👓 Meta Drops €3B on AI Glasses

NVIDIA's milestone, AI layoffs, and Thoma Bravo keeps buying SaaS

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

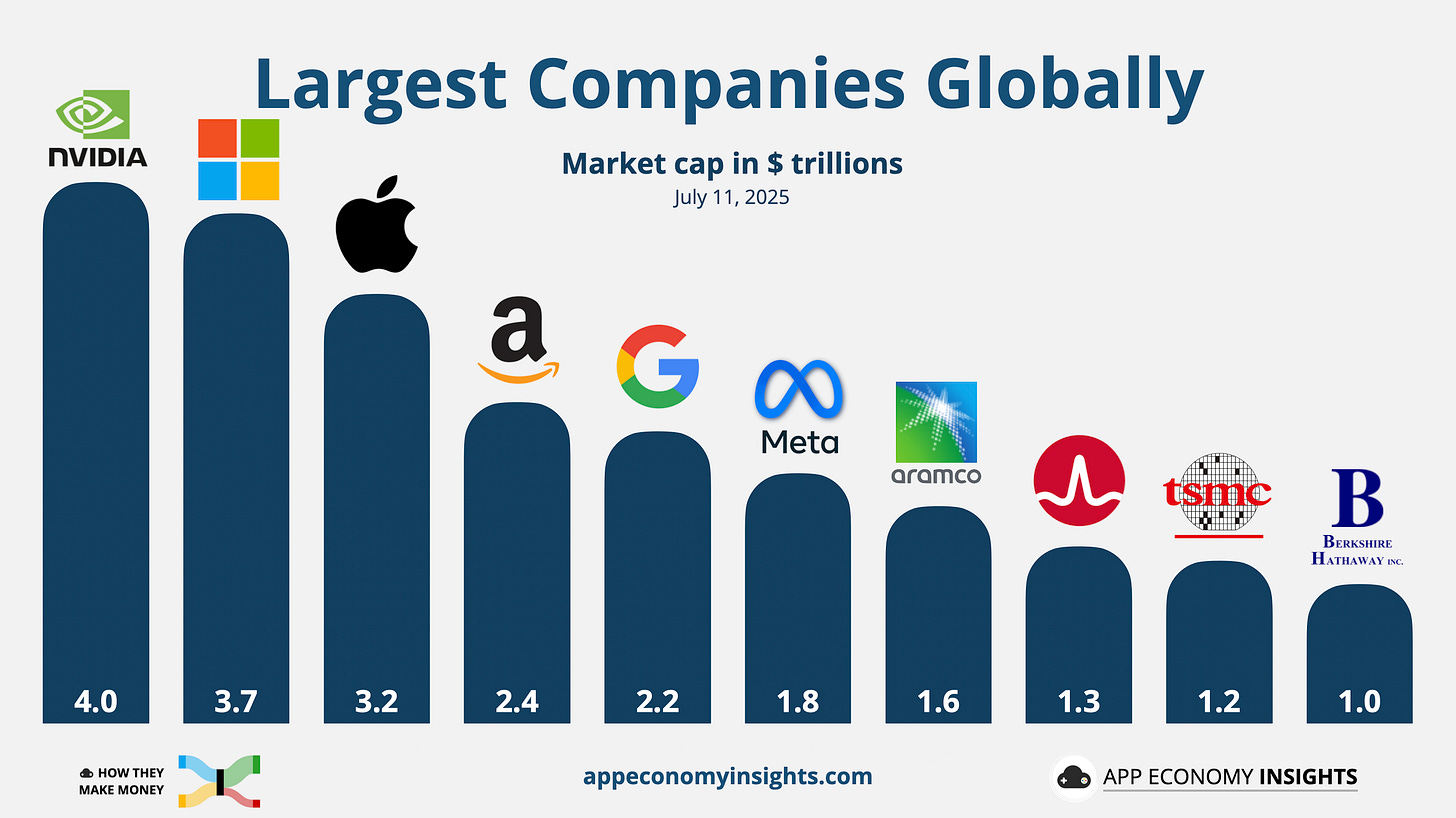

🤖 NVIDIA becomes first $4 trillion company

NVIDIA just made history as the first company ever to hit a $4 trillion market cap. That makes it bigger than Google and Meta combined, and more valuable than 214 of the smallest S&P 500 companies put together.

It’s a staggering milestone for a company that, just two years ago, was worth $750 billion. Now it commands 7.5% of the entire S&P 500, and investors aren’t done bidding it up.

The catalyst? AI, AI, AI.

NVIDIA’s chips power the AI arms race across OpenAI, Meta, Microsoft, Google, and Amazon. Together, they’re expected to spend $350 billion on capex this year, much of it earmarked for AI infrastructure.

Since early 2023, NVIDIA’s stock has surged over 1,000%, fueled by demand for its Hopper and Blackwell GPUs. And despite trade tensions and export controls, demand remains insatiable. As hyperscalers rush to build AI data centers, NVIDIA is selling the picks and shovels.

CEO Jensen Huang, now a Silicon Valley icon in his leather jacket, has called this a "new industrial revolution." And despite the historic run, NVIDIA still trades at ~33× forward earnings, below its 10-year average, suggesting the valuation hasn’t outrun its fundamentals.

The next catalyst? Earnings in late August. If NVIDIA beats and raises again, as it often does, that $4T badge may be just another stop on the way up.

Today at a glance:

👓 Meta’s €3 billion bet

🤖 AI-induced layoffs are here

🐶 Datatog Joins the S&P 500

💰 Thoma Bravo’s SaaS delisting machine

👓 Meta drops a €3 billion bag for AI glasses

In between interviews to poach top AI talent, Zuck just invested €3 billion for a 3% stake in EssilorLuxottica—parent company of Ray-Ban and Oakley—doubling down on AI-powered smartglasses.

And who can blame him? Ray-Ban Meta glasses have sold over 2 million units, and Meta aims for 10 million per year by 2027.

EssilorLuxottica is no ordinary eyewear company. It commands nearly 40% global market share in lenses and frames, with FY24 results showing €26.5 billion in revenue and €3.3 billion in net profit.

Meta’s move puts EssilorLuxottica at the heart of the wearable AI race. It’s the supersized version of Google’s investment in Warby Parker we previously covered. 👇

And to make sure the hardware has the brains to match, Meta just poached Ruoming Pang, Apple’s top AI engineer behind the foundational models powering Apple Intelligence. According to Bloomberg, he received a pay package worth more than $200 million over several years. The AI talent war rages on.

🤖 AI-induced layoffs are here

Microsoft is cutting another 9,000 jobs, its third major layoff this year, following 2,000 roles in January and nearly 7,000 in May. That’s ~4% of its global workforce gone, as the company doubles down on its AI pivot.

Sales and gaming units were hit the hardest, with a clear theme: out with old-school sales specialists and middle managers, in with AI-savvy engineers and leaner teams. Xbox, Bethesda, and King saw roles axed, while Redmond HQ was the most impacted by the restructuring. As Microsoft pours billions into AI infrastructure, it's reshaping the org to match and trading headcount for horsepower.

It’s not just Microsoft. We’ve seen this movie before:

Meta’s “year of efficiency” in 2023 kicked off a wave of cost discipline across Big Tech, after years of pandemic-fueled overhiring.

Google, Salesforce, Amazon, and CrowdStrike have all trimmed headcount in recent months, often in the name of AI reorganization or cost discipline.

🔎 A recent Deloitte survey found that many corporate boards are targeting up to 20% cost reductions via AI-driven productivity gains, even as CIOs ramp up hiring for AI-specific roles. Marc Benioff said last month that AI is doing “30% to 50% of the work at Salesforce now."

There’s a tale of two tech worlds right now:

AI leaders and researchers are commanding NBA All-Star–level bonuses.

Meanwhile, thousands of roles are being quietly eliminated—either to offset soaring AI infrastructure costs or because those jobs are no longer needed.

The result? Less tech winter, more AI harvest season. If your role doesn’t feed the AI flywheel, it may be on the chopping block.

🐶 Datatog joins the S&P 500

Datadog replaced Juniper Networks in the S&P 500 earlier this week. This milestone sparked a stock surge and briefly pushed the cloud monitoring platform’s market cap above $50 billion.

Getting into the S&P 500 takes more than size. Companies must meet strict criteria across several dimensions:

Headquarters in the US.

Listing on a major US exchange.

A market cap of over $20 billion.

Sufficient liquidity and trading volume.

Show consistent profitability over the last 5 quarters.

Datadog checks all the boxes after a clear pivot to profitability. While the company turned a small operating loss in Q1 FY25, it has been profitable on a trailing-12-month basis for the past five quarters.

Who’s next?

Every S&P reshuffle creates buzz about who might be next.

Here are the leading contenders:

AppLovin (ad-tech): Massive $115+ billion market cap.

MicroStrategy: Huge market cap over $110+ billion but tied up in Bitcoin.

Robinhood: $80+ billion market cap and massive user base, but the committee may still be wary of its earnings consistency.

The key takeaway? Even sustained profitability and a massive market cap aren't always enough. The S&P 500 committee weighs multiple factors, from free float to voting structure to sector balance, and keeps some decisions close to the vest. For companies like AppLovin, the wait may be more a matter of when, not if.

💰 Thoma Bravo’s SaaS delisting machine

Thoma Bravo is buying restaurant-tech platform Olo for $2.0 billion, a 65% premium over its unaffected share price.

Olo was doing well on its own, with positive cash flow and inching toward profitability in its latest quarter, along with a healthy net revenue retention of 111% and revenue growth of 21% Y/Y.

With over 750 brands on its ordering platform—including Denny’s, P.F. Chang’s, and Shake Shack—Olo joins a growing list of public SaaS companies Thoma Bravo has taken private in recent years.

Over the past six years, Thoma Bravo has developed a playbook centered on acquiring vertical and enterprise SaaS leaders. Here are the largest:

Proofpoint $12.3B (2021): Email security and threat protection platform.

Digital Aviation $10.6B (2025): Boeing’s flight‑software suite.

Anaplan $10.4B (2022): Enterprise planning & performance platform.

RealPage $10.2B (2021): Property management SaaS giant.

Coupa $8.0B (2023): Spend‑management SaaS.

SailPoint $6.9B (2022): Identity governance and administration.

Darktrace $5.3B (2024): Cybersecurity AI platform.

Ping Identity $2.8B (2022): Identity‑access management.

ForgeRock $2.3B (2023): Digital identity and access platform.

Imperva $2.1B (2019): Data and app security (later sold for $3.6B).

With Olo, the firm has now deployed over $70 billion across dozens of software companies.

Thoma Bravo specializes in:

Finding category leaders with high recurring revenue.

Paying up front to unlock value through private ownership.

Driving efficiencies, bolt-on acquisitions, and long-term improvements.

Exiting through IPOs or strategic sales once momentum returns.

It’s a deliberate consolidation of SaaS infrastructure, one niche at a time.

The market giveth, and the market taketh away.

The Olo deal fits the mold: category leadership, recurring revenue, and margin expansion potential. While the board may see it as a win, public shareholders are left on the sidelines. Even if Thoma Bravo’s playbook pays off, an all-cash offer means no future upside for the rest of us.

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Disclosure: I am long AAPL, AMZN, DDOG, GOOG, META, NVDA, and TSM in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

best newsletter for information on AI investing. however I am a low fund investor and limited to purchasing power of maybe 1,000.00 $ us. which means i could buy 8 shares of Nvidia for a projected profit of aprox. 44.00 $ us in 2 years. THAT is if one could just buy such small qty.

I have a gut feeling about AI glasses like computer on your nose glasses. facial ID, maps, cost comparison. how to fix, on your nose. lol. wish I could upgrade. totally enjoy your info.

john Blanchard, jrblanchard530@msn.com. thank you.