🏈 Disney Gives NFL a Stake

A bold move to future-proof ESPN

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

🏈 ESPN’s new minority owner: The NFL

The world’s most valuable sports league now owns a piece of the network that broadcasts it.

In a landmark no-cash deal, Disney is giving the NFL a 10% stake in ESPN, valued at roughly $3 billion. In return, ESPN will take over the distribution of NFL Network, RedZone, and other league content.

It’s a move for strategic control, and it comes just weeks before ESPN launches its $30-per-month standalone streaming app.

With YouTube, Amazon, Netflix, and Apple circling, Disney is doing everything it can to lock in the most valuable content in live sports: NFL games. Giving the league partial ownership ensures ESPN is aligned with its most essential partner and stays relevant as the cable bundle crumbles.

As CEO Bob Iger put it:

“This will go a long way toward improving ESPN’s prospects as it migrates to a direct-to-consumer product.”

Disney’s play is simple: mitigate churn today, gain pricing power tomorrow.

It’s building a premium streaming experience anchored by live sports, with fantasy, betting, personalized highlights, and e-commerce on deck. The endgame? Competing head-on with FanDuel, DraftKings, and Big Tech.

This summer’s biggest media move didn’t happen at the box office, but in the boardroom. And Disney’s deal with the NFL could inspire the rest of the market.

Today at a glance:

📈 Streaming subscriber trends

🏰 Disney: Parks & Streaming To The Rescue

🦚 Comcast: Broadband Slide Continues

🎥 Warner: Studio Hits Lead the Show

⛰️ Paramount: Last Quarter Before Skydance

📈 Streaming subscriber trends

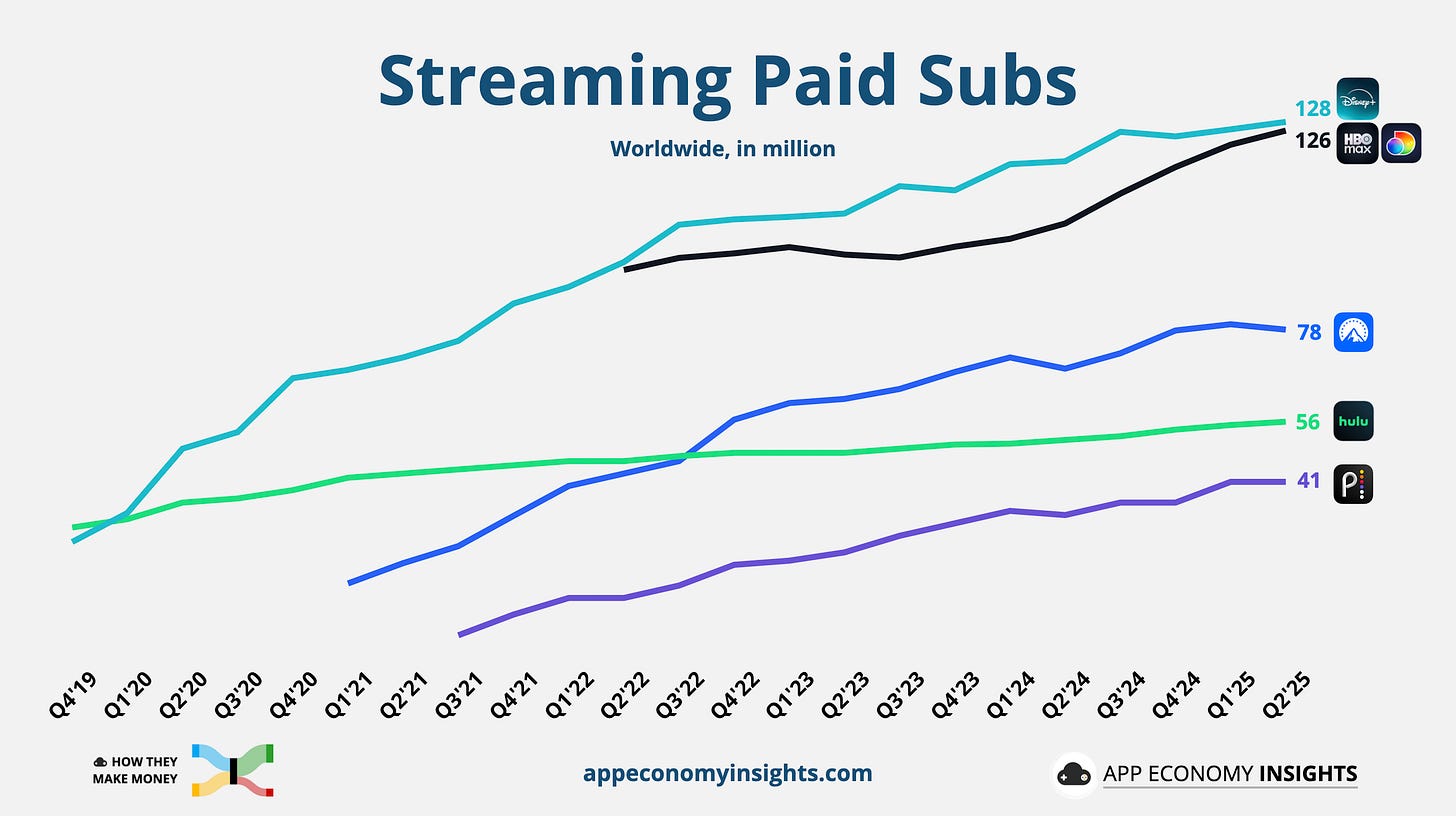

Remember, Netflix capped 2024 with 302 million members, but has stopped sharing membership numbers. That leaves us focusing on the best of the rest. Let’s zoom in on the streaming platforms still reporting their figures.

Net additions were meager across the board. Only HBO Max gained a meaningful number of subscribers in Q2, but much of that growth came at a lower average revenue per user, driven by ad-tier distribution and international expansion.

Note: Platforms like YouTube Premium, Prime Video, and Apple TV+ don’t share subscriber numbers quarterly—if at all.

Now, let’s break down how the biggest players performed this quarter.

🏰 Disney: Parks & Streaming To The Rescue

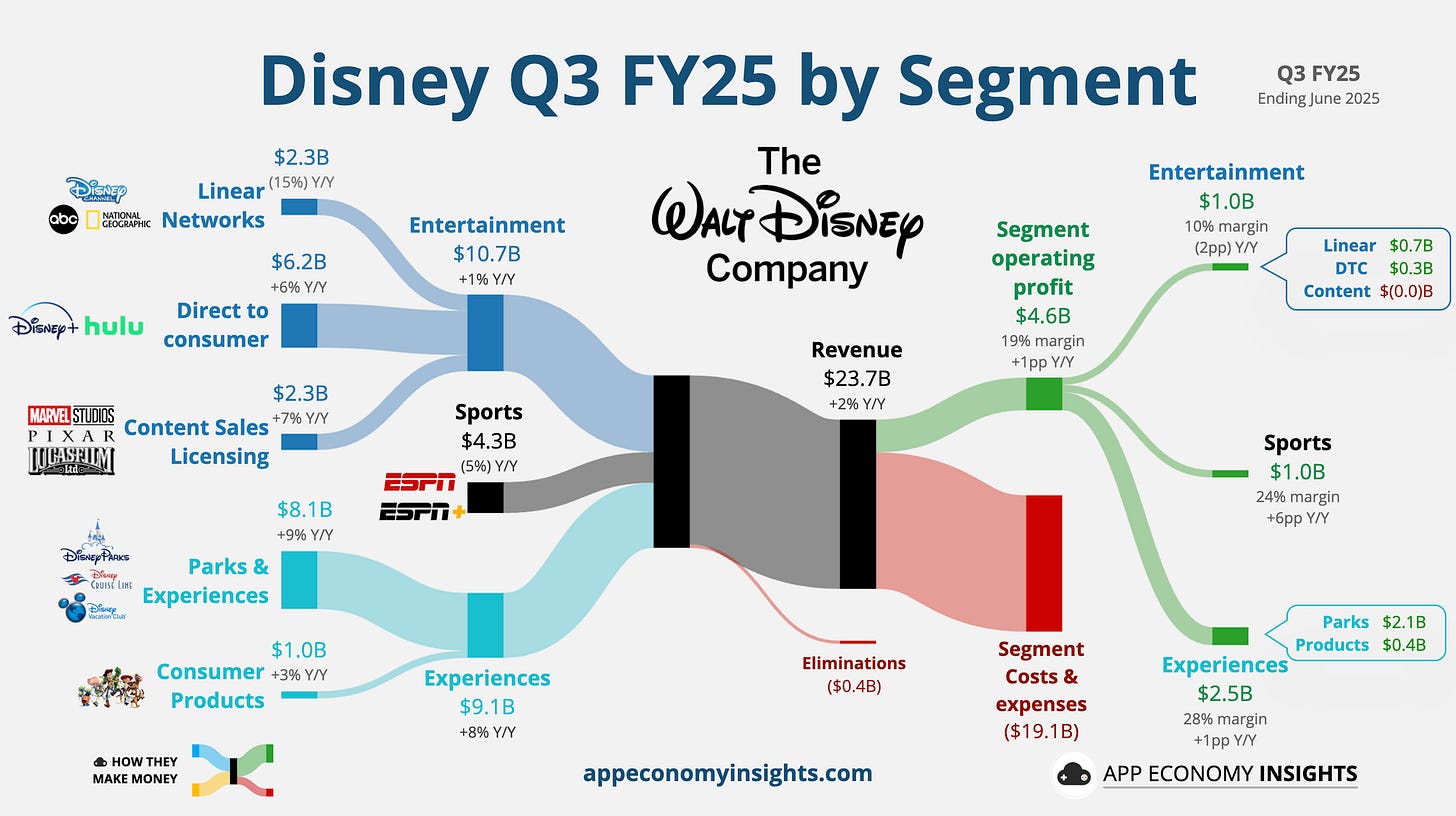

Disney’s fiscal year ends in September, so the June quarter was Q3 FY25.

📈 Streaming stays profitable: Direct‑to‑consumer earned $346 million in operating income, its fourth straight profitable quarter, driven by higher pricing and improved efficiency. Disney+ added 1.8 million subscribers (reaching 128 million), while Hulu gained 900,000 (reaching 56 million), both slightly below expectations. Average revenue per user for Disney+ rose 1% to $7.86. Starting next fiscal year, Disney will stop reporting subscriber counts, focusing instead on profitability metrics, following in Netflix’s footsteps.

🏰 Parks and cruises surge: Experiences revenue rose 8% to $9.1 billion, with operating income up 13% to $2.5 billion, a record Q3 for Walt Disney World despite new competition from Universal’s Epic Universe. Domestic parks and cruise demand remained strong, while China parks faced softer attendance. Disney highlighted early bookings for its new Singapore‑based cruise ship launching in December, already sold out for its first two quarters.

📺 Linear TV remains a drag: Revenue from traditional TV networks fell 15% to $2.3 billion, with operating income down 28% to $0.7 billion amid cord‑cutting and weaker ad rates. ESPN’s revenue slipped 5%, though Disney is preparing to launch its $30‑per‑month standalone ESPN streaming service in August, bundled with Hulu and Disney+ for $36.

🍿 Content sales mixed: Content Sales and Licensing revenue rose 7% to $2.3 billion, though theatrical results were uneven. Pixar’s Elio was a box office disappointment, and Thunderbolts underperformed despite a strong Marvel brand. Still, licensing and home entertainment drove segment growth, with Lilo & Stitch helping boost merchandise revenue.

🔮 Updated guidance: Disney raised its FY25 adjusted EPS growth forecast to 18% year-over-year (up from 16% previously) and expects $1.3 billion in annual streaming operating income. Experiences are projected to grow 8%, sports 18%, and entertainment DTC double digits.

What to make of all this?

Disney is betting big on bundled streaming (Disney+/Hulu/ESPN) and franchise‑driven films to carry momentum into FY26. With Lilo & Stitch topping $1 billion and Fantastic Four leading the box office, Disney has regained its blockbuster footing. But it faces the challenge of balancing nostalgia, new IP, and heavy content investments.

🦚 Comcast: Broadband Slide Continues

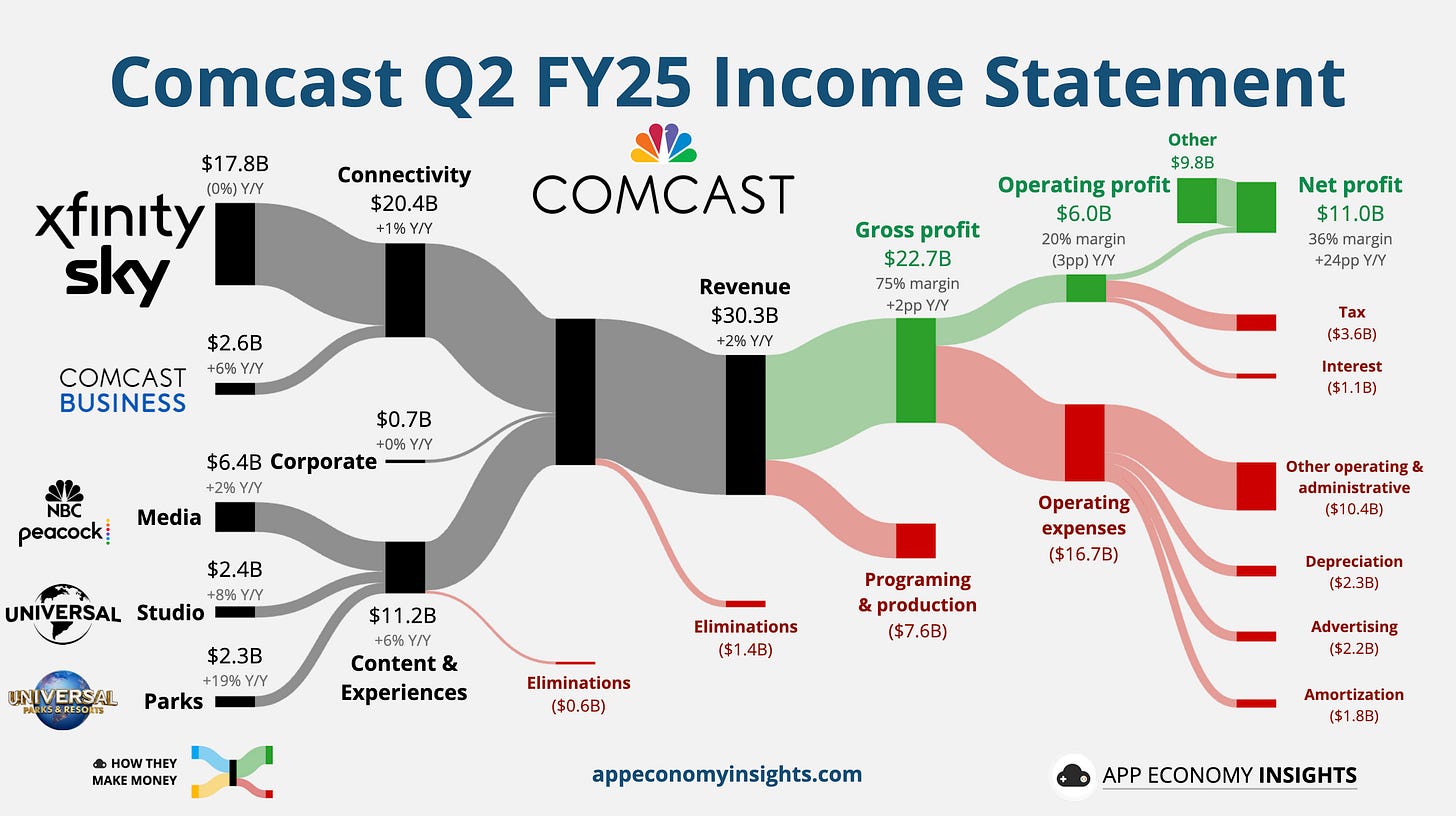

📸 Big picture: Revenue grew 2% to $30.3 billion ($0.5 billion beat), adjusted EPS rose 3% to $1.25 ($0.07 beat), and free cash flow reached $4.5 billion. A massive $9.4 billion gain from the Hulu sale inflated net profit to $11.0 billion.

📉 Subscriber losses widen: Comcast lost 226,000 broadband customers in Q2, deeper than Q1’s 199,000 losses but better than the 257,000 analysts expected. Pay-TV losses also eased slightly to 325,000 versus 383,000 expected. Wireless was a standout, adding a record 378,000 lines. Connectivity and platforms revenue was slightly up at $20.4 billion, supported by new pricing guarantees and bundled offers.

📈 Peacock’s losses shrink: Peacock ended the quarter flat at 41 million subscribers, with revenue up 18% to $1.2 billion (part of the Media segment). Losses narrowed to $101 million from $215 million last quarter, helped by Love Island USA engagement. A $3 monthly price hike begins in Q3, ahead of NBA streaming rights launching this fall.

🎥 Studios lift results: Universal Studios revenue rose 8% to $2.4 billion on the strength of How to Train Your Dragon. The July release of Jurassic World: Rebirth is expected to boost Q3. Content licensing also contributed to the gain, though EBITDA fell 31% due to higher costs.

🎢 Epic Universe drives parks surge: Theme parks revenue jumped 19% to $2.3 billion with the opening of Epic Universe in Orlando. Management highlighted strong pre‑bookings, higher per‑capita spending, and minimal cannibalization of other Universal parks.

📺 Versant spinoff progresses: Comcast is spinning off MSNBC, CNBC, USA Network, and other cable channels into Versant Media Group by year‑end. The move aims to streamline operations around broadband, streaming, and wireless, while freeing Versant to pursue acquisitions and turnaround strategies.

What to make of all this?

Comcast’s growth engines — wireless, parks, and Peacock — are firing, but the broadband slide overshadows the story. Even with better‑than‑expected losses, reversing the core decline remains the swing factor for sentiment. The Hulu windfall and Versant spinoff give Comcast breathing room to double down on growth bets, but investors will watch closely for proof that broadband can stabilize before the rest of the portfolio offsets the drag.

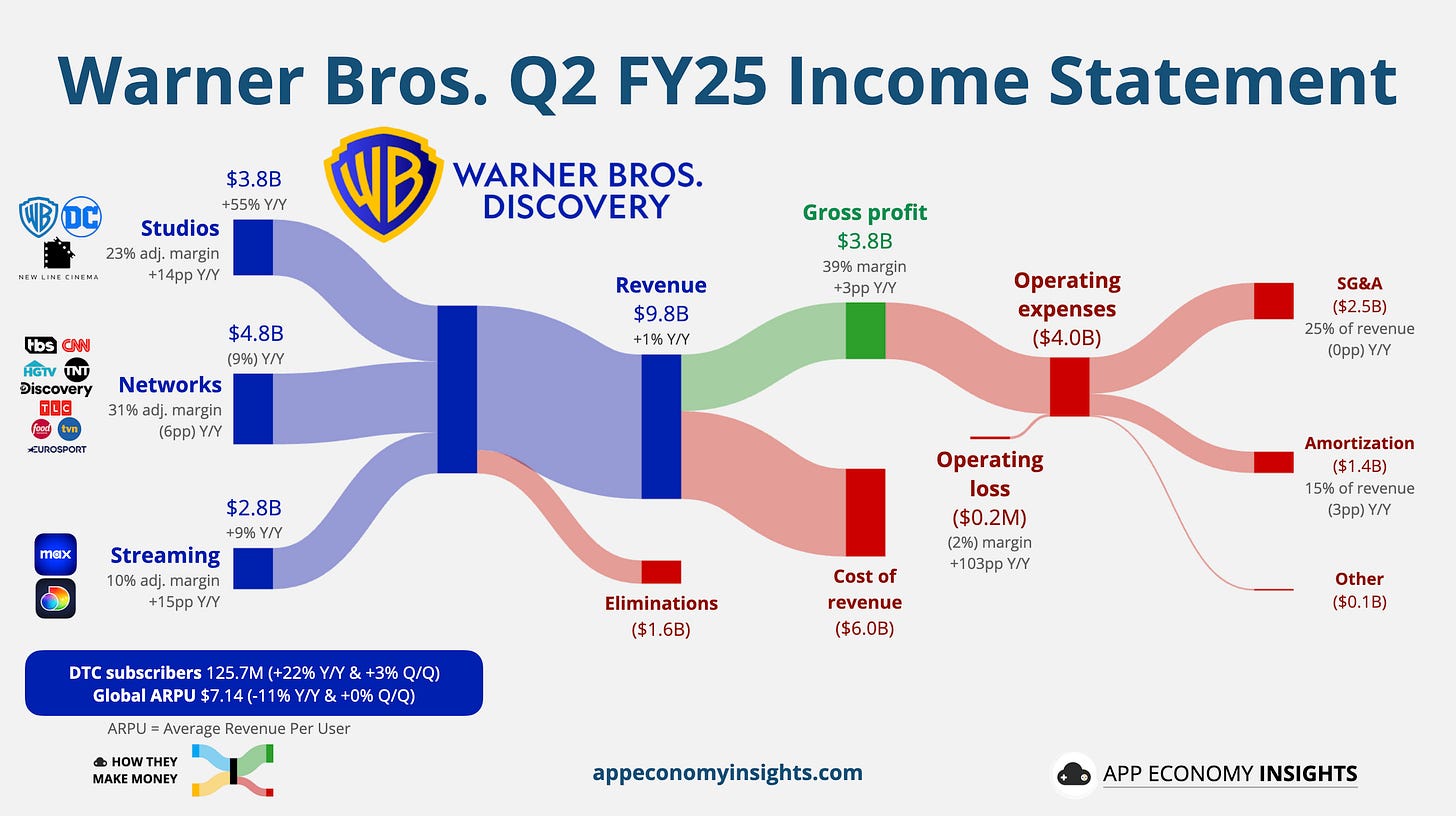

🎥 Warner: Studio Hits Lead the Show

🎬 Studios rebound: Studios revenue surged 55% Y/Y to $3.8 billion, powered by hits like Minecraft, Sinners, and Final Destination: Bloodlines. Adjusted EBITDA reached $0.9 billion, with a full-year target of $2.4 billion. Management emphasized fewer, bigger films going forward—targeting 12–14 annual releases, including tentpoles like Superman, The Lord of the Rings, and Harry Potter.

📺 Linear still dragging: Global Networks revenue fell 9% Y/Y to $4.8 billion, and EBITDA declined 24% to $1.5 billion, with cord-cutting and weaker international rates driving the slump. US viewership declines, especially post-NBA and March Madness, continue to weigh on ad sales (down 13%). Warner completed six major carriage renewals and is preparing to spin off this segment as a standalone entity.

📈 More subscribers at a lower price: The “re-rebranded” HBO Max and Discovery+ added 3.4 million subscribers in Q2, reaching 126 million globally, above expectations. Streaming revenue rose 9% to $2.8 billion, and adjusted EBITDA flipped to a $293 million profit from a loss a year ago. However, ARPU fell 11% globally (-8% in the US), as growth skewed international and ad-tier wholesale deals weighed on pricing. Management remains confident in hitting $1.3 billion streaming EBITDA by 2025 and 150 million subs by 2026.

💵 Profit and debt progress: Warner had a small operating loss (see visual), compared to a $10 billion loss a year ago (which included write-downs). Free cash flow hit $700 million, despite $250 million in separation-related costs. The company reduced gross debt by $2.7 billion in the quarter to $35.6 billion, with net leverage at 3.3x. CEO David Zaslav says the company is “past peak investment mode” and shifting focus to harvesting returns.

🌍 Strategic clarity post-split: Warner Bros. Discovery is preparing to split into two by mid-2026:

Warner Bros.: Streaming and Studios (HBO, Max, DC, Gaming, IP library).

Discovery Global: Cable networks (CNN, TNT, Discovery, sports, Discovery+).

Streaming password-sharing crackdowns will begin in Q4 2025, with broader monetization efforts expected in 2026. International expansion continues, with HBO Max launching in Australia and plans for Europe (UK, Germany, Italy) in 2026.

What to make of all this?

Zaslav emphasized that “a three-year attack plan” is paying off, calling out HBO Max momentum, box office success, and disciplined IP development. CFO Wiedenfels said a “10-digit figure” of deferred intercompany profit is expected to flow into the P&L over time. Management stressed cost control and bundling as future growth levers.

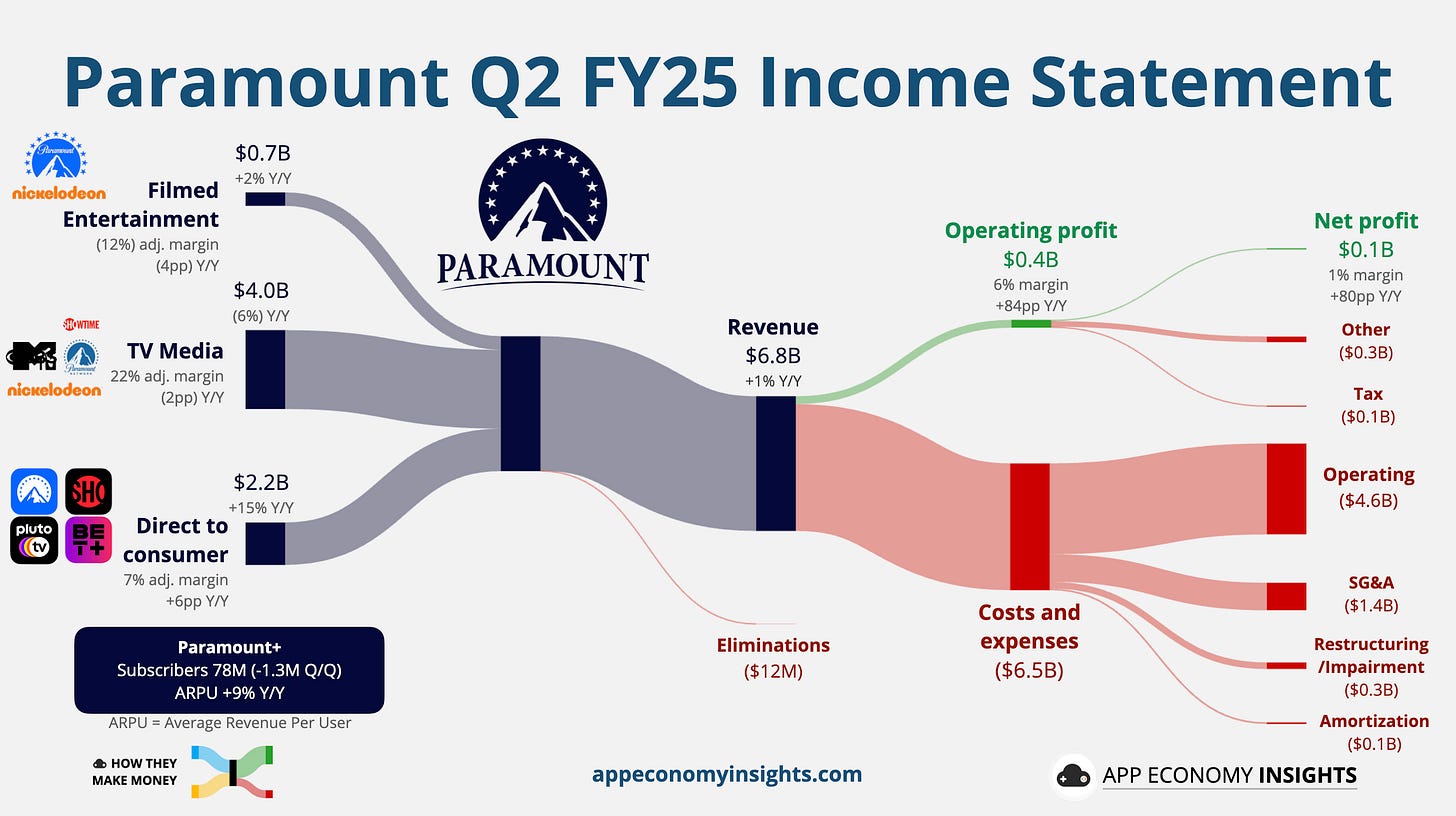

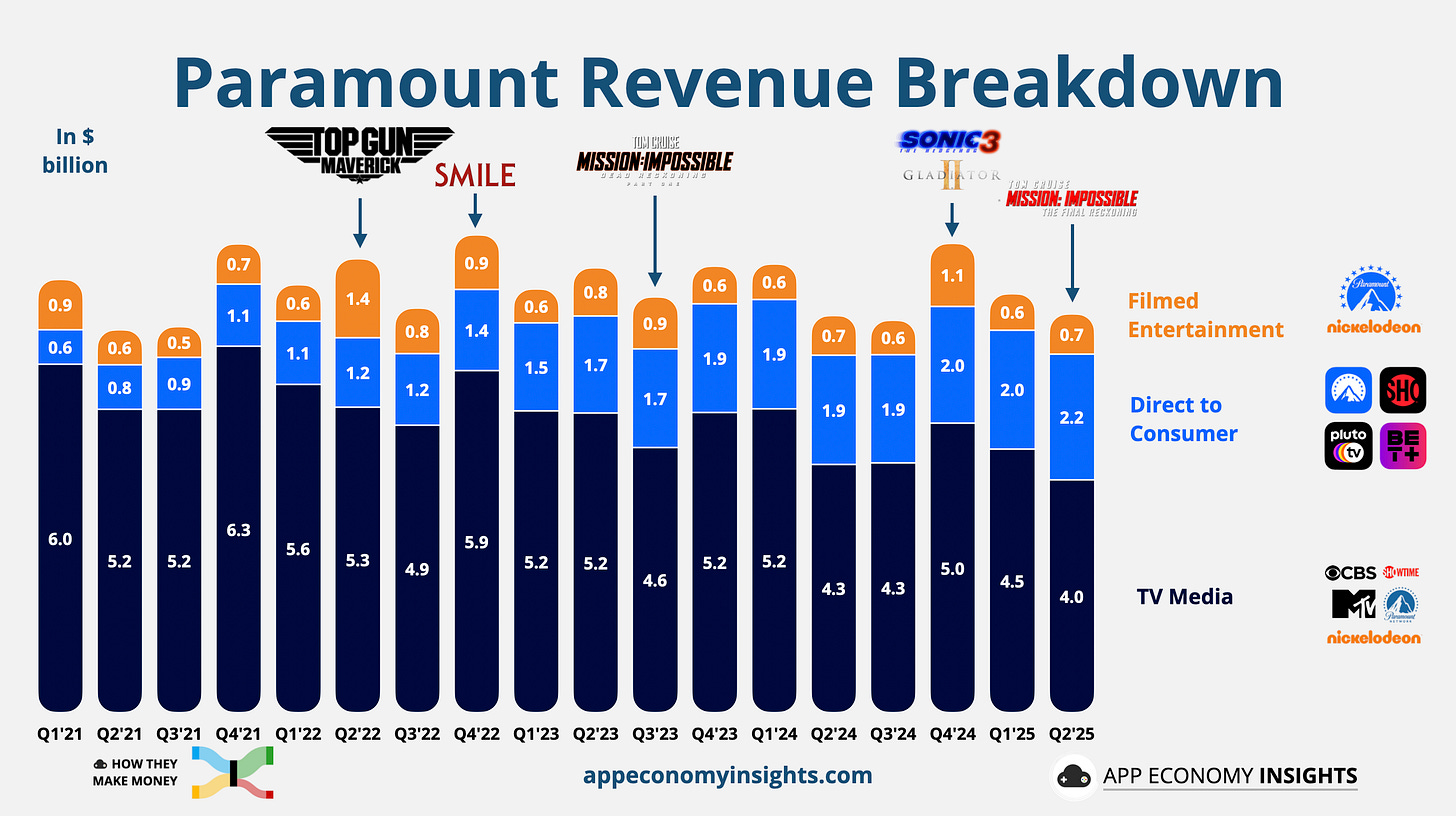

⛰️ Paramount: Last Quarter Before Skydance

📈 Streaming momentum: Direct‑to‑consumer revenue rose 15% to $2.2 billion, with Paramount+ subscribers at 78 million (down 1.3 million sequentially due to an expired international bundle). Streaming losses narrowed sharply, and adjusted operating profit improved to $157 million from $26 million a year ago, marking global profitability for the first half of 2025. Engagement rose 11% Y/Y, with churn down 70 basis points.

🎥 Film division rebounds: Filmed entertainment revenue grew 2% to $690 million, led by an 84% jump in theatrical revenue from Mission Impossible: The Final Reckoning, offset by a decline in licensing due to weaker animated content. Franchise strength is boosting library viewership across Paramount+, though the segment posted an $84 million loss amid rising production costs.

📉 TV media declines persist: TV media revenue fell 6% to $4.0 billion as cord‑cutting and weak ad markets weighed on results. Adjusted operating profit declined 15% to $863 million, with affiliate and ad revenue both under pressure despite solid sports programming.

🤝 Skydance merger: The $8 billion merger with Skydance Media received FCC approval and just closed on August 7. David Ellison will lead the new Paramount Skydance Corporation (ticker: PSKY), with Jeff Shell as president. Paramount agreed to employ an ombudsman for two years to monitor political bias at CBS as part of the approval conditions.

⚖️ Legal overhang resolved: Paramount settled the $16 million lawsuit filed by President Trump over a 60 Minutes interview. The settlement avoided further legal distraction during merger negotiations but sparked controversy, coinciding with CBS’s cancellation of The Late Show with Stephen Colbert.

What to make of all this?

The Skydance deal resets the company’s future, bringing new leadership, deeper resources, and a franchise-driven strategy. But challenges remain: linear declines, political scrutiny, and the need to sustain streaming momentum in a crowded market will determine whether Paramount Skydance can turn this pivot into lasting growth.

📊 Stay tuned for over 40 companies visualized tomorrow in our PRO coverage!

Eli Lilly, Uber, Shopify, Airbnb, Sony, Celsius, Duolingo, and more.

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Disclosure: I own AAPL, AMZN, GOOG, NFLX, and ROKU in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.