The Great Apple Paradox

No AI breakthrough, yet poised to cash in

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Each year, Apple previews the future of its ecosystem for developers at WWDC.

That future includes navigating lawsuits, regulations, and the AI arms race.

Apple is behind in AI. And it’s starting to show.

Paradoxically, though, thanks to how it makes money, it might not matter.

Let us explain, with some context.

App Store Shenanigans

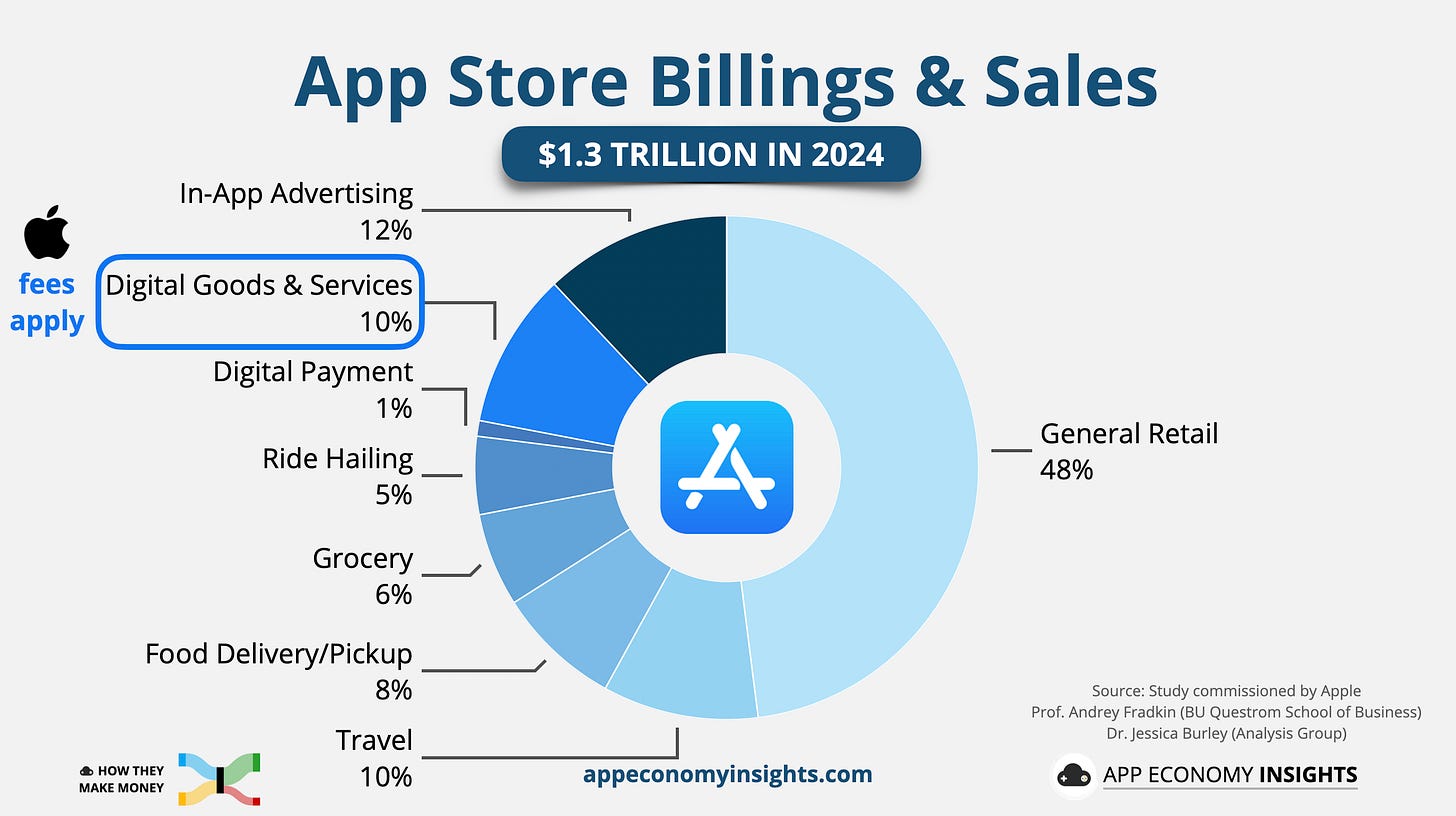

Ahead of WWDC, Apple dropped a glossy stat: the App Store facilitated $1.3 trillion in commerce last year. That’s up from $0.5 trillion in 2019, good for a 20% CAGR.

Sounds impressive—and it is. But let’s read between the lines.

The stat comes from a report Apple commissioned to reinforce its favorite story: the App Store is an economic engine, not a rent-seeking tollbooth.

Here’s the key message: 90% of that $1.3 trillion isn’t subject to Apple’s fees. It includes Uber rides, Amazon orders, and other physical transactions that Apple doesn’t actually process.

The remaining slice, digital goods and subscriptions, where Apple does take a cut, still brought in ~$130 billion. And that slice is under fire.

Following a major antitrust loss in 2021, Apple was required to allow developers to link to external payment methods. Apple complied—sort of—by allowing links, but slapping a 27% fee on any sales made that way. Critics called it a sham fix, padded with “scare screens” and fine print meant to discourage adoption.

Now, judges, regulators, and developers are pushing back:

In the US, a court ruled Apple can’t charge the 27% fee on out-of-app payments.

The EU charged Apple with violating the Digital Markets Act by making alternative payments too painful to implement.

Developers like Spotify and Epic are routing users around Apple’s ecosystem, and calling the old model a monopoly in disguise.

A possible misstep for Apple? Not treating games as a distinct case. Sony and Microsoft both charge game publishers a 30% cut on digital sales and in-game purchases, just like Apple, and they’ve faced little regulatory pushback for it.

Here’s the thing: Games are estimated to represent over half of all digital goods and services sold on the App Store. Had Apple carved out non-gaming apps with a distinct model, it might have defused antitrust pressure on its broader app economy.

As Uncle Ben once said, “With great power comes great responsibility.” Apple says its model protects users and ensures trust. But to many, it looks like a last stand to preserve one of the most profitable tollbooths in tech.

But wait, there’s more. As our search habits face disruption from ChatGPT and other AI challengers, Apple is a collateral casualty. Those reported $20 billion+ in traffic acquisition payments from Google (tied to Safari search traffic) are at risk.

WWDC was all about Apple defending the foundation of its services empire, while regulators close in.

FROM OUR PARTNERS

🧰 The Tools, Templates & Playbook for Your AI Consultancy

The AI consulting market is about to grow by a factor of 8X – from $6.9 billion today to $54.7 billion in 2032. But how does an AI enthusiast become an AI consultant? How well you answer that question makes the difference between just “having AI ideas” and being handsomely compensated for your contribution to an organization’s AI transformation.

Thankfully, you don’t have to go it alone — our friends at Innovating with AI have welcomed 700 new students into The AI Consultancy Project, their new program that trains you to build a business as an AI consultant. Some of the highlights current students are excited about:

The tools and frameworks to find clients and deliver top-notch services

A 6-month plan to build a 6-figure AI consulting business

Students getting their first AI client in as little as 3 days

👉 Click here to request access to The AI Consultancy Project

🧠 Apple Intelligence — 1 year later

Apple’s 2024 WWDC promised groundbreaking AI-powered Siri features that have yet to be shipped or demoed.

The keynote began with a brief recap of Apple Intelligence features released over the past year, including Genmoji, Writing Tools, and Notification Summaries.

SVP of Software Engineering Craig Federighi admitted Apple was behind on Siri:

“This work needed more time to reach our high-quality bar, and we look forward to sharing more about it in the coming year.”

Translation: it's not ready. And it probably won’t be before 2026.

That explains why Apple may have been more conservative with any AI announcements this year, only showing features that are ready to ship in 2025.

Strategic delay or warning sign?

In the AI era, where Google, Microsoft, and OpenAI are releasing new capabilities every other week, Apple increasingly appears several laps behind in the race.

Siri, originally pitched as the centerpiece of Apple Intelligence, now lags behind not just ChatGPT and Gemini—but Alexa, too. Internally, Apple has already reshuffled leadership: Siri now falls under Mike Rockwell (formerly of Vision Pro), signaling a pivot after reported reliability issues with the LLM-powered assistant.

Last year, Apple promised its AI would be personal, private, and deeply integrated into the fabric of your device. Instead, it continued its slow integration of AI into everyday actions, expanding Apple Intelligence into more places, like live translations and writing tools. That said, these are becoming table stakes.

But the flagship moment—Apple’s full-on assistant leap—still hasn’t arrived.

Foundation Models framework

Apple is giving developers access to its on-device language models via App Intents and Shortcuts, allowing third-party apps to tap into AI-powered tasks without sending data to the cloud.

Opening Apple Intelligence to developers may not grab headlines, but it’s a critical announcement. It could spark a wave of new, privacy-first AI apps that can work offline and that Apple didn’t have to build itself.

On-device access means developers can skip expensive cloud inference costs, while users get privacy by default. No internet? No problem. Apple is betting privacy and affordability will lure developers into building directly on Apple Intelligence.

Visual Intelligence is a winner

Apple Intelligence can now interpret images, extracting text, identifying objects, and describing layout with surprising fluency.

After taking a screenshot, users can now tap directly on elements to search for similar items or ask follow-up questions via ChatGPT.

See a pair of shoes in a screenshot? You can tap them to find similar options on Etsy or search for them on Google, right from the photo. This brings a ‘Google Lens’ feature directly inside the iPhone interface—no app switch required.

It’s a subtle, powerful shift: from AI as a destination, to AI as an invisible layer.

It also opens the door to more commercial intent. These “screenshot search” interactions could drive meaningful downstream queries—fueling the Traffic Acquisition Cost (TAC) revenue Apple books from partners like Google, a major contributor to its Services segment.

Design overhaul: The “Liquid Glass” Era

The most visible change announced was a new design language called Liquid Glass.

More depth, blur, and consistency across iOS, iPadOS, macOS, and visionOS.

Feels modern, but familiar—this isn’t a jarring iOS 7 moment.

It’s about making Apple’s whole ecosystem feel more unified and intuitive.

The new design might require more time in the oven, based on screenshots shared online. The official release is still a few months away, allowing for fixes and improvements, so I would refrain from jumping to a conclusion for now.

OS renaming & Platform Consistency

Apple dropped version numbers in favor of calendar-year naming (iOS 26, macOS 26, etc.). And all platforms—from iPhone to Vision Pro—share the new visual language and system features.

The goal: consistency across form factors, so switching devices feels seamless.

Games get their own home

Apple doesn’t have a console, but it does have something no one else does: half a billion people playing games on iPhone.

This year, Apple announced:

A new Games app, acting as a central hub for all titles—native or Apple Arcade—with shared leaderboards, achievements, and discovery tools.

A continued push to bring AAA titles to Mac and iPad, with Ubisoft, Capcom, and others already onboard.

Still, for a platform that generates tens of billions from gaming every year, the announcements felt underwhelming.

The bigger question: Will Apple eventually carve out games as a distinct App Store category with separate business terms? The company provided no news on that front.

📱 The Great Apple Paradox

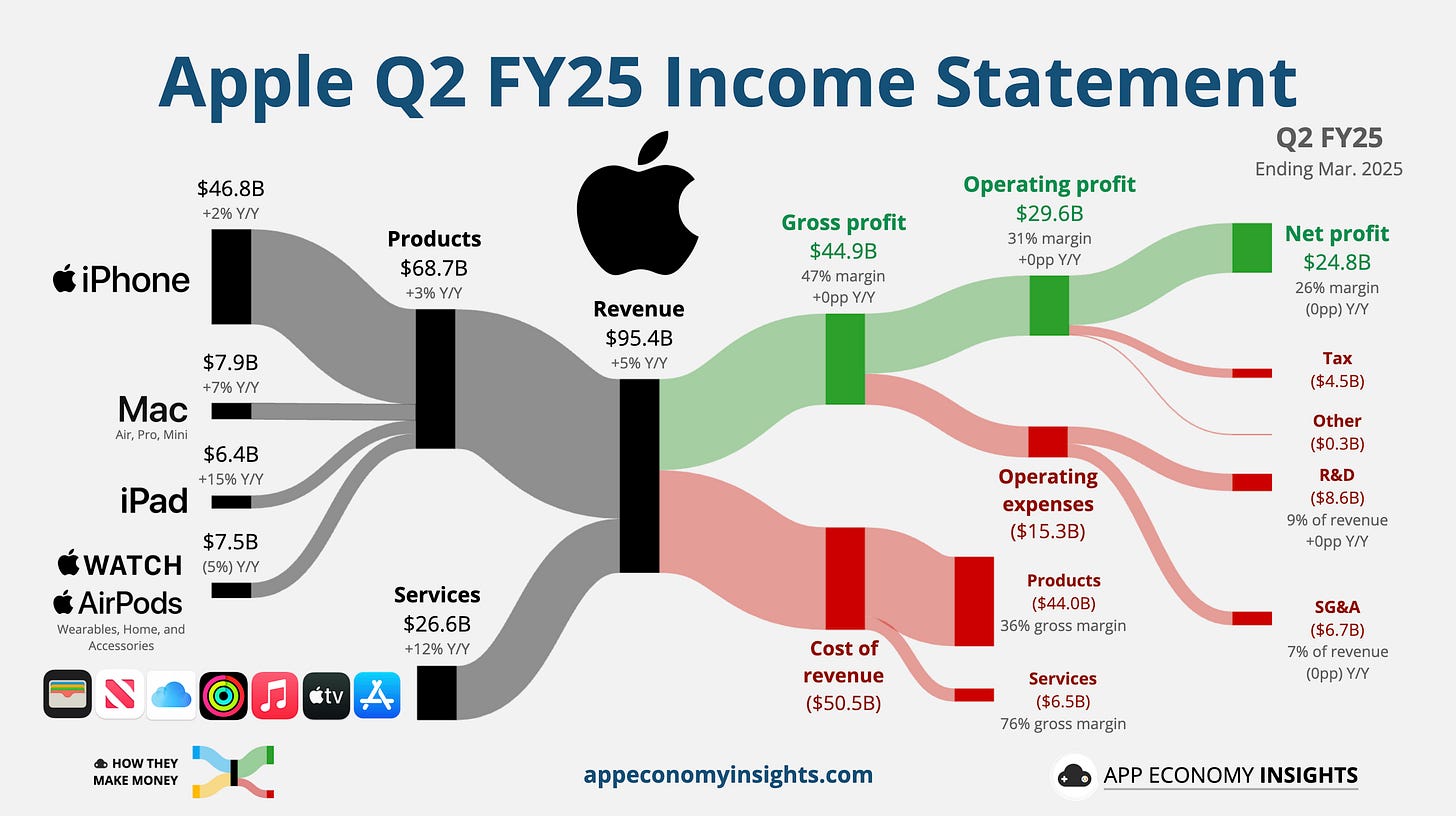

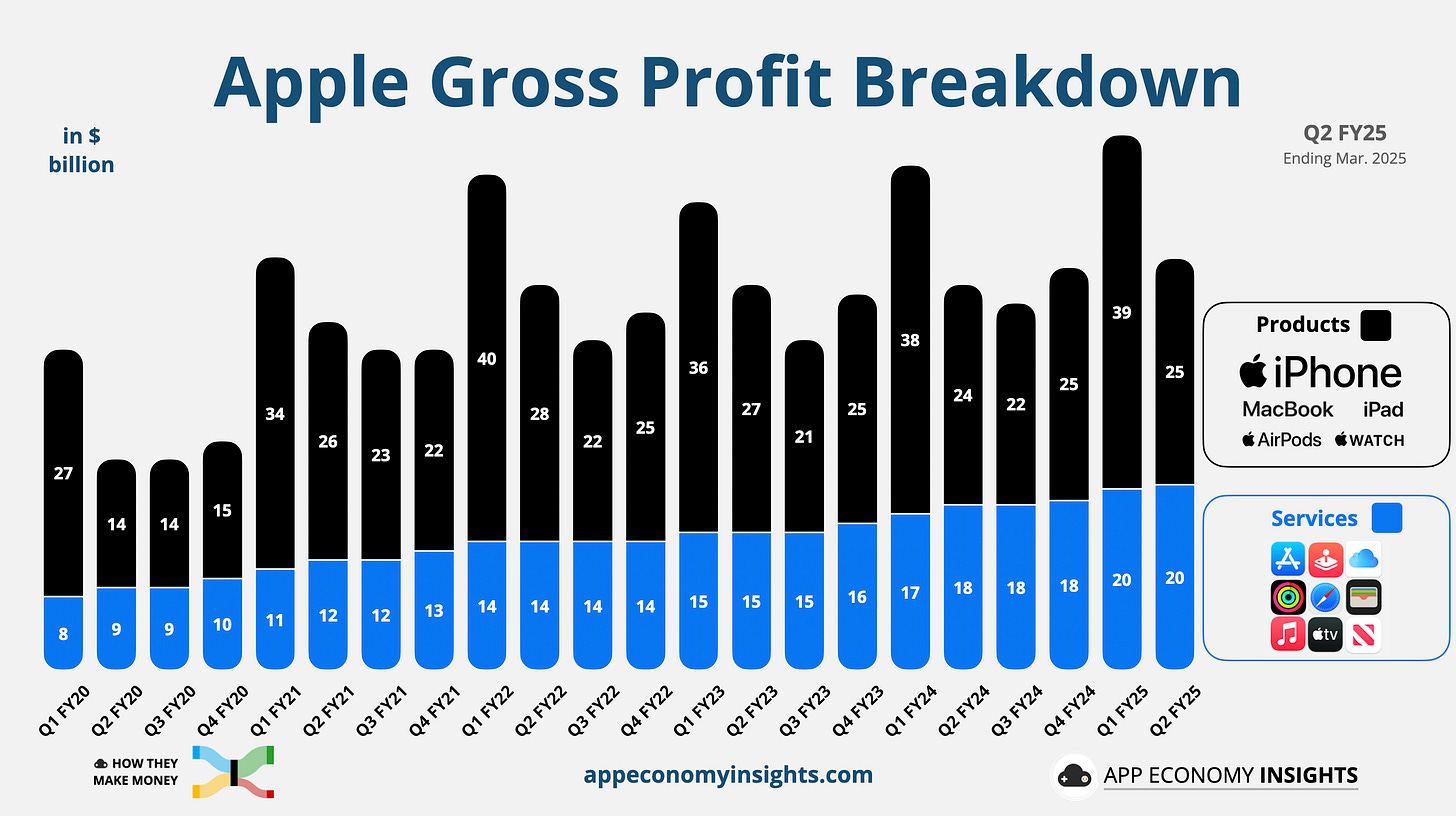

Services account for roughly a quarter of Apple’s revenue through subscriptions, partnerships (such as Google’s TAC), payments, and App Store fees.

But it's not just about the top line. Every dollar received from Services generates more than twice the gross profit of Products. As a result, Services accounted for a substantial 42% of Apple’s gross profit in FY24, making it a key engine of profitability.

The great Apple paradox? Cupertino earns over $20 billion per year from search, without offering a search product. In fact, Apple makes much more from Search than Microsoft does—and Microsoft owns Bing.

Now, Apple aims to pull off the same trick in the AI era: becoming the gateway to revenue-bearing AI prompts sent to OpenAI, Google, and others.

Once ChatGPT starts running ads, how many billions might OpenAI pay Apple each year to remain the preferred model on Apple Intelligence?

Eventually, Apple could rake in tens of billions in AI-related Services revenue, not coming from its own AI products.

This isn’t just pragmatism. It’s strategy. Apple is partnering with the best, offering user choice, and wrapping it all in privacy guardrails.

Apple doesn’t need to build the best AI model. It just needs to be the most convenient and trusted entry point to them. Apple can capture a significant share of the new technology wave simply by enabling it on its products. Its base of over 1 billion active devices will do the legwork.

That is, as long as regulators don’t get in the way.

Apple concluded its WWDC keynote with a hilarious song written entirely from real App Store reviews. Who else is getting goosebumps?

“To the people who develop the apps we love.”

Apple didn’t steal the AI spotlight this year—but it doesn’t have to. As long as it captures the entry point, the prompts, and the payments, it can win on monetization. The only question is whether it can stay just boring and seamless enough that users—and regulators—don’t even think about it.

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Disclosure: I am long AAPL, GOOG, and NVDA in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.