👔 Who’s the Highest-Paid CEO?

Over 3x Jensen Huang's pay

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

👔 Who’s the Highest-Paid CEO?

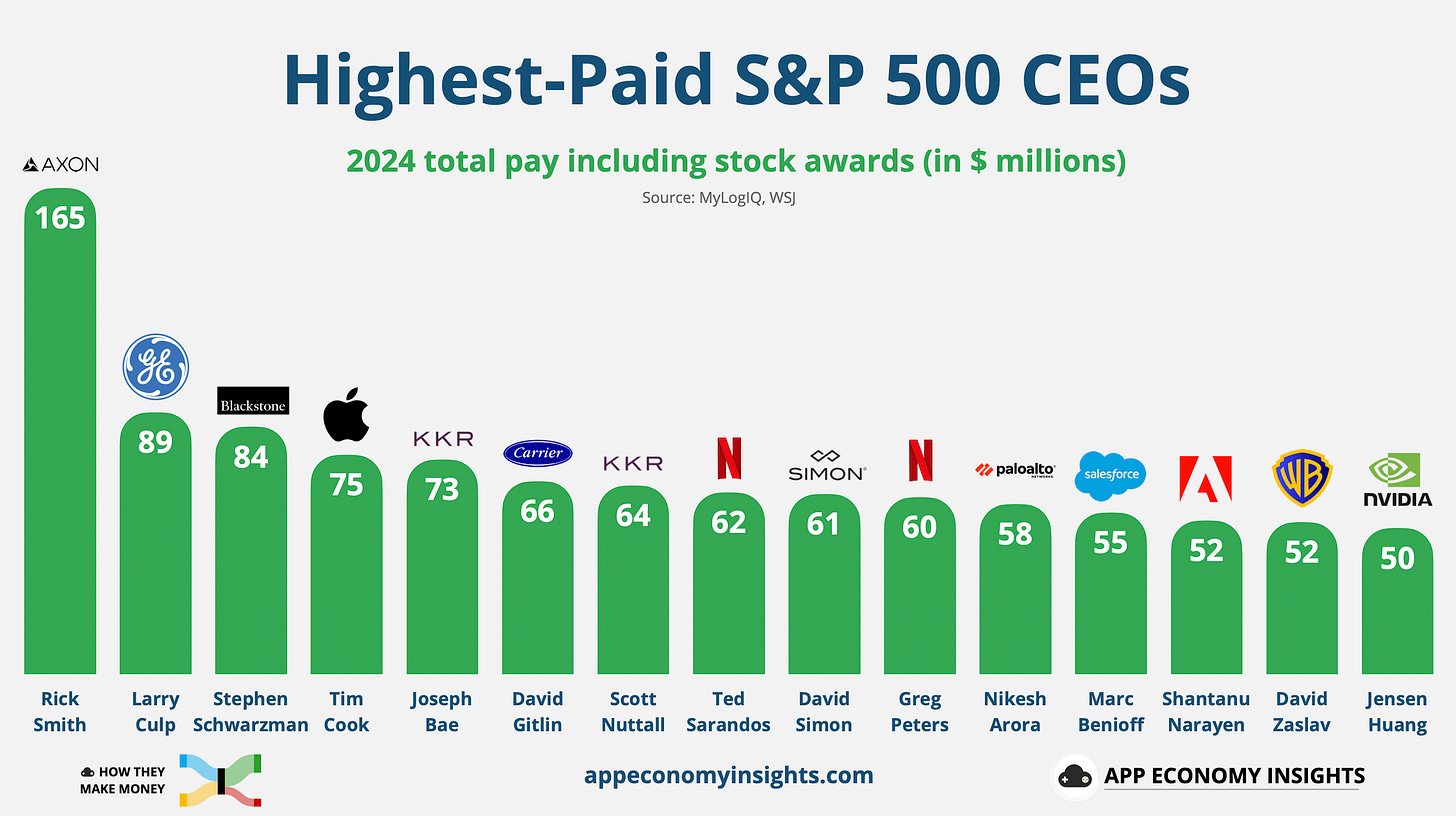

Rick Smith, co-founder and CEO of Axon, raked in $165 million in 2024—over three times what NVIDIA’s Jensen Huang earned.

Smith was the only S&P 500 chief to crack the $100 million mark, while half of all CEOs made under $17 million. That kind of gap begs the question:

How does a company best known for Tasers justify such a windfall?

If you think Axon is just a hardware company, think again. It now resembles a tech platform like Apple—built on high-margin services, a sticky software ecosystem, and (dare we say) an emerging AI business.

According to MyLogIQ data reported by The Wall Street Journal, nearly all of Smith’s compensation stems from performance-based stock awards tied to long-term goals. Smith himself explained:

“I can make zero—or $500 million—I feel better about making a lot if I can also make zero. For me, it creates that startup kind of vibe.”

Axon’s stock has surged 160% over the past year, putting Smith’s award value near $500 million on paper. But what’s more surprising? This equity program is open to every Axon employee. Staff can convert part of their pay into restricted shares that triple or go to zero based on performance. But no matter how generous the stock grant, it only pays off if the business delivers.

So, what’s fueling Axon’s rapid rise from “Taser maker” to a $60 billion public-safety juggernaut?

📊 Let’s visualize Axon’s evolution—so you can decide whether Smith’s payout is a shocker… or a sign of exceptional execution.

Today at a glance:

🤝 The End of Killing

👮🏻 How Axon Makes Money

☁️ From Hardware to Cloud

🤝 The End of Killing

Rick Smith’s mission wasn’t to chase money—it was to save lives. In 1993, freshly out of Booth Business School, he couldn’t shake a memory: two of his high school friends were gunned down in a parking lot. Around the same time, his mother considered buying a handgun out of fear.

His instinct: there must be a better way.

1967 → 1993: The TASER’s Rocky Origins

1967: NASA engineer Jack Cover reads about a man stuck on an electrified fence—immobilized but unhurt. He imagines: “What if we used a jolt of electricity to incapacitate someone without killing them?” Out comes the T.S.E.R. (Tom Swift Electric Rifle), later shortened to “TASER.”

1975: Taser Systems launches. The weapon fires dart-like probes carrying an electric charge. Early tests show promise—but then…

The US Consumer Product Safety Commission bans it over safety concerns.

It’s classified as a firearm (Title II), requiring serial numbers. All existing units must be recalled and destroyed.

Bankruptcy ensues.

1980s: Tasertron (licensed by Barnet Resnick) tweaks the design, but reliability hovers around 56%. The infamous 1991 Rodney King beating, where a TASER fails, damages public trust.

By 1993, the idea seemed dead… until Rick Smith picked up the phone.

1993–2001: Rick’s Breakthrough

1993: Rick calls Jack Cover: “Let’s fix this thing.” They swap gunpowder for compressed nitrogen, stripping away the “firearm” label. Rick and brother Tom form ICER Corp.—“Incapacitating Electronic Restraint”—later rebranded Air Taser. The design finally works reliably, delivering a consistent jolt.

1998: After Tasertron’s exclusive police rights lapse, Air Taser’s TASER M26 lands in law enforcement’s hands. Departments realize they can subdue suspects without killing them—a game-changer.

2001: IPO under the name TASER International.

2004: Revenue jumps from $7 million to $68 million in just two years.

🎢 Not for the faint of heart: Three years post-IPO, the stock soared nearly 50×—yet it nearly collapsed under legal pressure in 2005.

2005–2010: Cameras, Controversy, and Momentum

2005 Crisis: TASERs face a barrage of lawsuits linking “non-lethal” incidents to fatalities. Sales plunge 30%, net income collapses 95%.

2006 Pivot: Launch of TASER Cam—a small camera triggered when a TASER is drawn. It records every moment leading up to and after deployment, offering legal cover for officers and Axon alike.

2009 Expansion: Introduction of the Axon Body camera and Evidence.com, a cloud-based evidence management platform. Suddenly, Axon isn’t just a hardware vendor—it’s a digital ecosystem.

2010–2025: Axon Emerges

2017: TASER International rebrands as Axon, reflecting a broader mission: “public-safety technology” rather than hardware alone.

2019: Rick Smith publishes The End of Killing, where he explains his goal of making bullets obsolete.

2022: Achieves FedRAMP High for cloud security—unlocks federal contracts.

2023: Axon’s Body 4 camera captures 160° video, live streams, and offers real-time alerts. It automatically unlocks cloud storage, AI redaction, and audit trails.

2024: Axon acquires Fusus (real-time operations technology) and Dedrone (drone detection and neutralization), integrating them into its platform.

2025: A $60 billion market cap, 17,000+ US agencies onboard, and a thriving recurring-revenue business.

📈 Snapshot: Axon’s stock performance places it among the world’s best-performing public companies—unthinkable for a company that almost died in two bankruptcies.

👮🏻 How Axon Makes Money

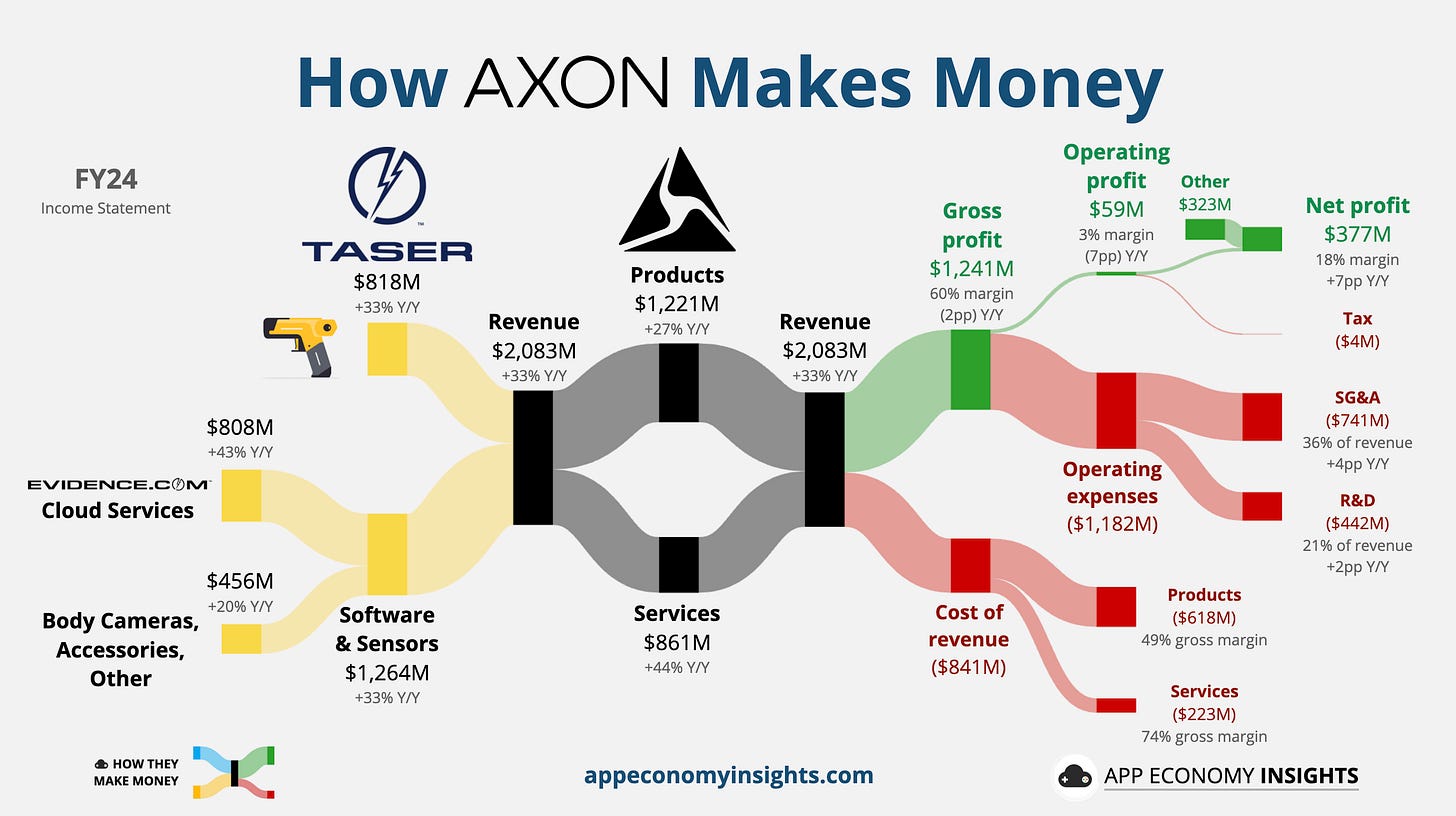

Axon isn’t just a Taser company anymore:

Cloud services account for the majority of gross profit.

Over 96% of customers are now on recurring subscription plans.

If this looks like Apple’s income statement, that’s no coincidence—Axon is following a similar playbook, a hybrid of hardware grit and software savvy. Today, the business splits cleanly into two segments: