indicating disruption.

In other words: Know the stage. Then, judge the balance.

🚩 Digging Deeper

The Rule of 40 is simple—but the inputs are critical. Not all revenue growth is equal, and not all profitability metrics are created the same. Here's what to prioritize:

📊 Revenue Metrics: Focus on Recurring Revenue

ARR (Annual Recurring Revenue) and MRR (Monthly Recurring Revenue) are gold standards. They reflect subscription-based income that’s predictable and repeatable—ideal for evaluating SaaS businesses.

Total Revenue can work, too, especially for companies without pure subscription models. Just be mindful of one-time services, hardware sales, or lumpy contracts.

🔎 Tip: Not all revenue growth is equal. High-quality growth means recurring, high gross margin, and ideally driven by upsell and cross-sell—leading to high dollar-based retention.

💵 Profitability Metrics: Watch out for adjustments

Free Cash Flow margin is often favored. It shows how much actual cash the business is generating after capital expenditures.

Adjusted EBITDA margin is common in public filings—but be careful. It often excludes some expenses arbitrarily and is also called “bullsh*t earnings” by the late Charlie Munger.

Operating margin (GAAP basis) includes all operating expenses and can be compared between peers. However, it can occasionally include some non-recurring items that pollute the analysis (such as restructuring costs or impairment), so it’s not perfect.

Be consistent—and watch for aggressive adjustments.

SBC (stock-based compensation) is particularly important to call out. It’s how software companies attract and retain talent—and often makes up 20%+ of revenue. Excluding it can paint a flattering (and misleading) picture. Most management teams remove SBC in the adjusted metrics. And since SBC is a non-cash expense, it’s excluded from all cash flow metrics.

🔎 Tip: I focus on GAAP operating profit (non-adjusted) for this reason. It creates a level playing field by including SBC—and reflects the true cost of running the business, without investment gains/losses or interest polluting the analysis..

And yes, our visuals present the income statement on a GAAP basis.

You’re welcome.

🤖 What About AI?

The rise of AI software is transforming the growth profile of SaaS companies—but not always in obvious ways.

AI can boost revenue growth through premium features, usage-based pricing, and new customer segments. But it also introduces cost pressures, such as AI talent and expensive infrastructure for model training and inference.

That’s why the Rule of 40 is more relevant than ever. It helps investors see through the hype and ask the right questions:

Are margins improving or worsening as AI adoption grows?

Can a company turn early AI traction into sustainable growth?

In the AI era, fast growth alone isn’t enough. The Rule of 40 keeps companies honest.

💡 Examples Across Growth Stages

Not all Rule of 40 scores mean the same thing. Here’s how it plays out across the software lifecycle, using three real-world examples:

Early-Stage: GitLab (GTLB)

Still prioritizing growth

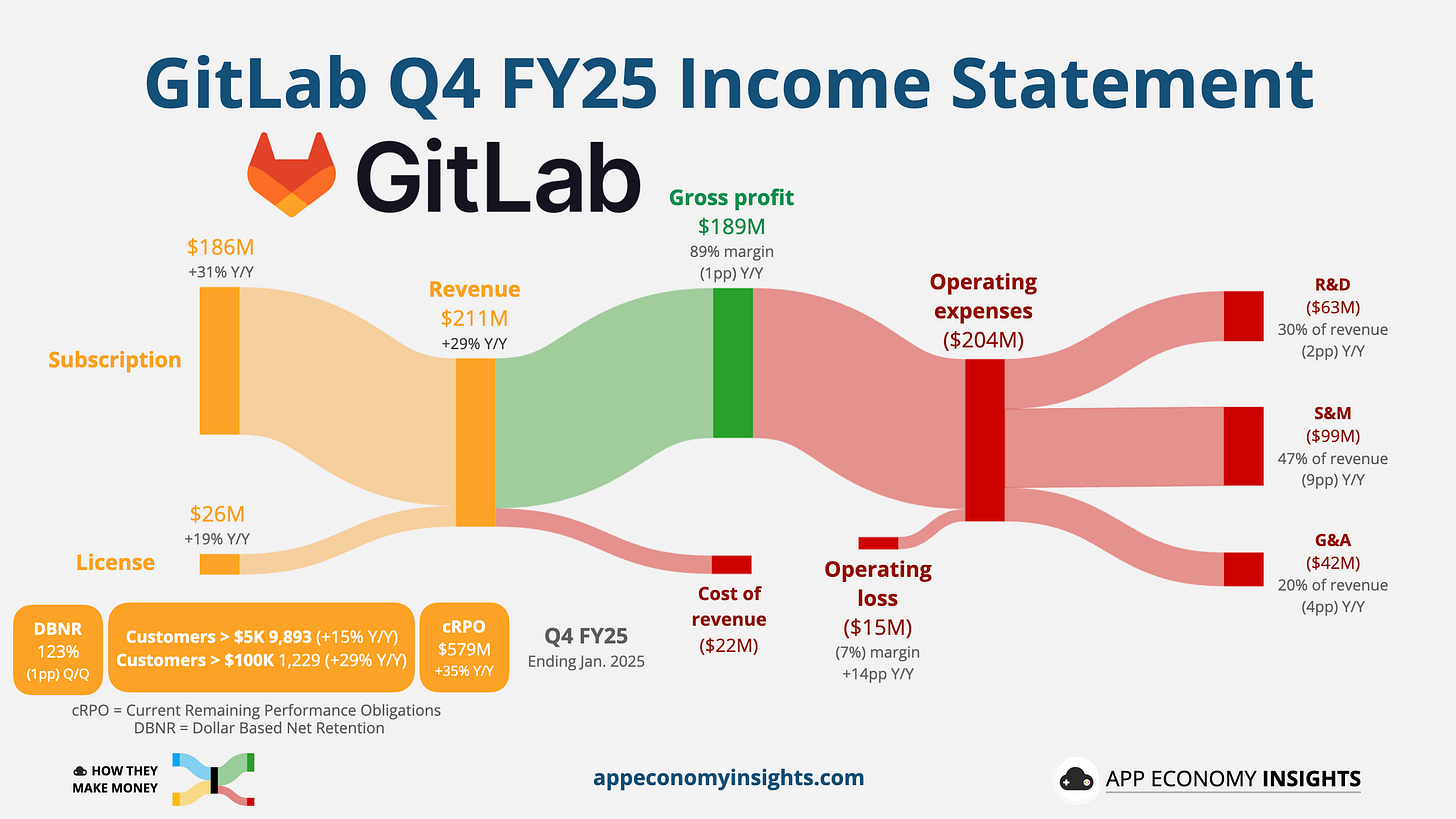

In Q4 FY25 (January quarter):

Revenue Growth: 29% Y/Y, with Subscription revenue growing of 31% Y/Y and representing 88% of the top line. Another strong KPI here is the current RPO (next-12-month obligations from existing contracts), rising 35% Y/Y, implying a potential growth acceleration.

Profitability: Free Cash Flow margin of 16% in the past 12 months, and operating loss margin of -7% in Q4 (improving by 14 percentage points Y/Y).

Rule of 40 Score: 45+ if you focus on FCF, or ~22 if you focus on operating margin.

GitLab is investing aggressively in products (like Duo AI) and go-to-market, especially in the enterprise category. The company is showing exceptional operating leverage, indicating that it’s well on its way to being a high performer on the Rule of 40, even on a GAAP basis.

🔍 Watch for:

Margin expansion as GitLab Dedicated (single tenant SaaS solution) scales.

Upsell and cross-sell traction with enterprise clients.

Progress toward the Rule of 40 over time.

📌 For early-stage companies like GitLab, Rule of 40 is a target—not a requirement.

Mid-Stage: Palantir (PLTR)

Balancing scale and margins

In Q4 FY24 (December quarter):

Revenue Growth: 36% Y/Y.

Profitability: Free Cash Flow margin of 44% in the past 12 months, and operating margin of 1% in Q4 and 11% in FY24.

Rule of 40 Score: 80 if you focus on FCF, or 47 if you focus on operating margin in the past year.

Palantir is in a sweet spot. It’s monetizing explosive demand for AI while maintaining impressive profitability. The company was added to the S&P 500 in 2024 after being profitable for four consecutive quarters. The US commercial business is booming, and margins are expanding as deals scale.

🔍 Watch for:

European adoption catching up.

Whether margins hold as growth decelerates.

Continued momentum in commercial bookings.

📌 Mid-stage companies must sustain strong Rule of 40 scores by showing durable growth while improving margins as they scale.

Mature: Salesforce (CRM)

Margin-heavy, growth-light

In Q4 FY25 (January quarter):

Revenue Growth: 8% Y/Y.

Profitability: Free Cash Flow margin of 33% in the past 12 months, and operating margin of 18% in Q4 and 19% in FY25.

Rule of 40 Score: 41 if you focus on FCF, or 27 if you focus on operating margin in the past year.

Salesforce is a classic mature SaaS business. It’s navigating single-digit growth, but strong cash flows and operational efficiency give it an excellent score on the Rule of 40. AI products like Agentforce offer optionality but haven’t yet bent the curve.

🔍 Watch for:

Reacceleration in top-line growth.

Expansion in RPO (future revenue visibility).

Margin stability during its current leadership transitions.

📌 Mature companies must lean on efficiency—or reignite growth—to stay in Rule of 40 shape.

The Rule of 40 is a universal framework—but your interpretation should shift based on where the company is in its journey:

Early-stage: Prioritize growth trajectory and margin potential.

Mid-stage: Look for efficient scaling and durable growth.

Mature: Watch for new initiatives and margin discipline.

📈 Improving the Rule of 40

Improving a Rule of 40 score means either growing faster, becoming more profitable, or both. The best software companies pull multiple levers at once. Here are a few common strategies:

Expand Net Revenue Retention (NRR): Upselling existing customers is often more efficient than acquiring new ones. Strong NRR fuels growth without hurting margins.

Improve sales efficiency: Lowering Customer Acquisition Cost (CAC) or accelerating payback time boosts profitability and operating leverage.

Embrace product-led growth: Letting the product drive adoption can reduce marketing spend and improve margins.

Optimize gross margin: Infrastructure savings, automation, and scaling support costs can lift profitability—even with flat growth.

Monetize innovation: New features, pricing tiers, or usage-based models can increase revenue per customer while protecting margins.

Ultimately, the companies that shine long-term are those that scale efficiently—adding revenue faster than they add cost.

📌 Practical Insights

The Rule of 40 is one of the simplest—and most powerful—ways to assess a software company’s financial health. By blending growth and profitability into a single score, it cuts through the noise and helps investors focus on what really matters: sustainable, long-term value creation.

But it’s not a magic number. It’s a lens.

Used thoughtfully, the Rule of 40 can help you:

Screen for quality: High scores reflect strong growth, operational efficiency—or both.

Understand tradeoffs: Low scores aren’t always bad for early-stage disruptors. High scores aren’t always sustainable.

Track evolution: A rising score often signals maturing operations. A falling one might point to decelerating growth or margin compression.

Pair with context: Leadership, product strength, competitive moat—those intangibles still matter.

Here’s a quick snapshot of its strengths and limitations:

Strengths

✅ Simple and intuitive: Easy to calculate, easy to compare

✅ Highlights sustainability: Balances two key financial forces

✅ Widely adopted: Trusted by VCs, public investors, and operators

Limitations

❌ SaaS-specific: Less useful outside recurring revenue models

❌ Can be gamed: Especially with adjusted earnings or SBC exclusions

❌ Ignores intangibles: Doesn’t capture brand, moat, or leadership quality

Bottom line: The Rule of 40 is a great starting point—but not the full story.

That’s it for today!

Stay healthy and invest on.

Disclosure: I own CRM, GTLB, and PLTR in App Economy Portfolio, our investing service, where we identify and accumulate shares of exceptional software companies—from fast-growing disruptors to proven cash machines.

If thoughtful, long-term investing resonates with you, join our investing community and get instant access to our curated stock portfolio.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or the views of any other organization.

Thank you

How do we know which phase or stage of a company's development cycle it is in? Is there a rule or formula for diagnosing this?