☁️ Amazon: Betting The Farm

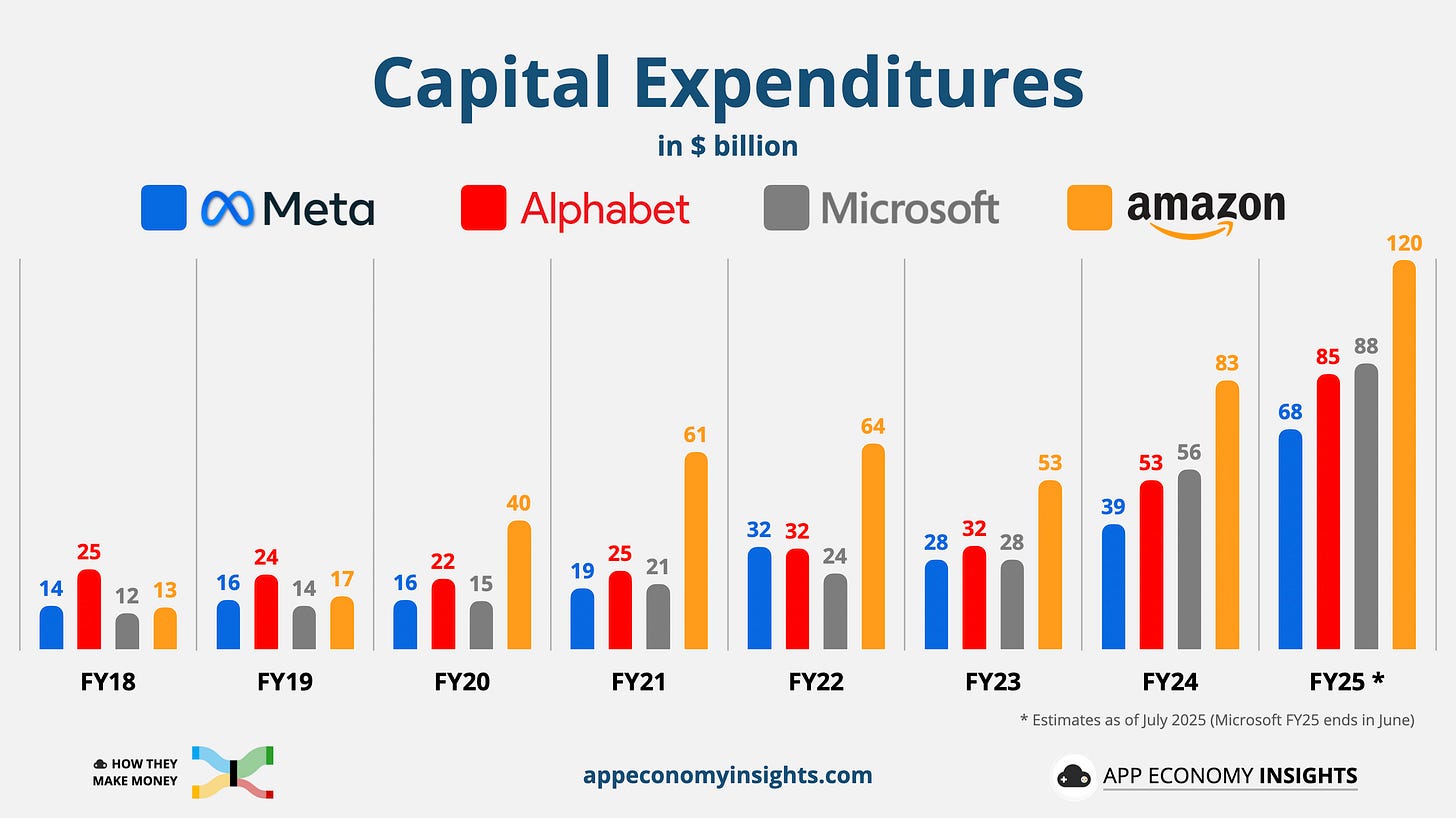

$120B in CapEx fuels a cloud race where scale must meet speed

Welcome to the Free edition of How They Make Money.

Over 230,000 subscribers turn to us for business and investment insights.

In case you missed it:

Amazon (AMZN) just delivered a quarter well ahead of expectations.

Prime Day set new records. Ads accelerated at their fastest pace in over a year.

But the spotlight remains on the AI arms race.

AWS leads the cloud market at a $123 billion run rate, but Azure and Google Cloud are grabbing near‑term growth headlines.

The key number: $120 billion in CapEx for FY25, up from ~$105 billion previously. Amazon is pouring that into Trainium 2 chips, multi‑gigawatt data centers, and agentic AI across Alexa and Bedrock. That scale of reinvestment means near‑term margin pressure but potentially massive long‑term payoff.

As Kuiper satellites, ads, and AI agents collide, Amazon is making the boldest reinvestment bet in Big Tech. The kind that pays off if you think in decades instead of years.

Here’s what stood out this quarter.

Today at a glance:

Amazon Q2 FY25.

Recent developments.

Key quotes from the call.

Kuiper and the CapEx war.

1. Amazon Q2 FY25

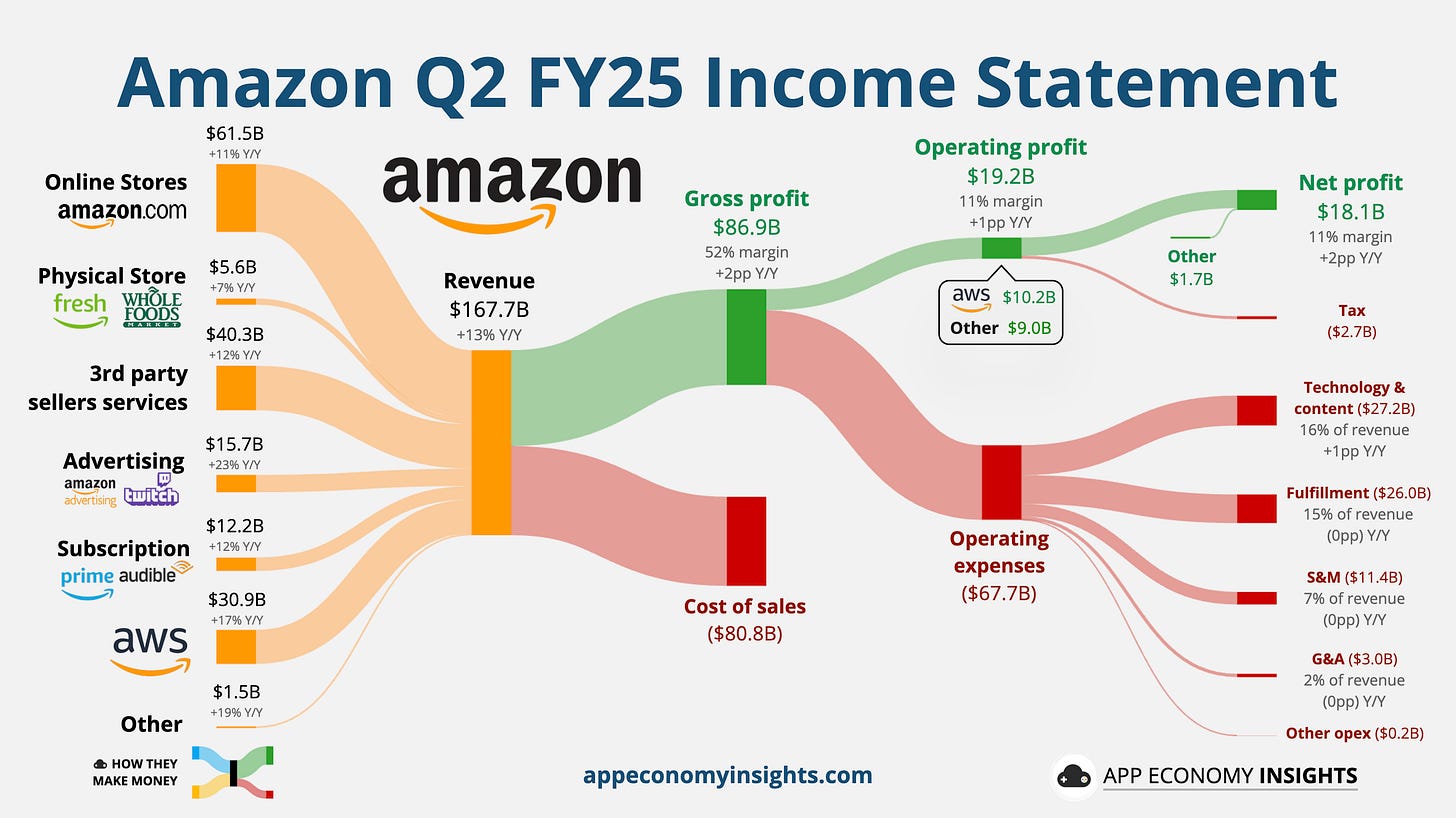

Income statement:

Revenue breakdown:

💻 Online stores (37% of overall revenue): Amazon.com +11% Y/Y.

🏪 Physical store (3%): Primarily Whole Foods Market +7% Y/Y.

🧾 3rd party (24%): Commissions, fulfillment, shipping +12% Y/Y.

📢 Advertising (9%): Ad services to sellers, Twitch +23% Y/Y.

📱 Subscription (7%): Amazon Prime, Audible +12% Y/Y.

☁️ AWS (18%): Compute, storage, database, & other +17% Y/Y.

Other (1%): Various offerings, small individually +19% Y/Y.

Revenue grew +13% Y/Y to $167.7 billion ($5.6 billion beat).

Gross margin was 52% (+2pp Y/Y).

Operating margin was 11% (+1pp Y/Y).

AWS: 33% margin (-3pp Y/Y).

North America: 8% margin (+2pp Y/Y).

International: 4% margin (+3pp Y/Y).

EPS $1.68 ($0.35 beat).

Cash flow:

Operating cash flow TTM was $121 billion (+12% Y/Y).

Free cash flow TTM was $18 billion (-66% Y/Y), driven by the operating cash flow growth, offset by an 87% rise in Capex to $103 billion.

Balance sheet:

Cash, cash equivalent, and marketable securities: $93 billion.

Long-term debt: $51 billion.

Q3 FY25 Guidance:

Revenue $174 to $179.5 billion ($3.6 billion beat).

Operating income $15.5 to $20.5 billion ($1.4 billion miss).

So, what to make of all this?

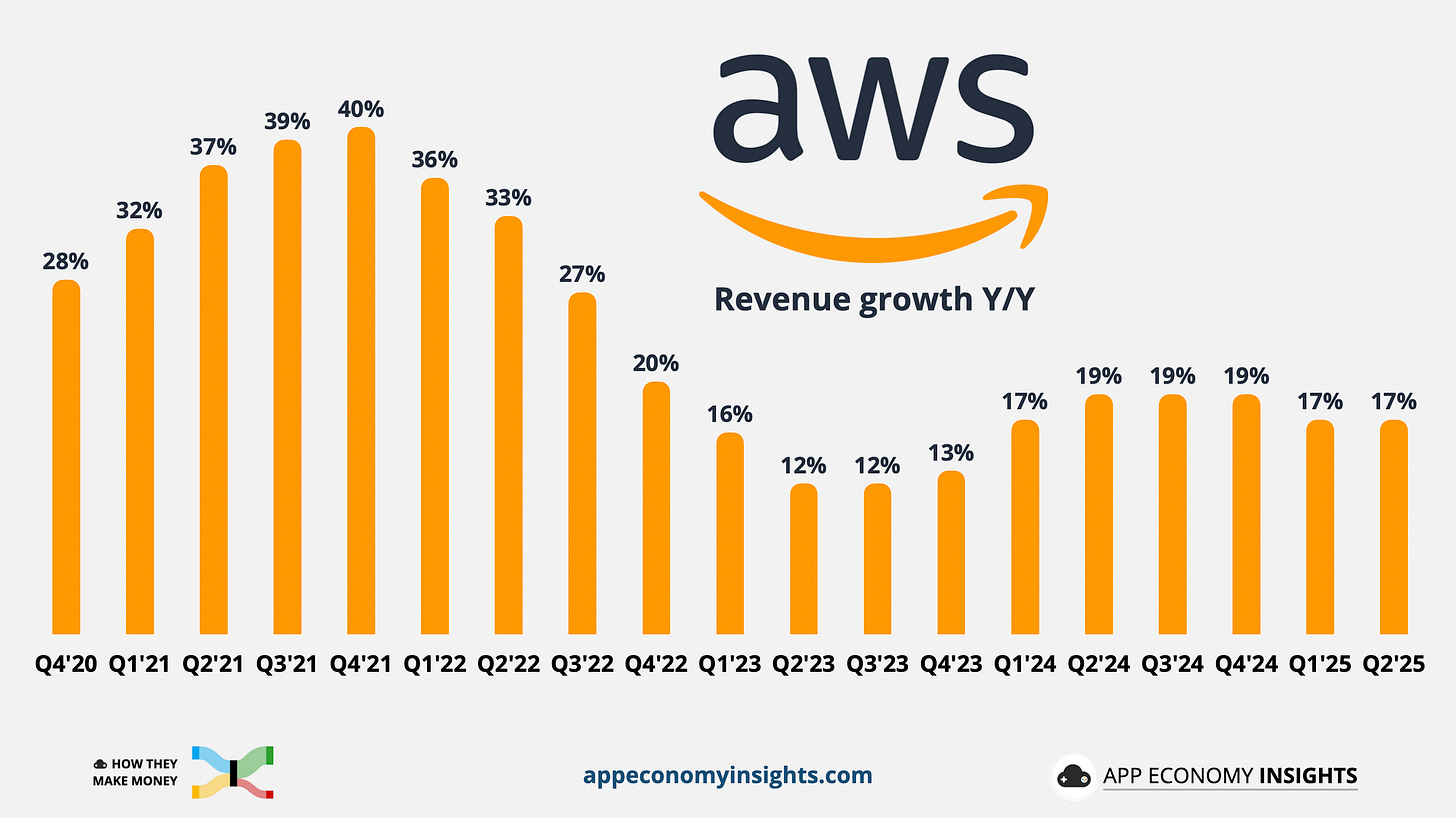

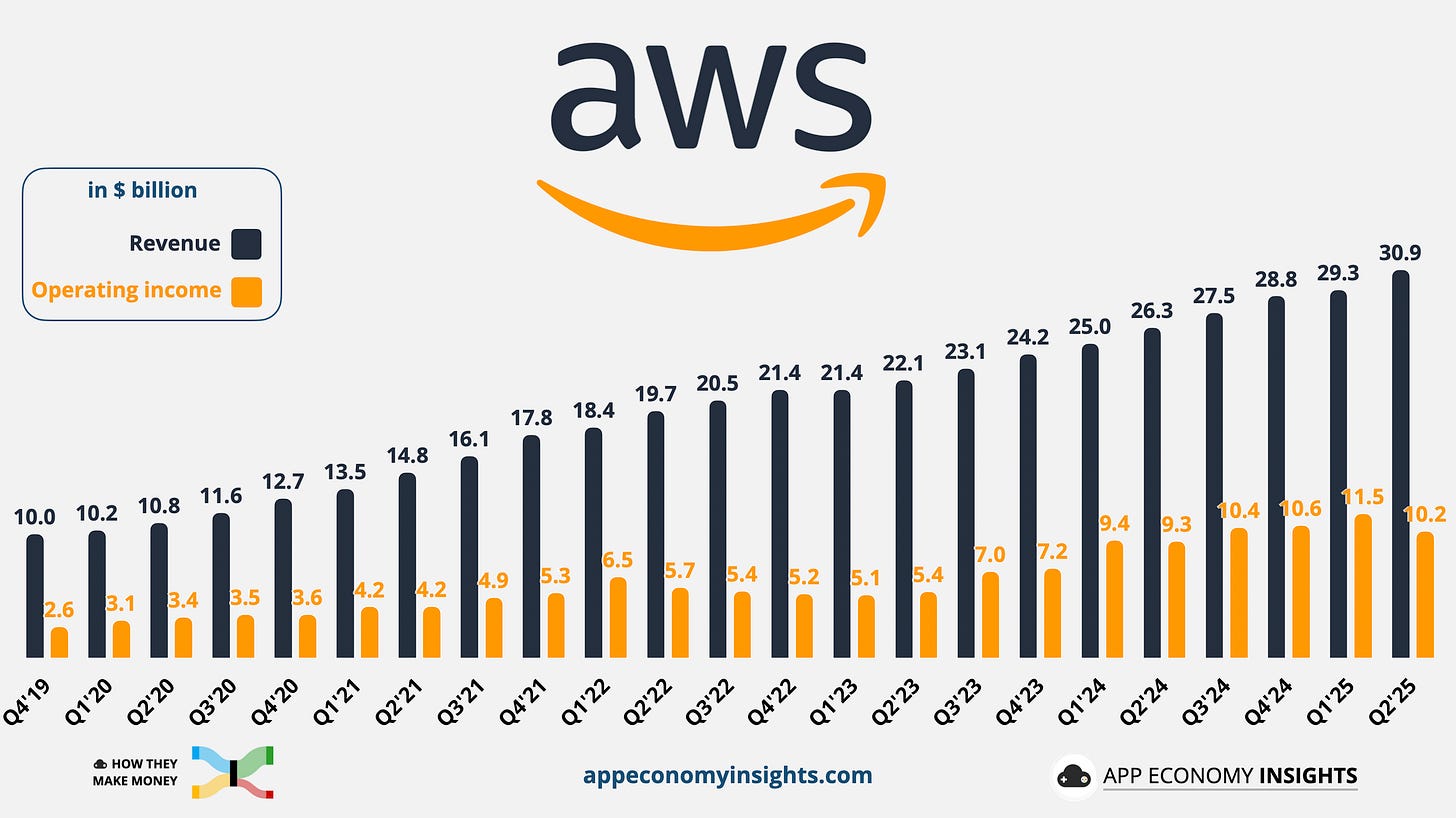

AWS steady, but lag narrative grows: AWS grew 17% Y/Y to a $123 billion run rate, with growth lagging Azure’s 39% and Google Cloud’s 32%. AI demand remains triple‑digit, but constrained by power and chip supply.

Retail momentum vs. tariff watch: Prime Day hit record sales and sign‑ups, signaling resilient consumer demand. Tariffs haven’t dented prices or volumes yet, but pre‑bought inventory rolls off in H2, creating potential margin pressure.

Ads are Amazon’s sleeper rocket: Advertising jumped 23% Y/Y, its fastest pace in 5 quarter, outpacing Meta and YouTube growth. New Roku and Disney DSP integrations position Amazon as the leading connected‑TV ad platform.

Margins hold despite AI drag: Company‑wide operating margin rose 140 bps Y/Y to 11.4%, despite AWS margin compression (33% vs 36% last year). Retail network efficiencies offset part of the AI CapEx drag.

2. Recent developments

🤖 The three layers of the AI stack

Amazon is still building furiously across infrastructure, models, and applications. Q2 brought two big shifts: agentic AI tools are moving center stage, and custom silicon is ramping into full production.

⚙️ 1) Infrastructure

Custom silicon ramps: Trainium 2 is now the backbone for Anthropic’s newest models and Bedrock workloads. Amazon claims ~30–40% better price/performance than comparable GPUs, critical as inference (not training) becomes the dominant cost.

AI superclusters: Multi‑gigawatt clusters (Project Rainier) are coming online, expanding training and inference headroom. Biggest constraint isn’t chips anymore, it’s power.

Third‑party GPUs: AWS launched EC2 instances with NVIDIA’s Grace Blackwell chips, offering choice for customers that prefer external silicon.

CapEx cadence: AI‑driven data center spend topped $31 billion in Q2 and will remain elevated through FY25 as AWS plays catch‑up with Azure and Google Cloud capacity.

🧠 2) Models

Bedrock momentum: Anthropic’s Claude 4 became Bedrock’s fastest‑growing model yet. Amazon’s own Nova family is now the #2 foundation model on the platform.

Nova differentiation: Nova is tuned for enterprise customization, allowing customers to inject proprietary data and optimize for cost/speed, an edge versus Llama or DeepSeek.

Agent Core launch: A new secure, serverless runtime for deploying AI agents. Handles memory, identity, and orchestration, solving a core scaling bottleneck for enterprises.

📱 3) Applications

Kiro coding agent: A new agentic IDE where developers “vibe code” via natural language, generating specs, tests, and docs automatically. Hundreds of thousands joined in weeks.

Alexa Plus rollout: Millions of US users are testing Alexa’s multi‑step actions (“set the table, dim the lights, play jazz”). Engagement is meaningfully higher than legacy Alexa.

AI across retail and ads: Generative AI continues to power personalized shopping, faster fulfillment (robotics + AI routing), and Amazon Ads (full‑funnel with DSP integrations).

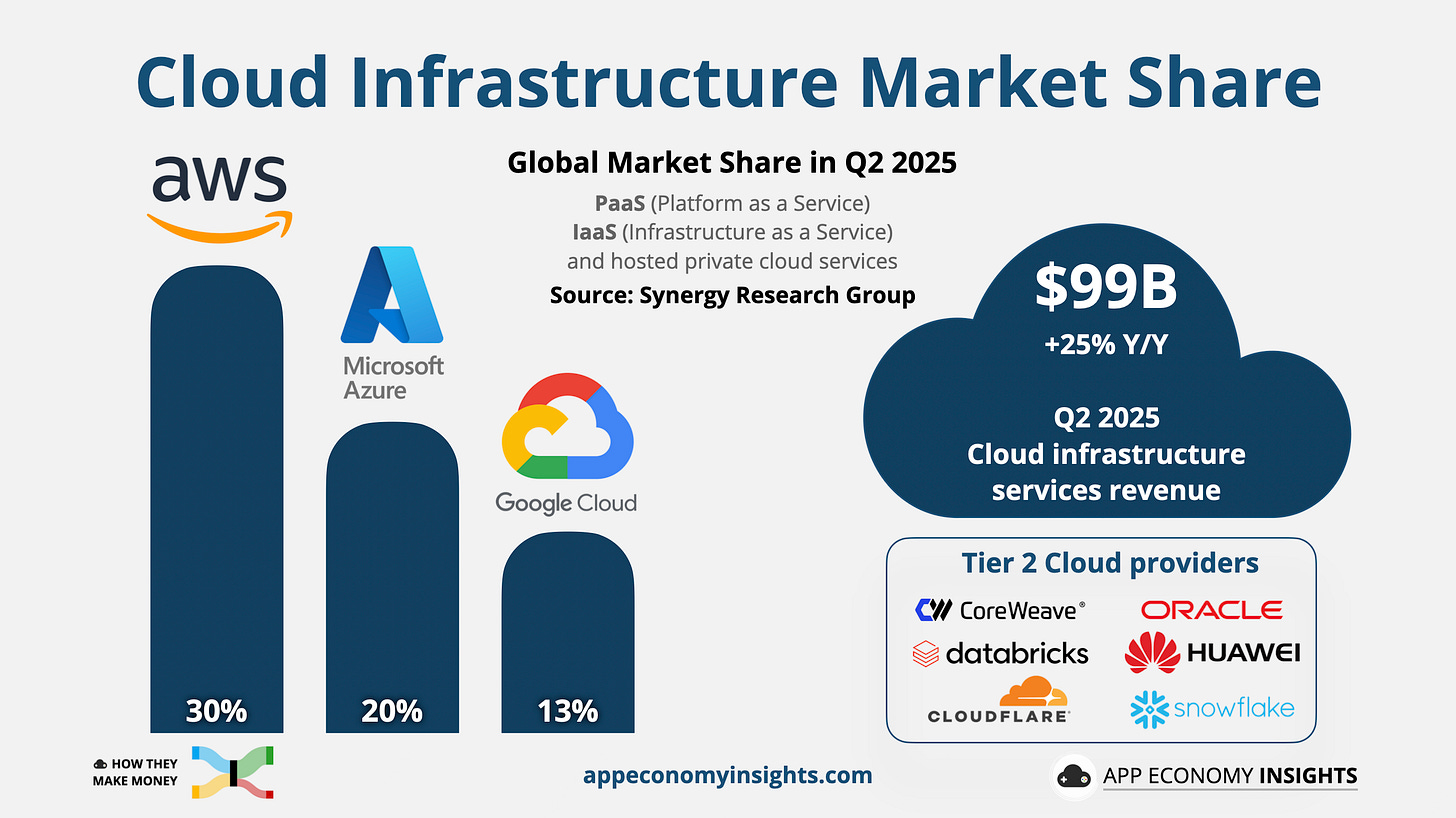

☁️ AWS market share and margins

Total cloud infrastructure market spending grew by 25% Y/Y to $99 billion in Q2 2025, an acceleration from 23% Y/Y in Q1. It’s a good time to be a cloud provider, and GenAI remains a critical growth factor.

Synergy Research Group projects growth above 20% for the next 5 years, with enterprise cloud services, social media and search expanding.

AWS had a commanding 30% market share, compared to 20% for Microsoft Azure and 13% for Google Cloud.

For context, in the June quarter:

Google Cloud (GCP + Workspace) grew 32% Y/Y (vs. 28% Y/Y in Q1).

Microsoft Azure grew 39% Y/Y (vs. 33% Y/Y in Q1).

AWS grew 17% Y/Y (unchanged).

As always, I wouldn’t read too much into growth rates since they are all capacity-contained and have a different product mix.

What about margins? AI CapEx and stock-based comp weighed on margins in Q2 (down 3pp Y/Y to 33%). Management had warned margins could fluctuate as AI investments flow through the P&L. AI is a short-term headwind on margin, but management expects the AI margin to match that of the non-AI business over time.

If you recall, the jump in AWS’s operating margin to 39% in Q1 was primarily due to an accounting adjustment (the useful life of servers was extended).

🛒 Advertising stays on track

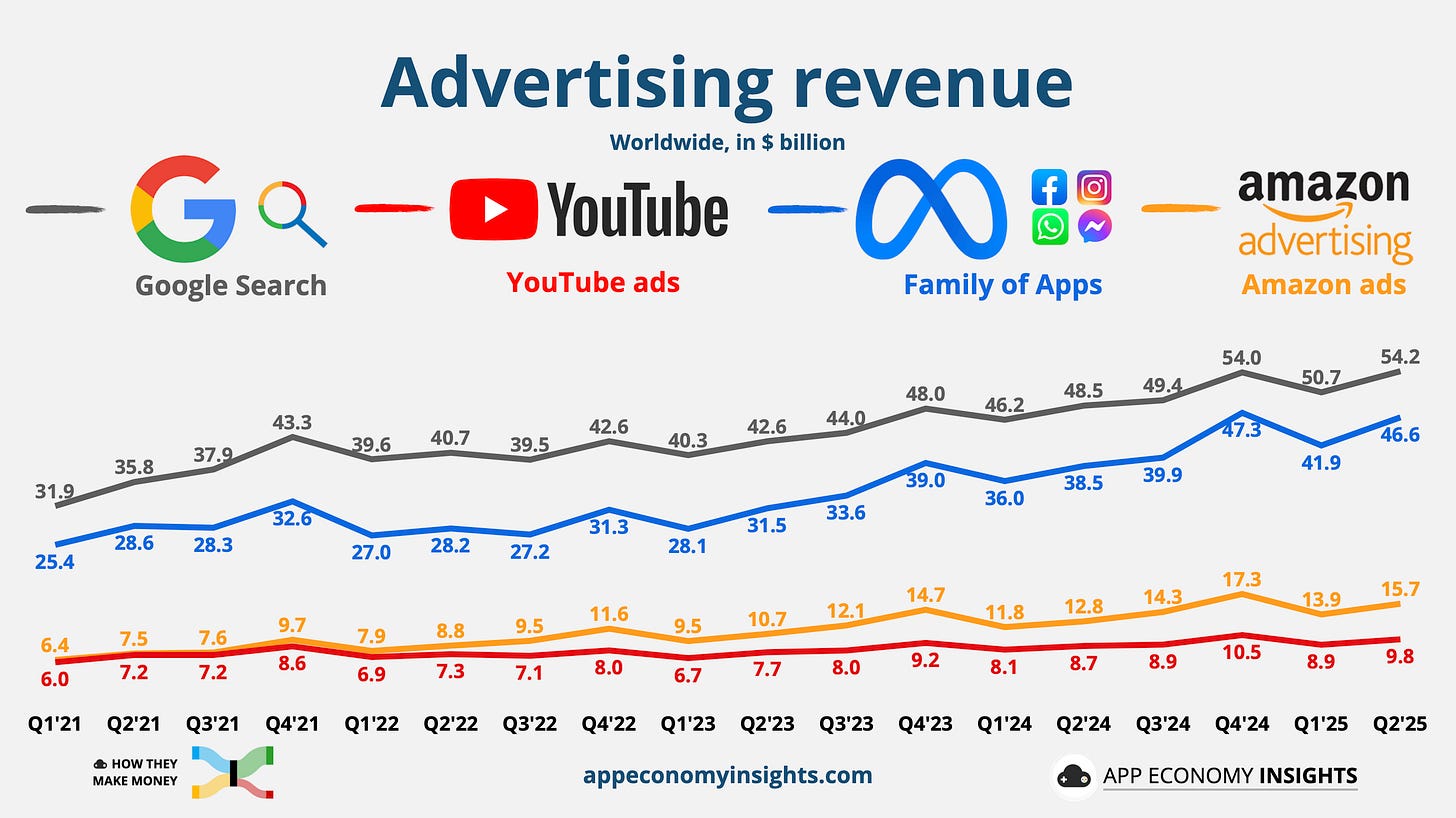

Amazon ads reached $15.7 billion in Q2 and now represent:

29% of Google Search (+3pp Y/Y).

34% of Meta's ad revenue (+0.5pp Y/Y).

160% of YouTube ads (+13pp Y/Y).

The gap with YouTube has widened in the past 4 years (see visual).

Prime Video’s shift to an ad‑supported default in 2024 and a new Roku partnership in June (80 million CTV households) give Amazon unmatched retail‑plus‑streaming data. It’s a moat neither Meta nor Google can replicate, and a sleeper driver behind Amazon’s rising margins (ex-AWS).

3. Key quotes from the earnings call

CEO Andy Jassy on Prime Day:

“This year’s Prime Day was our biggest ever with record sales, number of items sold, and number of Prime sign ups in the three weeks leading up to the event.“

Prime Day remains a growth engine. Beyond the sales spike, each sign‑up feeds Amazon’s flywheel: recurring Prime fees, higher purchase frequency, and deeper lock‑in, offsetting tariff uncertainty in H2.

On network efficiency:

“In Q2, we increased the share of orders moving through direct lanes by over 40% year over year […] We’ve reduced the average distance packages traveled by 12% and lowered handling touches per unit by nearly 15%.“

Regionalized logistics are paying off. Shorter routes and fewer touches cut costs while speeding delivery, a structural edge rivals can’t easily copy and a tailwind for margins.

On AWS agent tools:

“Agent Core is a set of building blocks that gives customers the industry’s first secure serverless runtime […] freeing them up to start deploying agents more expansively.“

AWS is positioning itself for the agent era: secure, serverless deployment as the pitch. The question: does this move the needle against Azure’s Copilot ecosystem or Google’s Gemini stack?

On long-term AI adoption:

“Remember, 85 to 90% of worldwide IT spend is still on premises versus in the cloud […] In the next ten to fifteen years, that equation is going to flip.“

The scale of untapped migration justifies Amazon’s record $120 billion CapEx plan. Even as AI dominates headlines, the broader shift from on‑prem to cloud remains AWS’s biggest tailwind.

4. Kuiper and the CapEx war

🚀 Project Kuiper: Amazon’s space bet

Amazon has now placed 78 production satellites into orbit as of July 2025 — two 27‑satellite Atlas V launches and a 24‑satellite Falcon 9 mission. A new 100,000 ft² payload facility at Kennedy Space Center is live, capable of prepping 100+ satellites per month and supporting multiple launch campaigns simultaneously.

Why it matters: Amazon must deploy half of its 3,232‑satellite constellation by mid‑2026 to keep its FCC license. Starlink already dominates with thousands of satellites and ~5 million users, so Kuiper’s catch‑up is high‑stakes. Analysts see Kuiper evolving into an “Amazon Space Platform,” with synergies for AWS, logistics, and robotics — but execution risk is real.

💰 The CapEx war

Q2 CapEx reached $31 billion and Amazon now expects ~$120 billion in FY25 (up from ~$105 billion previously). Nearly all of it is earmarked for AI infrastructure.

Amazon’s posture is singular in Big Tech:

No buybacks, no dividends.

Every dollar plowed into future growth.

A strategy at odds with Apple, Alphabet, and Meta, which returned a combined $280+ billion to shareholders in the past year.

Yes, AWS margins have slightly compressed, but this spending is a feature, not a bug.

Bottom line: Kuiper satellites, agentic AI, and ads are converging into Amazon’s boldest expansion cycle. If the biggest risk of the current cycle is to under‑invest, Amazon is the one playing it the safest.

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Disclosure: I am long AMZN, GOOG, META, NET, and SNOW in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Great breakdown, but I'm curious about your take on AWS losing market share momentum. 17% growth vs Azure's 39% feels significant, especially when you consider Amazon's scale advantage should be kicking in, not fading. Are you concerned this is more than just 'capacity constraints'?

Nothing new for Amazon though, they’ve always been willing to take risks since the start. Nice post.