🛎️ Airbnb Goes Beyond B&B

Not just where you sleep anymore

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

From airbeds to anything

In 2007, Airbnb launched with 3 air mattresses on the floor and a dream.

The original name comes from Air Bed and Breakfast. Seventeen years later, it wants to be more than where you stay.

It’s no secret that co-founder and CEO Brian Chesky wants Airbnb to become much more than its initial premise, a la Amazon. From matching hosts to developing social features, he wants to disrupt more than hotels.

At its 2025 Summer Release, Airbnb unveiled its biggest product shift in years: a redesigned app with two new pillars: Services and Experiences.

The goal is to recreate access to amenities and tailored activities, from room service to guided tours, without having to book a 5-star hotel.

Chesky summed it up:

“Basically, it’s the Airbnb of anything.”

This is more than a product refresh. It’s a bet that Airbnb can become an aggregator beyond homes and capture a larger share of your lifestyle. And it’s happening as the core business matures, growth cools, and the company seeks new ways to monetize its vast user base.

But is this a bold leap forward or a beautifully designed stretch?

Let’s dive in.

Today at a glance:

📱 The new Airbnb

📊 Airbnb economics

🧠 Founder Mode impact

🔎 Opportunities vs. risks

🤝 Marketplace dream vs. reality

🧭 Wallet share and network effects

FROM OUR PARTNERS

Is this startup the next billion-dollar buyout? [Round closes tomorrow]

Imagine investing in Ring before its $1.2B buyout by Amazon.

Or Nest, before Google's $3.2B acquisition.

By the time we hear about industry-changing companies, it’s usually too late. But right now, there’s a smart home startup making their way to homes in America. This tech startup is RYSE, and unlike Ring, you can still invest before their $1.90 round closes tomorrow.

Like how Ring disrupted home security, this company is revolutionizing smart blinds & shades— with $10M+ in revenue, 200% Y/Y growth, and sold in 127 Best Buy stores, they are primed for massive expansion.

1. 📱 The new Airbnb

Airbnb’s app just got its biggest makeover in years—and it’s no longer just about booking a place to sleep.

Now, it’s built around three icons: Homes, Experiences, and Services.

Going beyond lodging is a natural expansion for Airbnb.

Consider OTA giant Expedia (parent to VRBO). Lodging revenue in Q1 was comparable to Airbnb’s at $2.3 billion. But Expedia made another $0.7 billion via other segments, like advertising, flights, and car rentals.

Airbnb has long left money on the table, prioritizing focus on its core mission. So, the Summer 2025 release makes a lot of sense.

Here’s what’s inside:

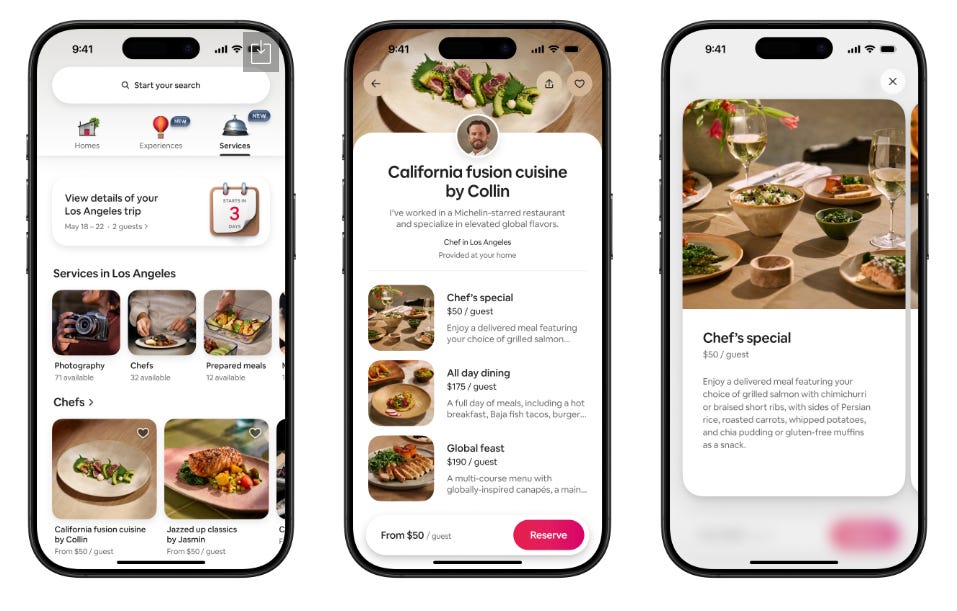

🛎️ Airbnb Services

A curated marketplace of in-home professionals you can book even when you’re not traveling.

Book a private chef for a dinner party.

Personal trainers, makeup artists, photographers, and more.

Massage therapists and spa services delivered to your doorstep.

Many services start under $50, with Airbnb taking a ~15% commission.

Unlike home rentals, Services are manually vetted, with providers averaging 10+ years of experience. Airbnb wants to guarantee quality, not just quantity.

Chesky explained:

“We don’t accept things that we don’t think will sell. […] We’ll probably manually vet them forever.”

It’s the kind of high-touch approach you’d expect from a hotel, now available from home, whether you are traveling or not. The goal is to seamlessly integrate these services within your trip and replicate the hotel experience. Though scaling could be more of a challenge when vetting manually (more on this in a minute).

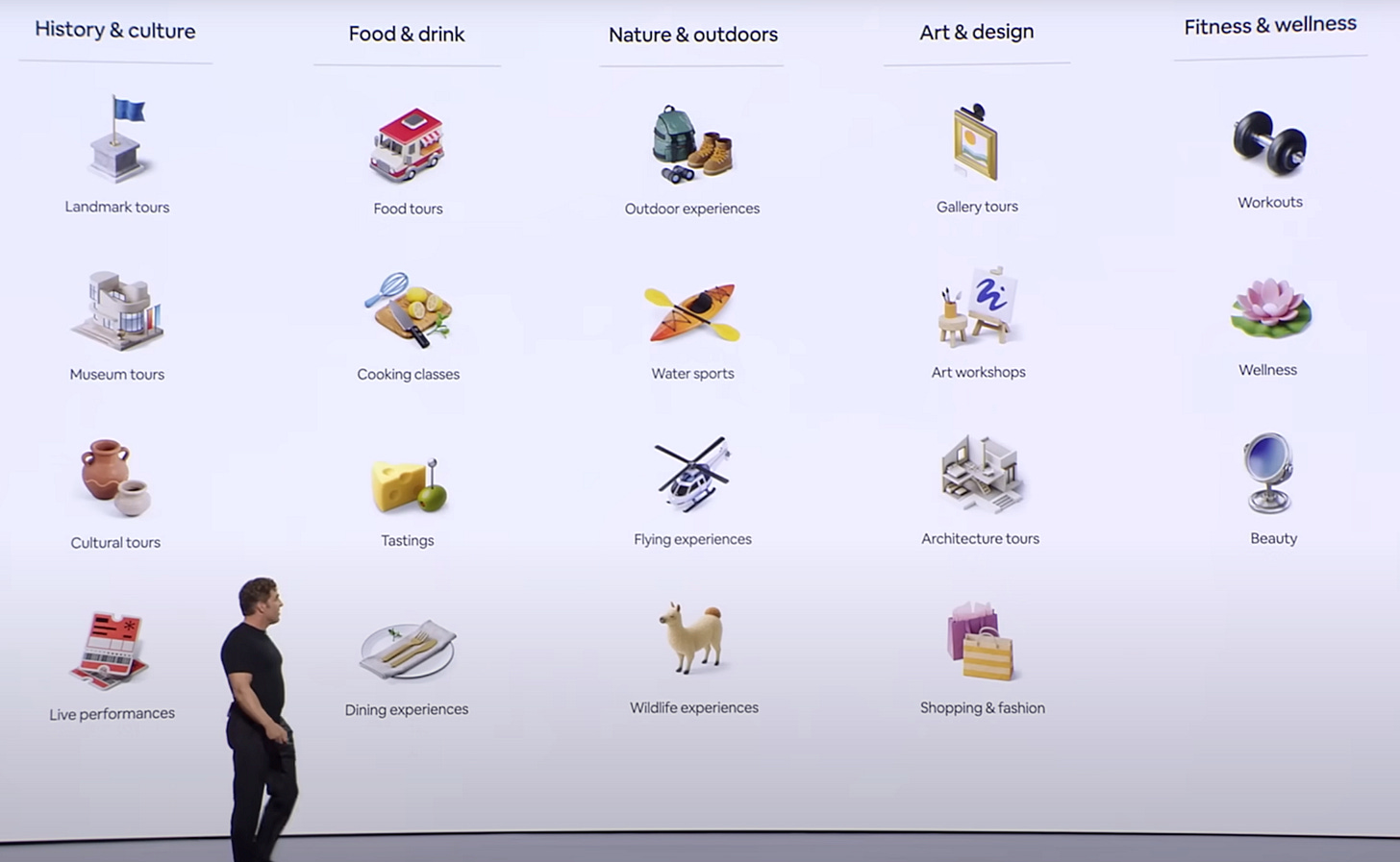

🥾 Airbnb Experiences

Not entirely new, but completely revamped. Experiences are now smaller in number but bigger in ambition.

Try lucha libre wrestling in Mexico City.

Learn to make ramen in Tokyo from an award-winning chef.

A restoration architect guides you through Notre-Dame in Paris.

Or join an Airbnb Original: like playing football with Patrick Mahomes.

There are nearly 20,000 hand-picked listings across 650 cities, each curated for uniqueness and quality. The average price? About $66.

Airbnb is steering away from tourist traps—and toward authenticity at scale. The goal? Replicating the success of its homes segment by focusing on uniqueness. If the platform can aggregate one-of-a-kind experiences, the inventory will become more valuable and harder to replicate elsewhere.

Critically, Airbnb is building a social element with guest profiles within the new app. You’ll be able to see who else is attending, message other guests, share photos, and keep in touch.

With Services and Experiences, Airbnb is betting on a future where people plan their activities through the app. And that future is starting to look a lot more like a lifestyle brand than a travel utility.

2. 📊 Airbnb economics

Airbnb is a typical two-sided marketplace, connecting guests and hosts.

The company now counts:

5 million+ hosts.

2 billion+ guest arrivals.

8 million+ active listings worldwide.

220+ counties with listings available.

At IPO, 90% of hosts were individuals, and most had just one listing. That fragmentation is still a feature, not a bug: it creates unique, local inventory that platforms like Expedia or Booking can’t easily replicate. And it may be Airbnb’s secret weapon as it expands into services and experiences.

Hosting is the foundation of the Airbnb experience. The company's long-term success depends on its capacity to acquire and retain hosts on its platform, fueling network effects for its marketplace.

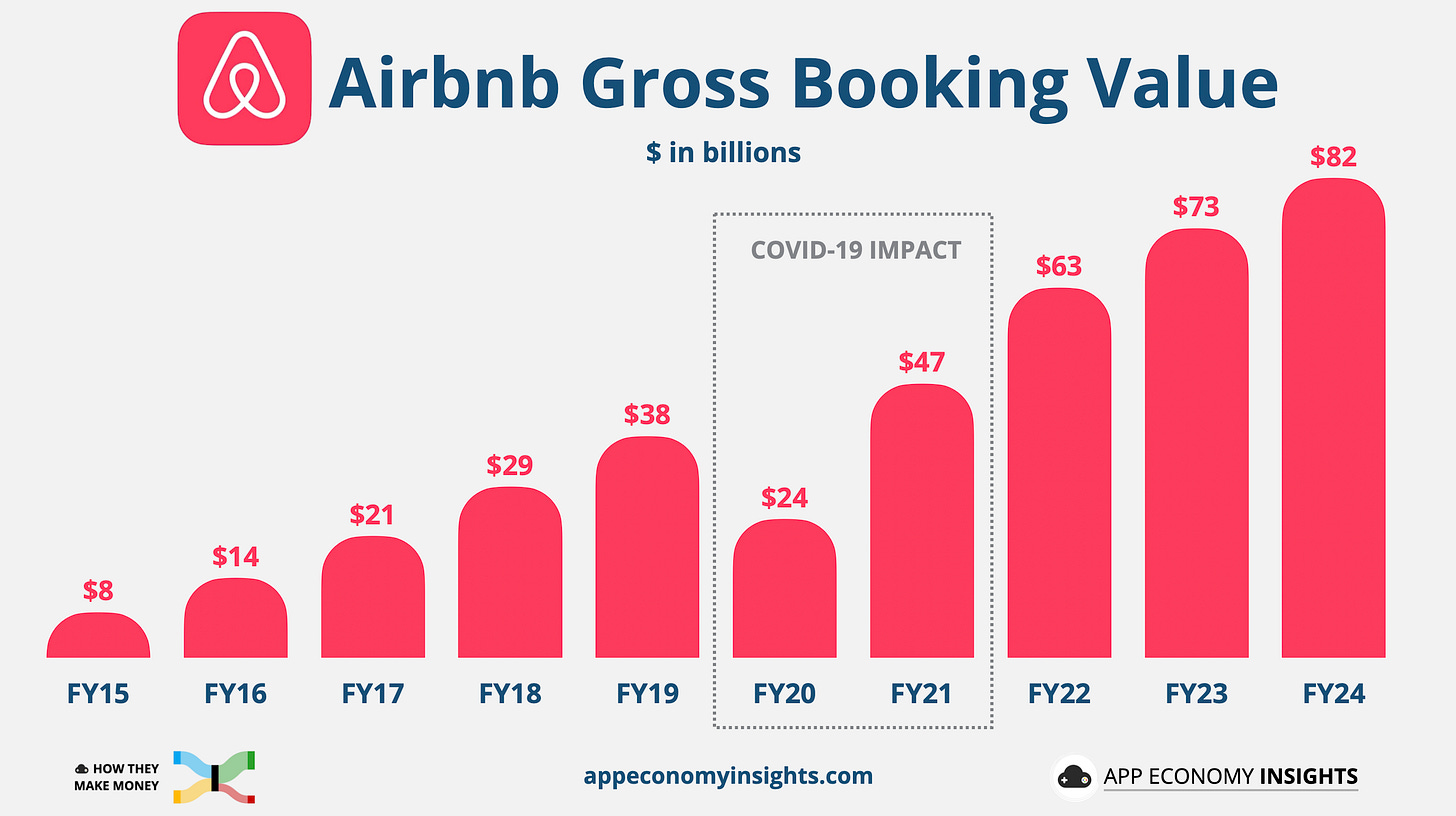

The dollar value guests spend is called Gross Booking Value (GBV), growing 12% Y/Y to $82 billion in FY24. It includes host earnings, service fees, and taxes. Airbnb keeps roughly ~13% of GBV via fees (or 15% excluding taxes).

Airbnb’s revenue has two main components:

🛖 A host fee, in % of the price set by the host (3% for homes).

👨👩👧👧 A guest fee, in % of the price set by the host (12%).

Key metrics in Q1 2025:

Nights and experiences booked: up +8% Y/Y to 143 million.

Gross Booking Value: up +7% Y/Y to $24.5 billion.

Revenue: up 6% Y/Y (or 8% fx neutral) to $2.3 billion ($10 million beat).

Now let’s visualize why Airbnb looks nothing like Expedia or Booking when it comes to where the money goes.