📦 How AI Really Disrupts Commerce

What Walmart and Target's earnings reveal

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Is the AI hype finally meeting reality?

According to OpenAI CEO Sam Altman, we may be in an AI bubble. Speaking to reporters in San Francisco last week, he captured the paradox perfectly:

“Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes. Is AI the most important thing to happen in a very long time? My opinion is also yes."

For many, the GPT-5 launch felt more like a refinement than a revolution. This sentiment has many analysts wondering if we are entering the AI hype cycle’s “trough of disillusionment.”

This shift forces a crucial question: Where can AI monetize right now? All eyes are turning to commerce, and the race to capture value from discovery to checkout.

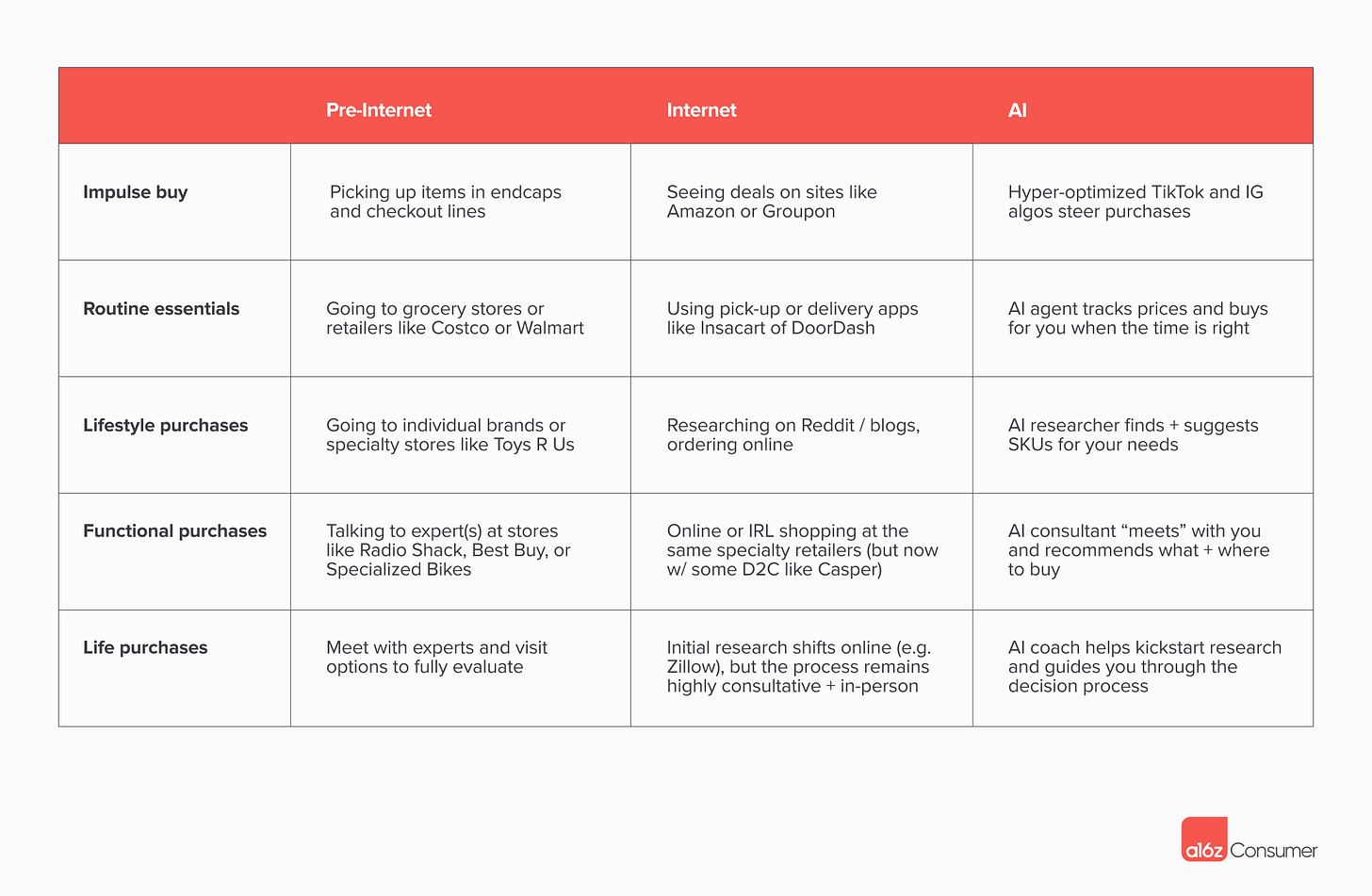

Not every purchase gets “agented” the same way. Venture firm a16z mapped buying in the AI era by level of consideration, from impulse to life decisions, offering a useful lens. We can already see it play out in hyper-optimized social feeds and personal LLMs that handle research, price-watching, and shortlists.

The bottom line? While the decision-making process is moving to algorithms and AI agents, the platforms closest to the checkout, like Amazon and Shopify, are still poised to capture the final action. For these e-commerce giants, a purchase is a purchase. Whether made by a human or a bot.

Now let’s take the pulse of commerce through this week’s earnings.

Today at a glance:

📈 E-commerce is back on trend

🛒 Walmart: Rare Profit Miss

🎯 Target: Leadership Shake-Up

📈 E-commerce is back on trend

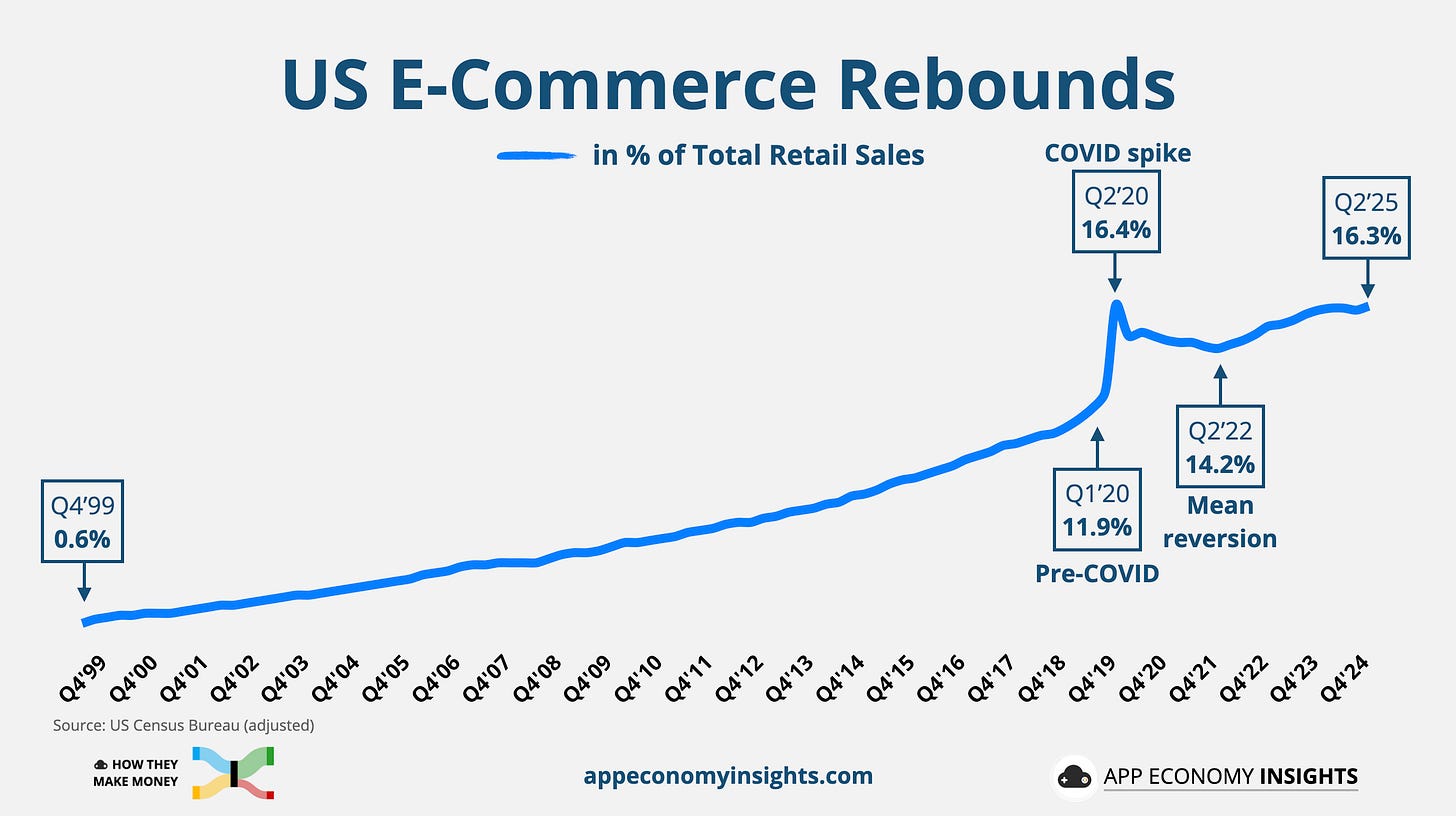

The context: In Q2 2025, US e-commerce hit $304 billion, growing 5% year-over-year. That pushes its share of total retail sales to 16.3%, nearly erasing the "mean reversion" from the last few years and closing in on the all-time high set during 2020's lockdowns. With this momentum, e-commerce could easily hit a new record this holiday season.

Look no further than Shopify to see this trend in action. As one of the highlights of this earnings season, Shopify saw both its GMV and revenue accelerate to 31% Y/Y growth in Q2, as the company goes upmarket and expands internationally. Merchant Solutions, with services like Shopify Payments, has been the real growth engine.

Key takeaway: This reveals the new playbook in e-commerce. As the market matures, the incremental profit is flowing to retail media and marketplaces. Watch ad revenue (Amazon Ads, Walmart Connect) and take-rate mix more than GMV growth to see the real dollar impact.

🛒 Walmart: Rare Profit Miss

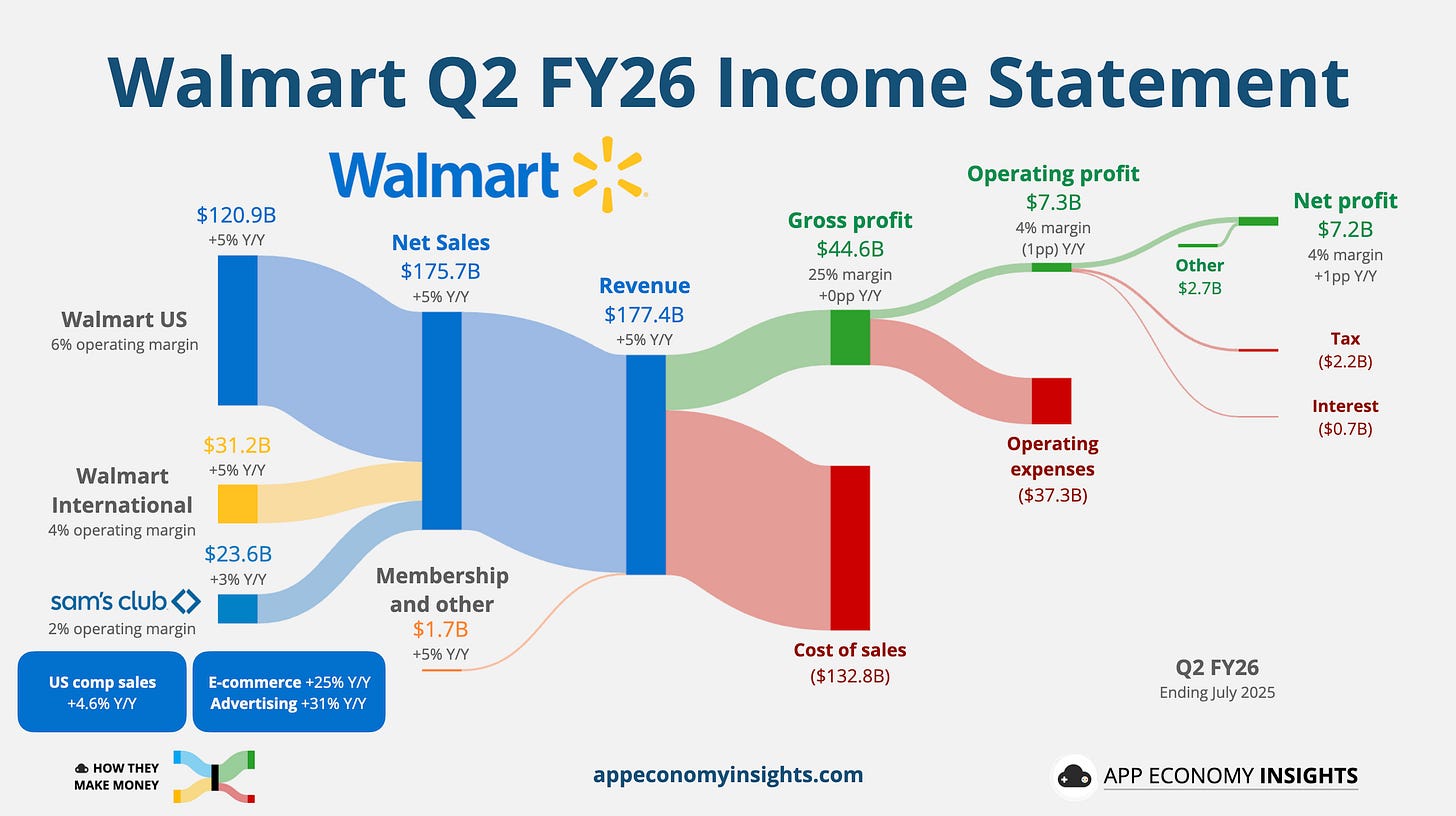

Walmart’s fiscal year ends in January, so the quarter that just ended was Q2 FY26.

📈 E-commerce surge: Revenue rose 5% Y/Y to $177.4 billion ($3 billion beat). US comparable sales rose 4.6%, outpacing most big-box peers. Global e-commerce climbed 25%.

📺 Ads flywheel: The global advertising business grew 46%, including VIZIO, acquired in December 2024 for $2.3 billion. Walmart Connect, the company’s retail media business integrating online and in-store advertising, was up 31% (ex VIZIO).

💳 Membership momentum: Membership & other income rose 5%, including 15% growth in membership income globally, supported by same-day delivery and other convenience-driven services.

🚚 Speed as a moat: Fast fulfillment is resonating. About one-third of recent store-fulfilled deliveries were “express” (under 3 hours), with customers willing to pay for speed. Amazon CEO Andy Jassy has touched on this theme for years.

🏷️ Price leadership vs. tariffs: Walmart is absorbing part of tariff costs to keep price gaps tight. US prices still rose ~1% this quarter as post-tariff inventory arrives. Higher-income households remain a key source of share gains.

📊 Margins & mix: Gross margin ticked up slightly, supported by the revenue mix (ads, marketplace), even as discrete expenses pressured profitability.

💸 Profit miss: Adjusted EPS was $0.68 (a rare $0.06 miss) due to higher self-insured liability claims, legal, and restructuring costs. The operating margin compressed slightly to 4% and shares fell after the report.

🔮 Improved guidance: Management raised the FY26 outlook with net sales expected to grow to 3.75%–4.75% (compared to 3.0 to 4.0% previously).

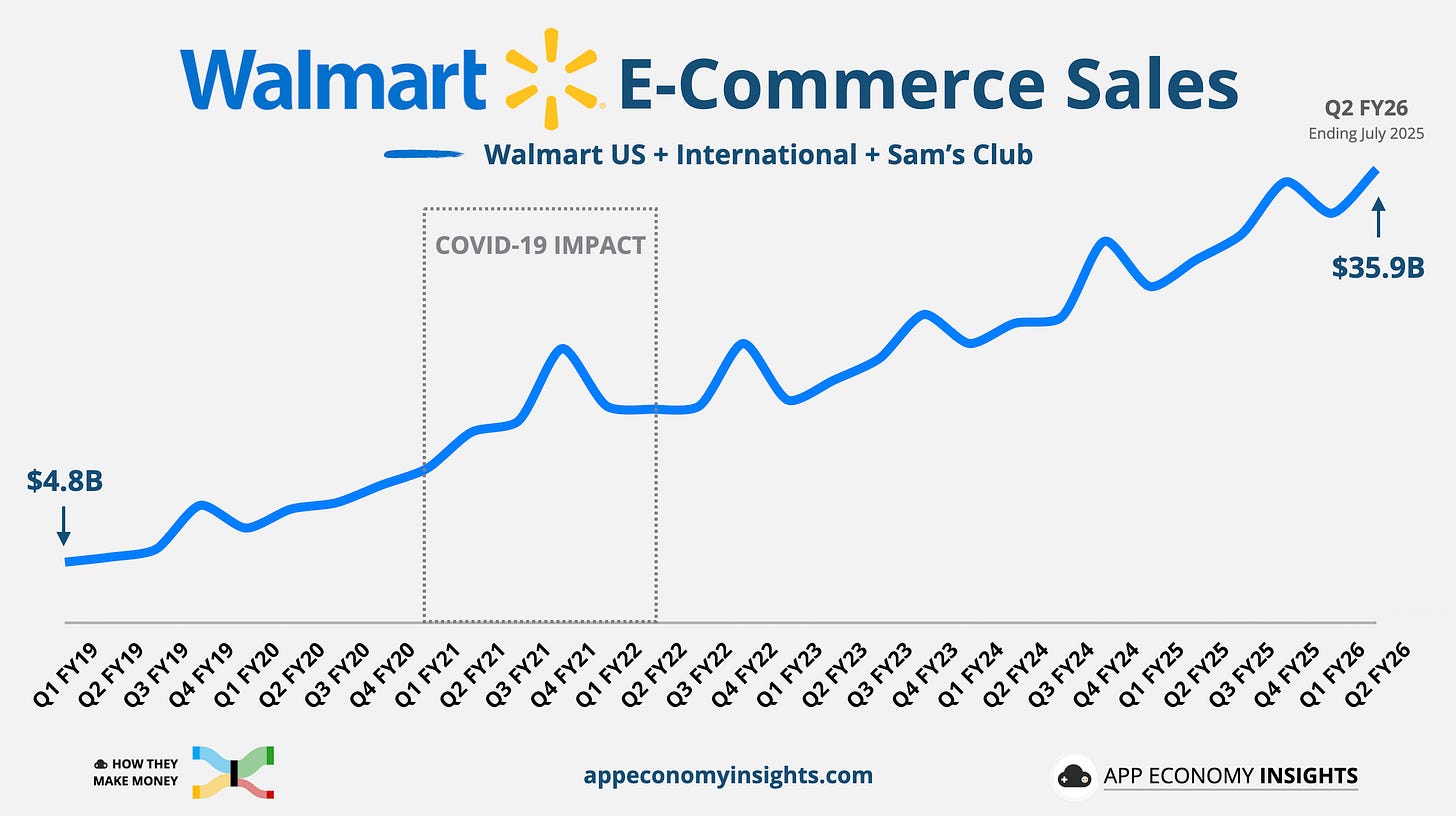

E-commerce is now 20% of Walmart’s revenue (+3pp Y/Y)

Walmart’s e-commerce revenue has surged roughly 7× in 7 years, a growth reminiscent of Amazon’s rise in popularity in the late 2010s. The COVID spike reset the baseline higher, and growth has continued.

The reported e-commerce sales include advertising revenue. Walmart leverages its first-party customer data to offer targeted and effective ads to a broader range of industries like automotive and financial services.

Growth is coming from store-fulfilled pickup and delivery, marketplace expansion, and Walmart+ membership (estimated at ~25 million). The result is a durable flywheel that those without a nationwide store network will struggle to match. Using 4,600 US stores as mini-fulfillment hubs and monetizing that demand with ads gives Walmart a defensible flywheel to compete with Amazon.

What to make of all this?

Don't let the headline fool you. Walmart’s engine—a powerful mix of grocery traffic, same-day delivery, and a booming retail media business—is stronger than ever. The profit miss was noise. The signal is the accelerating omnichannel strategy that is solidifying its position as a true challenger to Amazon.

🎯 Target: Leadership Shake-Up

Target is navigating a major transition, with a CEO shake-up looming as the company pivots its business model from in-store sales to high-growth digital and membership revenue.

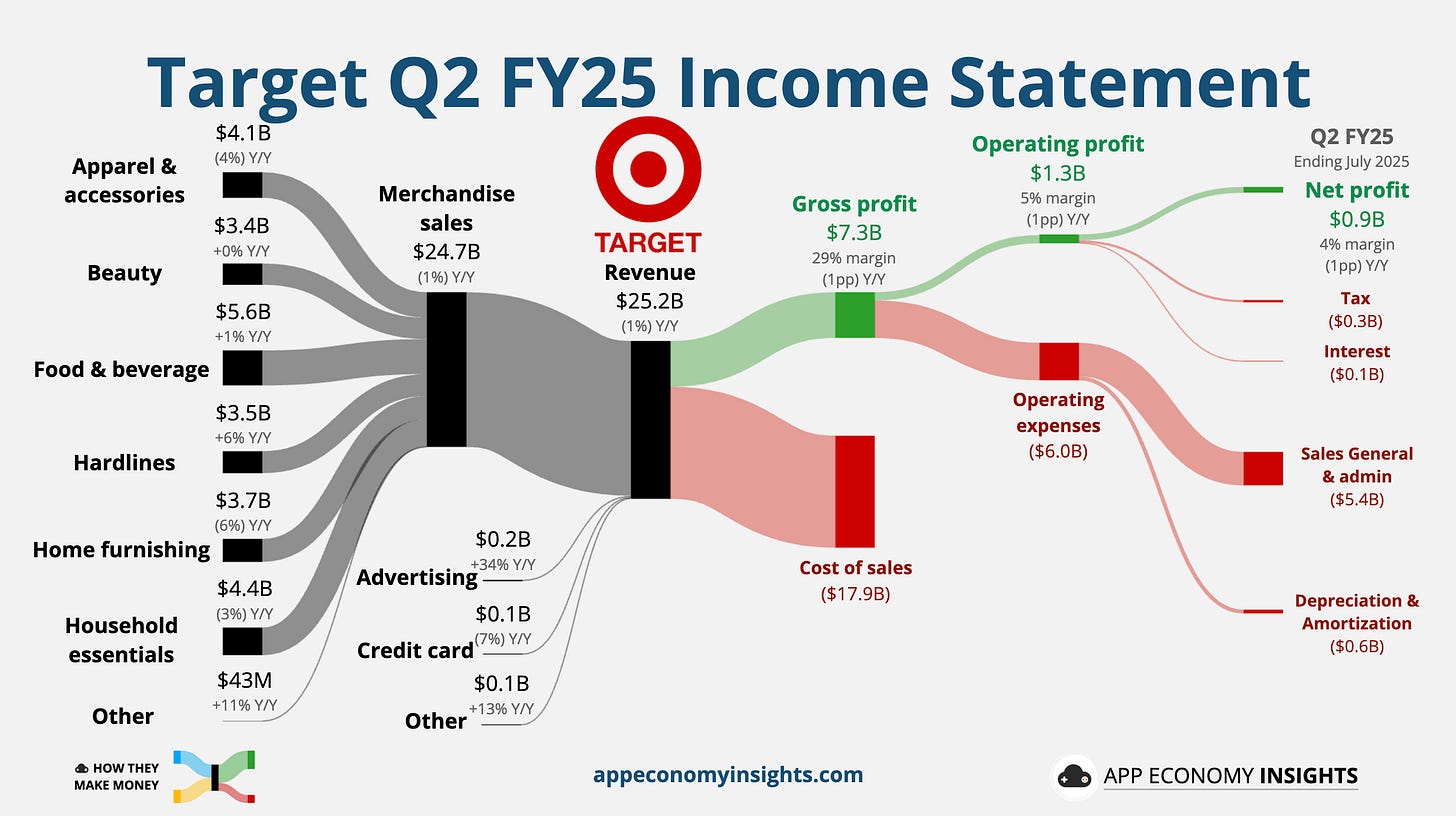

📉 Stores down but digital up: Total revenue dropped 1% Y/Y to $25.2 billion ($0.3 billion beat). Comparable sales fell 1.9%, with sales at stores down 3.2% while digital rose 4.3%. The real story, however, was that non-merchandise sales (media business, membership) rose 14%, and same-day delivery via Target Circle 360 surged more than 25%.

💸 Margin pressure persists: Gross margin was 29% and operating margin 5% (both down 1pp Y/Y), held back by markdowns and higher costs. While improving non-merch revenue and lower inventory shrink helped, tariffs remain a persistent headwind.

💄 Beauty reset: The Ulta Beauty at Target shop-in-shop partnership will wind down in August 2026, giving Target optionality to reconfigure that space and assortment over time.

👤 A new era of leadership: CEO Brian Cornell will be succeeded by COO Michael Fiddelke in February 2026. Cornell is not slowing down on his way out after 11 years at the helm. He's pushing a new "Enterprise Acceleration Office" to speed up execution and drive change faster.

🔮 Cautious outlook: Target maintained the FY25 outlook for a low-single-digit decline in revenue. However, they also reiterated a multi-year goal to add over $15 billion in sales by 2030, leveraging merchandising, guest experience, and tech.

What to make of all this?

Target is leaning on same-day convenience, membership (Circle 360), and non-merch revenue to improve comps while it resets merchandising and store execution. The incoming CEO has a lot on his plate to accelerate change across digital operations, discretionary recovery, and tariff pass-through.

This quarter widened the gap between the retail giants. While Walmart hits the accelerator on its omnichannel strategy, Target is navigating a pit stop with its leadership transition.

Next up, we're turning our attention to the global picture with coverage of Chinese e-commerce giants Alibaba and PDD (Temu).

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Disclosure: I own AMZN and SHOP in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.