📊 PRO: This Week in Visuals

PG, JNJ, AXP, ISRG, TXN, VZ, SCHW, GEV, UAL, AAL

Welcome to the Saturday PRO edition of How They Make Money.

Over 170,000 subscribers turn to us for business and investment insights.

In case you missed it:

Our PRO coverage includes timely updates on the recent big earnings.

📧 Free subscribers get our Friday articles and sneak peeks.

💌 Premium subscribers get:

Tuesday articles.

Access to our archive.

Monthly reports with 200+ companies covered.

💼 PRO members get all of the above, plus our Saturday coverage.

Today at a glance:

🧴 Procter & Gamble: Volume Boost

💊 Johnson & Johnson: MedTech Weakness

💳 American Express: Holiday Tailwind

🦾 Intuitive Surgical: Surging Growth

⚙️ Texas Instrument: Sluggish Demand

📱 Verizon: Broadband Momentum

🏦 Charles Schwab: Record Inflows

⚡ GE Vernova: Record Orders

🛩️ United Airlines: Demand Takes Off

🦅 American Airlines: Corporate Rebuild

1. 🧴 Procter & Gamble: Volume Boost

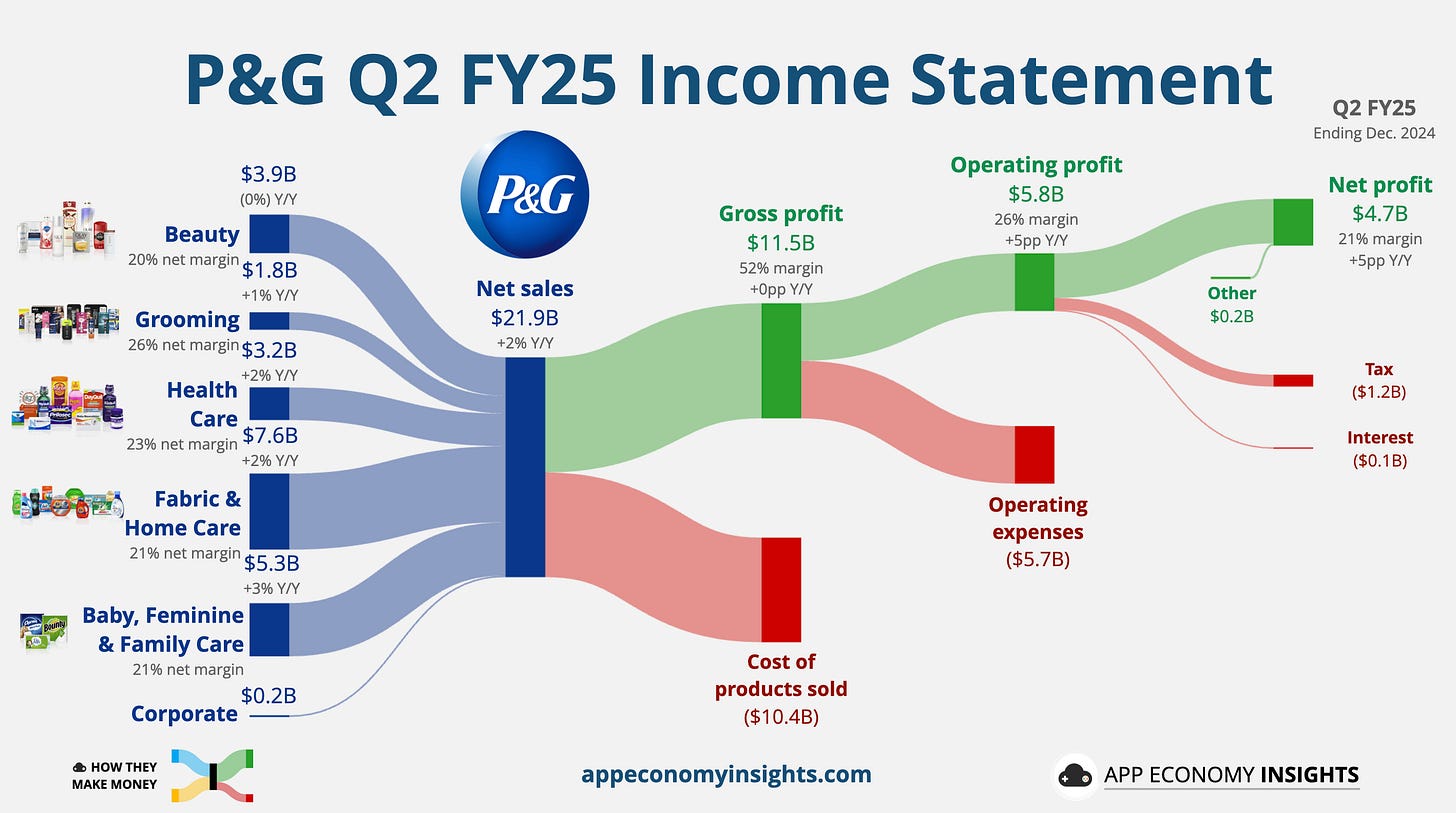

In its December quarter (Q2 FY25), Procter & Gamble’s revenue grew 2% Y/Y to $21.9 billion ($310 million beat), with an adjusted EPS of $1.88 ($0.02 beat). Organic sales rose 3% Y/Y. For the first time since 2019, pricing was flat Y/Y, while organic volume increased 2%, led by healthcare, grooming, and home care—though China’s slowdown weighed on beauty sales.

Despite inflation concerns, consumers are trading up—opting for premium products and bulk sizes, reinforcing P&G’s pricing power and brand strength. The company reaffirmed its FY25 guidance of 2-4% revenue growth and EPS between $6.91 and $7.05. The challenge now is sustaining volume growth of its essentials, from Gilette razors to Tide detergent, as the boost from pricing fades.