🍿 Netflix: Peak Attention?

Earnings impress, but flat engagement raises deeper questions

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Netflix (NFLX) just delivered another impressive quarter.

Revenue is up. Margins are rising. Cash is flowing.

But one thing isn’t moving: engagement.

Despite a blockbuster slate and subscriber growth, Netflix’s share of US TV time has stayed flat for over two years. With paid sharing now fully rolled out and YouTube gaining ground, the battle for attention is getting harder.

This quarter shows what Netflix is doing right and what might be getting harder to fix.

Let’s break it down.

Today at a glance:

Netflix Q2 FY25.

Price, Ads, and Originals.

Quotes from the earnings call.

Engagement plateau or ceiling?

1. Netflix Q2 FY25

Income statement:

Revenue +16% Y/Y to $11.1 billion ($20 million beat).

Operating margin 34% (+7pp Y/Y).

EPS $7.19 ($0.12 beat).

Cash flow (TTM):

Operating cash flow: $9.1 billion (22% margin).

Free cash flow: $8.5 billion (20% margin).

Balance sheet:

Cash and short-term investments: $8.4 billion.

Debt: $14.5 billion.

FY25 Guidance:

Revenue +15%-16% Y/Y to $44.8-$45.2 billion ($1 billion raise).

Operating margin 29.5% (0.5pp raise).

So, what to make of all this?

👑 Another beat across the board: Revenue, operating income, and EPS all came in slightly above guidance. Operating margin surged to 34%, up 7 percentage points Y/Y. EPS jumped 47% Y/Y, driven by pricing power and ad sales.

💵 The shift from subs to dollars continues: Netflix no longer reports subscriber counts—and it doesn’t need to. The business is maturing, with revenue and margin as the key focus. UCAN growth accelerated to 15%, fueled by the full impact of price hikes.

💰 Still printing cash: Free cash flow hit $2.3 billion in Q2. That’s funding buybacks ($1.7 billion this quarter) and debt paydown, while still investing aggressively in content and ads infrastructure.

📢 Ad tech fully deployed: The Netflix Ads Suite is now live across all ad markets. Nearly 1 in 2 new subs in those markets now choose the ad plan. Management still expects ad revenue to double in 2025.

🤼♂️ Live becomes a fixture: WWE RAW remains a top performer, and the live slate is ramping fast: Taylor vs. Serrano 2, the upcoming Canelo vs. Crawford bout, and a Christmas Day NFL doubleheader show Netflix is serious about live programming.

🧠 New UI, smarter surfacing: A redesigned TV homepage rolled out to 50% of users and is already outperforming expectations. Real-time personalized rows and integrated previews are making it easier to find what to watch.

🍿 Zooming out: Netflix raised full-year guidance across the board, boosted by a weaker dollar. With blockbuster titles still to come—Stranger Things finale, Wednesday S2, Knives Out 3—momentum is building for a massive second half.

2. Price, Ads, and Originals

📈 Churn to die for

Netflix has price hikes down to a science.

After a rocky adjustment in early 2022 that drove a noticeable uptick in cancellations, the company has fine-tuned its approach, turning a potential churn risk into a predictable growth lever.

In January 2025, Netflix raised prices across all US plans. The result followed a familiar pattern based on Antenna’s analysis:

Churn rose from 1.8% in December to 2.5% in January

Then quickly eased to 2.3% in February

And 2.1% by May

These churn levels are the envy of any subscription business.

The takeaway is clear: every price hike triggers a churn spike, followed by a swift return to baseline. That’s pricing power in a nutshell.

👀 What we watched

Netflix’s latest Engagement Report shows members watched 95 billion hours in H1 2025—up 1% Y/Y, despite a backloaded slate.

Key takeaways:

Enduring appeal: Nearly half of the viewing came from titles released in 2023 or earlier. Money Heist, Lucifer, and Red Notice all delivered 20M+ views.

Deep bench: Even top shows account for <1% of total viewing time.

Global dominance:

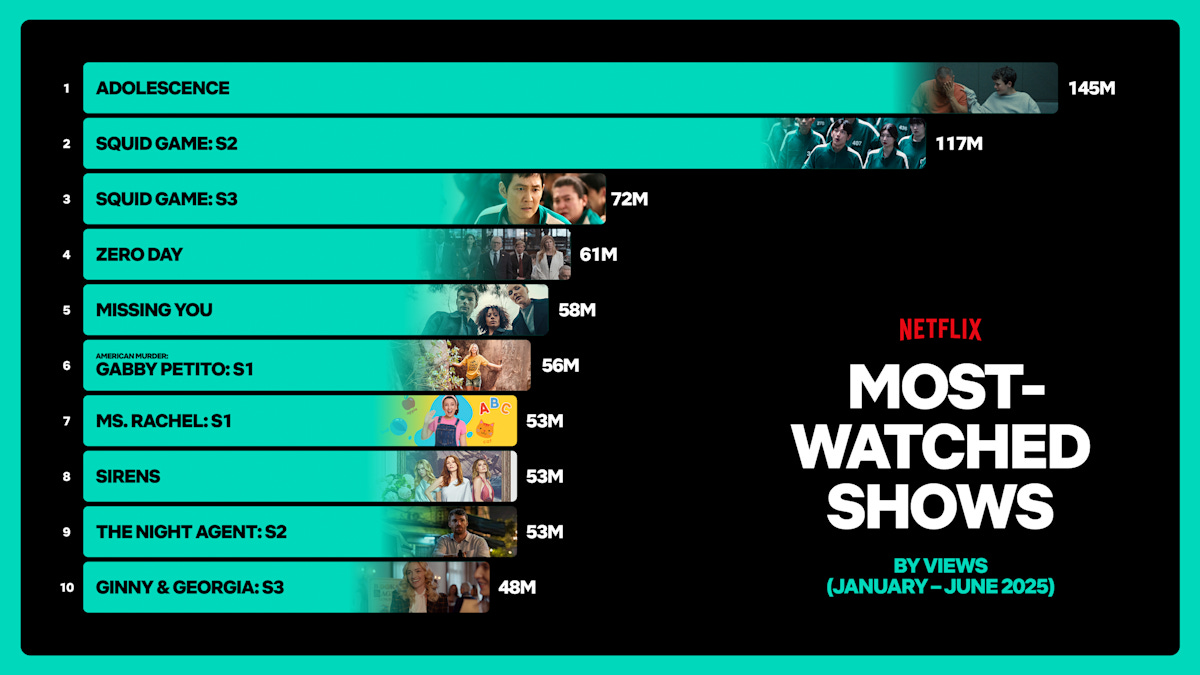

Adolescence (UK) led with 145M views.

Squid Game hit 231M across all seasons.

Non-English titles drove one-third of total viewing.

Breakouts across genres:

STRΛW (103M), Exterritorial (88M), KPop Demon Hunters (80M).

WWE events drew 280M+ hours.

Ms. Rachel (53M), Naruto (45M), and Running Point (41M) led in kids, anime, and comedy.

Netflix continues to win on variety, longevity, and global reach, with no single show doing all the heavy lifting.

📺 Squid Game takes the cake

In this newsletter, we often talk about the Netflix effect boosting acquired shows like Suits (Universal) or Young Sheldon (CBS) and giving them a new life. It has made Netflix the pace to be for publishers who seek a broader reach.

But let’s shift focus to what Netflix truly excels at: Original series.

Netflix has 12 original shows in the top 20 in the first half of 2025, with Squid Game alone capturing 15 billion minutes watched, according to Nielsen.

Squid Game took the #1 spot despite releasing Season 3 on June 27, with massive viewership from early July missing from the picture.

Stranger Things had no new episode in the first half, but still managed to garner 5 billion minutes and ranked #17.

📢 Ads at scale

The password-sharing crackdown that began in May 2023 was a clear win, nearly doubling monthly gross adds from 0.9 to 1.8 million, according to Antenna. But the boost was always going to be short-lived, as the pool of long-time freeloaders dried up. Now, the spotlight shifts to the ad tier.

The ad-supported plan is playing an increasingly central role in subscriber growth. According to Antenna, the ad tier now accounts for nearly 1 in 2 Gross Adds, up from just 20% two years ago. The ad tier is quickly becoming the default.

3. Key quotes from the earnings call

Here’s what management said—and what it means for the road ahead.

Co-CEO Greg Peters

On flat engagement

“Total view hours did grow a bit in the first half of 2025. […] We are optimistic and expect that our engagement growth in the second half of this year will be better than in the first half given our strong second half slate.”

Netflix’s surge in revenue hasn’t translated into a surge in hours watched. Why? Paid sharing cut off freeloaders, and not all were replaced. It’s a key paradox: more members, but not more people watching. It could be why Netflix’s share of US TV time has flatlined near 8% for over two years.

On the launch of Netflix Ads Suite globally:

“That rollout was generally smooth across all countries. We see good performance metrics across all countries, and the early results are in line with our expectations. […]. The most immediate benefit from this rollout is just making it easier for advertisers to buy on Netflix.”

The next wave will bring better ad personalization and interactivity. It’s not rocket science. If Netflix can avoid big mistakes, ads should become a massive business.

On the new user interface:

“The Netflix you get on a Tuesday night is different from the Netflix you get on a Sunday afternoon. […] We are very confident that we have got a much better platform in this new user experience to build from.”

The UI refresh may seem subtle, but in a world where Instagram and TikTok optimize feeds in real time, Netflix needs to promote content dynamically, especially as live programming grows. This redesign could quietly become a key driver of engagement.

Co-CEO Ted Sarandos

On live sports:

“Sports are a subcomponent of our live strategy. […] It is a pretty small part of view hours as well right now. That being said, not all view hours are equal. And what we have seen with live is it has outsized positive impacts around conversation, around acquisition, and we suspect around retention.”

While Apple is reportedly in pole position to sign a deal for F1 rights in the US, Netflix remains committed to global live events, with a focus on impact, not just hours.

4. Engagement plateau or ceiling?

Engagement is the north star for Netflix—fueling word-of-mouth, long-term retention, and pricing power.

According to Nielsen, streaming accounted for 46% of US TV time in June, up from 40% a year ago and hitting an all-time high. The jump came at the direct expense of cable, which fell to a 23% share, down from 27% a year ago.

Despite the broader shift, Netflix captured 8.3% of US TV time, almost unchanged from a year earlier.

Netflix’s share has hovered near 8% for over two years. Amazon Prime Video and Disney+ are in the same boat—flatlining. Most streaming gains have gone to smaller players like Roku and Paramount+.

Meanwhile, YouTube is lifting the entire category. It jumped to 13%, up from 10% a year ago. Total streaming time is rising, but YouTube is capturing the lion’s share.

Netflix’s next growth engine is expected to come from international expansion, monetization, and deeper engagement.

But what if one part of the story is stalling?

Management often frames Netflix’s 8% share of TV time as a sign of massive untapped potential. In the Q2 call, co-CEO Greg Peters said:

“There is about 80% of total TV view share that neither Netflix or YouTube are winning right now. We think that represents a huge opportunity for which we are competing aggressively and we aim to grow our share.”

This has become a recurring theme in Netflix’s investor narrative.

But the past two years tell a different story.

If engagement growth is stalling in the US—Netflix’s most developed market—it may hint at what’s ahead elsewhere. The company could be bumping up against a structural engagement ceiling, at least for now. A massive untapped opportunity makes for a beautiful soundbite—but it can just as easily be a pipe dream.

And in a world of infinite content, with AI enabling compelling videos from a single prompt, the battle for attention is only getting harder from here on out.

Stay tuned for updates on other streaming giants in the coming weeks. 🍿

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Disclosure: I own NFLX, GOOG, AMZN, AAPL, and ROKU in App Economy Portfolio, where I share my ratings (BUY, SELL, or HOLD) with members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.