📊 PRO: This Week in Visuals

AAPL META V MA PG ABBV HERMES LVMH UNH L'OREAL MRK BKNG QCOM ARM BA SPOT LRCX KLAC SBUX CDNS COIN HOOD MDLZ RBLX UPS NET PYPL F ADIDAS HSY EA KHC KERING RDDT SOFI GRAB ALGN ROKU CFLT APPF ETSY

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Weekly articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

📱Apple: Pull-Forward Demand

🕶️ Meta: AI Spending Accelerates

💳 Visa: Spending Holds Up

💳 Mastercard: New Partnerships

🧴 Procter & Gamble: Price Hikes Ahead

💊 AbbVie: Eyeing Mental Health

👜 Hermès: Luxury Outlier

✨ LVMH: Softer Demand

💼 UnitedHealth: Reform Under Pressure

💄 L'Oréal: US and China Rebound

🦠 Merck: Before Keytruda Cliff

🏝️ Booking: Connected Trips Rise

⚙️ Arm: AI Push Thin Margins

🛩️ Boeing: Deliveries Drive Progress

📲 Qualcomm: AI Diversification Gains

🎧 Spotify: Slushing Ad Performance

🧠 Lam Research: Record Margins

🔬 KLA: AI Tailwinds

☕️ Starbucks: Early Signs of Stabilization

📈 Coinbase: Trading Slump

🪶 Robinhood: Crypto Fuels the Boom

🍪 Mondelez: Cocoa Costs Bite

💡 Cadence: China Fines

📦 UPS: Tariffs Hit Hard

👾 Roblox: Viral Surge

💳 PayPal: New Ambitions

☁️ Cloudflare: Growth Reaccelerates

🚙 Ford: $2B Tariff Hit

👟 Adidas: Tariffs Cloud Momentum

🏎️ Electronic Arts: F1 Boost

🍫 Hershey: Cocoa Weighs Heavy

🌭 Kraft Heinz: Still Searching for Stability

🧣 Kering: Gucci Sales Collapse

👽 Reddit: Fastest Growth in 3 Years

🏦 SoFi: Fee-Based Momentum

🛵 Grab: Profitable Growth Holds

🦷 Align: Weaker Volumes

📺 Roku: Platform Momentum Builds

📊 Confluent: Cloud Outlook Disappoints

📦 Etsy: Buyer Slump

🏡 Appfolio: AI Lifts Growth

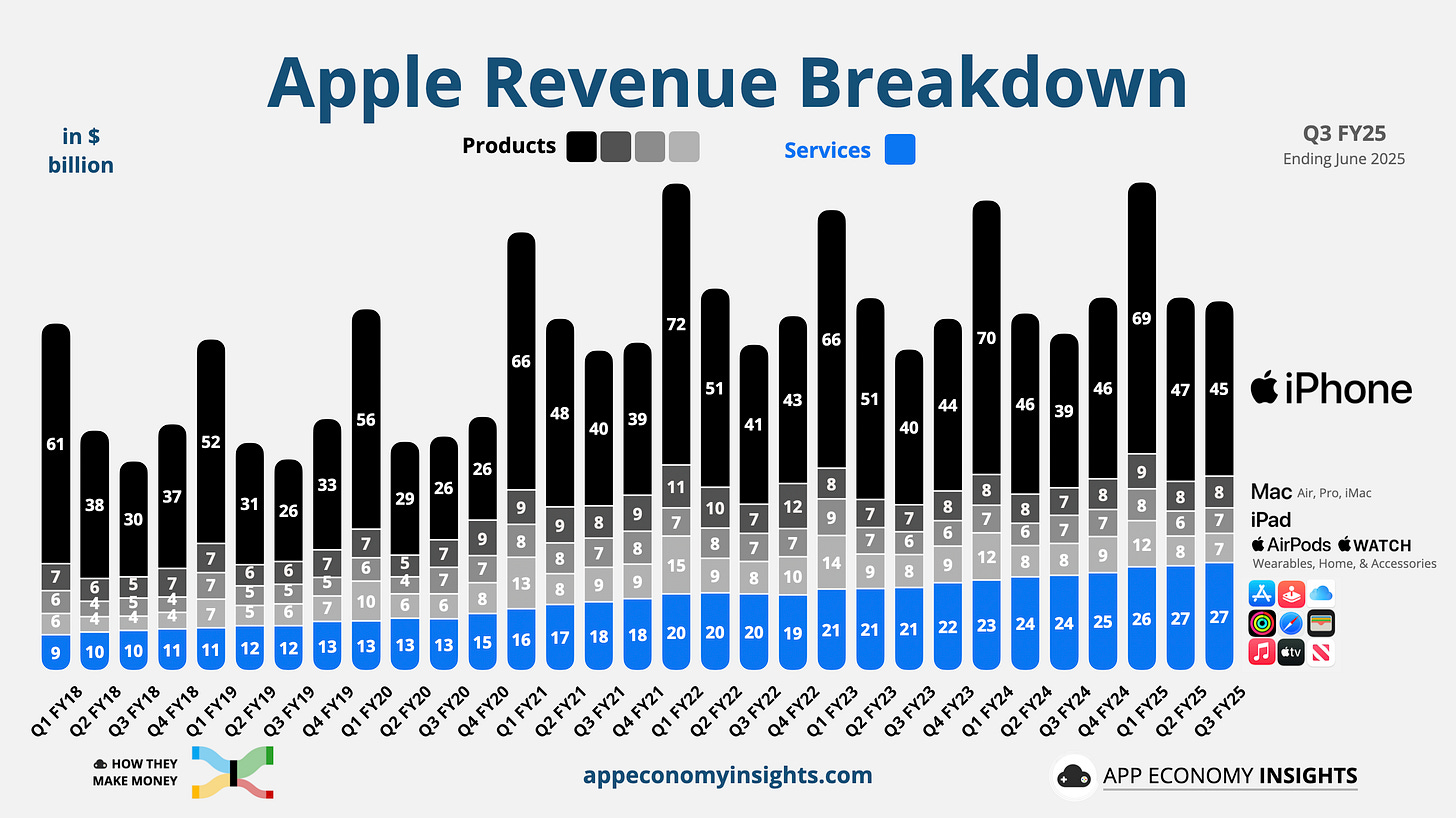

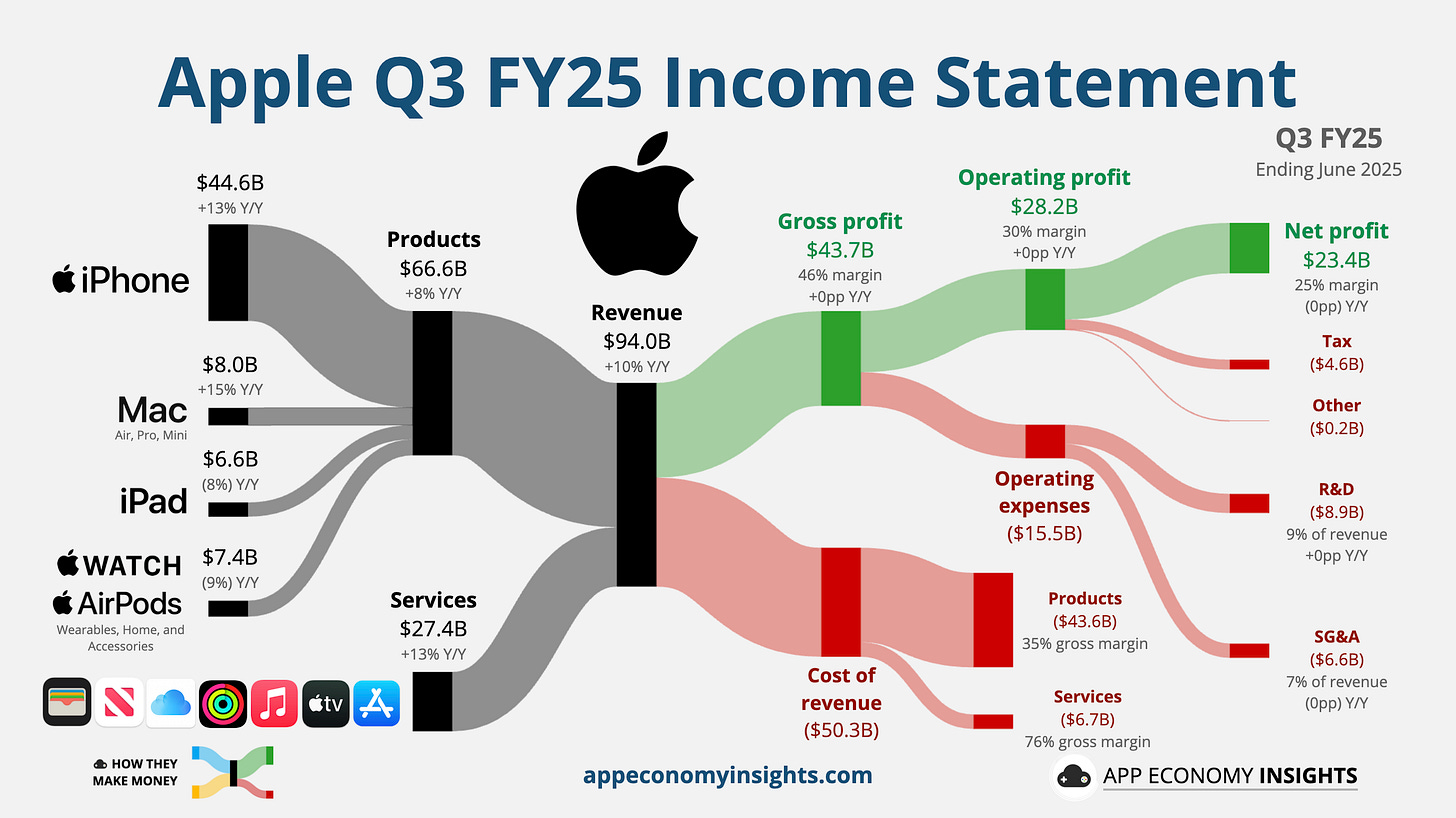

1. 📱Apple: Pull-Forward Demand

Apple’s June quarter (fiscal Q3 FY25) revenue jumped 10% Y/Y to $94.0 billion ($4.9 billion beat) with EPS up 12% to $1.57 ($0.14 beat). It was a surprisingly strong performance in a seasonally weaker quarter.

📱 iPhone sales jumped 13% Y/Y to $44.6 billion, boosted by strong upgrade cycles linked to pull-forward demand ahead of tariff hikes, which could impact future quarters. Tim Cook noticed an “unusual buying pattern” in the US.

💳 Services grew 13% Y/Y to a record $27.4 billion, supporting Apple’s highest June-quarter revenue ever.

Despite an $800 million tariff hit on costs, Gross margin held at 46% as Services continue to boost Apple's margin profile.

Geographically, China returned to growth, up 4%, while North America and emerging markets accelerated. Apple guided for mid- to high-single-digit revenue growth next quarter, with tariffs-related costs expected to rise to $1.1 billion.

Management highlighted expanded AI investments, including 20+ new Apple Intelligence features, and ongoing supply chain diversification (India and US manufacturing ramping). Regulatory risks are still on the horizon around the Google search deal and App Store changes we’ll cover in the coming weeks.

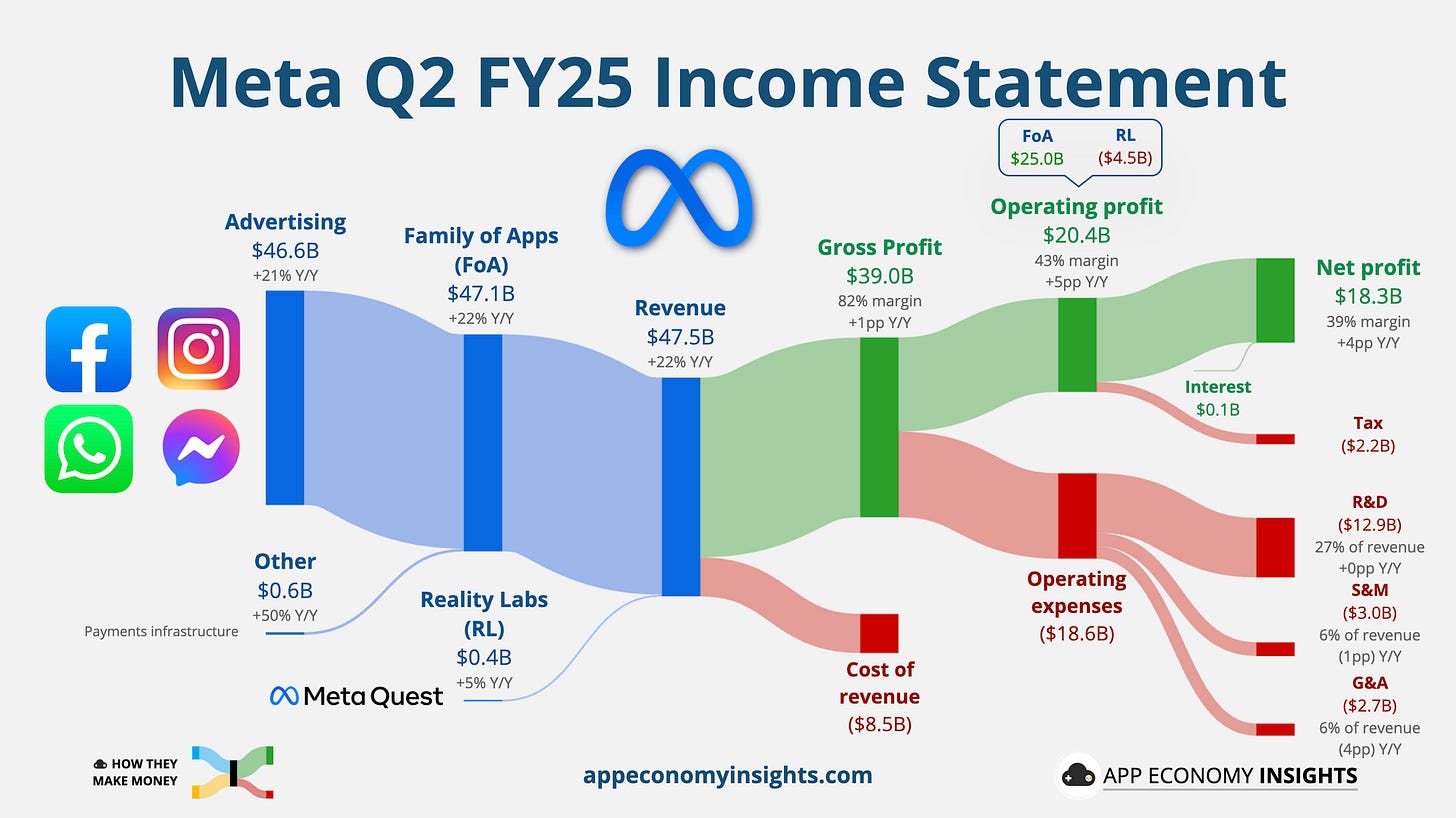

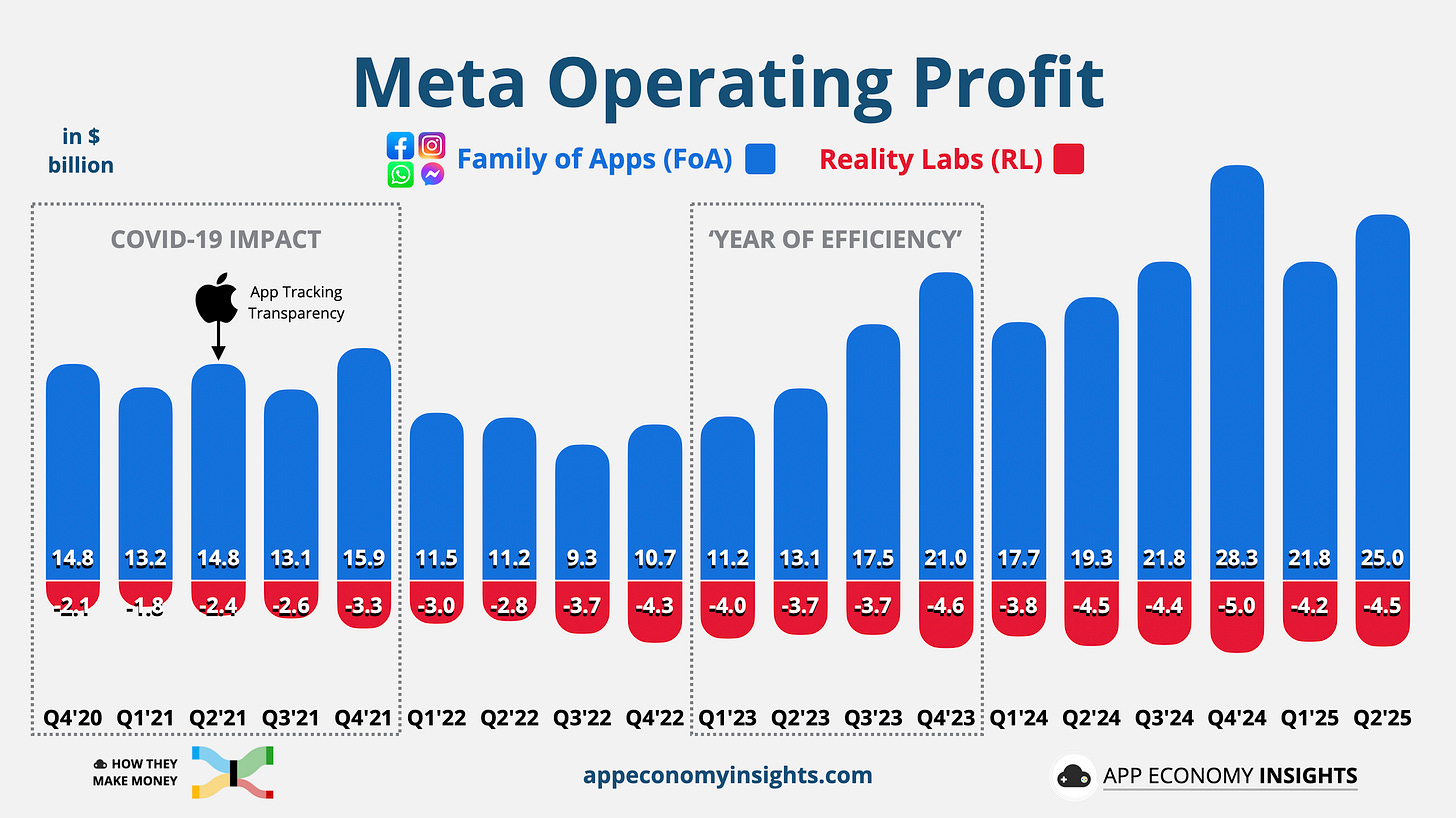

2. 🕶️ Meta: AI Spending Accelerates

Meta posted a blowout Q2, with revenue up 22% Y/Y to $47.5 billion ($2.7 billion beat) and EPS up 36% to $7.14 ($1.24 beat).

Ad strength drove results, as impressions rose 11% and average price per ad climbed 9%, pushing operating margin to 43%. Daily active users across the Family of Apps rose 6% Y/Y to 3.48 billion, and Meta AI now boasts more than 1 billion monthly users. The core ad engine is funding massive AI investments and the persistent Reality Labs’ losses ($4.5 billion).

CapEx guidance held at $66–72 billion for 2025 ($64-72 billion previously), with another significant increase flagged for 2026 (possibly hitting $100 billion) as Meta builds superintelligence capabilities via new Prometheus and Hyperion data center clusters. Zuck announced the formation of Meta Superintelligence Labs to consolidate AI research teams through aggressive hiring and accelerate frontier model development.

While regulatory risks loom in Europe and tariff pressures remain, Meta guided Q3 revenue growth to 17%-to-24% Y/Y (above consensus), signaling continued momentum as AI drives both product innovation and ad efficiency.