🪙 Buffett Steps Down

Palantir, AMD, Hims, and Celsius kick off the week

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

The Oracle of Omaha is stepping down.

After six decades, Warren Buffett—now 94—is retiring as CEO of Berkshire Hathaway at the end of the year.

His successor, Greg Abel, will inherit the world’s 8th largest publicly traded company: a $1+ trillion powerhouse built on trust, patience, and a track record like no other—more than 5,500,000% gains since 1964.

That means $1 invested in Berkshire became $55,000, excluding taxes, fees, or reinvested dividends. By comparison, $1 in the S&P 500 returned $391—still impressive, but a vivid reminder of what long-term outperformance can compound into.

Buffett taught generations how to invest—not just with capital, but with character. He proved you can win without rushing, without shouting, and without compromising your principles.

His time at the helm is ending.

But his blueprint endures.

Today at a glance:

🦎 Berkshire: Buffett’s Last Brushstroke

🕵️ Palantir: ‘Ravenous Whirlwind’

↗️ AMD: Steady Climb in AI Race

🏎️ Ferrari: Pricing Power on Display

💊 Hims & Hers: Post-Compounding Pivot

⚡️ Celsius: Alani Integration

🌊 DigitalOcean: Scaling AI Simplicity

FROM OUR PARTNERS

Big Tech Has Spent Billions Acquiring AI Smart Home Startups

The pattern is clear: when innovative companies successfully integrate AI into everyday products, tech giants pay billions to acquire them.

Google paid $3.2B for Nest.

Amazon spent $1.2B on Ring.

Generac spent $770M on EcoBee.

Now, a new AI-powered smart home company is following their exact path to acquisition—but is still available to everyday investors at just $1.90 per share.

With proprietary technology that connects window coverings to all major AI ecosystems, this startup has achieved what big tech wants most: seamless AI integration into daily home life.

Over 10 patents, 200% year-over-year growth, and a forecast to 5x revenue this year — this company is moving fast to seize the smart home opportunity.

The acquisition pattern is predictable. The opportunity to get in before it happens is not.

1. 🦎 Berkshire: Buffett’s Last Brushstroke

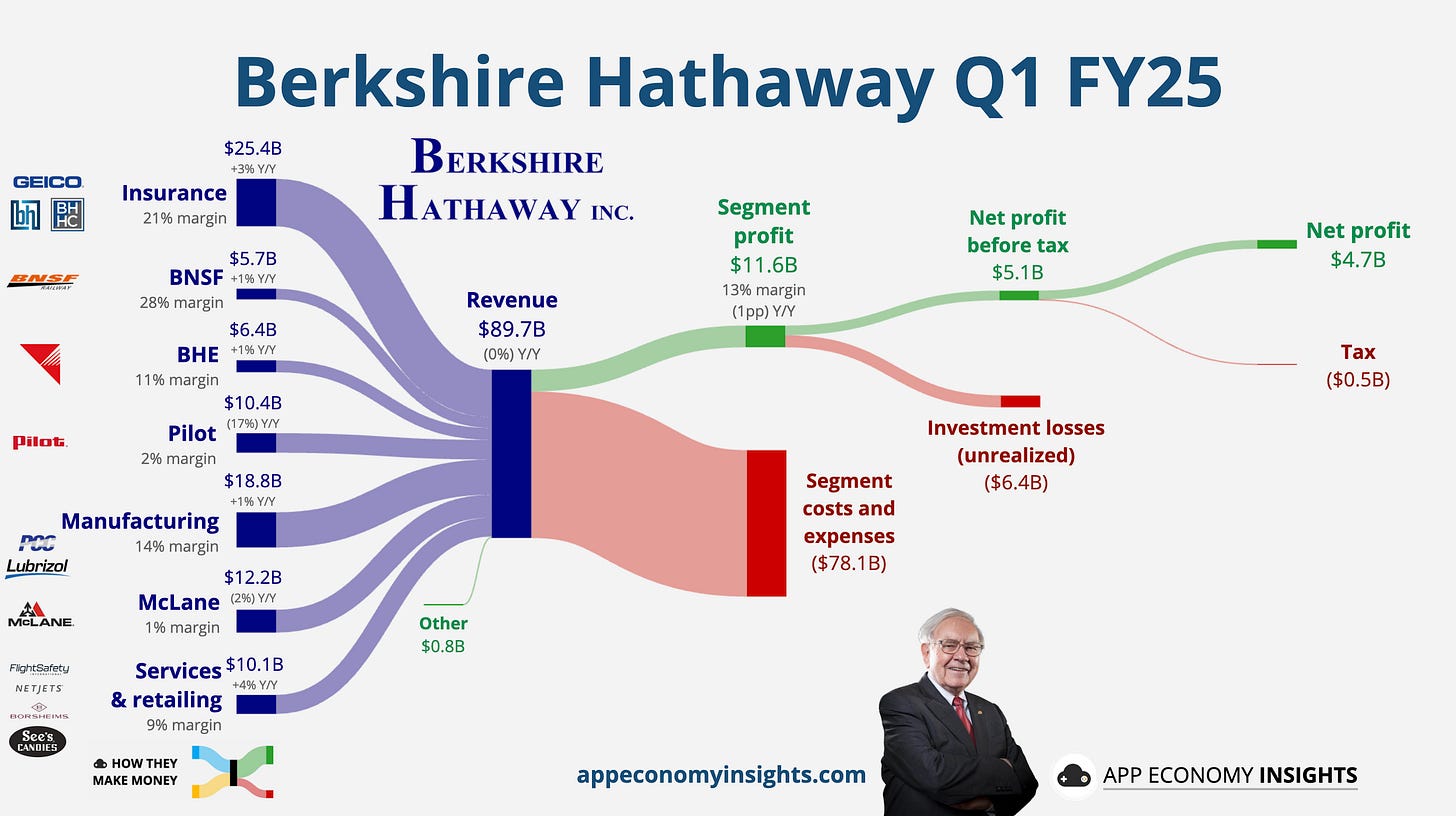

Buffett once called Berkshire his ‘painting’—a canvas expanded over decades, each investment a deliberate brushstroke. Berkshire enters its CEO transition with $348 billion in cash—a new record—and a portfolio still anchored by giants like Apple, Bank of America, and Coca-Cola. Operating earnings fell 14% this quarter as the broader economy softened, but Geico gained share and investment income rose 11%, thanks to rising Treasury yields.

Buffett stayed cautious. No buybacks for a third straight quarter. More stocks sold than bought. Commenting on recent events, his message was clear: long-term thinking matters more than market noise. Greg Abel now leads the next era. He isn’t trying to be Buffett—nor should he. His task is to preserve the culture, protect the compounding machine, and write the next great chapter with the same calm confidence that built it.

2. 🕵️ Palantir: ‘Ravenous Whirlwind’

Palantir posted another quarter well above expectations with revenue up 39% Y/Y to $884 million ($22 million beat). US commercial sales surged 71%, reaching a $1 billion run rate, partially offset by a 5% decline in the rest of the world. Government revenue rose 45% Y/Y, accelerating again. Management raised full-year guidance across the board—now expecting revenue to grow 36% Y/Y to $3.9 billion ($147 million raise) and as much as $1.8 billion in free cash flow.

CEO Alex Karp called demand a “ravenous whirlwind,” citing record deal activity and accelerating AIP adoption. Total customer count rose 39% Y/Y to 769, and Palantir booked $810 million in US commercial contract value (+183%). Its Rule of 40 score rose to 83 (using adjusted operating margin), balancing strong growth with stepped-up investment in talent.

Still, with shares up nearly 5x in the past year, the bar was sky-high. The stock pulled back post-earnings as investors weighed valuation risk and tempered international growth. But Palantir’s momentum in US defense and enterprise AI remains undeniable.

3. ↗️ AMD: Steady Climb in AI Race

AMD’s revenue jumped 36% Y/Y to $7.44 billion ($320 million beat), while adjusted EPS came in at $0.96 (a $0.03 beat). The Data Center segment led the charge again, growing 57% Y/Y to $3.7 billion, fueled by demand for MI300 AI accelerators and EPYC processors. However, growth decelerated from the triple-digit pace seen in prior quarters, reflecting the industry digestion and new export restrictions.

Client revenue surged 68% Y/Y to $2.3 billion as AMD continued to gain ground on Intel in PCs. Gaming revenue fell 30% to $647 million, weighed down by the maturing console cycle. Embedded sales dipped 3% Y/Y.

Revenue guidance for Q2 was solid at $7.4 billion (midpoint), $0.2 billion above consensus, though it includes an $800 million charge tied to tightened US export controls on China. Excluding this, adjusted gross margin is expected at 54%.

While AMD remains far behind NVIDIA in AI chips, it’s keeping pace and widening its product reach. CEO Lisa Su emphasized momentum in data center and AI, despite regulatory and macro headwinds. The race is long, and AMD is still very much in it.