🐳 Meta: DeepSeek Tailwinds

Why AI innovation is good for Meta's core business

Welcome to the Premium edition of How They Make Money.

Over 180,000 subscribers turn to us for business and investment insights.

In case you missed it:

Meta (META) has been on a tear, up nearly 20% in the past month.

Chinese AI upstart DeepSeek just sent shockwaves through the industry with a cutting-edge model that runs inference at a fraction of the usual cost. If history is any guide, this might be good news for Meta.

Zuck has a track record of copying and scaling competitors’ best ideas—from Snapchat’s Stories to TikTok’s Reels. DeepSeek might be his next blueprint.

Meta’s business runs on AI-driven ranking and recommendation engines, which keep users engaged longer and make ads more effective. The company pours billions into AI infrastructure and monetizes it through its core ad business.

The trillion-dollar question: Could DeepSeek’s breakthroughs help slash Meta’s AI costs over time? The market seems to think so.

Let’s visualize the quarter and break down the latest insights.

Today at a glance:

Meta Q4 FY24.

DeepSeek implications.

Key quotes from the earnings call.

Regulatory scrutiny and Zuck’s pivot.

1. Meta Q4 FY24

Meta operates across two business segments:

💬 FoA: Family of Apps (Facebook, Instagram, Messenger, and WhatsApp).

🥽 RL: Reality Labs (AR/VR hardware and supporting software).

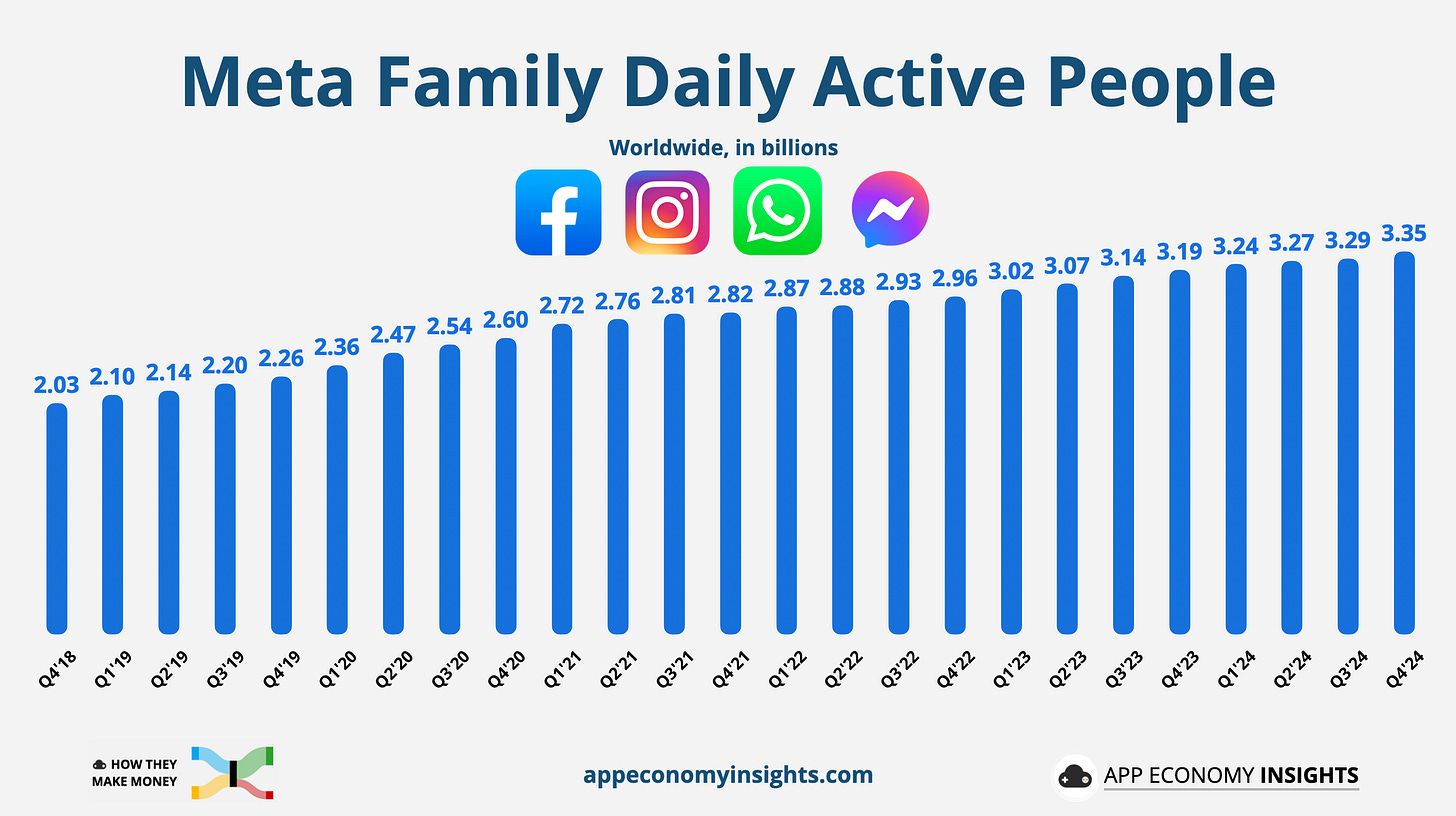

FoA Daily Active People grew +5% Y/Y to 3.35 billion, adding 60 million daily actives in Q4—an acceleration from 50 million added in Q4 FY23.

Meta now reaches over half the global population aged 15-80. With key markets saturated, future growth will rely more on boosting engagement and ad efficiency than adding new users. Yet, Meta somehow manages to add tens of millions of users every quarter.

Zuck called out:

Facebook & Instagram: Time spent on video was up double digits Y/Y, with Reels reshared 4.5 billion times a day.

WhatsApp: Passed 100 million US monthly actives in a historically weaker region.

Meta AI: Monthly actives surged to 700 million (from 500 million in Q3). The assistant will soon remember prior queries and develop personalized intuition based on user interests.

Threads: Reached 320 million monthly actives (up from 275 million in Q3), adding 1 million sign-ups per day. Meta will test ads in Q1, but revenue expectations for 2025 remain low.

Advertising metrics:

Ad impressions +6% Y/Y (vs. +7% Y/Y in Q3).

Average price per ad +14% Y/Y (vs. +11% Y/Y in Q3).

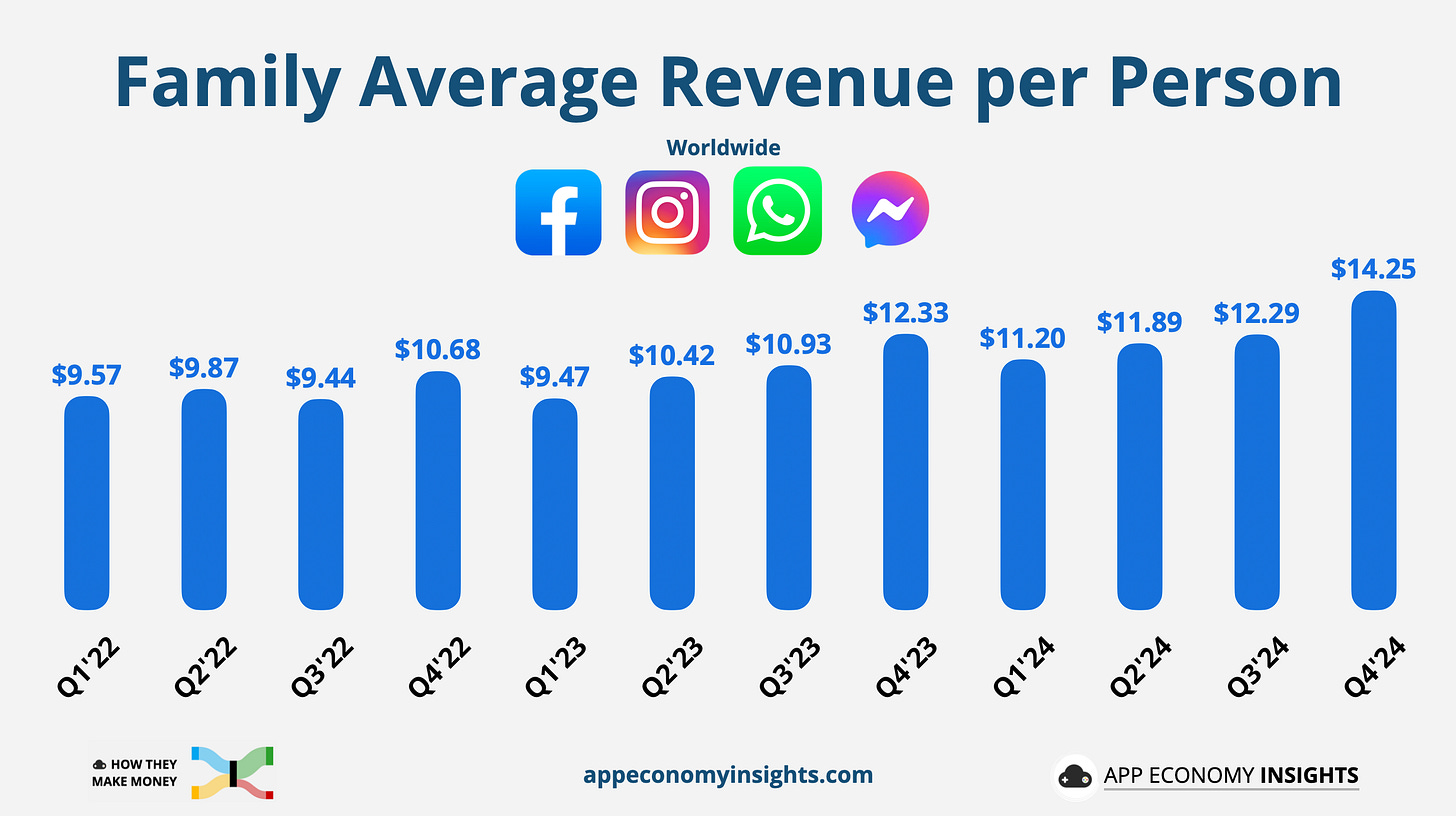

Average revenue per person +16% Y/Y to $14.25 (+12% Y/Y in Q3).

In short, Meta’s revenue growth was price-driven, implying higher ROAs (return on ad spend) for advertisers.

Income statement: