🔎 Google: AI Push Intensifies

Rising demand forces record $85B investment

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Alphabet (GOOG) is turning up the heat on its AI push.

The company lifted its 2025 capital spending plan to $85 billion, a $10 billion increase, to meet surging demand for AI infrastructure.

AI features are spreading fast across the ecosystem: 2 billion people now use AI Overviews each month, and the Gemini app alone has 450 million monthly users.

But pressure is mounting. Regulators are weeks from a landmark remedies ruling that could reshape Search and Chrome. Meanwhile, AI‑native startups are reimagining how people interact with the web and threatening to bypass ads entirely.

Google is racing to scale AI at breakneck speed while defending the core business from existential threats.

Here’s what stood out this quarter.

Today at a glance:

Alphabet Q2 FY25.

Tailwinds meet headwinds.

Key quotes from the earnings call.

Browsers, Agents, and Gemini everywhere.

1. Alphabet Q2 FY25

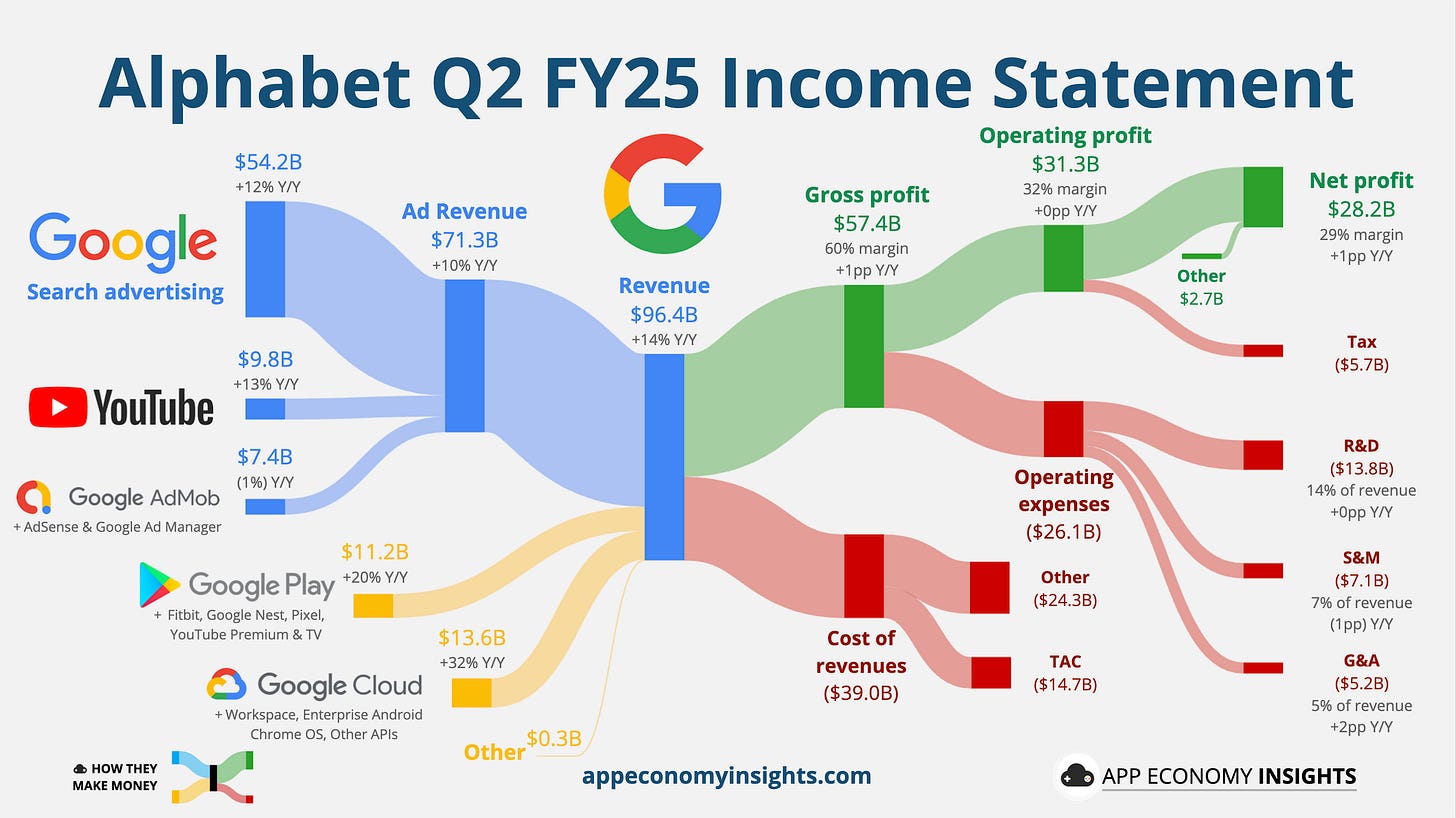

Income statement:

Revenue grew +14% Y/Y to $96.4 billion ($2.5 billion beat).

🔎 Advertising: $71.3 billion (+10%).

Search: $54.2 billion (+12%).

YouTube ads: $9.8 billion (+13%).

Network: $7.4 billion (-1%).

📱 Subscriptions, platforms, and devices: $11.2 billion (+20%).

☁️ Cloud: $13.6 billion (+32%).

Margin trends:

Gross margin: 60% (+1pp Y/Y).

Operating margin: 32% (flat Y/Y).

Services (Advertising & Other): 40% (flat Y/Y).

Cloud: 21% (+9pp Y/Y).

Earnings per share (EPS) grew 22% Y/Y to $2.31 ($0.12 beat).

Cash flow:

Operating cash flow was $27.7 billion (+4% Y/Y).

Free cash flow was $5.3 billion (-61% Y/Y).

Balance sheet:

Cash, cash equivalents, and marketable securities: $95 billion.

Long-term debt: $24 billion.

So, what to make of all this?

Revenue grew 13% Y/Y in constant currency, just shy of the 14% Y/Y in Q1. Management did not break down any currency effect by segment, but it’s safe to say that they all benefited from a weaker dollar.

Search accelerated to +12% Y/Y, reversing last quarter’s slowdown, with retail and financial services driving the rebound. Fears of AI cannibalization are fading. AI Overviews are boosting commercial intent, turning what looked like a headwind into a tailwind.

YouTube Ads grew from +10% Y/Y in Q1 to +13% in Q2, with Shorts engagement up to 200 billion daily views.

Subscriptions, platforms & devices benefited from paid subscriptions that topped 270 million, led by YouTube Premium and Google One.

Cloud reaccelerated from +28% Y/Y in Q1 to +32% Y/Y, topping $50 billion in annual run rate. We’ll compare these results against AWS and Azure next week—stay tuned!

Margins hold up: Despite record AI spending, company-wide operating margin stayed at 32%, reflecting efficiency gains.

2. Tailwinds meet headwinds

AI demand is driving record growth, but regulatory pressure is peaking.

☁️ Cloud’s demand outpaces supply

Cloud includes GCP + Workspace. Management reiterated that GCP core and AI products are the main drivers of the growth, but without providing specifics.

Capacity tight amid AI surge: Cloud remains constrained as AI workloads spike. CapEx for servers and data centers rose 70% Y/Y, with 2025 guidance raised by $10 billion. Most new capacity won’t come online until 2026.

Backlog tells the story: Cloud backlog increased 38% Y/Y and 18% Q/Q, reaching $106 billion at the end of Q2. This visibility explains why CapEx keeps rising.

Margin expansion: Cloud’s operating margin hit 21% (vs. 18% in Q1 and 11% a year ago) on scale efficiencies and better backlog conversion, partly offset by heavier depreciation from AI infrastructure.

▶️ YouTube widens its streaming lead

YouTube contributes to two segments:

YouTube ads: Advertising revenue generated on YouTube properties.

Subscriptions: YouTube TV, Music, Premium, NFL Sunday Ticket, and data storage. Subscription revenue is mixed with the Play store and Pixel sales.

YouTube continues to dominate US streaming:

Share of US TV time hit 13% in June 2025 (excluding YouTube TV), up from 10% a year ago (29‑month streak at #1).

The platform is pulling further ahead of Netflix and Disney as ad dollars and viewers shift to short‑form and AI-generated content.

⚖️ Antitrust showdowns reach decision point

Multiple cases are converging in the next few months:

🔎 Search remedies trial: DOJ case nears verdict by mid‑August. Potential outcomes range from Chrome divestiture to limits on default search deals and Gemini’s integration.

💻 Ad tech monopolization: The remedies phase is now underway. Proposals include spinning off Ad Manager or AdX to break vertical integration.

📱 Play Store compliance: Third‑party billing pilots are live but remain contentious. Developers say prompts still steer users back to Google Play. Appeals are still ongoing.

🇪🇺 EU DMA scrutiny: Brussels says Alphabet’s compliance plan still falls short on search neutrality. Fines up to 10% of global revenue remain on the table.

The takeaway? Regulatory rulings could force structural changes to Search, Chrome, or ad tech, just as Alphabet ramps AI investment to record levels. The next few months will test whether AI growth can outpace regulatory drag.

3. Key quotes from the earnings call

CEO Sundar Pichai

On AI progress:

“Nearly all GenAI unicorns use Google Cloud […] leading AI research labs like Safe Superintelligence and Physical Intelligence use TPU specifically.”

Pichai underscored Alphabet’s full‑stack AI strategy, from custom chips to models to consumer products:

☁️ Infrastructure: TPU v7 “Ironwood” and expanding GPU fleets remain core differentiators, driving the record CapEx ramp.

🧠 Models: Gemini 2.5 now leads “nearly every major benchmark,” with 9 million developers building on the platform. Pichai teased “Deepting,” an advanced variant scoring a gold-medal performance in the International Math Olympiad.

📱 Products: Veo 3 video generation has produced 70 million clips since May. “Photo‑to‑video” tools are rolling out in the Photos app.

On Search:

“AI Overviews are now driving over 10% more queries globally for the types of queries that show them. […] AI features cause users to search more as they learn that search can meet more of their needs.”

AI is boosting search volume rather than cannibalizing it. Importantly, AI Overviews monetize at parity with traditional queries, turning higher engagement into a tailwind for ads. AI Mode already has 100 million MAUs in the US and India.

On Gemini:

“The Gemini app now has more than 450 million monthly active users, and we continue to see strong growth in engagement with daily requests growing over 50% from Q1.”

450 million MAUs come from the Gemini app alone, not counting Search or Workspace. For context, ChatGPT is estimated at ~1 billion monthly users, but Google’s massive distribution across Android, Chrome, and Workspace keeps it firmly in the race.

On Waymo:

“Waymo continues to scale and expand […] launched in Atlanta, more than doubled its Austin service territory […] and has now autonomously driven over 100 million miles on public roads.”

Waymo’s robotaxi business is accelerating: paid trips are up 5× Y/Y, with coverage expanding in Phoenix, LA, SF, and now Atlanta. In San Francisco, Waymo reportedly surpassed Lyft in market share in Q2, according to YipitData.

Chief Business Officer Philipp Schindler

On AI in ads:

“Over 2 million advertisers now use AI powered asset generation tools to run ads, a 50% increase on this time last year.”

The ad stack is becoming AI‑native, blending creative generation, bidding, and targeting. This shift could increase ad efficiency and advertiser lock‑in.

4. What to watch looking forward

🤖 OpenAI levels up

OpenAI’s new ChatGPT Agent shifts AI from chat to full task automation: navigating apps, composing emails, building presentations, and even placing orders via a virtual computer.

Premium rollout: Available to Pro, Team, and Enterprise users, with safeguards like sandboxed actions and approval prompts.

Competitive pressure: While still early, this raises the bar for Gemini’s agent ambitions—especially in Workspace and Android. The AI race is moving from chatbots to do-it-for-me agents.

🌐 Chrome faces AI‑native challengers

Startups like Arc, SigmaOS, and Sidekick are reimagining browsers as autonomous assistants — summarizing pages, autofilling forms, and anticipating intent with embedded LLMs.

Perplexity’s Comet: With over 15 million monthly active users, Perplexity AI recently launched Comet, a lightweight browsing layer for its $200/month Max tier. It merges search, answers, and navigation into a single AI-powered flow.

Ad disruption risk: These new interfaces often bypass traditional ads, surfacing direct answers instead of search result pages. That undercuts the visibility and effectiveness of the core monetization model.

Chrome’s response: Alphabet is testing a Gemini-powered sidebar and smart tab groups to keep pace—but AI-native challengers have the advantage of building around agents from day one.

While Chrome still holds over 60% global share, the real risk is a shrinking market. If AI agents browse and transact on our behalf, ads may never be seen, let alone clicked.

🧠 Gemini Everywhere

Alphabet is embedding Gemini 2.5 deeper across products:

Workspace: Pilots now offer smart replies, auto‑summarization, and live meeting insights in Gmail, Docs, and Meet — a direct counter to Microsoft Copilot.

Chromebook+: AI features like offline Gemini access and real‑time transcription headline, and new budget‑friendly laptops for students and schools.

Android 15 & Gemini Nano: Developers can now build around the on‑device LLM a la Apple Intelligence, powering translations, smart replies, and contextual suggestions — pushing Android toward AI‑native mobile.

The real story goes beyond the record AI spending. It’s how fast the AI chessboard is shifting. OpenAI is turning chatbots into agents. Startups are re‑wiring the browser. And regulators are circling.

Earnings from Microsoft, Amazon, and Meta are just days away. Stay tuned for more visual breakdowns here on How They Make Money.

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Disclosure: I am long AAPL, AMZN, GOOG, and NFLX in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.