💳 Klarna IPO: Key Takeaways

I spent hours reviewing the F-1 so you don't have to

Welcome to the Premium edition of How They Make Money.

Over 190,000 subscribers turn to us for business and investment insights.

In case you missed it:

Klarna has just filed for a highly anticipated US IPO, aiming to make waves in the Buy Now, Pay Later (BNPL) space.

This Swedish fintech giant reportedly seeks to raise $1 billion at a valuation of around $15 billion—still far from its $46 billion peak in 2021.

The company saw 24% revenue growth in 2024 while steadily improving its margins. But with looming regulations and stiffer competition, can Klarna solidify its spot as a global BNPL leader against a backdrop of market uncertainty?

I pored over the 300+ pages of Klarna’s F-1 so you don’t have to.

Let’s review what we learned.

Today at a glance:

Overview

Business Model

Financial highlights

Risks & Challenges

Management

Use of Proceeds

Future Outlook

Personal Take

1. Overview

Klarna was founded in 2005 by Sebastian Siemiatkowski (CEO) and co-founders Niklas Adalberth and Victor Jacobsson. Originally starting as a simple invoice solution in Sweden, Klarna popularized the concept of buy now, pay later—letting online shoppers split their purchases into interest-free installments. Over the years, it has become one of Europe’s biggest fintechs and expanded into 26 countries, including a significant push into the US.

Headquarters: Stockholm, Sweden (though the parent entity is now domiciled in the UK).

Mission: Disrupt traditional banking by offering transparent, fee-free consumer financing and flexible payment options for merchants.

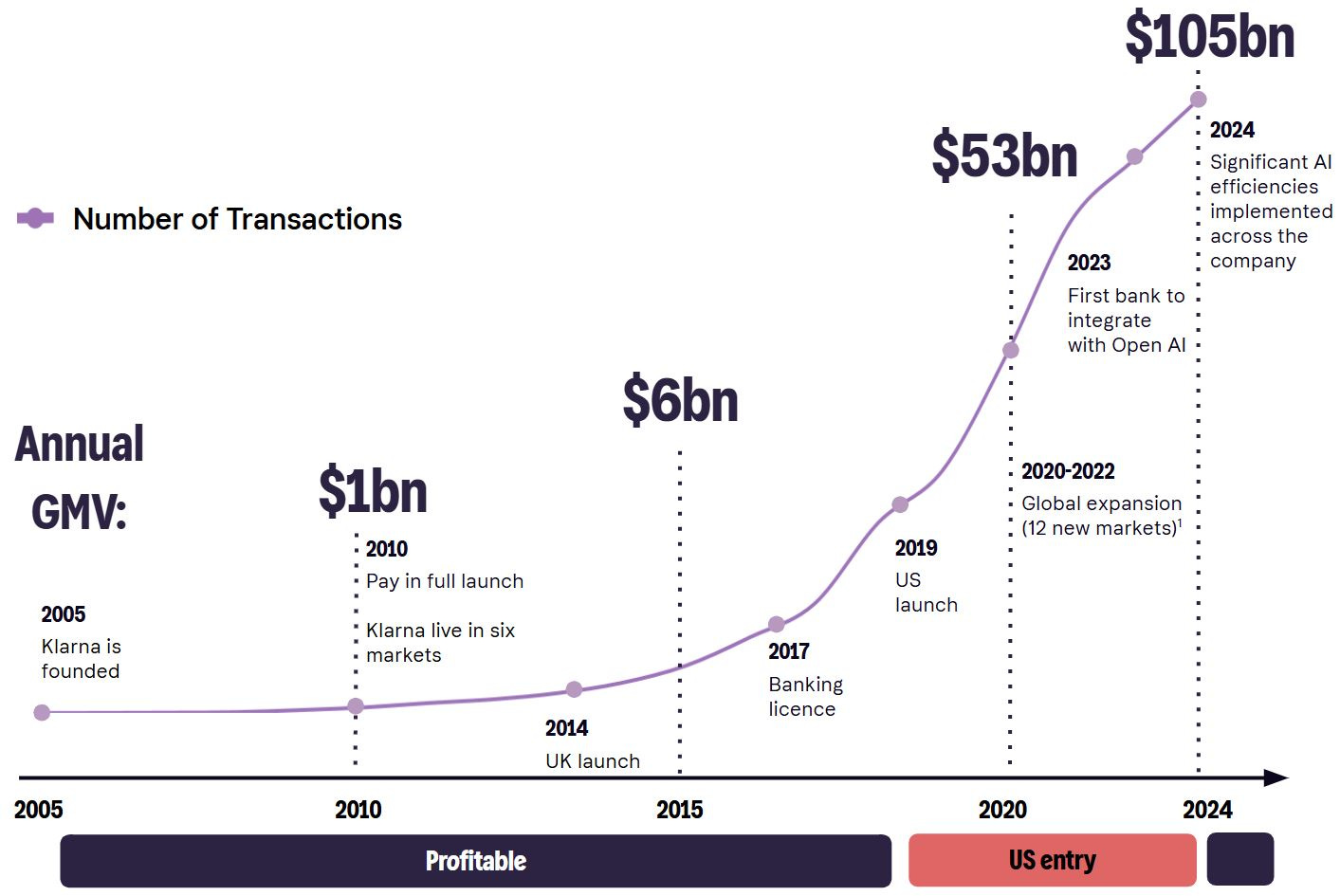

Key Milestones

2005: Founded in Sweden.

2014: Launches in the UK.

2017: Obtains a full European banking license, enabling broader financial services.

2019: After being profitable for 14 years, enters the US market, leading to a rapid increase in GMV (Gross Merchandise Volume) and expanding losses.

2022: Valuation plunges below $7 billion after hitting $46 billion at its peak.

2024: Improving margins, pivoting aggressively to AI-driven operations.

2025: Files for a US IPO on the NYSE under the ticker KLAR.

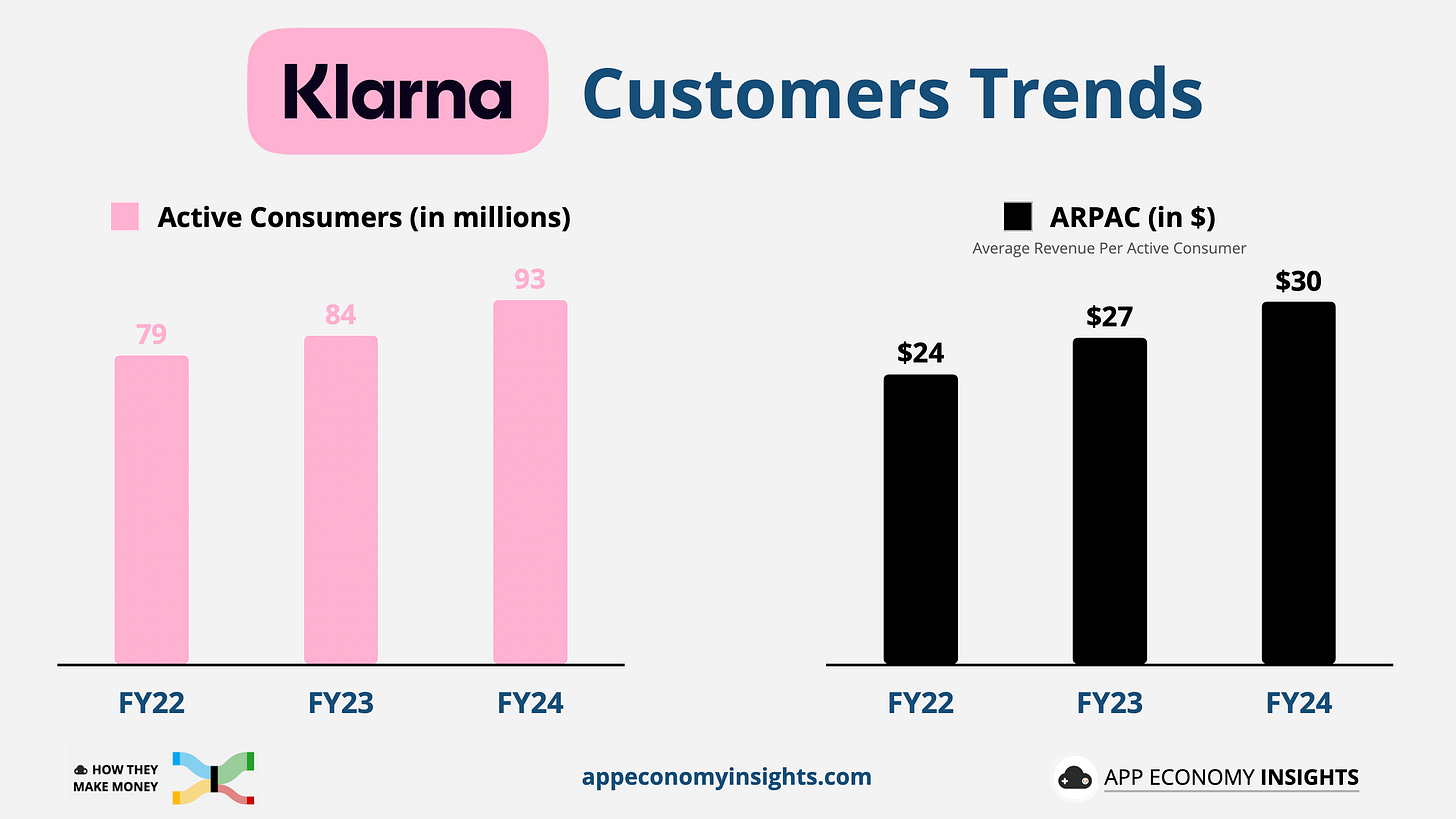

Klarna touts 2.9 million transactions per day made by 93 million active consumers in 2024 (+11% Y/Y) and 675,000 merchants, ranging from small e-commerce sites to global retailers like Walmart, Target, and Amazon. It also partners with Apple and Google, offering BNPL options through their wallets.

Beyond a rise in active consumers, the company has shown increased purchase frequency over time, as shown in its Average Revenue Per Active Consumer (ARPAC), which has grown by 11% Y/Y to $30 in 2024. The platform shows network effects, with engagement increasing as more merchants join the platform in new geographies.

2. Business Model

Klarna positions itself as a consumer-centric finance platform with BNPL at its core.

In FY24, Pay Later represented 79% of GMV.

Illustative Transaction

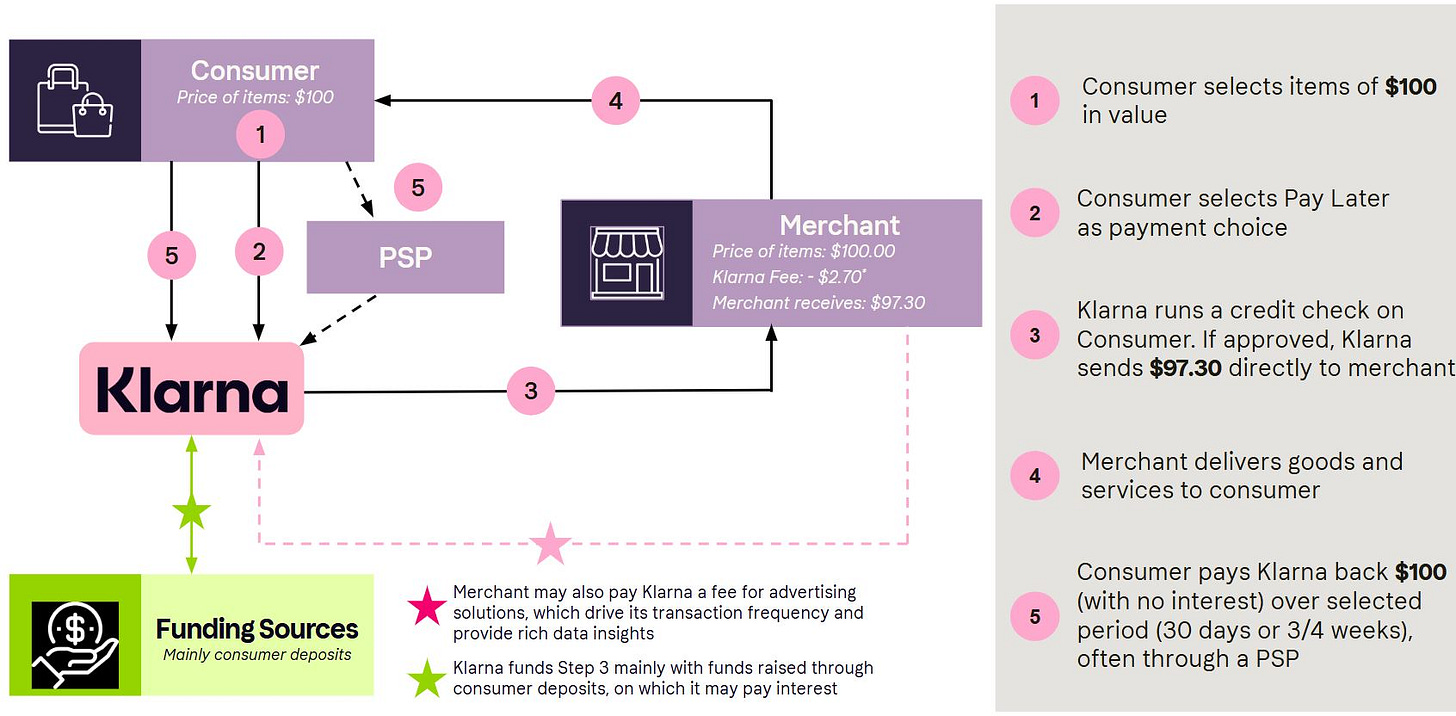

Imagine a shopper sees an item priced at $100 and chooses Klarna Pay Later at checkout. Here’s the high-level flow:

Consumer Chooses Pay Later: Klarna performs a credit check. If approved, Klarna immediately pays the merchant — in this example, $97.30, reflecting an average 2.7% merchant fee.

Merchant Delivers the Goods: The merchant receives funds upfront, while the consumer pays nothing at that moment.

Consumer Repays Klarna: Over the next 30 days or a few weekly installments, the consumer pays the full $100 to Klarna with no interest unless they opt for extra payment flexibility (like snoozing a due date or converting into a longer plan).

In most markets, Klarna’s merchant-led fees form the core of its revenue. That’s why there’s no upfront or installment charge to the consumer for a standard Pay Later purchase.

Klarna’s core initiatives cover five critical categories:

Interest-Free Instalments: Its flagship BNPL offering. Klarna charges merchants a fee in exchange for boosting their conversion rates and average order value.