📊 PRO: This Week in Visuals

LLY MCD SHOP UBER ANET NVO APP SONY AMGN PFE ABNB MAR FTNT CPNG FLUT XYZ DDOG TEAM TTWO YUM LYV TTD TOST EXPE PINS HUBS DKNG GPN ZG DUOL TWLO PAYC SNAP TEM KVYO NYT MTCH LYFT PTON DOCN TRIP DCBO

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

💊 Eli Lilly: Pill Doubts

🍟 McDonald's: Reigniting Growth

🇨🇦 Shopify: Canada’s Largest Stock

🚖 Uber: Accelerating User Metrics

🇩🇰 Novo Nordisk: Growth Reset

🧬 Amgen: Obesity Trials Advance

🖥️ Sony: PlayStation Power

🌐 Arista Networks: AI Tailwinds Accelerate

💉 Pfizer: Costs in Check

📱 AppLovin: Self-Serve Era Incoming

🛖 Airbnb: International Offsets Soft US

🔒 Fortinet: Slowing Services Growth

🏨 Marriott: International To The Rescue

🏈 Flutter: FanDuel’s Winning Streak

🇰🇷 Coupang: New Verticals Deliver

☁️ Atlassian: AI Momentum

🐶 Datadog: AI Cohort Lifts Outlook

🔲 Block: Borrow Fuels Rebound

📺 The Trade Desk: Kokai at Scale

🎮 Take-Two: Raising the Bar

🌮 YUM Brands: Digital Milestone

🎤 Live Nation: Latin America in Focus

🍞 Toast: New Locations Record

📢 HubSpot: AI-First Strategy Pays Off

📌 Pinterest: Gen Z Fuels Growth

✈️ Expedia: Guidance Takes Off

👑 DraftKings: Lucky Quarter

🏠 Zillow: Rentals Surge Again

🌎 Global Payments: Ongoing Shift

💬 Twilio: Growth Accelerates

🦉 Duolingo: New Subjects Take Flight

👻 Snap: Ad Glitch Hits Growth

💻 Paycom: AI-Driven Efficiency

🗞️ New York Times: AI Boosts Bundles

🔥 Match Group: Signs of Stabilization

🏴 Klaviyo: Upmarket Gains

🧬 Tempus AI: Genomics Revs Up

🚘 Lyft: Still Trailing Uber

🚲 Peloton: Profitable Again

🌊 Digital Ocean: AI Lifts Outlook

🍽️ Tripadvisor: Marketplaces Take the Lead

🎓 Docebo: Mid-Market Momentum

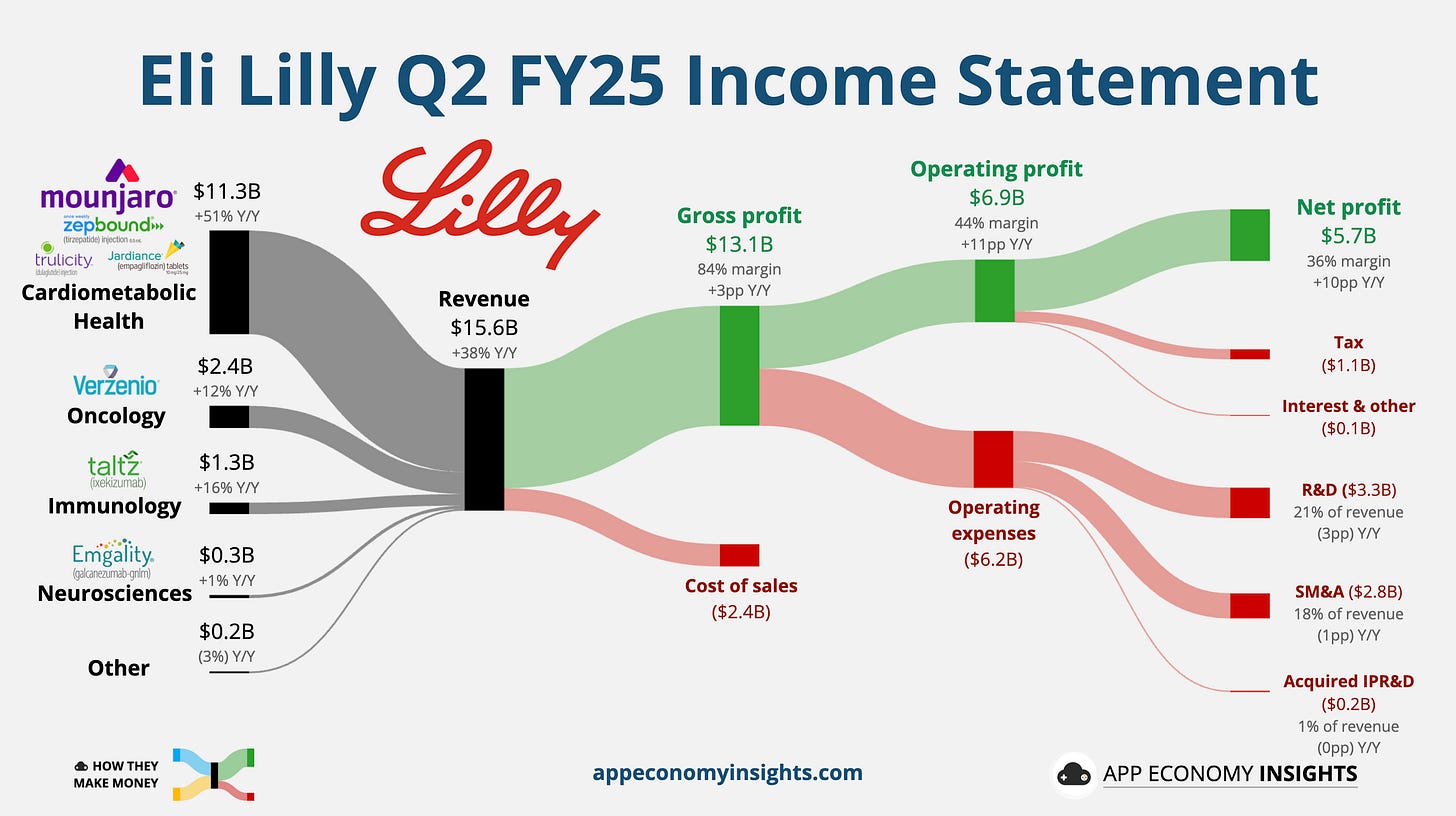

1. 💊 Eli Lilly: Pill Doubts

Eli Lilly’s Q2 revenue surged 38% Y/Y to $15.6 billion ($0.9 billion beat), led once again by its GLP-1 duo—Mounjaro (+68% to $5.2 billion) and Zepbound (+172% to $3.4 billion). Non-GAAP EPS jumped 61% to $6.31 ($0.72 beat), with gross margin improving to 84%.

Lilly raised its full-year revenue guidance to $60–62 billion (up from $58–61 billion), and non-GAAP EPS to ~$22.25 (from ~$21.53). Performance margins are expected to reach up to 45.5%, with plans to nearly double incretin production in 2H25.

But sentiment turned. Shares dropped ~14% on underwhelming Phase 3 data for orforglipron, its once-daily oral weight-loss pill. Patients lost up to 12.4% of body weight, trailing injectables like Novo Nordisk’s Wegovy (~15%), while 10% discontinued due to gastrointestinal side effects. Rival Novo surged on the news.

CEO Dave Ricks defended the profile, emphasizing oral convenience and scalable manufacturing. Despite headwinds like CVS dropping Zepbound, Mounjaro is now the top diabetes incretin in the US. The long-term thesis remains, but the road to pill-based dominance may be bumpier than hoped.

2. 🍟 McDonald’s: Reigniting Growth

McDonald’s returned to growth in Q2, with global same-store sales up 4%, ending a streak of weak quarters. US comps rose 2.5%, a sharp rebound from last quarter’s -3.6% decline, driven by positive check growth and strong reception to Snack Wraps, $5 bundles, and Minecraft-themed promotions. Revenue grew 5% Y/Y to $6.8 billion ($140 million beat), and EPS reached $3.19 ($0.04 beat).

International Licensed Markets (+6%) and International Operated Markets (+4%) outperformed, supported by value deals and new product launches like the Chicken Big Mac in Germany.

McDonald’s reaffirmed its full-year operating margin guidance in the mid-to-high 40% range and expects 2,200 new restaurant openings in 2025 (1,800 net adds). Digital remains a focus, with loyalty users exceeding 185 million across 60 markets and a 2027 target of 250 million.

Despite ongoing pressures on low-income consumers, management sees momentum building. CEO Chris Kempczinski cited a bifurcated consumer landscape but emphasized McDonald’s scale, affordability, and IP tie-ins as key to reengaging core customers and sustaining traffic gains.

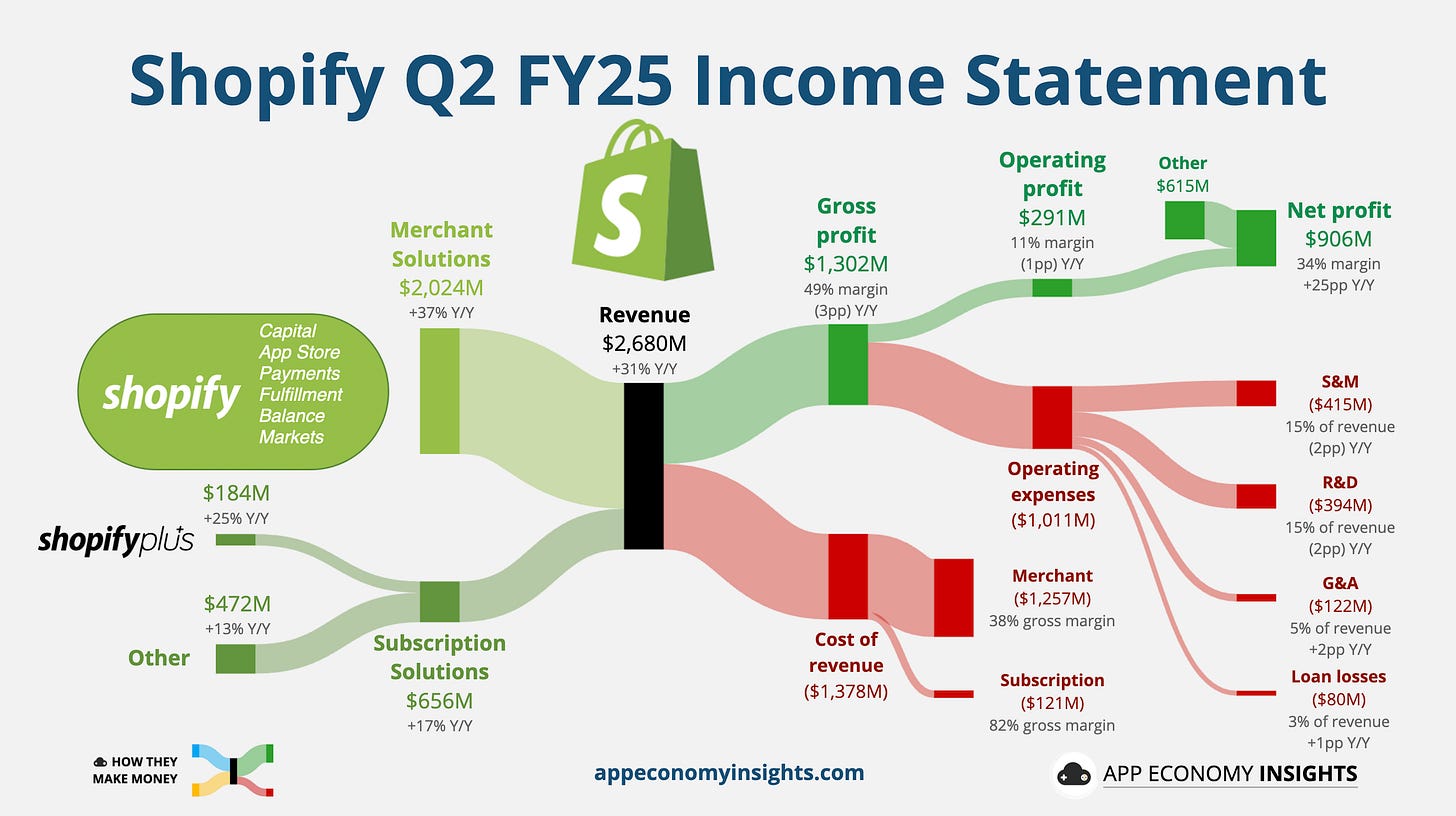

3. 🇨🇦 Shopify: Canada’s Largest Stock

Shopify’s Q2 revenue jumped 31% Y/Y to $2.68 billion ($130 million beat). Gross merchandise volume surged 31% to $87.8 billion ($6 billion above expectations), with notable acceleration in Europe (+42% Y/Y in constant currency). Monthly recurring revenue rose 9% Y/Y to $185 million.

Operating income came in at $291 million (vs. $248 million consensus). Net income soared to $906 million, driven by operating leverage and favorable equity investment in Affirm, Global-e, and Klaviyo after last quarter’s drag (see ‘Other” for $615 million in the top right of the visual). Free cash flow hit $422 million, or 16% of revenue (up from 15% in Q1).

Shopify regained its position as Canada’s most valuable public company, with shares surging over 20% to a new 52-week high. Wall Street celebrated large merchant adoption and international momentum. Citi called it a “blowout” quarter, suggesting market share gains more than offset macro concerns and tariff risk.

Looking ahead, Shopify expects Q3 revenue growth in the mid-to-high 20% range and gross profit growth in the low 20% range. Tariff pressures remain something to watch, but investor focus has shifted to the platform’s ability to scale across geographies and segments.

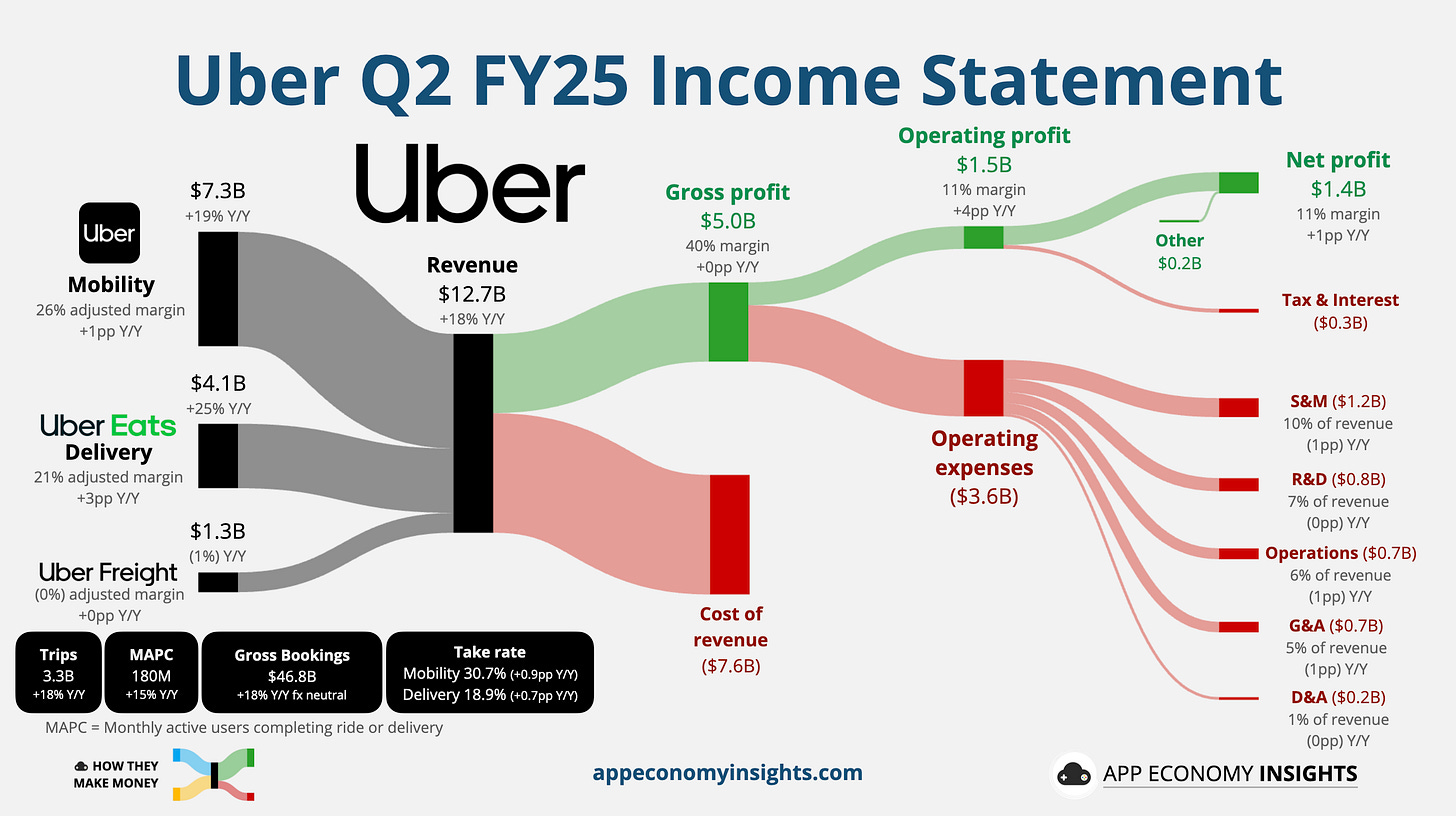

4. 🚖 Uber: Accelerating User Metrics

Uber’s Q2 revenue rose 18% Y/Y to $12.7 billion ($230 million beat). Gross bookings showed no sign of slowing down, rising 18% Y/Y to $46.8 billion, driven by 18% trip growth and a 15% rise in monthly active users to 180 million (an acceleration). Delivery outpaced Mobility again, with bookings up 20% vs. 16%, as Uber pushes its “barbell strategy” to serve both cost-conscious and premium users.

Adjusted EBITDA climbed 35% to a record $2.1 billion (4.5% of bookings), while free cash flow surged 44% to $2.5 billion. Net income reached $1.4 billion, aided by strong operating leverage and investment gains. Uber One membership jumped to 36 million, now contributing 40% of total bookings.

Despite the record quarter, Mobility bookings narrowly missed estimates ($23.8 billion vs. $23.9 billion). Still, Uber authorized a massive $20 billion buyback, effectively $23 billion with remaining capacity.

Looking ahead, Uber guided Q3 gross bookings to grow +17% to 21% in constant currency, and adjusted EBITDA to grow +30% to 36%. CEO Dara Khosrowshahi emphasized platform cross-sell and AV expansion, with new Waymo deployments in Atlanta and partnerships with Lucid, Nuro, and others to scale autonomous fleets over time. We covered the latest partnership in our review of Tesla’s earnings.