📊 PRO: This Week in Visuals

KO CSCO MCD SHOP AMAT SONY PANW APP MCO MAR ABNB COIN TTD ADYEY HOOD HUBS RDDT KHC GPN TWLO DKNG QSR Z CYBR ROKU PAYC CFLT

Welcome to the Saturday PRO edition of How They Make Money.

Over 180,000 subscribers turn to us for business and investment insights.

In case you missed it:

📧 Free members get our Friday articles and sneak peeks.

💌 Premium members receive monthly reports with 200+ companies visualized, one extra weekly article, and access to our archive.

💼 PRO members enjoy everything in Premium, plus our Saturday timely coverage of the most important earnings of the past week.

Today at a glance:

🥤 Coca-Cola: Unit Rebound

🌐 Cisco: AI & Splunk Drive Growth

🍟 McDonald: Recovery in Progress

🛍️ Shopify: Enterprise Expansion

⚙️ Applied Materials: China Headwinds

🖥️ Sony: PlayStation Powers Growth

🔒 Palo Alto Networks: NGS Momentum

📱 AppLovin: Pure Ad Tech Pivot

💼 Moody’s: EPS Guidance Jumps

🏨 Marriott: International Strength

🛖 Airbnb: New Investments

📈 Coinbase: Regulatory Tailwinds

📺 The Trade Desk: Big Revenue Miss

💳 Adyen: Unified Commerce Delivers

🪶 Robinhood: Crypto Surge

📢 HubSpot: AI Momentum

👽 Reddit: User Growth Slows

🌭 Kraft Heinz: Tough Road Ahead

🌎 Global Payments: Double Miss

💬 Twilio: Profitability Milestone

👑 DraftKings: Mixed Quarter

🍔 RBI: Burger King Remodels

🏠 Zillow: Weak Outlook

⏹️ CyberArk: ARR Tops $1 Billion

📺 Roku: Platform Strength

💻 Paycom: Cautious Outlook

📊 Confluent: Cloud Momentum

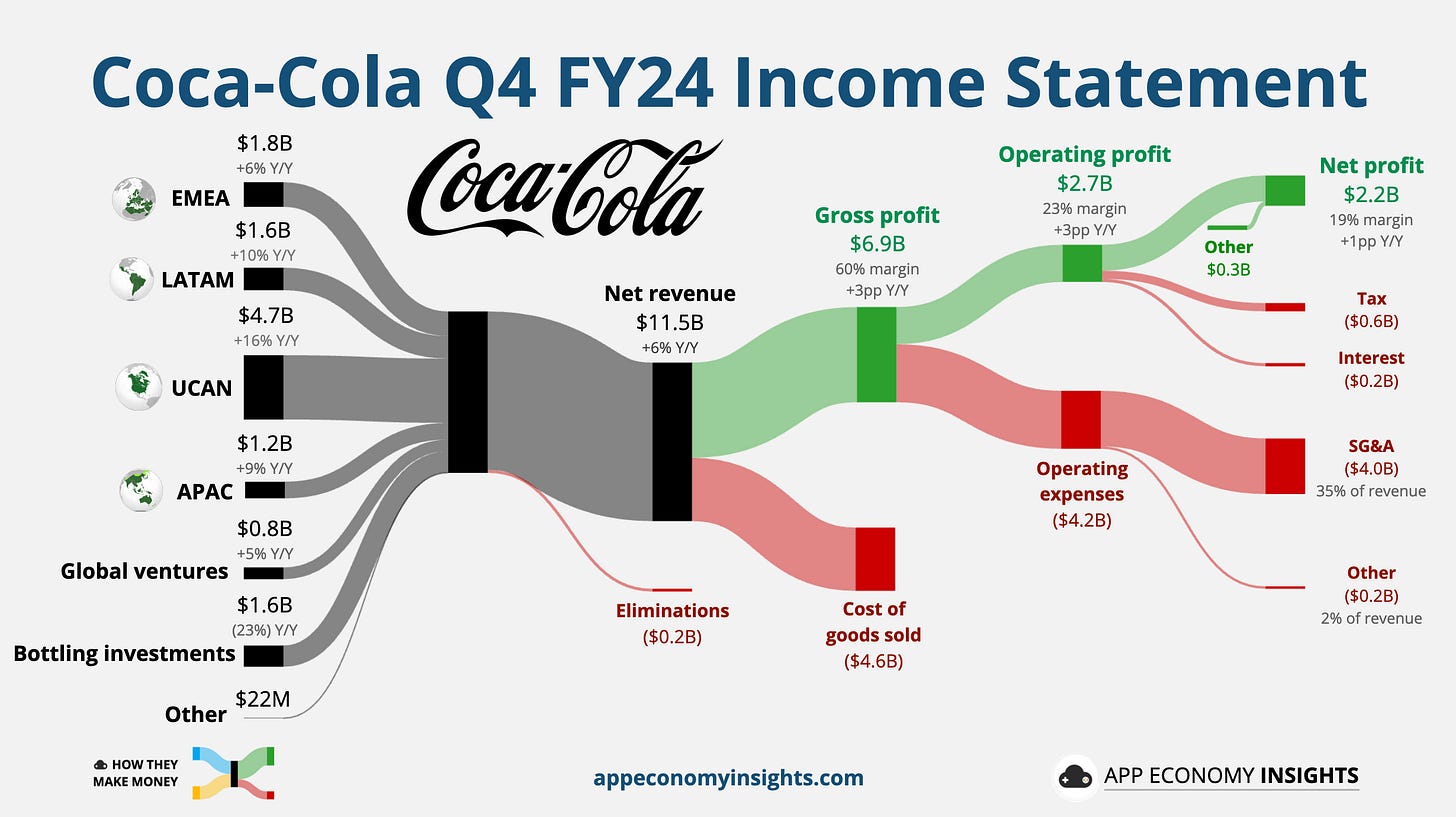

1. 🥤 Coca-Cola: Unit Rebound

Coca-Cola’s revenue grew 6% to $11.5 billion ($0.9 billion beat), and EPS was $0.55 ($0.03 beat). Organic revenue growth (excluding acquisitions, divestitures, and currency impact) was 14%, with a 2% increase in unit case volume, reversing last quarter’s decline. Higher prices remained a driver, with a 9% price/mix growth (expected to normalize in 2025). Coca-Cola Zero and Fairlife milk were standout performers, showing the company's ability to diversify beyond its flagship sodas.

Looking ahead, Coca-Cola expects organic revenue growth of 5%-6% in 2025 and EPS growth of 2%-3%, slightly below expectations. Foreign exchange (6%-7% EPS impact) and slowing price-driven growth will be headwinds. However, management remains confident in expanding market share, particularly through digital initiatives, international expansion, and value-added beverage categories like protein shakes and dairy.

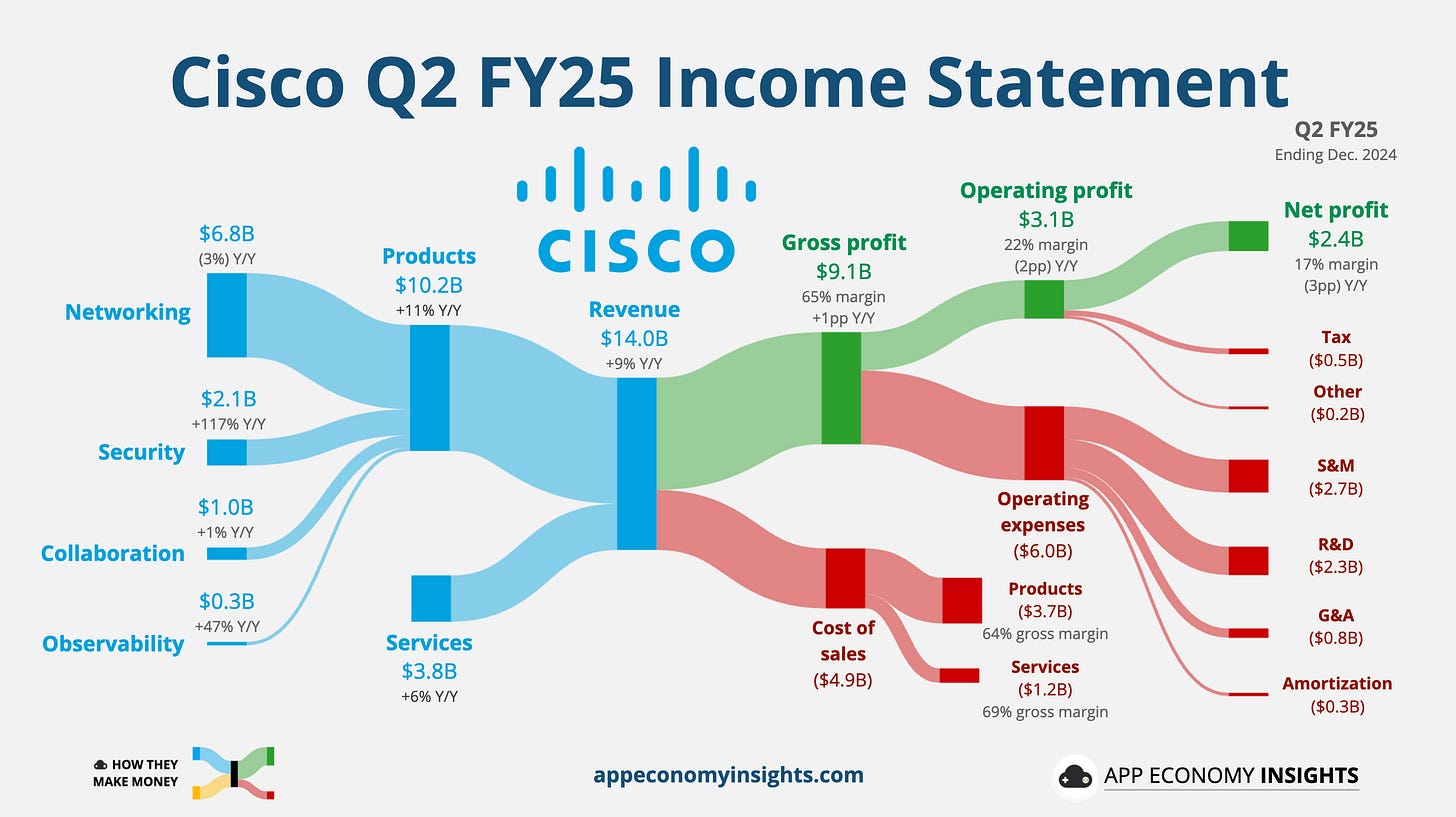

2. 🌐 Cisco: AI & Splunk Drive Growth

Cisco's Q2 FY25 revenue grew 9% to $14 billion ($120 million beat), marking its first return to annual growth in over a year. Adjusted EPS reached $0.94 ($0.03 beat). Splunk—acquired 11 months ago—boosted security and subscription revenue growth. AI infrastructure demand fueled a 29% order growth (or 11% when excluding Splunk), with AI-related orders expected to surpass $1 billion in FY25.

Looking ahead, Cisco raised the midpoint of its FY25 revenue guidance by $0.5 billion to $56.3 billion and approved a $15 billion share buyback increase. While federal spending remains soft, enterprise and cloud investments are accelerating. With AI networking momentum and continued transition to recurring revenue, Cisco is positioning itself for sustained growth.