💻 Microsoft: AI Efficiency Paradox

Satya Nadella believes AI use will skyrocket

Welcome to the Free edition of How They Make Money.

Over 180,000 subscribers turn to us for business and investment insights.

In case you missed it:

Microsoft (MSFT) just reported its Q2 FY25 (ending in December).

The stock dropped 6%, signaling another quarter where Microsoft struggled to meet high expectations.

But the bigger shock came earlier this week. DeepSeek, a Chinese AI upstart, unveiled a model that rivals OpenAI’s o1 at a fraction of the cost. It instantly became the #1 app on the App Store in the US.

Markets panicked, fearing that more efficient AI could weaken demand for high-end chips and cloud infrastructure. Many AI stocks tumbled.

So what does this mean for Big Tech?

Let’s break down what we learned and visualize Microsoft’s quarter.

Today at a glance:

Jevons Paradox.

Microsoft’s Q2 FY25.

Earnings call takeaways.

What to watch moving forward.

1. Jevons Paradox

Microsoft CEO Satya Nadella quickly took to X to share his take on DeepSeek, framing the AI debate through the lens of history:

If AI computing gets cheaper, shouldn’t demand for expensive AI chips and cloud infrastructure decline?

Not necessarily.

In 1865, British economist William Jevons made a surprising discovery about coal consumption. When steam engines became more efficient and used less coal per unit of power, total coal consumption skyrocketed instead of shrinking. Why? Because greater efficiency lowered costs and increased accessibility, leading to wider adoption across industries.

This became known as Jevons Paradox—the idea that efficiency gains don’t reduce demand for a resource. Instead, they fuel even greater usage.

Now in 2025, DeepSeek’s new AI model sparked fears that more efficient AI would hurt demand for high-performance chips and cloud computing. But history suggests efficiency gains don’t destroy demand—they fuel it.

Why This Could Be a Boon for Big Tech

💡 AI Becomes Ubiquitous: If AI computing gets cheaper, it doesn’t mean AI demand will shrink—it means AI will be everywhere. More businesses, developers, and industries will integrate AI into products, services, and daily operations.

☁️ AI Infrastructure Could Surge: Instead of shrinking, demand for cloud compute could explode. Lower AI costs mean more companies can participate, creating higher cloud infrastructure demand.

📈 AI Will Expand Beyond Silicon Valley: DeepSeek is a startup, not a Big Tech giant—a sign that AI innovation is not limited to major US players like OpenAI, Anthropic, and Google.

⚡ Energy & Chips Are Still Critical: Despite initial market fears, AI still needs vast computing resources. Even as efficiency improves, the sheer scale of AI adoption means data centers, GPUs, and energy infrastructure will remain in high demand.

🔄 The AI Cost Curve Accelerates Innovation: Nadella emphasized that AI isn’t just getting cheaper. It’s getting better. Efficiency gain could drive entirely new use cases, just as the falling cost of cloud computing enabled the mobile app revolution.

The Big Question

Will AI efficiency lead to cost savings—or an explosion of AI demand?

If history is any guide, AI isn't just becoming cheaper—it’s becoming inescapable.

Nadella downplayed DeepSeek’s negative impact, emphasizing Microsoft’s AI partnerships (OpenAI, Phi, etc.) and its long-term infrastructure investment strategy:

"DeepSeek has had some real innovations [...] but now that all gets commoditized and will be broadly used."

If this proves accurate, software companies could be clear winners. Demand would rise without hurting margins as much as investors initially feared.

The commoditization of LLMs appears inevitable. As a result, scale, reach, and distribution are critical advantages that could benefit incumbents.

2. Microsoft’s Q2 FY25

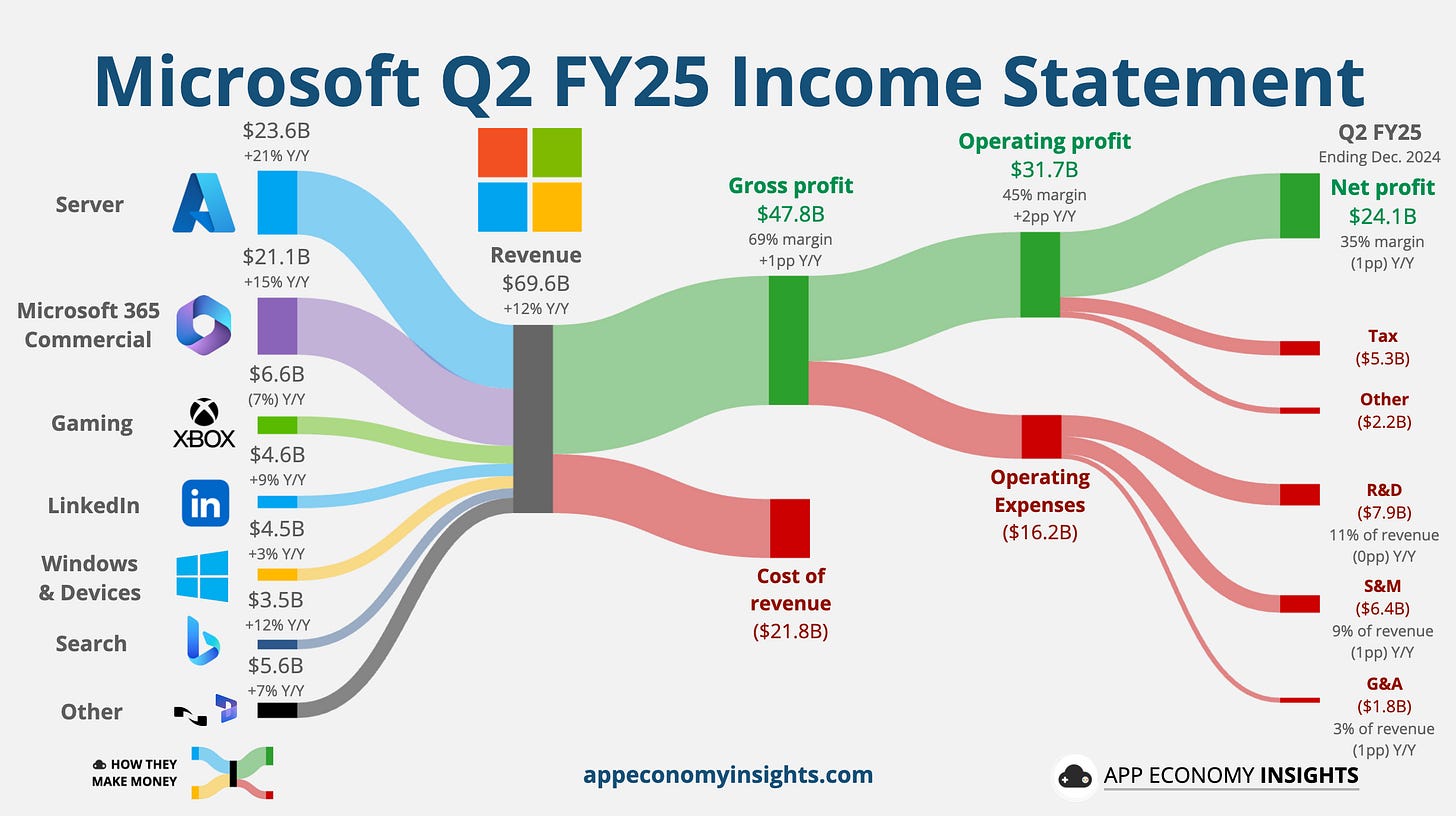

Income Statement:

Revenue grew 12% Y/Y to $69.6 billion ($0.8 billion beat).

Gross margin was 69% (+1pp Y/Y and flat Q/Q).

Operating margin was 45% +21pp Y/Y and -2pp Q/Q).

EPS grew 12% to $3.23 ($0.13 beat).

Product and Services Breakdown:

☁️ Server products and cloud services $23.6 billion (+21% Y/Y).

📊 M365 Commercial products and cloud services $20.4 billion (+13% Y/Y).

🎮 Gaming $6.6 billion (-7% Y/Y).

👔 LinkedIn $4.6 billion (+9% Y/Y).

🪟 Windows and Devices $4.5 billion (+3% Y/Y).

🔎 Search and news advertising $3.6 billion (+12% Y/Y).

🔒 Enterprise and partner services $1.9 billion (-1% Y/Y).

📈 Dynamics $1.9 billion (+15% Y/Y).

💻 M365 Consumer products and cloud services $1.8 billion (+8% Y/Y).

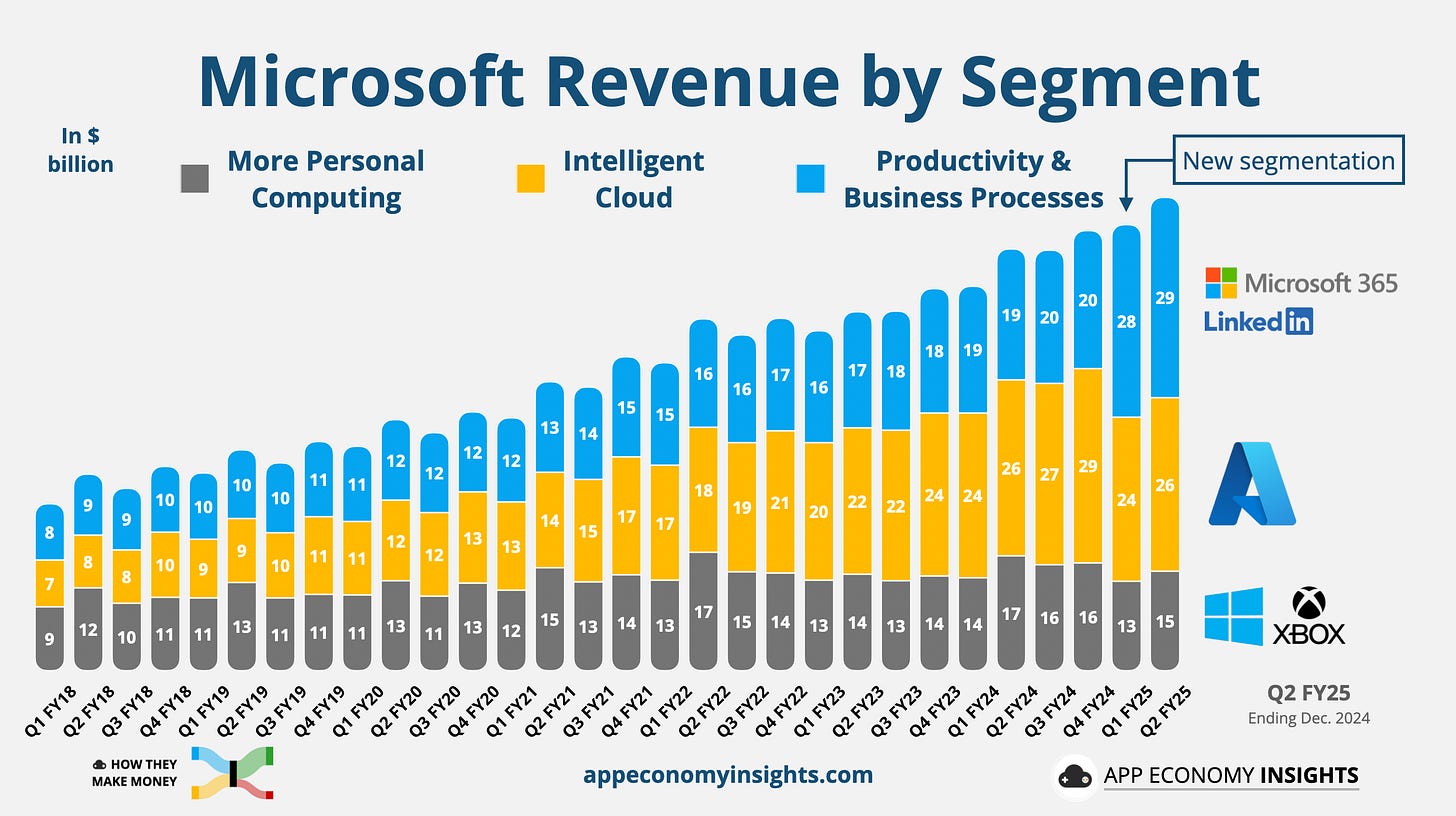

Core business segments:

As a reminder, Microsoft restructured its business segments last quarter to better align reporting with current operations:

📊 Productivity and Business Processes (now consolidating M365 Commercial revenue and Nuance) grew 14% Y/Y to $29.4 billion (ahead of forecast), driven by M365 Commercial, notably Copilot adoption.

☁️ Intelligent Cloud (now excluding Nuance) grew 20% Y/Y to $25.5 billion (high end of guidance), driven by Azure AI services.

🎮 More Personal Computing was flat Y/Y to $14.7 billion (ahead of forecast). The growth in search and advertising (boosted by Copilot Pro) was offset by softness in gaming.

Key Trends:

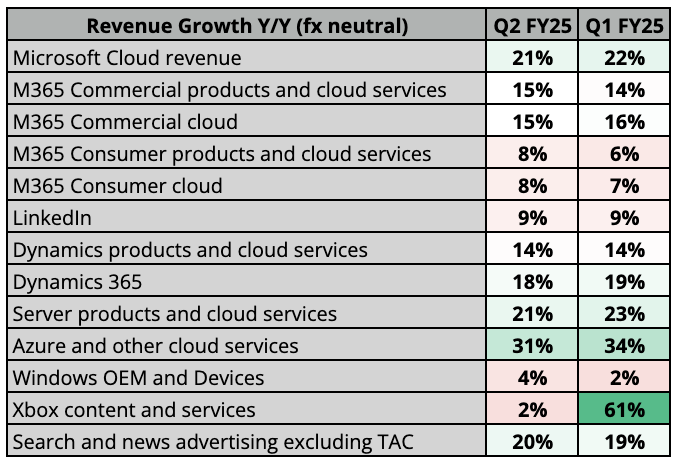

The table below compares growth year-over-year in constant currency following the new segmentation. Many of the products and services overlap.

Microsoft Cloud—spanning Azure, M365, and more—grew 21% Y/Y to $41 billion. It now accounts for 59% of total revenue, up 5pp Y/Y, cementing its dominance.

Azure is running the show and driving the growth of ‘Server products and cloud services’ and Microsoft Cloud.

Consumer products have a much weaker growth profile, with the exception of search. Copilot Pro contributed to stronger growth in the Search and News Advertising segment, a trend that is expected to continue.

Xbox growth was inflated by the Activision acquisition, completed on October 13, 2023. Q2 FY25 still benefited from an extra two weeks of Activision revenue compared to last year. Microsoft’s overall gaming revenue declined like the rest of the market due to the hardware cycle.

Cash flow:

Operating cash flow was $22.3 billion (32% margin, +2pp Y/Y).

Balance sheet:

Cash and cash equivalent: $72 billion.

Long-term debt: $43 billion.

So what to make of all this?

🚧 AI Growth vs. Capacity Limits: Azure AI services grew 157%, but Microsoft's cloud growth is constrained by data center shortages. Capacity constraints should ease by the end of FY25. For now, AI-driven demand is outpacing supply, limiting faster acceleration.

💰 Capex Soared 97% Y/Y to $23 billion: Microsoft is spending aggressively to expand AI infrastructure, expecting $80 billion in AI-related data centers this fiscal year. Some investors question whether this level of spending is necessary.

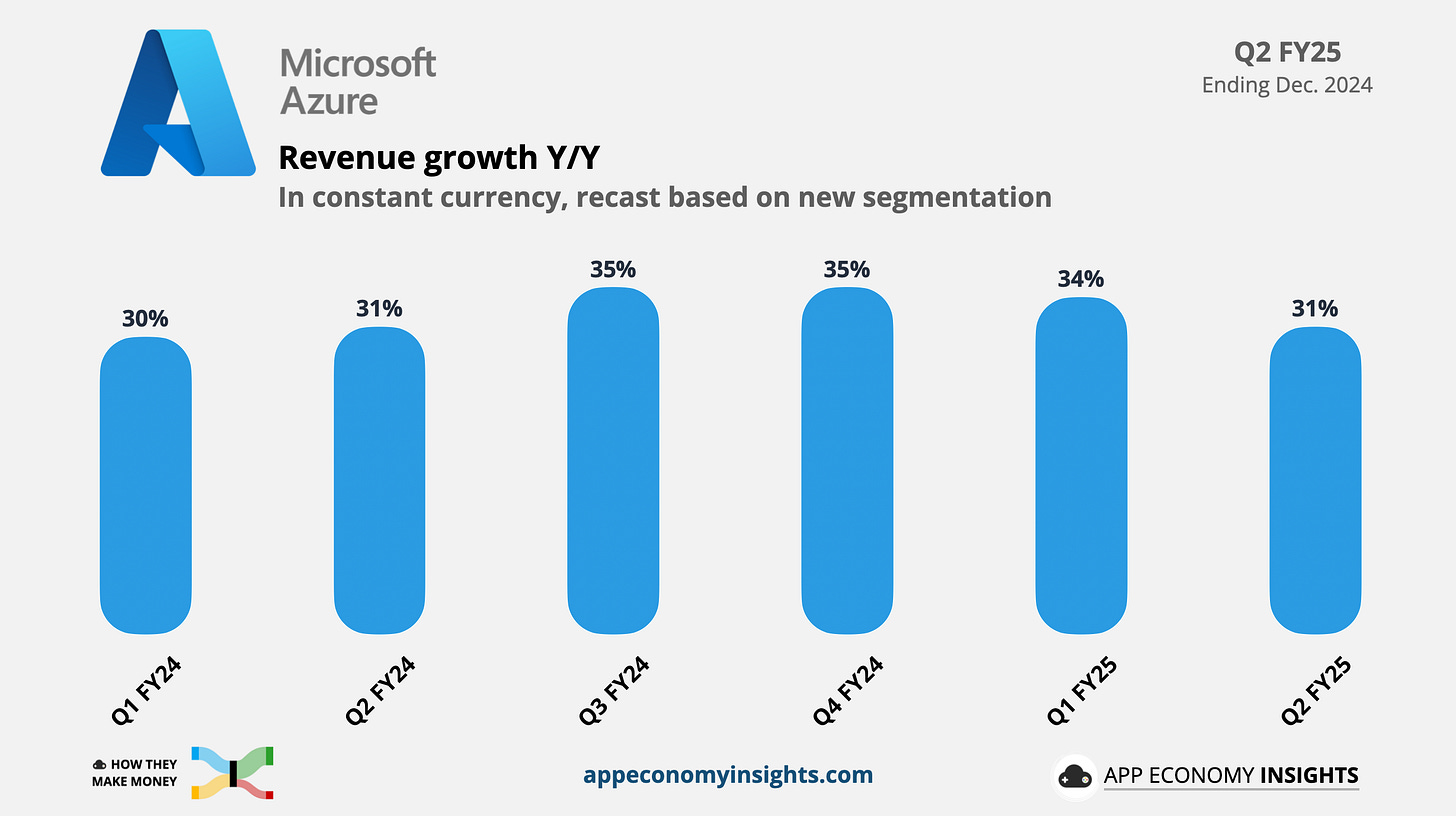

📉 Azure Growth Slowed Slightly: Azure's 31% Y/Y growth missed the high end of expectations and declined from 34% in Q1, showing some deceleration in cloud momentum. AI now contributed 13 percentage points to Azure’s growth.

🎮 Gaming Faced Industry Headwinds: Despite an extra two weeks of Activision revenue, gaming revenue declined 7% Y/Y, caused by broader hardware cycle challenges.

📊 Strong Bookings: Commercial bookings rose 67% Y/Y, driven by long-term Azure commitments from customers like OpenAI. Microsoft now has $300 billion in future service contracts yet to be recognized as revenue.

🔻 Margins Under Pressure: Gross margin was 69%, flat Q/Q, while operating margin fell 2pp sequentially, reflecting higher AI-related costs.

📅 Guidance Suggests Steady Growth: Microsoft expects double-digit revenue and operating income growth in FY25, with Azure growth stabilizing at 31%-32% and Copilot driving M365 adoption.

3. Earnings call takeaways

Satya Nadella shared critical milestones across Microsoft’s portfolio.

On Microsoft Cloud & AI Growth

“Our AI business has surpassed an annual revenue run rate of $13 billion, up 175% year-over-year.”

That’s up from $10 billion last quarter and puts AI at 5% of Microsoft’s overall revenue. The AI boom is fueling enterprise-wide deployments.

On Azure AI & Data Center Capacity

"Azure AI services grew 157% year-over-year and was ahead of expectations even as demand continued to be higher than our available capacity."

AI demand is outpacing Microsoft’s ability to scale data centers. CFO Amy Hood confirmed capacity constraints will persist through Q3 but should ease by year-end.

On AI Efficiency & Costs

"On inference, we have typically seen more than 2x price performance gain for every hardware generation and more than 10x for every model generation due to software optimizations."

Microsoft expects AI cost efficiency to improve over time, making AI cheaper and more accessible, which could fuel more demand rather than reduce revenue.

On Copilot Adoption

"When you look at customers who purchased Copilot during the first quarter of availability, Copilot customers have expanded their seats collectively by more than 10x over the past 18 months. […] Usage intensity increased more than 60% quarter-over-quarter."

Copilot is becoming a standard tool across enterprises. Microsoft is expanding its TAM with new offerings like Copilot Chat and Copilot Studio to embed AI agents into workflows. Seat expansion and increased engagement are bullish, but management came short of sharing actual revenue numbers.

On Commercial Bookings Strength

"Commercial bookings increased 67% and 75% in constant currency and were significantly ahead of expectations, driven by Azure commitments from OpenAI."

Microsoft secured record commercial bookings in Q2, signaling strong enterprise demand for Azure and AI workloads. OpenAI alone is a crucial factor.

On Capital Expenditures & AI Investment

"We expect quarterly spend in Q3 and Q4 to remain at similar levels as our Q2 spend ($22.6B). In FY26, we expect to continue investing against strong demand signals […] However, the growth rate will be lower than FY25 and the mix of spend will begin to shift back to short-lived assets."

Microsoft remains all-in on AI infrastructure, but CapEx growth will moderate in FY26 as data centers catch up with demand. Optimizing the software to lower inference costs will be a critical initiative.

On Gaming

"Black Ops 6 was the top-selling game on Xbox and PlayStation this quarter [...] Game Pass set a new quarterly revenue record."

Activision Blizzard titles boosted engagement, but hardware sales declined, reflecting the broader industry slowdown. Management is focused on improving the margin profile of the segment.

On LinkedIn & B2B Growth

"LinkedIn Premium surpassed $2 billion in annual revenue for the first time."

B2B advertising and subscriptions are driving steady LinkedIn growth, though the hiring market remains weak, causing a slowdown ahead.

On Azure’s Outlook

“We expect Azure revenue growth of 31%-32% in Q3, driven by strong AI demand."

Management previously said Azure would accelerate in the second half. Yet, the outlook was mostly flat sequentially (and still much slower than Q1). CFO Amy Wood talked about adjustments needed to the “scale motion,” with a renewed focus needed on cloud migration as opposed to going all-out on AI.

4. What to watch looking forward

🧠 The Evolution of AI Applications: Microsoft is betting on Copilot and its suite of AI-powered tools becoming the new standard for work. Will enterprises fully embrace AI at scale, or will adoption plateau once the novelty wears off? Early signs are positive.

🏗 AI Infrastructure Arms Race: The cloud computing giants are in an unprecedented spending cycle. Microsoft expects capacity to catch up by the end of FY25, but will its massive $80 billion investment prove to be a long-term moat, or will AI infrastructure become commoditized faster than expected?

💻 OpenAI Partnership & Model Innovation: Microsoft benefits from exclusive access to OpenAI’s models, but the arrival of competitive, low-cost AI alternatives like DeepSeek shows that OpenAI’s closed model could face disruption.

📢 AI Cost vs. Demand Trade-Off: If AI costs drop significantly, as Nadella suggested, will that fuel broader adoption—or erode pricing power? Investors should watch whether lower AI costs translate into more usage and monetization opportunities.

🔄 Reinvention of M365: Copilot adoption is strong, but Microsoft is pushing into AI agents and automation. Will these tools redefine productivity software the way Office once did, or are they just incremental upgrades?

🎮 Xbox’s Profitability Focus: Microsoft is shifting its gaming business toward higher-margin content and subscriptions, but can it sustain engagement in a weakening hardware cycle?

⚖️ Regulatory & Antitrust Watch: As AI and cloud computing become more central to business and government operations, Microsoft could face increasing scrutiny from regulators on competition and data privacy.

🌍 Global Expansion & Emerging Markets: With LinkedIn and Azure seeing strong growth in India, Brazil, and other regions, how much of Microsoft’s future depends on international expansion vs. US enterprise growth?

AI efficiency is rising, but the real test is whether it will fuel demand at a scale that justifies Microsoft’s massive CapEx bet.

That’s it for today!

Stay healthy and invest on.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Disclosure: I own AMZN, CRM, GOOG, and META in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Get Your Business a Custom Chart

Interested in custom charts for your organization or brand? Complete the form here, and we'll get in touch.

Nice Microsoft flashing logo - and great analysis too.