📊 PRO: This Week in Visuals

WMT TCEHY CSCO SONY AMAT NTES NU TTWO DT GLBE DLO

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🛒 Walmart: Tariff Uncertainty

📱 Tencent: Gaming Surge

🌐 Cisco: AI Orders Beat Early

🖥️ Sony: Tariffs Cloud Outlook

⚙️ Applied Materials: China Drops

🎮 NetEase: Blizzard is Back

🏦 Nu: Rising Despite Headwinds

🎮 Take-Two: GTA VI Delayed

🧊 Dynatrace: AI + Logs Drive Growth

🛍️ Global-e: Shopify Update

🌎 dLocal: TPV Growth Reaccelerates

FROM OUR PARTNERS

He’s already IPO’d once – this time’s different

Spencer Rascoff co-founded Zillow, scaling it into a $16B real estate giant. But everyday investors couldn’t invest until after the IPO, missing early gains.

"I wish we had done a round accessible to retail investors prior to Zillow's IPO," Spencer later said.

Now he’s doing just that. Spencer teamed up with fellow Zillow exec Austin Allison to launch Pacaso. Pacaso’s co-ownership marketplace is disrupting the $1.3T vacation home market. They’ve already surpassed $110M in gross profit and $1B in transactions.

Unlike Zillow, you can invest in Pacaso as a private company. Pacaso’s already reserved their Nasdaq ticker PCSO. But you don’t have to wait for a public listing to invest.

Invest in Pacaso at $2.80/share before 5/29.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

1. 🛒 Walmart: Tariff Uncertainty

Walmart’s revenue rose 3% Y/Y to $165.6 billion ($1.2 billion beat) in Q1 FY26 (ending in April), with US comparable sales up 4.5%, driven by higher transactions and larger average baskets. E-commerce was a highlight again, growing 22% globally and contributing 350bps to comp sales. Online operations posted a profit for the first time, boosted by pickup, delivery, and marketplace growth.

Advertising revenue surged 50% Y/Y, fueled by Walmart Connect (+31%) and the integration of VIZIO. Membership and other income rose 4%, supporting operating margin improvement despite FX headwinds. However, Walmart withheld Q2 EPS guidance and warned tariffs will lead to higher prices as early as June, testing its promise of everyday low prices.

Management reaffirmed FY26 guidance, but with general merchandise still soft and trade policy shifting weekly, Walmart is leaning on scale, supply chain flexibility, and digital efficiency to retain momentum in a volatile retail landscape.

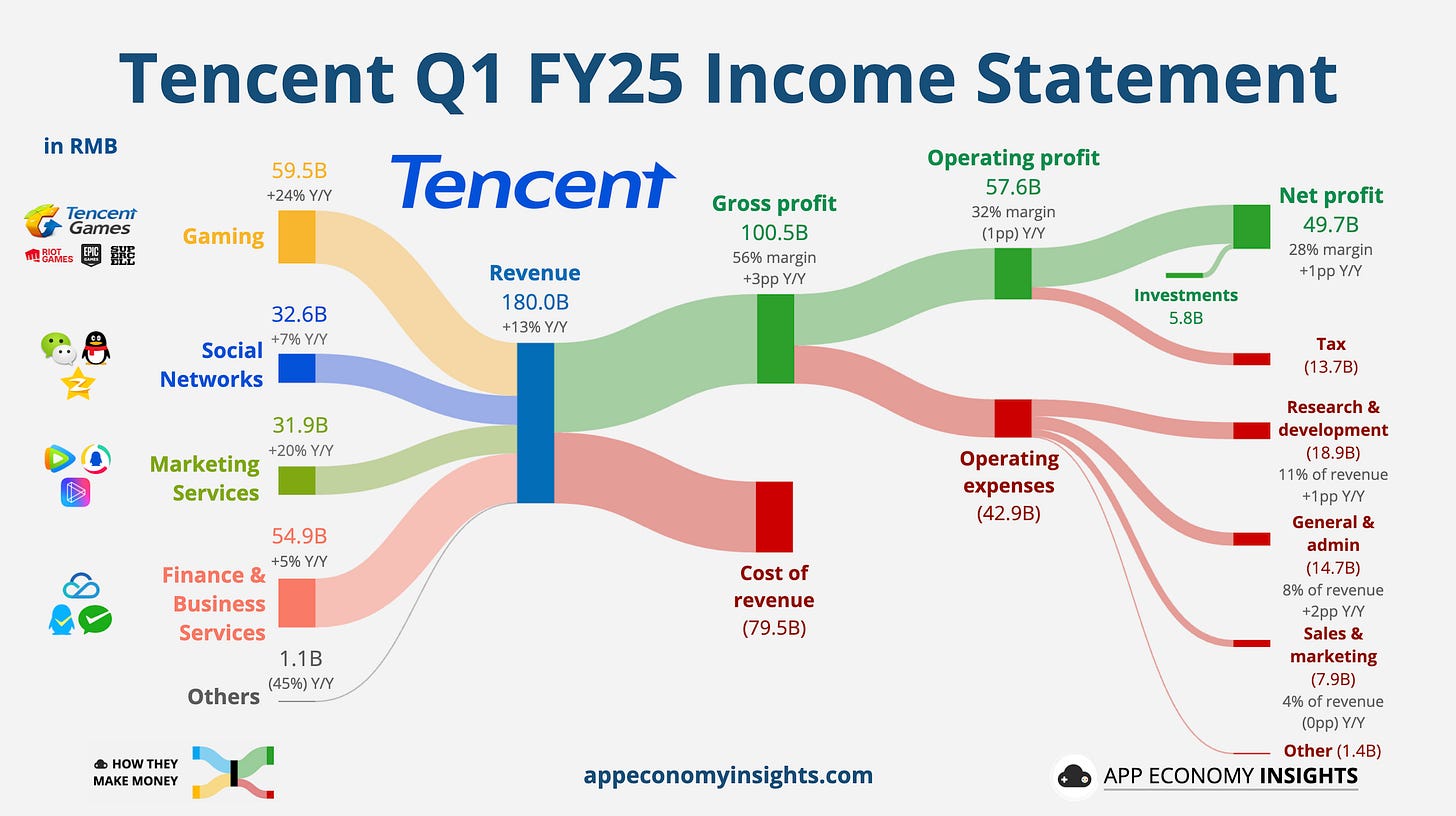

2. 📱 Tencent: Gaming Surge

Tencent delivered its best quarter on record, with revenue up 13% Y/Y to 180 billion yuan or $25 billion—the fastest growth since 2021—driven by a 24% jump in gaming revenue and AI-powered ad revenue up 20%. Flagship titles like Honor of Kings and Peacekeeper Elite, along with last year’s hit DnF Mobile fueled momentum. WeChat’s 1.4 billion MAUs continued to drive monetization across video, search, and mini-programs. Net income climbed 14% to $6.6 billion, falling slightly short due to heavy AI investment.

Capital spending nearly doubled to $3.8 billion, as Tencent ramps up its Hunyuan foundation model, Yuanbao chatbot, and GPU stockpiles amid US chip restrictions. With a growing ecosystem and partnerships like DeepSeek integration, Tencent is emerging as a central AI player in China. Analysts praised the company’s high-margin ad model, strong chip inventory, and operating leverage. Despite macro uncertainty and tariffs, Tencent stock is up nearly 25% YTD, reaffirming its lead in Chinese tech’s AI renaissance.