📊 PRO: This Week in Visuals

SAP KO IBM TMUS NOW TXN T ISRG VZ GEV LMT INTC FI MCO CMG HLT GM LUV DPZ AAL

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

☁️ SAP: Cloud & AI Lifts Profit

🥤 Coca-Cola: Volumes Dip

🌐 IBM: AI and Mainframe Momentum

📶 T-Mobile US: Record Adds

🧑💻 ServiceNow: AI Deals Accelerate

⚙️ Texas Instruments: Tariff Caution

📞 AT&T: Fiber & Wireless Gains

🦾 Intuitive Surgical: Margin Squeeze

📱 Verizon: Broadband Strength

⚡ GE Vernova: Guidance Raised

🛰️ Lockheed Martin: Massive Charges

🧑💻 Intel: Restructuring Deepens

💳 Fiserv: Growth Slows

💼 Moody’s: Private Credit Lifts

🌯 Chipotle: Comps Stay Negative

🏨 Hilton: Record Pipeline

🚗 GM: Tariff Toll Deepens

🛩️ Southwest: EBIT Slashed

🍕 Domino’s: Stuffed Crust & DoorDash

🦅 American Airlines: Domestic Drag

1. ☁️ SAP: Cloud & AI Lifts Profit

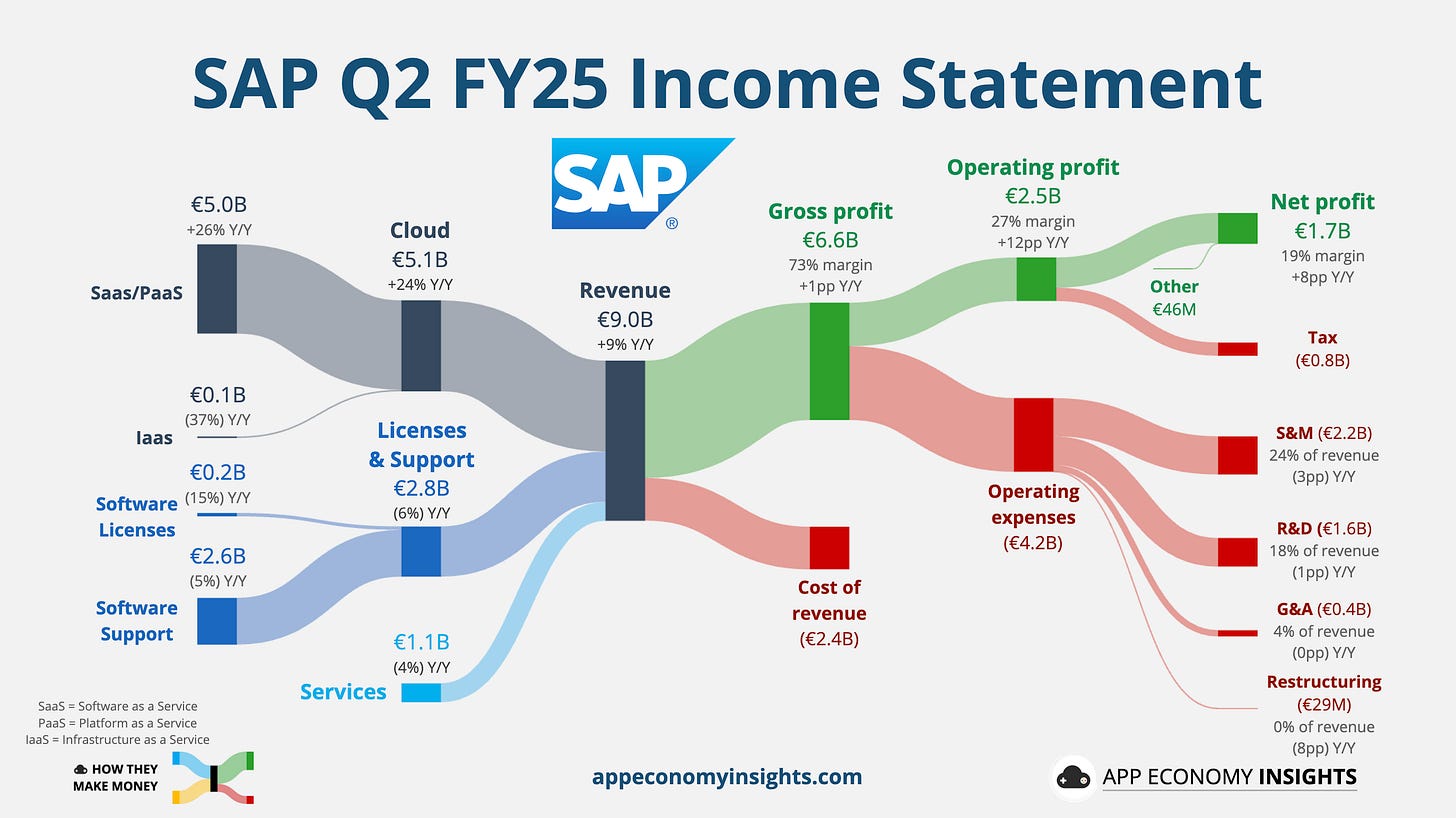

SAP’s Q2 revenue rose 9% Y/Y to €9.0 billion (in line), with non-IFRS EPS of €1.50 (above consensus), driven by 24% Cloud growth to €5.1 billion and a 30% jump in ERP cloud revenue. The cloud backlog climbed 28% in constant currency to €18.1 billion. Adjusted operating profit surged 35% Y/Y, aided by margin expansion and SAP’s own AI-powered cost efficiencies.

CEO Christian Klein reiterated SAP’s AI-first transformation, with 14 AI agents live and over 100 prebuilt data products now embedded across the Business Suite. Flagship wins this quarter included Alibaba, BMW, GSK, Delta, Adobe, and the German Armed Forces. SAP is doubling down on Business Data Cloud, now contributing up to 30% uplift in large cloud deals.

SAP reaffirmed its FY25 outlook: €21.6–€21.9 billion in cloud revenue, €10.5 billion in operating profit, and €8 billion in free cash flow. While currency headwinds and tariff-driven delays are softening the pace of bookings, management is confident in its strong H2 pipeline and cost discipline. The company’s recurring revenue mix now sits at 86%.

2. 🥤 Coca-Cola: Volumes Dip

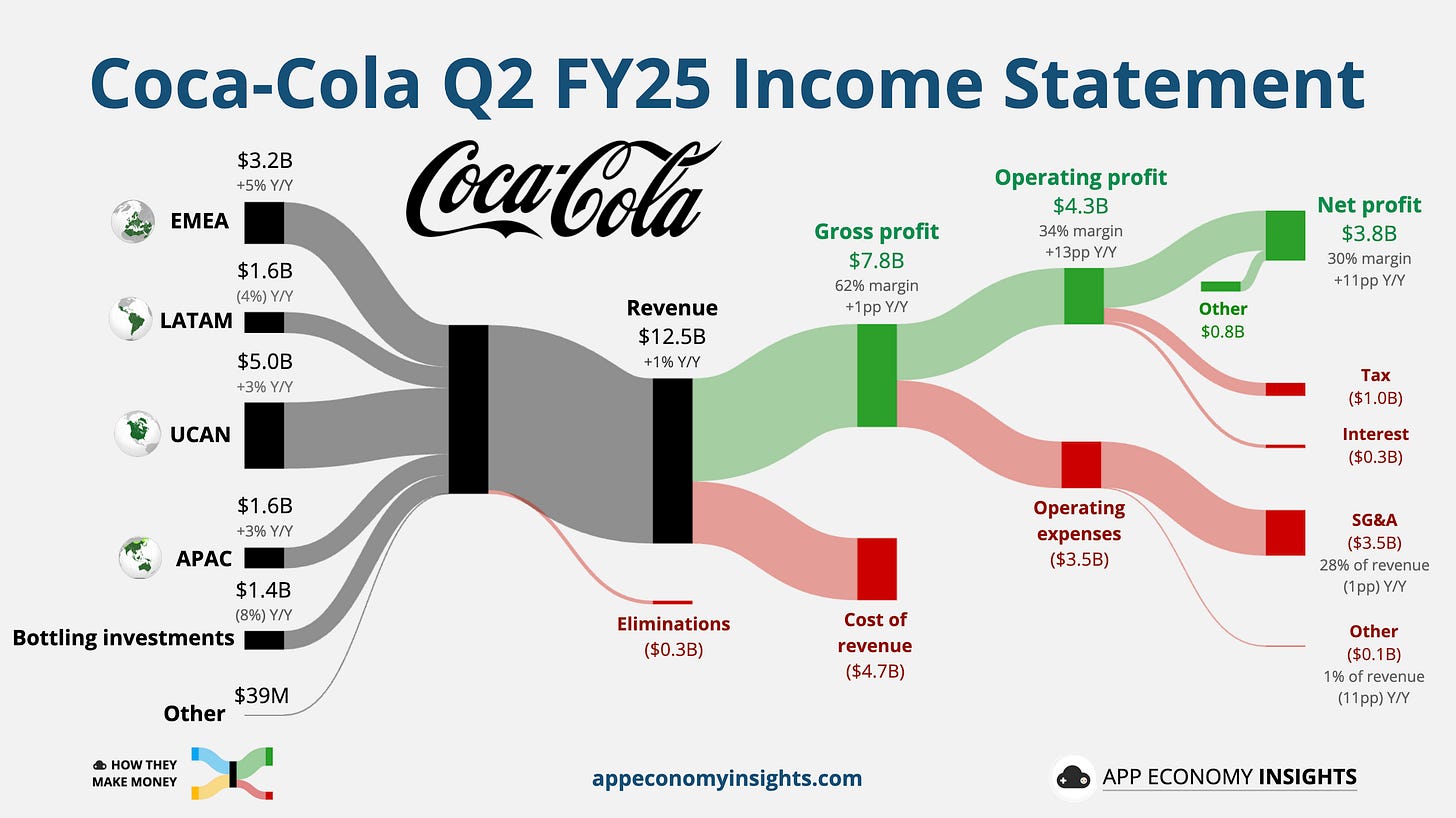

Coca-Cola’s Q2 revenue grew 1% Y/Y to $12.5 billion ($80 million miss), while adjusted EPS rose to $0.87 ($0.03 beat), powered by price/mix rising 6% Y/Y offset by a 1% global volume decline. Organic revenue grew 5%, with growth in Europe, Central Asia, and China offset by weakness in India, Mexico, and Thailand. Coca-Cola Zero Sugar remained a standout, with 14% growth.

Management slightly raised 2025 EPS guidance to ~3% growth (from 2%–3%) and now expects 5%–6% organic revenue growth, with currency and structural headwinds totaling ~2%. The new US cane sugar product line, encouraged by Trump’s “Make America Healthy Again” campaign, will debut this fall alongside the classic corn syrup version. Tariffs remain a concern but are still considered “manageable” due to Coca-Cola’s local production footprint. That said, shifting consumer preferences, GLP-1 adoption, and regulatory scrutiny weigh on the soda category.