☁️ CoreWeave IPO: Key Takeaways

I spent hours reviewing the S-1 so you don't have to

Welcome to the Premium edition of How They Make Money.

Over 190,000 subscribers turn to us for business and investment insights.

In case you missed it:

CoreWeave has finally stepped into the IPO spotlight, propelled by a behind-the-scenes race to secure the GPUs that power generative AI.

What began as a humble crypto-mining venture exploded from $16 million in revenue in 2022 to $1.9 billion in 2024—thanks in large part to mega-customers like Microsoft and a pivot toward specialized AI infrastructure.

Now, CoreWeave is reportedly aiming to raise $3.5–$4 billion at a valuation north of $35 billion, making this one of the most significant tech IPOs in recent years—and a crucial bellwether for the AI industry’s future.

So, what to make of this cloud computing startup backed by NVIDIA?

I spent hours reading the 300+ pages of CoreWeave’s S-1 so you don’t have to.

Let’s review what we learned.

Today at a glance:

Overview

Business Model

Financial highlights

Risks & Challenges

Management

Use of Proceeds

Future Outlook

Personal Take

1. Overview

CoreWeave isn’t your conventional Silicon Valley story.

Founded in 2017 by three former commodity traders—Michael Intrator, Brian Venturo, and Brannin McBee—the company started as a crypto-mining operation known as Atlantic Crypto.

Along the way, they amassed a large supply of NVIDIA GPUs to power crypto workloads. When the AI boom took off, they quickly pivoted to offering GPU-based cloud infrastructure for AI workloads, rebranding as CoreWeave.

Headquarters: Livingston, New Jersey (Yes, not the Bay Area!).

Mission: Provide specialized, high-performance AI compute infrastructure—essentially offering a “Maserati,” in their words, instead of the “minivan” approach of more general-purpose clouds.

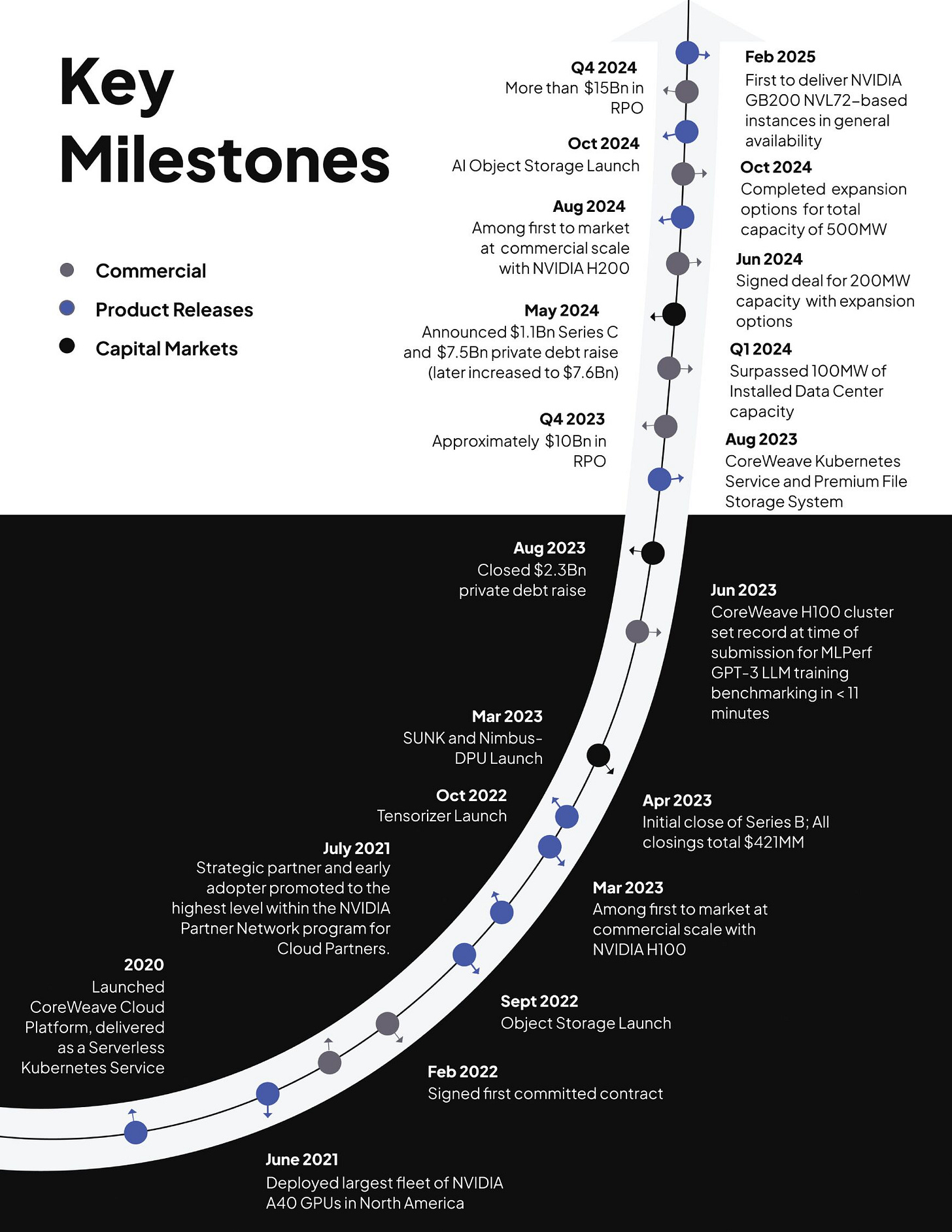

Key Milestones

2017: Incorporated as a crypto-mining venture.

2019: Pivots to AI-specific cloud services and rebrands as CoreWeave.

2023–2024: Rapid expansion of data center capacity (from 3 to 32).

2025: Officially files S-1, aiming for a Nasdaq listing under the ticker CRWV.

CoreWeave boasts a growing roster of high-profile AI customers. Major partners have included Microsoft, Meta, IBM, Cohere, and Mistral—alongside a ~6% equity stake from NVIDIA (who also happens to be a customer).

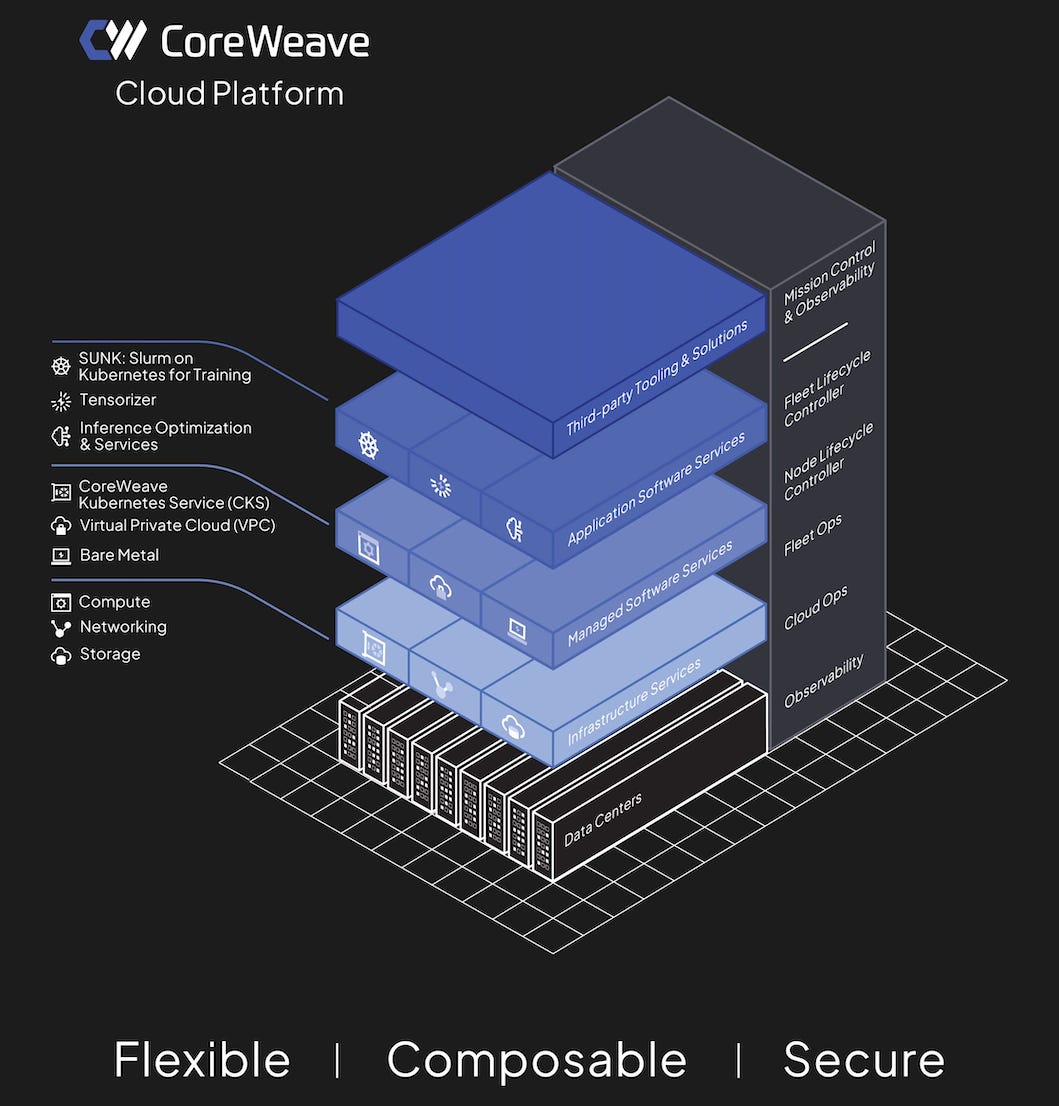

A Purpose-Built AI Cloud Stack

Under the hood, CoreWeave’s architecture combines:

Infrastructure Services (advanced GPU/CPU compute, high-performance networking, and storage).

Managed Software Services (a custom Kubernetes environment and bare metal service).

Application Software Services (tools for faster training and inference). By weaving these layers together—from GPU hardware all the way up to specialized model-optimization software.

By weaving these layers together—from GPU hardware to model-optimization software—CoreWeave positions itself as a dedicated platform for AI workloads, striving to outperform general-purpose clouds on both speed and scalability.

2. Business Model

CoreWeave is a GPU-focused cloud provider built specifically for AI and accelerated compute workloads. Think of it as a specialized alternative to general-purpose clouds like AWS, Azure, and Google Cloud.