📊 PRO: This Week in Visuals

NVO UBER SHOP MELI ARM ANET APP FTNT MAR COIN FLUT CPNG NET F EA HUBS DDOG TTD TOST EXPE GPN PINS DKNG AFRM Z PAYC NYT MTCH LYFT PTON

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🇩🇰 Novo Nordisk: GLP-1 Challenges

🚖 Uber: Soft US Travel

🛍️ Shopify: Tariff Headwinds

🤝 MercadoLibre: Argentina Rebounds

⚙️ ARM: Licensing Delays

🌐 Arista Networks: AI Demand Surges

📱 AppLovin: Ad Tech Momentum

🔒 Fortinet: Services Slowdown

🏨 Marriott: Softening US Demand

📈 Coinbase: Slowing Volume

🏈 Flutter: March Madness Setback

🇰🇷 Coupang: Margin Machine

☁️ Cloudflare: Largest-Ever Contract

🚙 Ford: Tariff Uncertainty Looms

⚽ Electronic Arts: EA SPORTS Rebound

📢 HubSpot: AI Momentum Continues

🐶 Datadog: AI-Powered Expansion

📺 The Trade Desk: Kokai Powers Growth

🍞 Toast: Enterprise Wins Fuel Growth

✈️ Expedia: US Travel Softens

🌎 Global Payments: Worldpay Acquisition

📌 Pinterest: Ad Resilience

👑 DraftKings: Mixed Quarter

🌈 Affirm: Nearly Profitable

🏠 Zillow: Rentals Shine

💻 Paycom: Automation Pays Off

🗞️ New York Times: 15M Subs by 2027

🔥 Match Group: Payers Decline

🚘 Lyft: Expanding in Europe

🚲 Peloton: Decline Continues

FROM OUR PARTNERS

Write at the speed you think.

Keyboard slowing you down? Say hello to Wispr Flow, the AI dictation tool that turns raw thoughts into ready‑to‑send prose—three times faster than typing. Speak normally; Flow cleans filler, fixes punctuation, and keeps your voice intact. Need a rewrite or a tone tweak? One click.

From Word to Slack to code editors, Flow rides shotgun in every app and speaks 100+ languages, so your ideas travel further. Team plans roll out voice‑first speed company‑wide.

Stop staring at a blinking cursor and start shipping ideas the moment they hit.

Ditch the keyboard—try Wispr Flow free today.

1. 🇩🇰 Novo Nordisk: GLP-1 Challenges

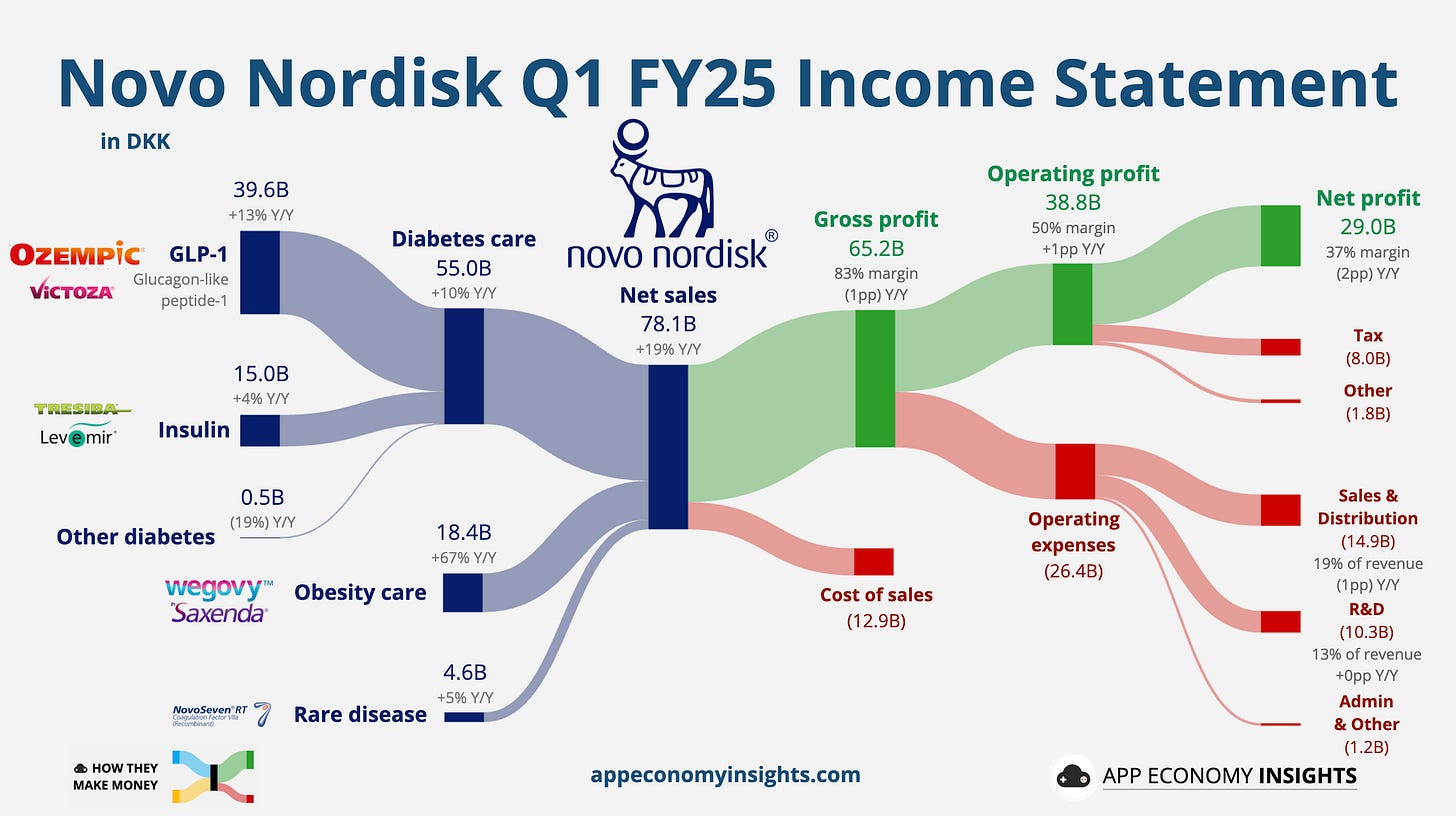

Novo Nordisk’s Q1 revenue rose 19% Y/Y to DKK 78.1 billion ($11.9 billion), driven by a 67% surge in obesity drug sales to DKK 18.4 billion, though Wegovy sales fell short of estimates, down 13% sequentially to DKK 17.4 billion. Operating profit increased 22% to DKK 38.8 billion, but the company lowered its 2025 outlook due to competition from compounded GLP-1 drugs, now expecting revenue growth of 13% to 21% (from 16%-24%) and operating profit growth of 16% to 24% (from 19%-27%).

Management emphasized that the recent FDA ban on compounded semaglutide, effective May 22, could boost branded sales in the second half of 2025. CFO Karsten Munk Knudsen projected a sales rebound for Wegovy following new distribution deals with CVS Health and telehealth providers like Hims & Hers. Despite the guidance cut, investors anticipate a recovery in GLP-1 demand amid reduced competition from copycat versions.

2. 🚖 Uber: Soft US Travel

Uber’s Q1 revenue rose 14% Y/Y (or +18% in constant currency) to $11.5 billion, missing estimates by $90 million. Gross bookings of $42.8 billion also fell short of the $43.1 billion consensus, with weaker US inbound travel and currency headwinds weighing on mobility. Adjusted EBITDA of $1.87 billion (+35% Y/Y) beat expectations, while operating income surged to $1.2 billion from $172 million a year ago, driven by cost efficiencies. Revaluations of investments added $51 million to net profit.

Trips continued to grow at a faster pace than the user base, showing rising engagement. While rideshare revenue growth slowed, delivery accelerated, and both segments expanded take rates. Adjusted EBITDA was 4.4% of gross bookings, up from 3.7% a year ago — a record high. Uber also announced a $700 million acquisition of Turkey’s Trendyol Go, the same day DoorDash revealed plans to buy Deliveroo ($3.9 billion) and SevenRooms ($1.2 billion), underscoring the rapid consolidation in delivery — a winner-takes-most market. Meanwhile, Waymo robotaxis now account for 20% of Uber rides in Austin as the autonomous vehicle push ramps up.

Looking ahead, Uber guided for Q2 bookings of $46.5 billion at the midpoint or up 18% in constant currency ($0.6 billion beat), showing no slowdown sequentially. Adjusted EBITDA is expected to reach ~$2.07 billion, reflecting 29% to 35% growth.

3. 🛍️ Shopify: Tariff Headwinds

Shopify’s Q1 revenue rose 27% to $2.36 billion ($30 million beat). It was the eighth quarter of revenue growth over 25% if we exclude the logistics business divestment. Gross merchandise volume increased 23% to $74.75 billion, narrowly missing estimates.

The quarter was impacted by an unrealized equity investment loss of ~$1 billion after a rough Q1 with tariffs impacting the stock price of Affirm, Global-E, and Klaviyo. Excluding this, net profit would have been $226 million. Free cash flow margin improved to 15%, up from 12% last year.

Looking ahead, Shopify expects Q2 revenue growth in the mid-20% range, in line with Q1, but gross profit margins are expected to contract slightly due to the revenue mix favoring Merchant Solutions. As a result, Q2 gross profit growth is expected in the high-teens percentage range, below the 20% consensus.

Shopify President Harley Finkelstein acknowledged potential tariff impacts from the expiration of the “de minimis” loophole, which previously allowed shipments under $800 to enter the US duty-free. While Shopify stated only 1% of GMV is directly affected by the change, analysts remain cautious amid ongoing trade uncertainty and cost pressures for small- and medium-sized merchants sourcing from China.

4. 🤝 MercadoLibre: Argentina Rebounds

MercadoLibre’s Q1 revenue surged 37% Y/Y (+64% in constant currency) to $5.9 billion ($420 million beat). Net income rose to $494 million ($9.47 per share and $1.47 beat), driven by robust growth in Argentina (+125% Y/Y) as trade barriers eased and consumer demand soared. Brazil and Mexico remained strong, with revenue up 41% and 51% Y/Y, respectively.

Commerce revenue rose 32% to $3.3 billion, while Fintech revenue climbed 43% to $2.6 billion, with total payment volume reaching $58.3 billion (+43%). The credit portfolio jumped 75% Y/Y to $7.8 billion, fueled by expanded consumer lending in Argentina.

Operating margins expanded to 13% despite ongoing investments in logistics and digital banking. The company plans to invest $13.2 billion this year, including a new fulfillment center in Texas to streamline cross-border shipping.

Despite Trump-era tariffs weighing on import volumes from Chinese merchants, MercadoLibre’s management remains bullish, citing 85% of Latin American transactions still occurring offline as a major growth opportunity.

Looking ahead, MercadoLibre remains focused on growing its ecosystem, particularly in underpenetrated markets like Chile, where its new consumer credit feature is gaining traction.