💰 WTF are Stablecoins?

Why Wall Street is going wild over a $1 coin

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Circle just pulled off one of the hottest IPOs of the year.

It’s nearly tripled on day one.

The deal was 25× oversubscribed.

Why all the excitement over a company that makes... a $1 coin?

Welcome to the strange and powerful world of stablecoins—crypto’s most misunderstood corner, and maybe its most useful one.

Stablecoins like USDC aren’t about moonshots or meme hype. They’re designed to stay exactly where they are: $1.

And yet, they’ve processed trillions in volume, become the backbone of DeFi (Decentralized Finance) and cross-border payments, and are now central to the US government’s plan to regulate digital money.

So what exactly is a stablecoin?

Why did Circle become a Wall Street darling overnight?

And why should you care about a crypto token that’s... intentionally boring?

Let’s break it down.

FROM OUR PARTNERS

Wispr Flow for iPhone — Talk naturally. Flow writes perfectly.

Flow is the AI voice keyboard that turns speech into polished text in any iPhone app—Slack, iMessage, Gmail, Notion—5× faster than typing.

AI-polished output: removes fillers, auto-punctuates

Works everywhere: universal keyboard inside every app

Learns your lingo: remembers names & acronyms

Whisper freely: dictate quietly without disturbing others

Desktop sync: notes mirror to Mac & Windows

Free plan with weekly word cap; upgrade to Pro for unlimited dictation.

💰 A Dollar That Doesn’t Flinch

In a world where Bitcoin can drop 10% before lunch, stablecoins are built to… not move. At least, not in price.

A stablecoin is a digital token pegged to a stable asset, usually the US dollar. One USDC = $1. Always. That’s the promise.

But how?

Behind every USDC is real money—a dollar (or short-term US Treasury) held in reserve. When you give Circle a dollar, they issue one USDC. When you redeem it, they give your dollar back and burn the token.

It's a simple idea with massive implications:

🌍 Global reach: Anyone with internet access can hold a dollar-backed asset without needing a US bank account.

⚡ 24/7 transfers: Unlike bank wires, stablecoins settle in seconds. No weekends. No holidays.

🔁 Programmable money: Developers can build apps that move dollars as easily as data.

It’s like putting the dollar on internet rails—and suddenly, money moves at the speed of software.

No wonder fintechs, payment networks, and crypto protocols are racing to plug into it.

🔘 Circle: The Company Making It Work

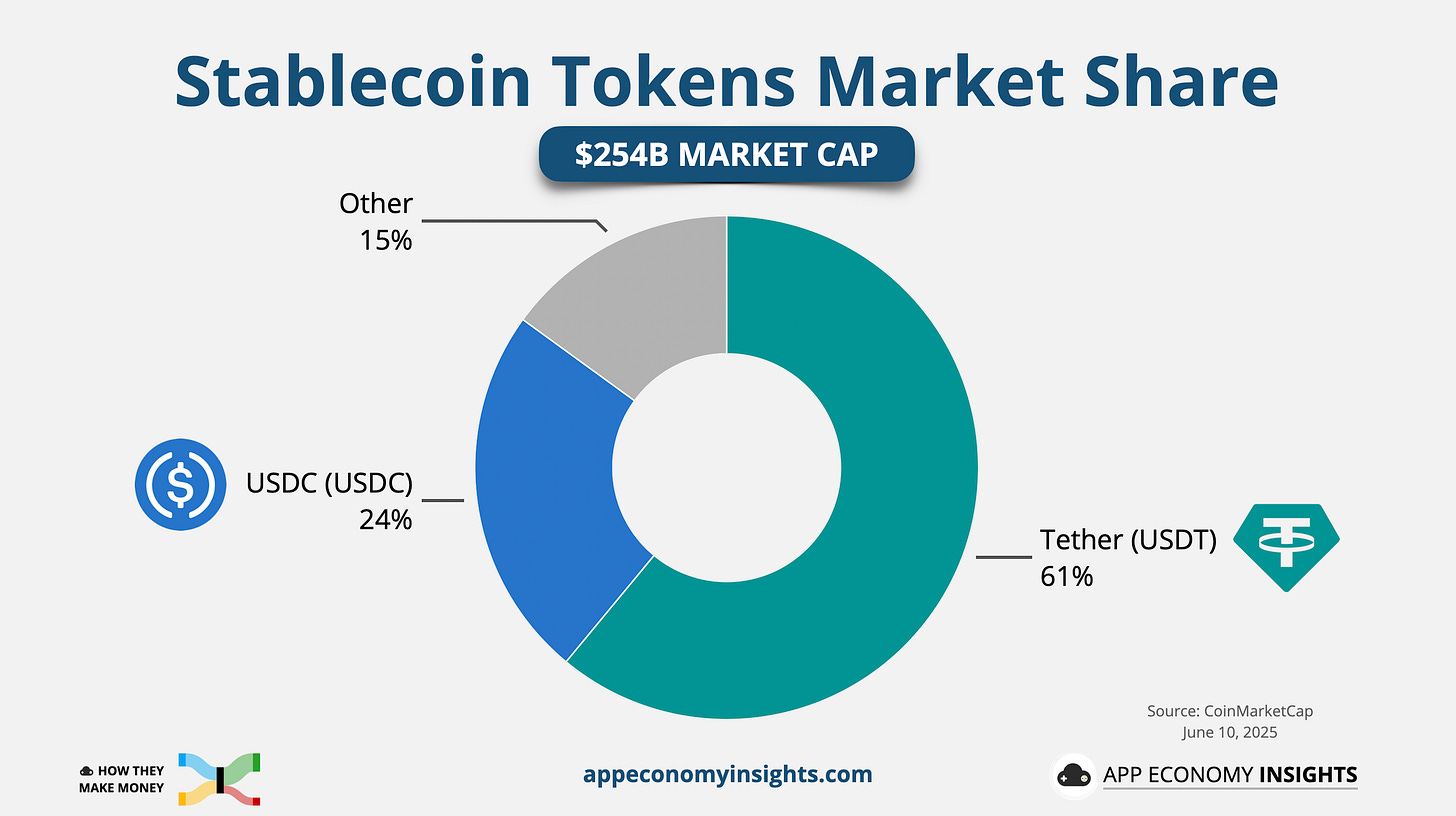

Circle is the company behind USDC, the second-largest stablecoin, with around $61 billion in circulation, trailing only Tether’s USDT at over $155 billion.

While Tether dominates by size, Circle is betting on something else: trust.

Where Tether has long faced criticism for its opaque reserve disclosures and offshore operations (now based in El Salvador), Circle has leaned into transparency, US regulation, and Wall Street partnerships.

It’s not trying to be the biggest stablecoin.

It’s trying to be the most trusted one, especially by regulators, institutions, and fintechs building on crypto rails.

So what exactly is Circle’s role?

👉 It mints and redeems USDC. When a customer sends $1 to Circle, they get 1 USDC. When they send back the USDC, they get $1 in return. No gimmicks, no partial backing—just a tight, transparent peg to the dollar.

👉 It safeguards reserves. Circle holds that money in cash and short-term US Treasuries, managed in part by BlackRock. The reserves are audited and publicly attested monthly, unlike its larger rival, Tether.

👉 It earns interest. Here’s the business model kicker: Circle earns yield on the dollars it holds. As interest rates rise, so do Circle’s earnings. In 2023, it reportedly earned hundreds of millions in revenue, largely from Treasury income.

👉 It provides infrastructure. Circle isn’t just minting coins. It’s building a platform. From APIs that power crypto wallets and fintech apps, to integrations with Visa, Coinbase, and Stripe, Circle is quietly becoming the backend of the “internet dollar.”

Instead of trying to be the next PayPal, they want to be what PayPal plugs into.

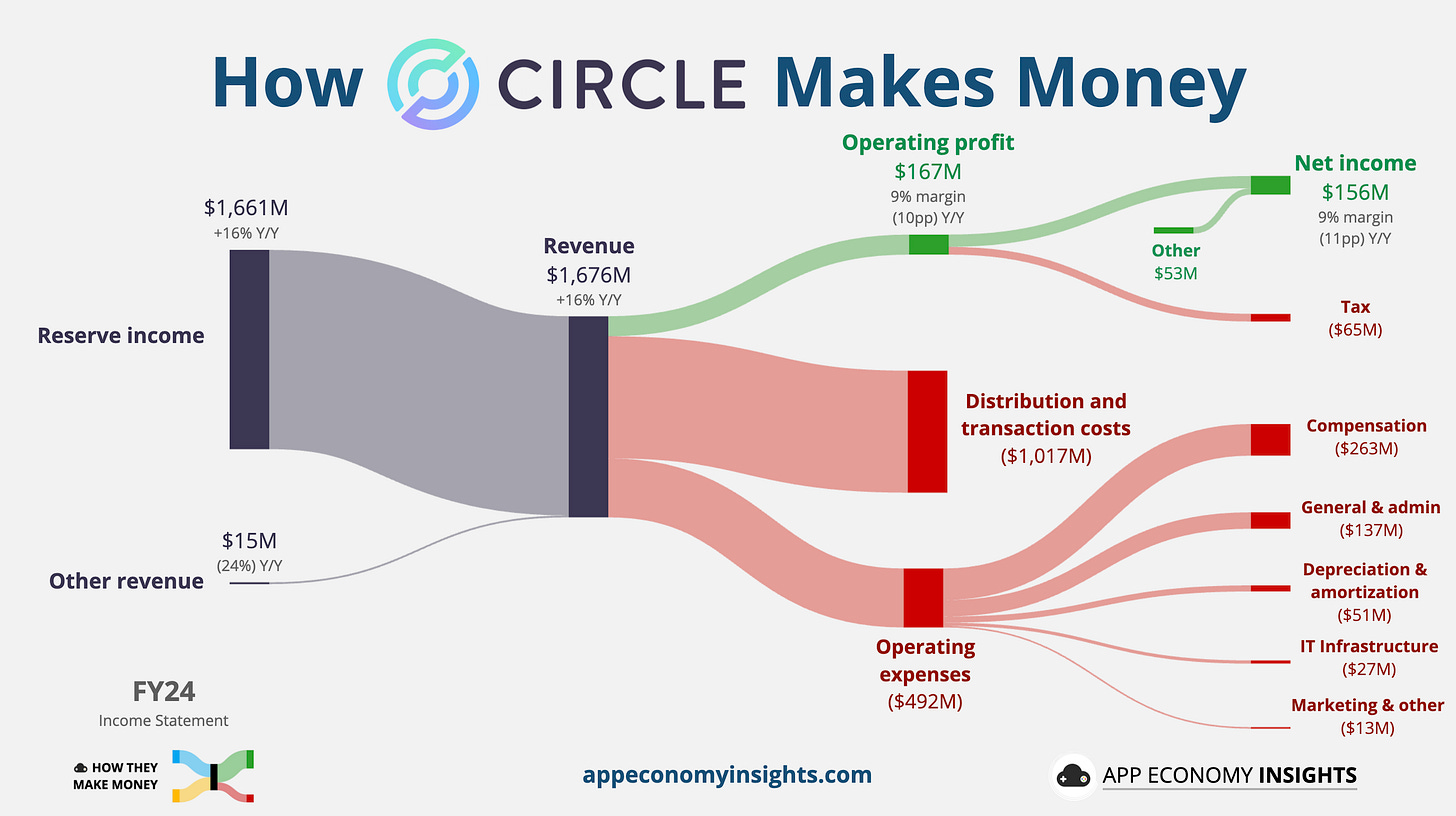

Circle’s business model is deceptively simple: They earn interest on the billions of dollars backing USDC—and they’re very efficient at it.

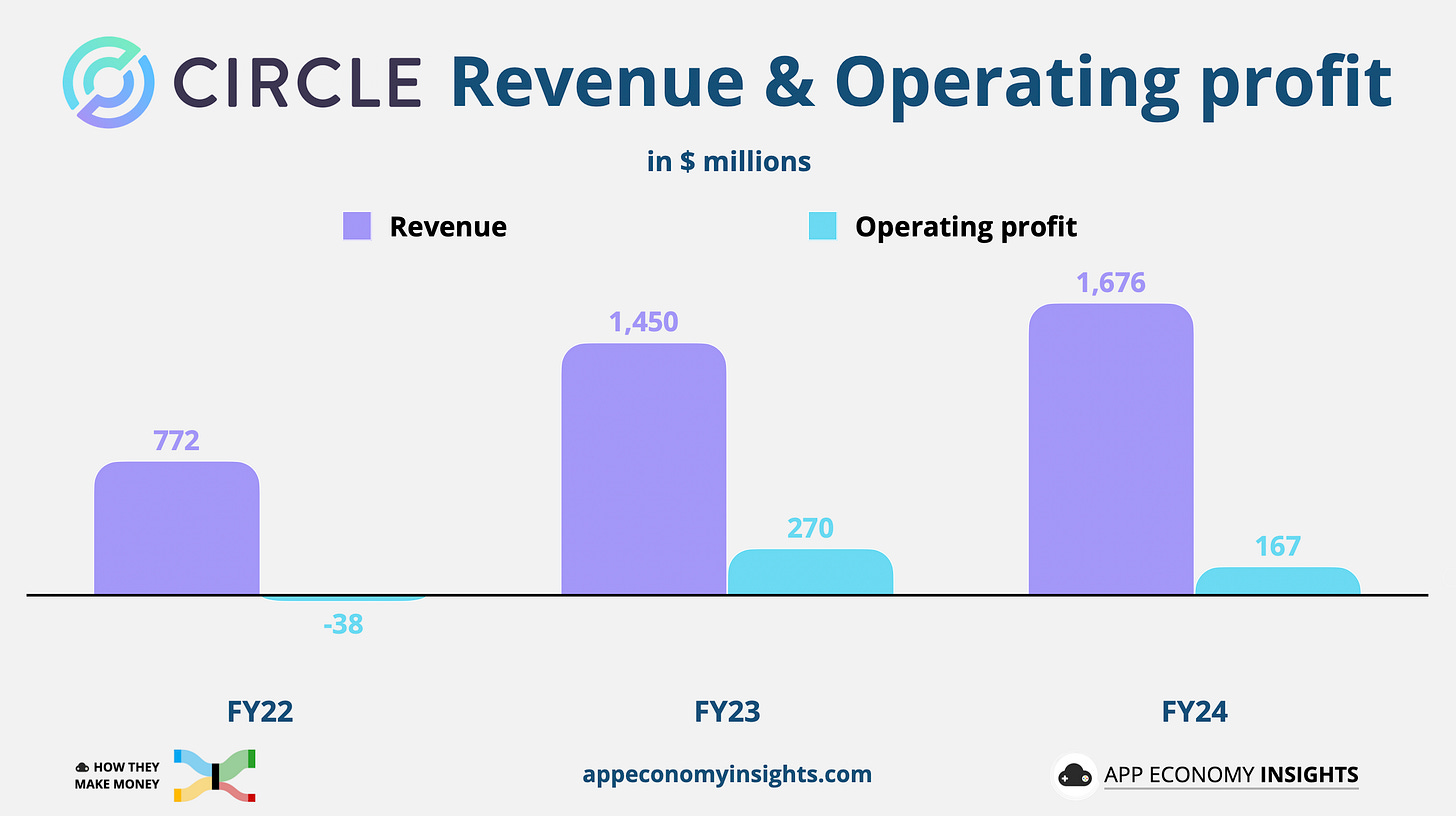

As the visual shows, $1.7 billion of Circle’s FY24 revenue came from reserve income, while “other revenue” (such as API services or platform fees) was just a rounding error.

The real eye-opener? Circle turned that into $167 million in operating income, with a tidy 9% margin. Despite over $1 billion in partner fees—primarily to Coinbase, which earns a 50% share of net USDC revenue—Circle is solidly in the green.

Most of the USDC reserves aren’t Circle’s corporate assets.

They are held off-balance sheet, in the Circle Reserve Fund managed by BlackRock.

This fund is legally separate and custodied by BNY Mellon.

The fund’s assets—US Treasuries and some cash—back the USDC in circulation, but don’t belong to Circle in the way that operating capital does.

As a result, $50+ billion in reserve assets (as of May 2025) show up in disclosures, attestations, and footnotes, but not in Circle’s balance sheet.

🧠 The takeaway: Stablecoins aren’t just digital dollars. When done at scale, they become interest-bearing machines.

📊 Mind-Blowing Numbers

Circle isn’t building some experimental crypto toy. It’s operating at real-world scale: