🎨 How Figma Makes Money

I spent hours reviewing the S-1 so you don't have to

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

🎨 Figma Files for IPO

Figma has officially filed to go public, marking one of the most anticipated software IPOs in recent memory.

The collaborative design platform has become a staple for millions of designers and developers, famously turning the browser into a design canvas and reshaping how teams build digital products.

This S-1 finally reveals what many suspected: Figma isn’t just a great product—it’s a great business.

In 2022, Adobe announced plans to acquire Figma for $20 billion—but regulators had other ideas. After a year of scrutiny, the deal collapsed in late 2023 due to antitrust concerns in the US, UK, and Europe. Adobe paid Figma a $1 billion breakup fee, and the company stayed independent.

Now Figma is aiming to earn that $20 billion valuation on its own terms.

The numbers are impressive:

$749 million in FY24 revenue, up 48% year-over-year.

Over 1,000 customers paying $100K+ annually.

95% of Fortune 500 use Figma.

And it's just getting started. Figma now has 13 million monthly active users. And remarkably, two-thirds are not designers. The company is evolving from a design tool into a full-stack product platform.

I went through all 300+ pages of Figma’s S-1 so you don’t have to.

Here’s what we learned.

Today at a glance:

Overview

Business Model

Financial highlights

Risks & Challenges

Management

Use of Proceeds

Future Outlook

Personal Take

1. Overview

Figma is a browser-based platform for collaborative design and product development. Its tools are used to brainstorm, wireframe, prototype, and ship digital products—all in one place and in real time.

The company was founded in 2012 by Dylan Field and Evan Wallace. It launched to the public in 2016 and began monetizing in 2017. What followed was one of the most explosive runs in SaaS history.

Today, Figma claims more than 13 million monthly active users, and its tools are used across a wide range of functions—not just by designers, but by product managers, engineers, marketers, and executives.

Headquarters: San Francisco, California.

Mission: Make design accessible to everyone.

Ticker: FIG (Nasdaq).

A Full-Stack Design Platform

Figma is evolving into a full product development suite used by 100% of the Fortune 100, including companies like Microsoft, Stripe, Airbnb, and Zoom. The company has quietly added new tools that map to every stage of the product lifecycle:

🧠 Ideate: FigJam (for whiteboarding and brainstorming), and Figma Slides (for real-time presentations with embedded design elements).

🎨 Design: Figma Design (the flagship UI tool), and Figma Draw (a dedicated vector editing space for detailed illustrations).

👨💻 Build: Dev Mode, a developer-focused workspace to inspect designs, view documentation, and streamline handoff.

🚀 Ship: Figma Sites, which lets users turn designs into working websites with responsive layouts, motion effects, and code layers.

📣 Promote: Figma Buzz, a tool to create on-brand marketing assets like social media graphics and digital ads.

⚡ Prototype with AI: Figma Make, an early AI-driven tool that turns prompts into working prototypes—potentially skipping traditional wireframing.

Together, these tools expand Figma’s reach across the entire product lifecycle—unlocking more users, more use cases, and more revenue per account.

What Makes Figma Different?

Figma’s key innovation was redefining how design software is delivered:

Web-first: No install required. Works across Windows, Mac, and Linux.

Multiplayer by default: Think Google Docs, but for design—multiple users can design, comment, and edit simultaneously.

Community-driven: Thousands of plugins, templates, and widgets created and shared by users.

This combination gave Figma a distinct edge over incumbents like Adobe, which were slower to embrace browser-native, collaborative workflows.

The Adobe Deal That Wasn’t

In September 2022, Adobe announced it would acquire Figma for $20 billion in cash and stock, one of the largest private tech acquisitions ever.

But in December 2023, the companies terminated the deal after mounting regulatory pressure in both the US and Europe. Adobe paid Figma a $1 billion breakup fee, and Figma retained full independence.

Now, with IPO proceeds on the horizon, Figma is out to prove it didn’t need a buyer to scale. It’s aiming to become a public-market leader on its own.

2. Business Model

Figma is a classic product-led growth company, with a twist.

While many SaaS companies rely on sales teams to land large enterprise deals, Figma built its business bottom-up: individuals and small teams start using the free tier, and usage spreads organically across organizations. Once usage hits critical mass, enterprise plans kick in.

It’s the kind of growth engine that’s hard to manufacture—and even harder to replicate.

Land and Expand

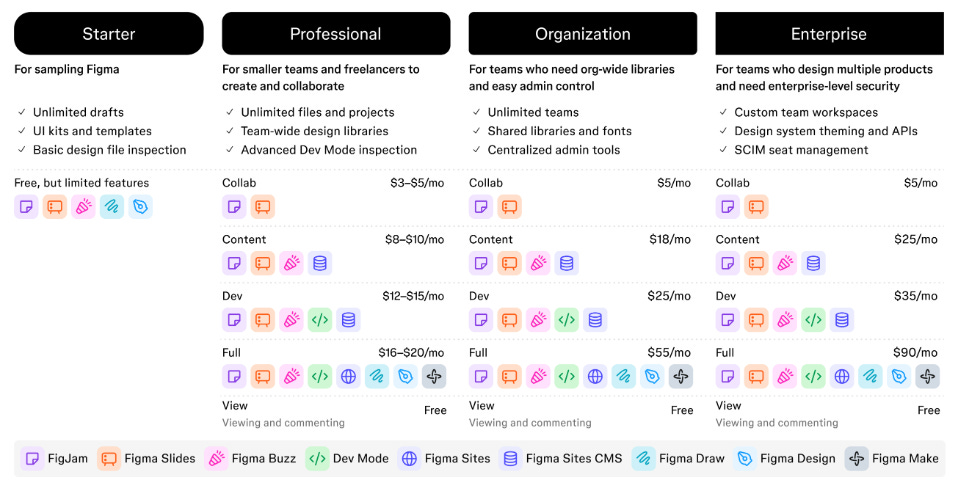

Figma operates a freemium model with four plan tiers:

Starter: Free tier for individuals and early-stage teams.

Professional: Paid tier with additional access controls and features.

Organization: Designed for scaling teams with more robust admin tools.

Enterprise: Tailored for large companies with enhanced security, support, and procurement controls.

The business grows through a seat-based pricing model. Users are charged per “editor” seat, meaning only those actively creating or modifying files need a paid license. Viewer-only roles are free, which helps drive viral adoption. Figma also offers a range of seat types—Viewer, Collaborator, Content, Developer, and Full—tailored to specific workflows.

The flywheel looks like this:

A designer invites a colleague to collaborate.

That person invites a PM or engineer.

Usage spreads across functions.

Procurement steps in once the tool becomes critical infrastructure.

This is how Figma turned viral adoption into:

11,000+ customers spending over $10,000 ARR (annual recurring revenue).

1,000+ customers spending over $100,000 ARR.

Net Retention With a Catch

Figma’s business thrives on expansion:

Net dollar retention hit 132% in Q1 FY25—but the fine print matters. Figma only includes customers still spending over $10,000 today, then looks back at what those same customers were spending a year ago. That makes it more of a flattering expansion rate among retained enterprise accounts, rather than a true retention metric factoring in churn. It’s undeniably impressive, but the label is misleading. It's unclear why this was even called net dollar retention in the S-1.

Average revenue per paying customer has climbed steadily with seat growth, cross-team expansion, and new products like FigJam and Dev Mode.

Usage-based features—like storage, commenting, and handoff tools—create more monetization opportunities as teams scale.

Not Just for Designers

Figma often refers to itself as a productivity platform disguised as a design tool. That’s intentional. The company sees its market far beyond the design org. In many companies, Figma has become the connective tissue between:

Designers, building the product UI.

Engineers, inspecting files in Dev Mode.

Product managers, defining flows and specs.

Marketers and execs, giving feedback or approving designs.

This cross-functional appeal is what separates Figma from legacy tools and what opens the door to much broader enterprise budgets.

3. Financial Highlights

Figma’s Q1 FY25 results reflect a company with breakout SaaS economics—and a story that’s now rebounding after a one-off financial reset in 2024.

Here’s a snapshot of Q1 FY25 (ended March 2025):

Here are the most critical KPIs: