🇫🇷 Luxury Leaders Visualized

LVMH, Hermès, L'Oréal, EssilorLuxottica, Kering

Welcome to the Premium edition of How They Make Money.

Over 180,000 subscribers turn to us for business and investment insights.

In case you missed it:

🇫🇷 French luxury leaders have just reported their FY24.

As you'll see in our visuals, they have a certain je ne sais quoi.

These companies only report financials twice a year, making this a prime opportunity to dive into their performance. They dominate fashion, leather goods, jewelry, watches, sunglasses, perfumes, cosmetics, and more.

One standout this year is eyewear titan EssilorLuxottica, whose Ray-Ban Meta smart glasses are blurring the lines between luxury and technology.

Today at a glance:

LVMH: Gradual Recovery

Hermès: Pricing Power

L’Oréal: Expanding Luxury Portfolio

EssilorLuxottica: Ray-Ban Meta Momentum

Kering: Not So Gucci

The big picture

Luxury is facing headwinds after a V-shaped post-pandemic recovery. Most analysts track personal luxury goods (excluding vehicles, services, and food).

Here are key insights from Bain’s Fall 2024 market study:

📉 First decline in 17 years: The personal luxury goods market shrank 2% in 2024 to $381 billion, marking its first non-COVID contraction since 2008. Bain still sees long-term growth potential, but near-term headwinds remain.

🇨🇳 China’s luxury demand weakens: Once a growth engine, China’s luxury market fell ~20% in 2024. Economic pressures and shifting consumer preferences toward domestic brands could challenge global luxury players.

🚪 50 million luxury consumers lost: Rising prices have priced out millions, particularly among younger shoppers. Gen Z’s brand advocacy is waning, raising concerns about luxury’s next wave of buyers.

💰 Pricing power hits a wall: Average luxury goods prices in Europe have surged 52% since 2019, but customers are now pushing back. High-net-worth shoppers are downtrading or questioning value, especially in handbags and leather goods.

📱 Digital luxury isn’t a silver bullet: AI-powered personalization is rising, but Bain warns that "luxury is a feeling." The industry must balance high-tech with high-touch experiences to sustain desirability.

🏛️ Back to basics: Bain urges luxury brands to recenter on craftsmanship, creativity, and exclusivity—the timeless elements that sustain pricing power and long-term brand equity.

🔮 Slow growth ahead: The industry is expected to grow below 4% CAGR (compound annual growth rate) in the next five years.

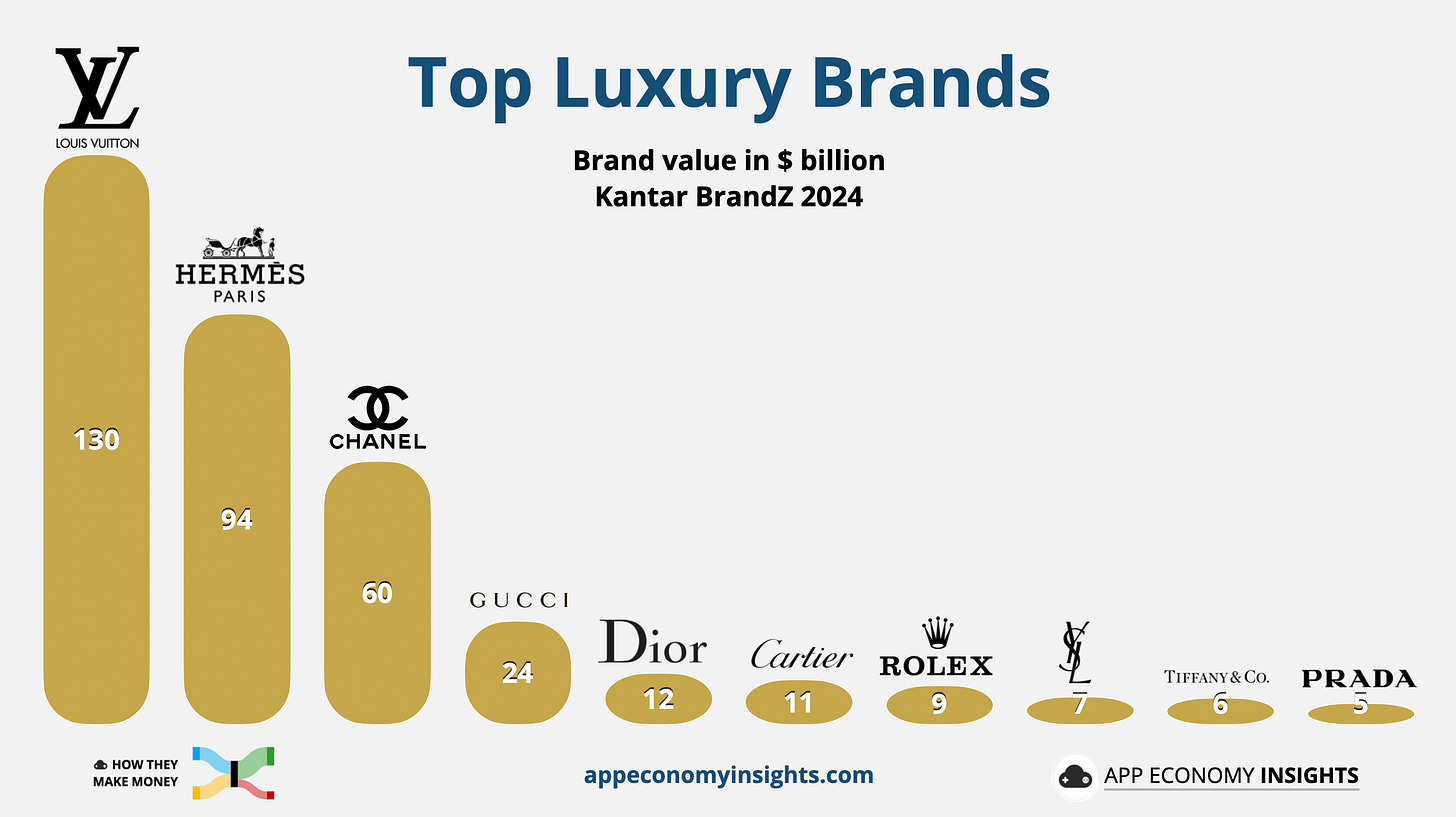

Every year, Kantar BrandZ ranks the most valuable global brands based on their financial contributions to their parent companies and consumer insights. In 2024, the most valuable luxury brands were:

Louis Vuitton ($130 billion).

Hermès ($94 billion).

Chanel ($60 million).

Gucci ($24 billion).

Dior ($12 billion).

Cartier ($11 billion).

Rolex ($9 billion).

Saint Laurent / YSL ($7 billion).

Tiffany & Co. ($6 billion).

Prada ($5 billion).

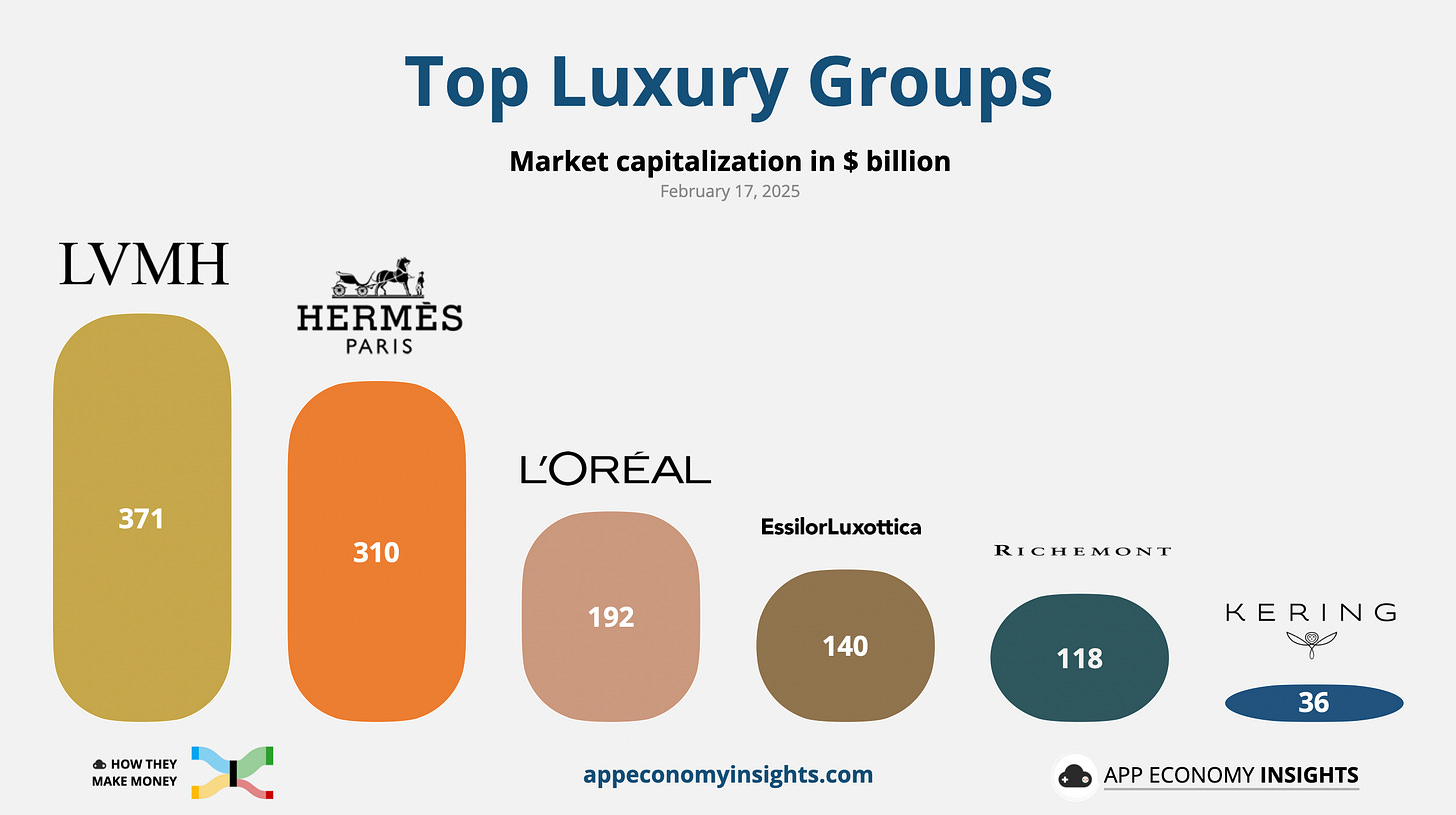

French conglomerate LVMH, the largest company in Europe, owns Louis Vuitton, Dior, and Tiffany & Co (acquired in 2020 for $16 billion). The largest luxury goods companies by market cap in February 2025 are:

LVMH 🇫🇷: $371 billion.

Hermès 🇫🇷: $310 billion.

L’Oréal 🇫🇷: $192 billion.

EssilorLuxoticca 🇫🇷: $140 billion.

Richemont 🇨🇭: $118 billion.

Kering 🇫🇷: $36 billion.

These are some of Europe's most valuable companies. For context, Nike is the most valuable clothing and accessories brand outside of Europe, worth $108 billion.

L’Oréal and EssilorLuxoticca are not always categorized as luxury giants, but they are worth including here because of the sheer scale of their revenue from luxury goods. For example, L’Oréal’s Luxe division (Lancome, Giorgio Armani) made €15.6 billion in revenue in FY24, more than Hermès's total revenue (€15.2 billion).

Let’s look closer at the specific businesses.

1. LVMH: Gradual Recovery

Noteworthy items:

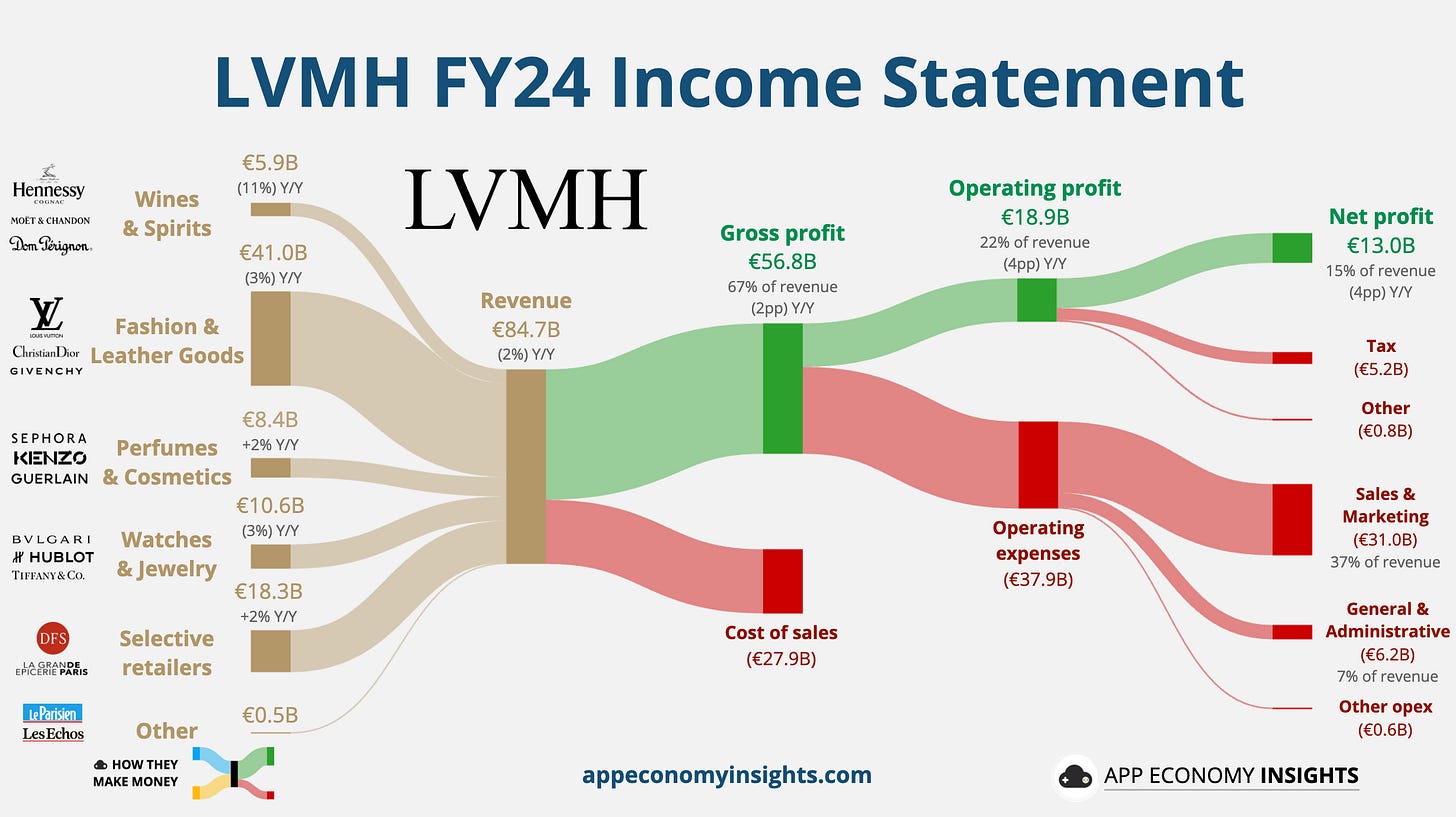

👜 Fashion & Leather Goods struggle: Sales fell 3% Y/Y and profit 10%. While the segment represents 48% of revenue, it contributes 78 % of operating profit.

🇨🇳 China remains a drag: Sales in Asia (ex-Japan) declined 12.5%, with Q4 China revenue down 10% Y/Y. CEO Bernard Arnault expects a "gradual recovery" rather than a quick rebound.

🌍 Mixed regional performance: While China struggled, Japan saw +18% growth, Europe and the US saw modest gains, and wines & spirits continued to underperform globally.

📉 Margins contracted: Operating profit fell 14% Y/Y to €18.9 billion, driven by higher cost of labor and minimal price hikes.

📊 Marketing expenses hit a new high: LVMH spends more on marketing and selling expenses (€31 billion) than on the goods it sells.

🏷️ Dior faces pricing fatigue: Luxury analysts noted that aggressive price hikes at Dior have made it less desirable relative to competitors.

💍 Jewelry holds up: Tiffany saw a surprise 9% sales increase, reflecting continued demand for jewelry.

🔮 Outlook: Selective optimism: Arnault struck a cautious tone but noted Louis Vuitton has started 2025 with double-digit growth (though boosted by a Zendaya x Murakami campaign).

Key takeaway:

LVMH’s weak organic growth in fashion and leather goods signals continued pressure on soft luxury, while jewelry and selective retailing show resilience. The recovery in China remains slow, but Japan offers a bright spot. Investors expected a stronger rebound, and the stock is still trading where it was nearly four years ago.