🕵️♂️ Palantir: 'Once in a Generation'

Plus AMD, MercadoLibre, and Hims & Hers earnings

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

🗓️ It’s peak earnings season!

A flood of reports from the world’s most‑watched companies is rolling in, and we’re tracking the early standouts.

Coming up: Disney, Warner, Shopify, Uber, Airbnb, and more.

Today at a glance:

🦎 Berkshire: Kraft Heinz Pain

🕵️ Palantir: ‘Astonishing AI Impact’

↗️ AMD: AI Demand vs. China Curbs

🤝 Mercado Libre: Free Shipping Trade‑Off

🏎️ Ferrari: Tariff Relief

⚡️ Axon: AI and Software Propel Growth

💊 Hims & Hers: GLP‑1 Reset

1. 🦎 Berkshire: Kraft Heinz Pain

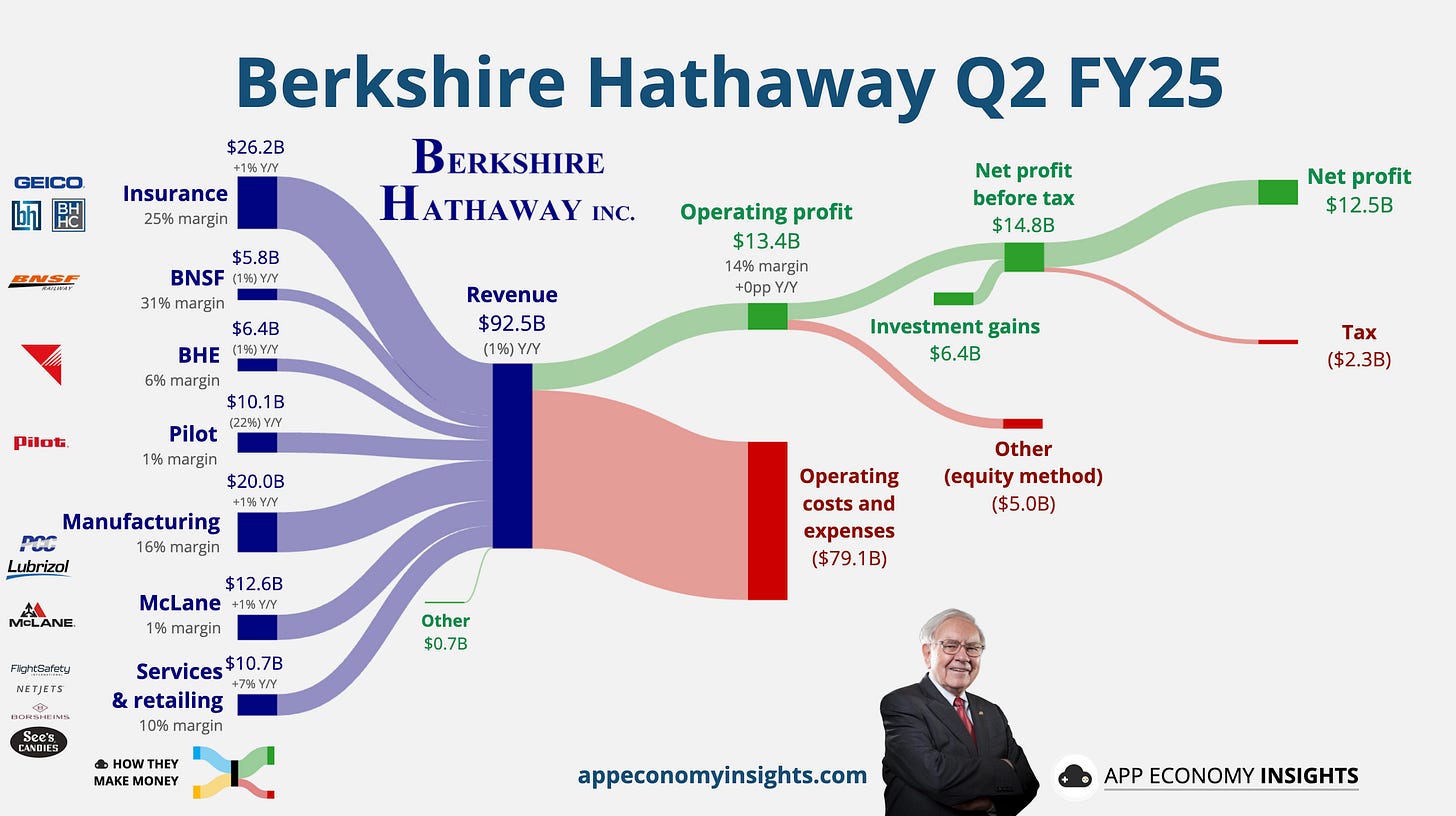

Warren Buffett’s Berkshire booked a $5.0 billion write‑down on its long‑troubled Kraft Heinz stake, using the equity method (an accounting adjustment that lowers the value of its investment), cutting its carrying value to $8.4 billion.

Revenue slipped 1% Y/Y to $92.5 billion with a relatively flat operating profit as wildfire losses in its insurance arm wiped out gains at BNSF and Berkshire Energy. Net profit plunged versus last year, driven by smaller investment gains and the write-downs.

The cash hoard remains massive at $344 billion, near record highs, but Berkshire stayed cautious: no buybacks for a fourth straight quarter and net equity sales of nearly $7 billion. With Buffett set to step down as CEO at year-end, successor Greg Abel inherits both the war chest and the challenge of deploying it. For now, Berkshire is signaling patience, waiting for the right pitch rather than swinging at every opportunity.

2. 🕵️ Palantir: ‘Astonishing AI Impact’

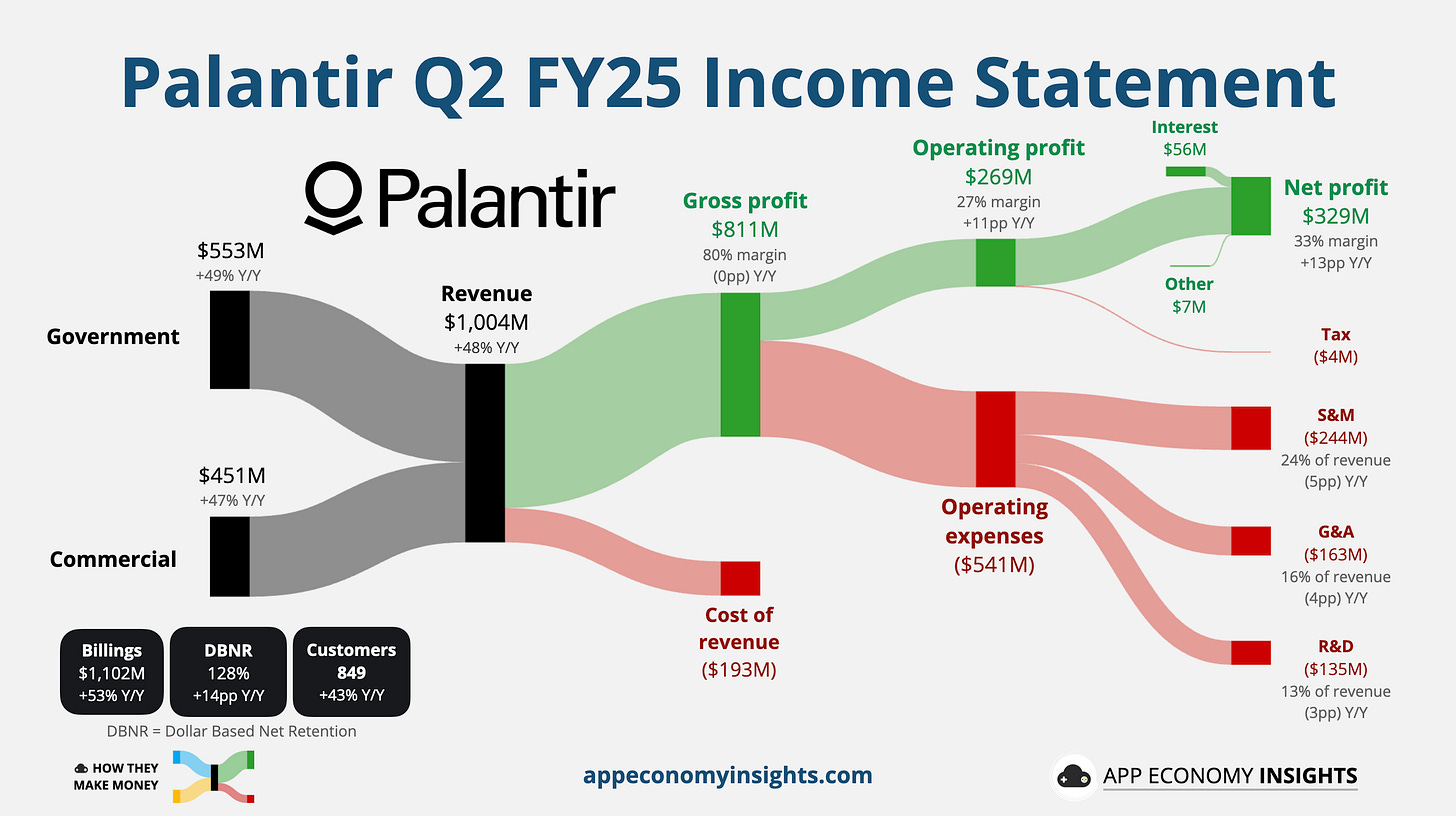

Palantir smashed expectations again, crossing $1 billion in quarterly revenue for the first time, up 48% Y/Y and $61 million ahead of estimates. Total US revenue grew 68% to $733 million, cementing the US as Palantir’s growth engine. US commercial sales surged 93% to $306 million, while US government revenue climbed 53% to $426 million.

Management raised full‑year guidance across the board: revenue now expected to grow 43% Y/Y to ~$4.15 billion (vs. $3.9 billion prior) and free cash flow to reach $1.8–$2.0 billion. The company also posted a record Rule of 40 score of 94 and record total contract value of $2.27 billion (+140% Y/Y), reflecting surging demand for its AI platform (AIP) and a string of new federal deals, including a 10‑year, $10 billion Army contract consolidation.

CEO Alex Karp called the performance “once in a generation,” pointing to Palantir’s years‑long bet on AI infrastructure, from Ontology to embedded AI tools, finally translating into record demand across both defense and enterprise customers.

PLTR is now a 10‑bagger (up 900%) since it entered our real-money portfolio in January 2024, a sign of just how wild investor enthusiasm around Palantir and AI has become. The stock is trading at the highest multiples in the S&P 500, and valuation risk is hard to ignore, even as the company cements itself as a leader at the intersection of defense and enterprise AI.

3. ↗️ AMD: AI Demand vs. China Curbs

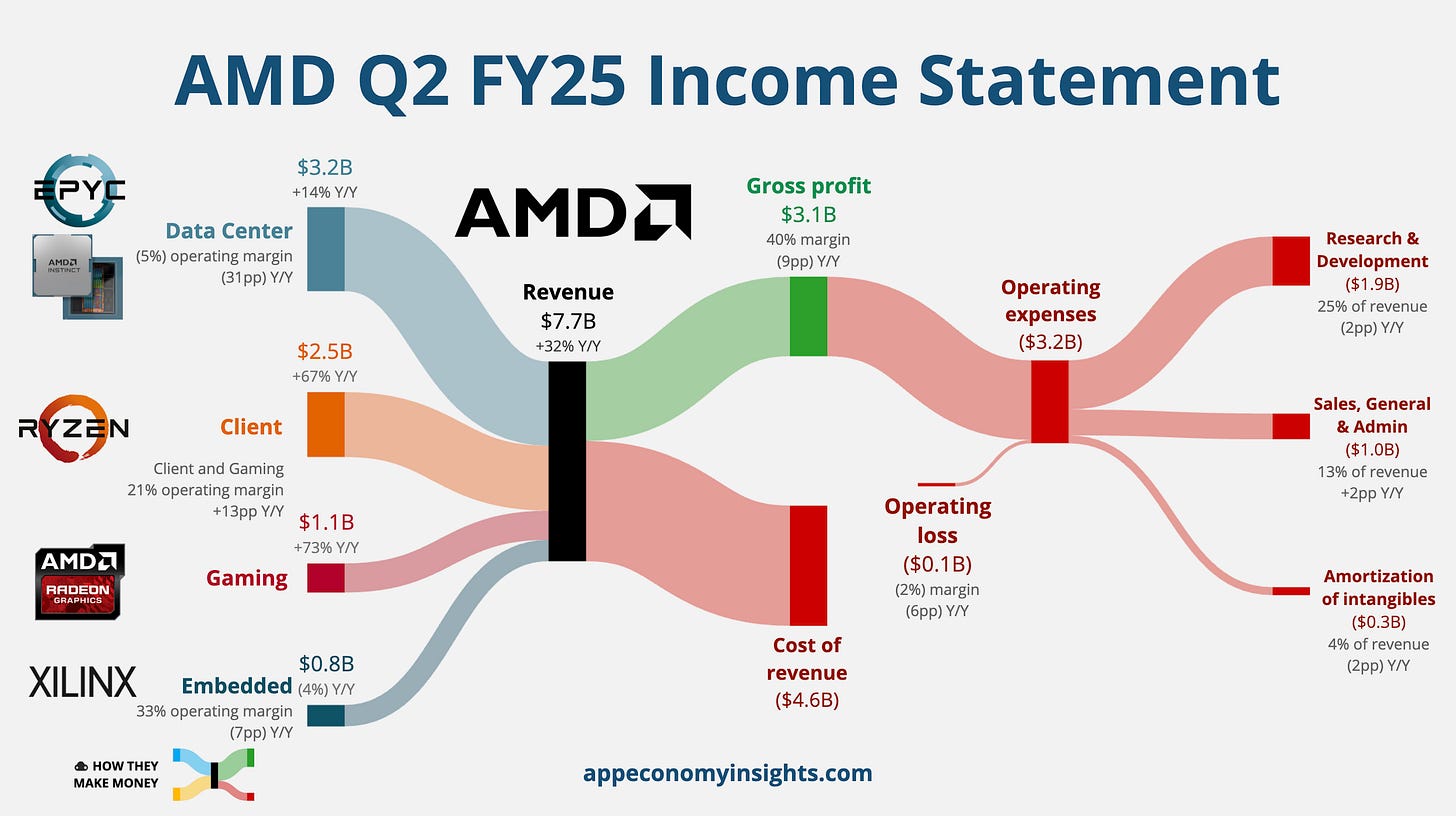

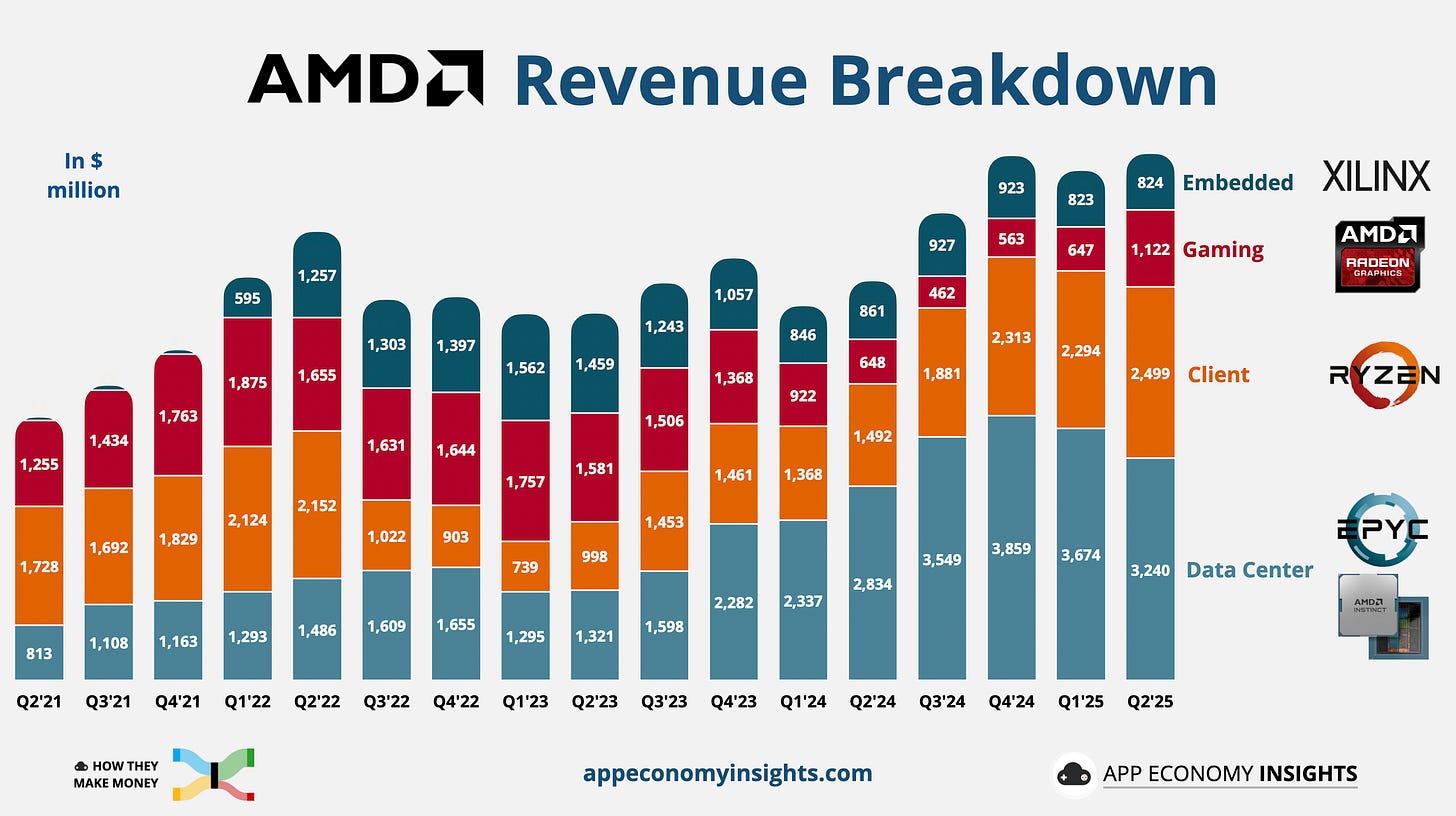

AMD’s revenue climbed 32% Y/Y to $7.69 billion ($260 million beat), while adjusted EPS of $0.48 was in line.

Data Center rose 14% Y/Y to $3.2 billion on demand for MI300 accelerators and EPYC processors, though growth slowed and margins were hit by US export controls on the MI308 chip. Without the $800 million charge tied to these restrictions, adjusted gross margin would have been 11 points higher.

Client revenue jumped 67% Y/Y to $2.5 billion, driven by strong uptake of Ryzen 8000 and Zen 5 desktop CPUs as AMD gained share from Intel. AI‑capable laptops also boosted sales, reflecting a broader PC refresh cycle. Gaming revenue surged 73% to $1.1 billion on higher semi‑custom chip shipments for PlayStation and XBOX consoles and steady GPU demand, aided by AI‑accelerated features.

The Q3 outlook beat expectations. AMD guided revenue to $8.7 billion (midpoint), roughly $0.4 billion above consensus, with gross margin expected to rebound to 54%. The outlook excludes China AI chip shipments as licenses remain under review, making the beat even more impressive.

CEO Lisa Su expects “significant growth” in the second half, driven by computing and AI demand. AMD is still very much in the AI race.