💳 How Chime Makes Money

What the IPO filing reveals about the business model

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

A mobile bank for the masses, finally stepping into the spotlight.

Chime has officially filed for its long-awaited IPO, aiming to make a splash in the fintech world. The neobank reportedly plans to raise over $1 billion at a valuation of around $11 billion, significantly lower than its $25 billion Series G round during the 2021 tech bubble.

The company grew revenue 30% in 2024 and turned a profit for the first time in Q1 2025. But with growing competition, regulatory scrutiny, and its heavy reliance on interchange-based fees, can Chime become a long-term winner in consumer banking?

I read Chime’s 300+ page S-1 filing so you don’t have to.

Let’s visualize how they make money and the key insights that matter.

Today at a glance:

Overview

Business Model

Financial highlights

Risks & Challenges

Management

Use of Proceeds

Future Outlook

Personal Take

FROM OUR PARTNERS

Top investors are buying this “unlisted” stock

When the team that co-founded Zillow and grew it into a $16B real estate leader starts a new company, investors notice. That’s why top firms like SoftBank invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties – revamping a $1.3T market.

By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits.

Now, after 41% gross profit growth last year, they recently reserved the Nasdaq ticker PCSO. But the real opportunity is now, at the unlisted stage.

Until May 29, you can join Pacaso as an investor for just $2.80/share.

Share in their growth before the deadline.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

1. Overview

Chime was founded in 2012 with a mission to reimagine banking for the everyday American. Rather than operating as a bank itself, Chime partners with regulated institutions like The Bancorp Bank and Stride Bank to offer checking and savings accounts, earning money primarily through interchange fees on debit and credit card transactions.

The company gained widespread adoption during the pandemic by enabling early access to stimulus checks when many consumers needed it most.

From day one, Chime positioned itself as the antithesis of traditional banks: no overdraft fees, no minimum balances, no physical branches. Its mobile-first experience and user-friendly tools helped make it one of the most downloaded finance apps in the US.

Headquarters: San Francisco, California.

Mission: Help members achieve financial progress by eliminating fees and making banking more accessible.

Key Milestones

2012: Founded to reduce reliance on overdraft and maintenance fees.

2014: Public launch of Chime’s first bank account and debit card.

2020: Surged in popularity amid stimulus-driven demand.

2021: Raised $750 million at a ~$25 billion valuation.

2024: Revenue surpassed $1.6 billion; losses narrowed significantly.

2025: Filed to go public on Nasdaq under the ticker CHYM.

Growth at Scale

As of March 2025, Chime reported 8.6 million active users (+23% Y/Y), with 67% using it as their primary financial account—a key internal benchmark for user engagement. On average, active members made 54 transactions per month in Q1 2025—highlighting how deeply integrated Chime is in users’ daily financial lives.

What makes Chime sticky isn’t just zero fees—it’s the product suite that builds long-term loyalty:

SpotMe: Fee-free overdrafts up to $200.

MyPay: Early access to earned wages.

Credit Builder: Secured card to build credit score.

Auto-Save: Round-up and save features.

These tools increase engagement and retention, especially for financially vulnerable users.

Rather than chase a “super app” strategy, Chime sticks to a focused mission: delivering simple, trusted, mobile-first banking for the mass market.

In the 12 months ending March 2025, the company processed $121 billion in payment volume.

2. Business Model

Chime positions itself as a mobile-first financial platform for Americans underserved by traditional banks. Rather than charging fees, it makes money primarily through interchange fees—a small slice of the total amount merchants pay when users swipe their Chime-issued Visa card.

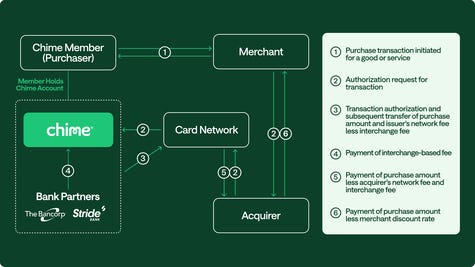

Bank partners The Bancorp and Stride hold customer deposits and issue accounts. Chime wraps these services in a seamless mobile app with consumer-friendly features designed to build financial health.

Underpinning these features is ChimeCore, the company’s proprietary transaction engine launched in 2024. By owning its backend ledger and payments infrastructure, Chime reduces third-party dependencies and keeps its operating costs lean—a key reason it can offer fee-free banking while maintaining high gross margins.

Illustrative Flow

Here’s how the model works:

A customer makes a debit card purchase.

The merchant pays an interchange fee to Visa.

Chime earns a portion of that fee.

Chime keeps users engaged with various tools and features, encouraging recurring usage and account primacy.

Interchange-Driven Model

For now, over 72% of Chime’s revenue comes from interchange-based fees.

Chime’s model scales with card usage, not deposits or lending.

The more users treat Chime as their primary financial account, the more revenue the platform generates, without charging users directly.

Unit Economics

Chime tracks its operating efficiency using a non-GAAP metric called Transaction Profit, which is defined as revenue minus direct costs like payment processing, partner bank fees, fraud losses, and credit-related costs tied to its secured credit card product.

In Q1 2025, Chime generated $349 million in transaction profit on $519 million in revenue—a 67% transaction margin.

That’s up from $236 million in Q1 2024, though transaction margin declined from 79% as the company scaled newer features like Credit Builder and MyPay.

This measure reflects the core unit economics of Chime’s business, before factoring in fixed costs like R&D, customer support, and compliance. Management uses it to highlight the sustainability of the business even without monetizing through fees or interest spreads.

No Lending—Yet

Unlike peers like SoFi, Chime doesn’t currently make money from loans or net interest income. However, the S-1 suggests the company may explore credit offerings in the future.

For now, Chime’s strategy is simple: offer banking that feels free, friendly, and fast, and earn when people swipe.

3. Financial Highlights

Now, let’s dive into the numbers.

Let’s break down the KPIs that tell the real story.