📈 Broadcom: AI at the Center

Is there room for one more in the Mag 7?

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Two of the most anticipated earnings reports this week came from two tech giants riding very different waves.

🦅 CrowdStrike is still rebuilding trust after last year’s IT outage, showing solid growth but cautious guidance.

📈 Broadcom, fresh off a 70% rally, delivered record AI-driven results and raised its outlook, but it wasn’t enough for investors.

One’s navigating recovery. The other is testing whether it belongs in the same league as the Magnificent Seven.

Let’s unpack both.

FROM OUR PARTNERS

🧰 The Tools, Templates & Playbook for Your AI Consultancy

The AI consulting market is about to grow by a factor of 8X – from $6.9 billion today to $54.7 billion in 2032. But how does an AI enthusiast become an AI consultant? How well you answer that question makes the difference between just “having AI ideas” and being handsomely compensated for your contribution to an organization’s AI transformation.

Thankfully, you don’t have to go it alone — our friends at Innovating with AI have welcomed 700 new students into The AI Consultancy Project, their new program that trains you to build a business as an AI consultant. Some of the highlights current students are excited about:

The tools and frameworks to find clients and deliver top-notch services

A 6-month plan to build a 6-figure AI consulting business

Students getting their first AI client in as little as 3 days

👉 Click here to request access to The AI Consultancy Project

🦅 Crowdstrike: Post-Outage Rebuild

The cybersecurity leader is still climbing back after last year’s global outage. Q1 showed strong customer retention and solid execution, but guidance was again disappointing.

Key metrics:

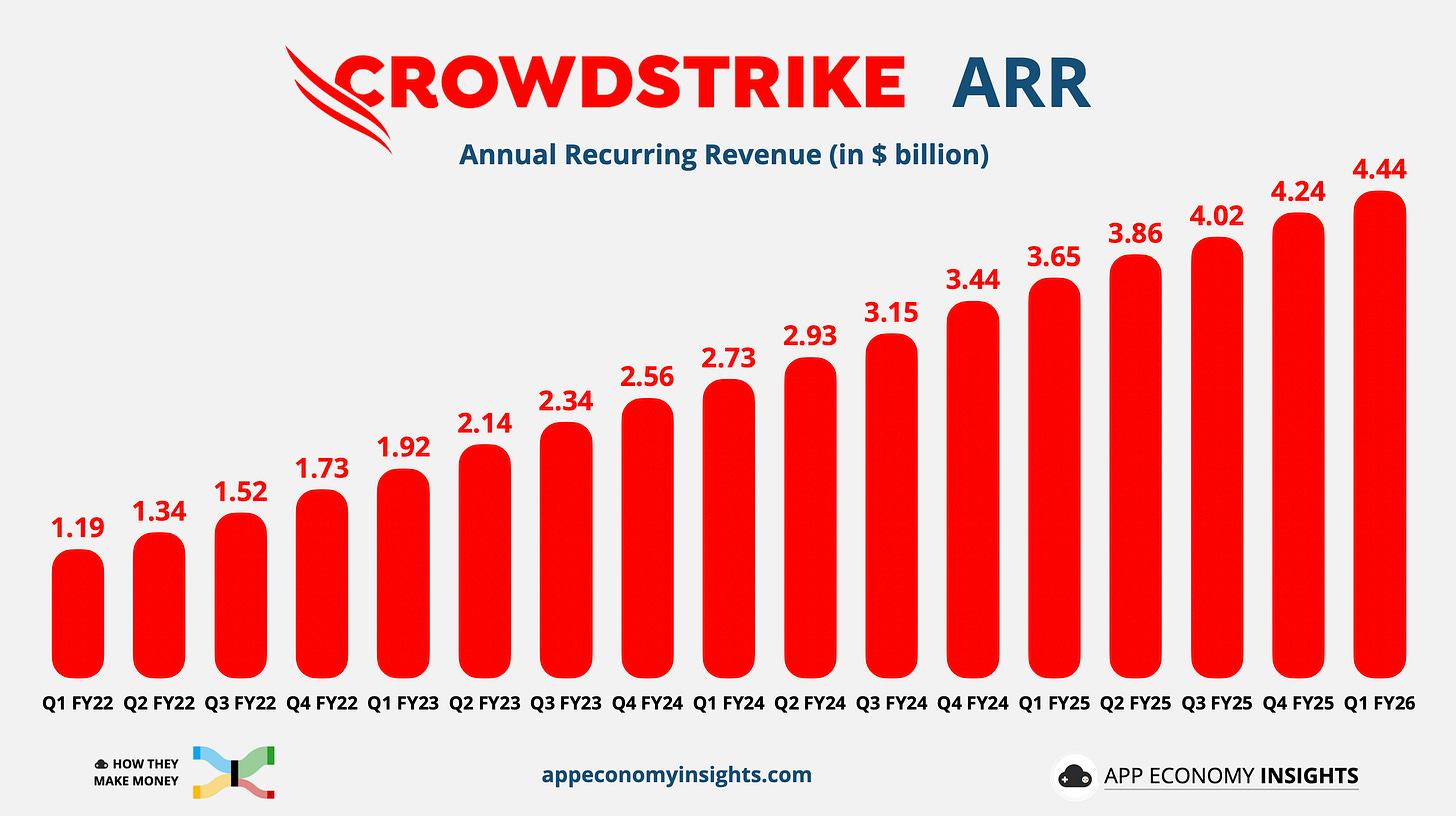

Annual Recurring Revenue (ARR): ARR grew 22% year-over-year to $4.44 billion, adding $194 million in net new ARR. This is a sequential decline from Q4's $224 million, but still exceeded internal expectations, indicating resilience amid the ongoing customer-commitment package (CCP)—a temporary discount program launched following the July 2024 outage we covered here.

Gross Retention Rate: Remained strong at 97%, reflecting continued customer loyalty despite the prior year's outage.

Income statement:

Revenue grew 20% Y/Y to $1.10 billion ($10 million miss).

☁️ Subscription grew +20% Y/Y to $1,051 million.

💼 Professional services grew +8% Y/Y to $53 million.

Operating loss margin was -11% (-12pp Y/Y).

Non-GAAP operating margin was 18% (-5pp Y/Y).

Non-GAAP EPS $0.73 ($0.07 beat).

Cash flow:

Operating cash flow was $384 million (35% margin).

Free cash flow was $279 million (25% margin).

Balance sheet:

Cash and cash equivalents: $4.6 billion.

Long-term debt: $0.7 billion.

Guidance:

Q2 FY26: Revenue +22% Y/Y to ~$1.15 billion (slightly short of the $1.16 billion consensus).

FY26: Revenue +21% Y/Y to $4.78 billion (unchanged). Non-GAAP EPS ~$3.50 ($0.05 beat).

So, what to make of all this?

Customer credits and discounts continue to impact growth. Launched to retain customers following the July 2023 outage, the CCP program is tapering off but still impacted revenue by $11 million in Q1. The drag is expected to be $10–15 million per quarter until Q4 FY26.

Sales and marketing spend remains high. 40% of CrowdStrike’s operating expenses go to this category. Stock-based comp made up 25% of total OpEx this quarter, leading to concerns about dilution.

Profitability dipped, but cash generation is intact. GAAP losses widened due to elevated R&D and legal costs related to the outage (Delta and others are suing). The company remained capital efficient with a 25% free cash flow margin, a slight improvement from 23% in Q4.

No customer exodus. Despite last year’s disaster, dubbed “the largest IT outage ever,” customers stayed. That’s rare and a strong signal of product stickiness.

Investors want more. Despite solid execution, the slight Q2 guidance miss triggered a decline in the stock price. The Street wanted a guidance raise, and didn’t get one.

This is still CrowdStrike’s comeback year.

While the business is executing well, CCP-related drag, conservative guidance, and unresolved legal issues are weighing on sentiment. That now includes inquiries from the DOJ and SEC nto CrowdStrike’s ARR reporting and the July outage—amplifying the legal overhang tied to last year’s fallout.

That said, ARR is growing steadily, cash is piling up, and customers haven’t walked away—a testament to the platform’s durability. CrowdStrike still targets $10 billion in ARR by FY31, suggesting recent turbulence may be more noise than signal. And with AI-powered endpoint protection becoming critical infrastructure, they may get there.

The stock price already reflects the optimism, with a valuation of 25x forward revenue. That puts CrowdStrike in rarified air, only behind Palantir and Cloudflare in the cloud software category.

📈 Broadcom: AI at the Center

Broadcom just posted another record quarter, riding strong demand for custom AI chips and VMware-fueled software growth. But after a 70% stock rally, even a beat wasn’t enough to impress.

Segment Breakdown

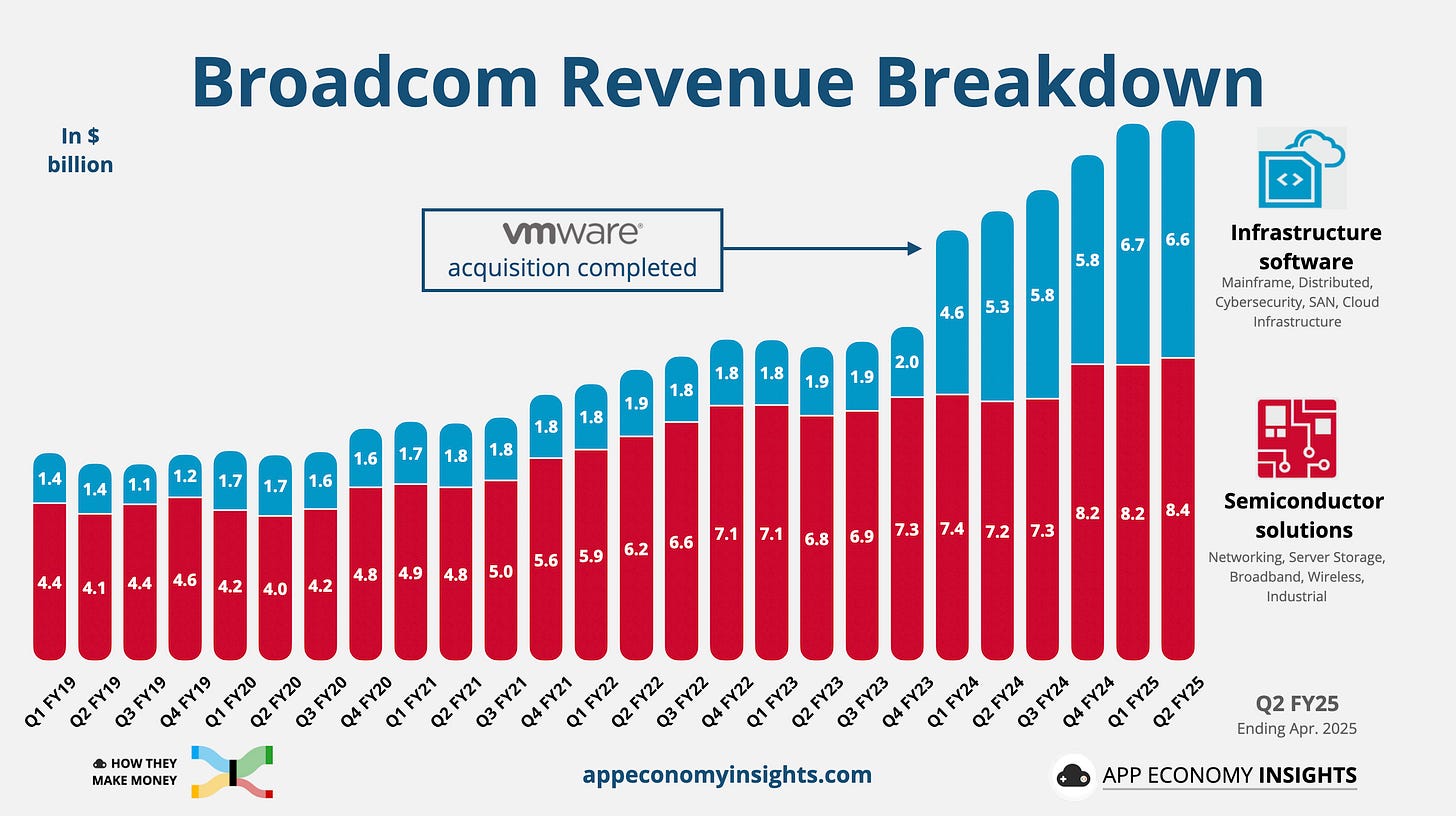

⚙️ Semiconductor solutions grew +17% Y/Y to $8.4 billion, powered by AI networking and custom chip demand.

💽 Infrastructure software grew +23% Y/Y to $6.6 billion, benefiting from Broadcom’s transition to subscription-based pricing and stronger synergies post-acquisition.

AI revenue: $4.4 billion (+46% Y/Y), including ASICs and switch chips sold to Google, Meta, and other hyperscalers.

Income statement:

Revenue grew 20% Y/Y to $15.0 billion ($30 million beat).

Net income surged 134% to $5.0 billion.

Adjusted EBITDA margin was 67% (+8pp Y/Y).

Non-GAAP EPS $1.58 ($0.01 beat).

Cash flow:

Operating cash flow was $6.6 billion (44% margin).

Free cash flow was $6.4 billion (43% margin).

Balance sheet:

Cash and cash equivalents: $9.5 billion.

Long-term debt: $61.8 billion.

Guidance:

Q3 FY25: Revenue +21% Y/Y to ~$15.8 billion (just ahead of consensus). AI semiconductor revenue expected to reach $5.1 billion (+16% Q/Q).

Adjusted EBITDA Margin: At least 66% of revenue

So, what to make of all this?

AI demand remains the engine. Broadcom’s AI chip business—custom ASICs and high-speed networking—grew 46% Y/Y to $4.4 billion and is expected to rise another 16% in Q3. That’s real momentum, especially given the early stage of inference demand.

Software scale is finally material. VMware now accounts for nearly half of total revenue. The shift to subscriptions is unfolding smoothly, with CEO Hock Tan noting “continued momentum.” Broadcom’s software segment is starting to match the scale of its semis business.

Guidance was solid, not stunning. Despite Q3 revenue guidance of $15.8 billion coming in slightly above consensus, investors were hoping for more. After a 30% rally in the past month alone, the bar was simply too high. Shares dipped after-hours.

Margins and cash flow are elite. With 66–67% EBITDA margins and 43% free cash flow margins, Broadcom is among the most capital-efficient businesses in tech. A $4.2 billion repurchase in one quarter sends a clear message.

Market expectations are a double-edged sword. After briefly crossing a $1.2 trillion valuation, Broadcom is priced as a top-tier AI enabler. But that comes with risk: investor expectations are high. Even a clean beat and raised outlook couldn’t satisfy a market that had already priced in excellent execution.

Delivering at scale

Broadcom is firing on all cylinders. The AI chip business is growing rapidly, VMware is scaling as a core software platform, and free cash flow is enormous. This quarter demonstrated consistent execution across both semiconductors and software, with guidance indicating further strength ahead.

The muted stock reaction says more about inflated expectations (the stock has rallied 70% in the past two months) than about the results themselves. With AI at the center of its business, Broadcom looks well-positioned to keep delivering, quarter after quarter.

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Disclosure: I own CRWD, NET, and PLTR in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Superb visuals, and analysis Bertrand!

Thank you for the detailed insights!