🧠 OpenAI: Beyond ChatGPT

And the ongoing drama with Microsoft

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

OpenAI isn’t slowing down.

It’s monetizing, diversifying, and fighting fires—all at once.

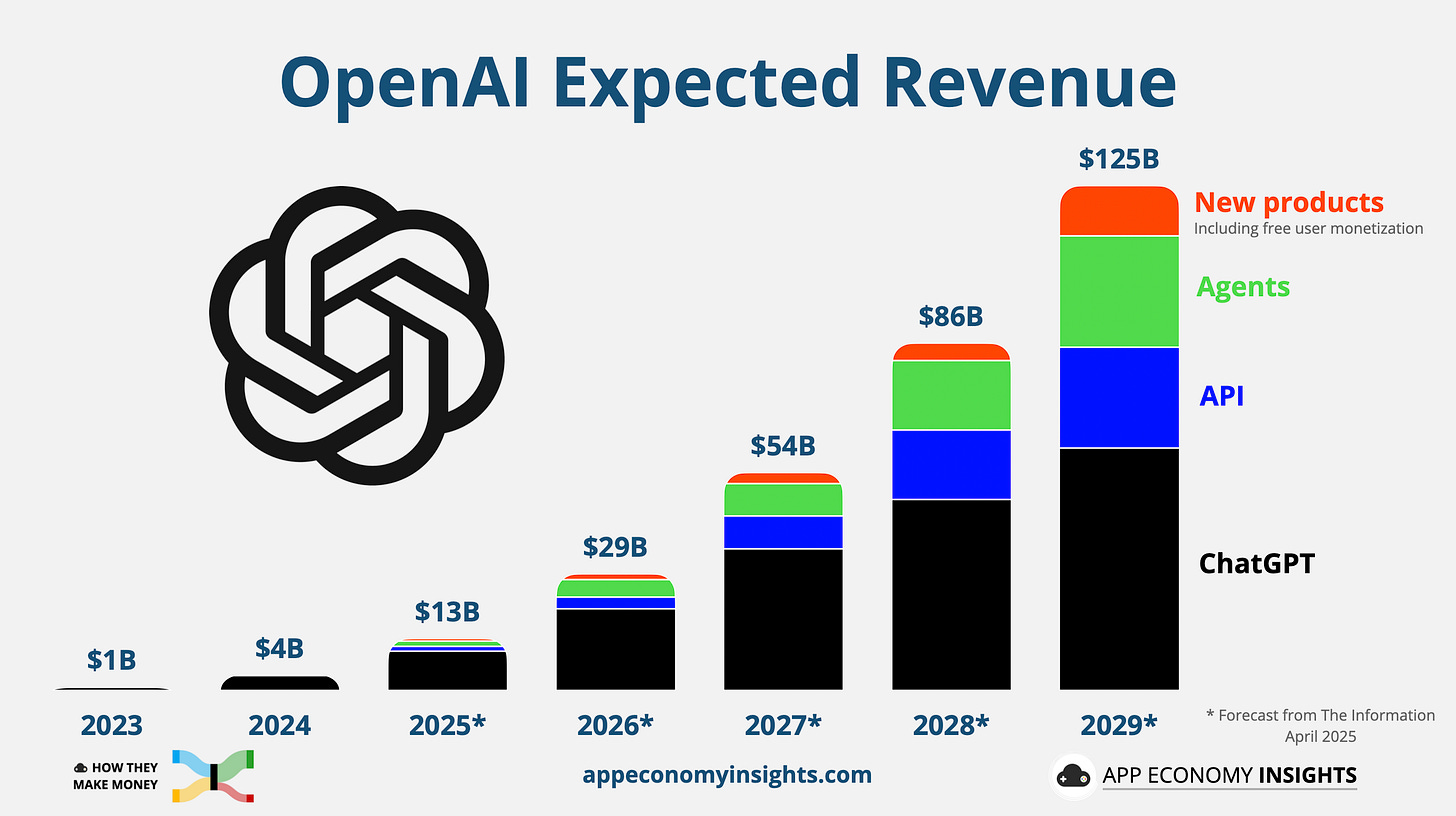

Shifting from ChatGPT subscriptions to APIs, agents, and new products, OpenAI is projecting $125 billion in revenue by 2029.

Wait.. what?

If that internal forecast—reported by The Information—makes you pause, I wouldn’t blame you. It implies a faster ramp than Google or Facebook ever saw. But OpenAI’s unit economics are wildly different, with management not expecting to be cash flow positive until 2029.

OpenAI made around $4 billion in revenue in 2024 and is on track to reach $13 billion in 2025. While ChatGPT makes up the vast majority of revenue, OpenAI is racing to prove it’s more than a one-product wonder.

Ben Thompson described OpenAI as an “accidental consumer tech company”—a research lab that stumbled into the mainstream with ChatGPT and now finds itself racing to monetize AI faster than Big Tech. What started as a nonprofit project is now reshaping search, productivity, and digital assistants.

So, where will the money come from?

ChatGPT: Premium subscriptions and enterprise licenses remain the foundation.

API access: Licensing models to developers and enterprises continues to grow, powering tools like Notion, Khan Academy, and Stripe.

Agents: Automated, task-based AI agents that go beyond chat—booking flights, handling customer service, or even writing code.

New products: Think memory, app stores, voice interfaces, and monetizing free-tier users via ads.

Amid Azure tension, OpenAI wants to hedge its GPU bets, and maybe hedge its partnerships too. In addition, the company is buying startups, battling poaching from Meta, and doubling down on its ambition to lead the AGI race.

All while still answering to a nonprofit board.

So what’s really going on?

This is a story about power consolidation, talent warfare, and the multi-front campaign to own AI’s future.

Let’s break it down.

Ongoing Microsoft-OpenAI Drama.

The For-Profit Pivot.

GPU Partnership With AMD.

Talent is the New Arms Race.

The Altman Playbook: Vision or Volatility?

The Investor Lens.

FROM OUR PARTNERS

Cars Are Built in Minutes; Why Not Houses?

How do you aim to disrupt the massive, outdated ~$5T home construction market?

Introduce assembly-line automation like BOXABL did.

Much like Henry Ford automating car manufacturing, they’re bringing assembly-line efficiency and mass production to an artisanal, slow industry. BOXABL homes are factory-built, folded, shipped via truck, and unfolded on site in one hour.

And they're not just dreaming big; they're delivering: initial prototype order delivered to SpaceX in 2020, a 156-home project order from the DoD completed in 2021, and active deliveries to developers and consumers.

They’ve raised $200M+ from 50,000+ investors since 2020, and their current opportunity ends tonight at midnight PT, so act fast.

Invest in BOXABL for $0.80/share and claim your bonus before it’s too late.

This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://invest.boxabl.com/#circular

1. Ongoing Microsoft-OpenAI Drama

It started as one of the most successful corporate bets of the decade.

Microsoft poured over $13 billion into OpenAI, secured exclusive Azure access, and integrated OpenAI’s models across Bing, Microsoft 365, and GitHub Copilot.

But now? It feels more like a custody battle. According to the Wall Street Journal, OpenAI wants to loosen Microsoft’s grip on its AI products and computing resources. It wants to:

Convert into a public-benefit corporation.

Raise institutional capital and eventually go public.

Work with other cloud providers beyond Azure.

Microsoft, understandably, isn’t thrilled. The tech giant is reportedly demanding a larger stake in the new entity, possibly more than the ~33% OpenAI has floated. Their agreement also grants Microsoft access to all of OpenAI’s IP, which has been a concern for Windsurf, a potential competitor to GitHub Copilot.

OpenAI’s response? Quietly threatening to accuse Microsoft of anticompetitive behavior and invite regulatory scrutiny, according to a recent report from The Wall Street Journal.

Microsoft wants perpetual rights to OpenAI’s models—even post-AGI.

OpenAI wants freedom to scale and monetize on its own terms.

For now, Microsoft holds the cards—IP access, compute control, and a revenue-sharing agreement that locks OpenAI in. Unless the deal is done by the end of 2025, OpenAI risks losing up to $20 billion in planned funding.

2. The For-Profit Pivot

OpenAI was founded in 2015 as a nonprofit, with a mission to ensure AGI benefits all of humanity. But building frontier AI is expensive. So in 2019, OpenAI created a “capped-profit” subsidiary, allowing investors to earn up to a 100x return.