🎮 Memory Wall Hits Hardware

And the Super Bowl AI beef you didn't expect

Welcome to the Premium edition of How They Make Money.

Over 290,000 subscribers turn to us for business and investment insights.

In case you missed it:

🏈 Super Bowl AI Beef

While the Seahawks and Patriots battled on the turf on Sunday, the real heavy-hitting happened in the ad breaks.

Anthropic decided to go for the jugular with a series of Super Bowl spots mocking OpenAI’s pivot toward a subsidized, ad-supported ChatGPT. Sam Altman fired back on X, calling the ads "clearly dishonest," and labeling Anthropic’s approach as "expensive products for rich people." The era of ad-free AI has become a marketing battleground for users and talent.

While AI labs fight for the soul of the software, the hardware world is fighting for the silicon to run it. Memory suppliers are prioritizing High-Bandwidth Memory (HBM) for AI data centers, leading to a memory crunch.

That brings us to the companies most exposed to the shortage. There’s a quiet reshuffling of power across consumer electronics, semiconductors, and platform economics.

Today at a glance:

🎮 Sony: Hardware Retreat

📲 Qualcomm: Memory Wall

☁️ Arm: Cloud AI Engine Ignites

1. 🎮 Sony: Hardware Retreat

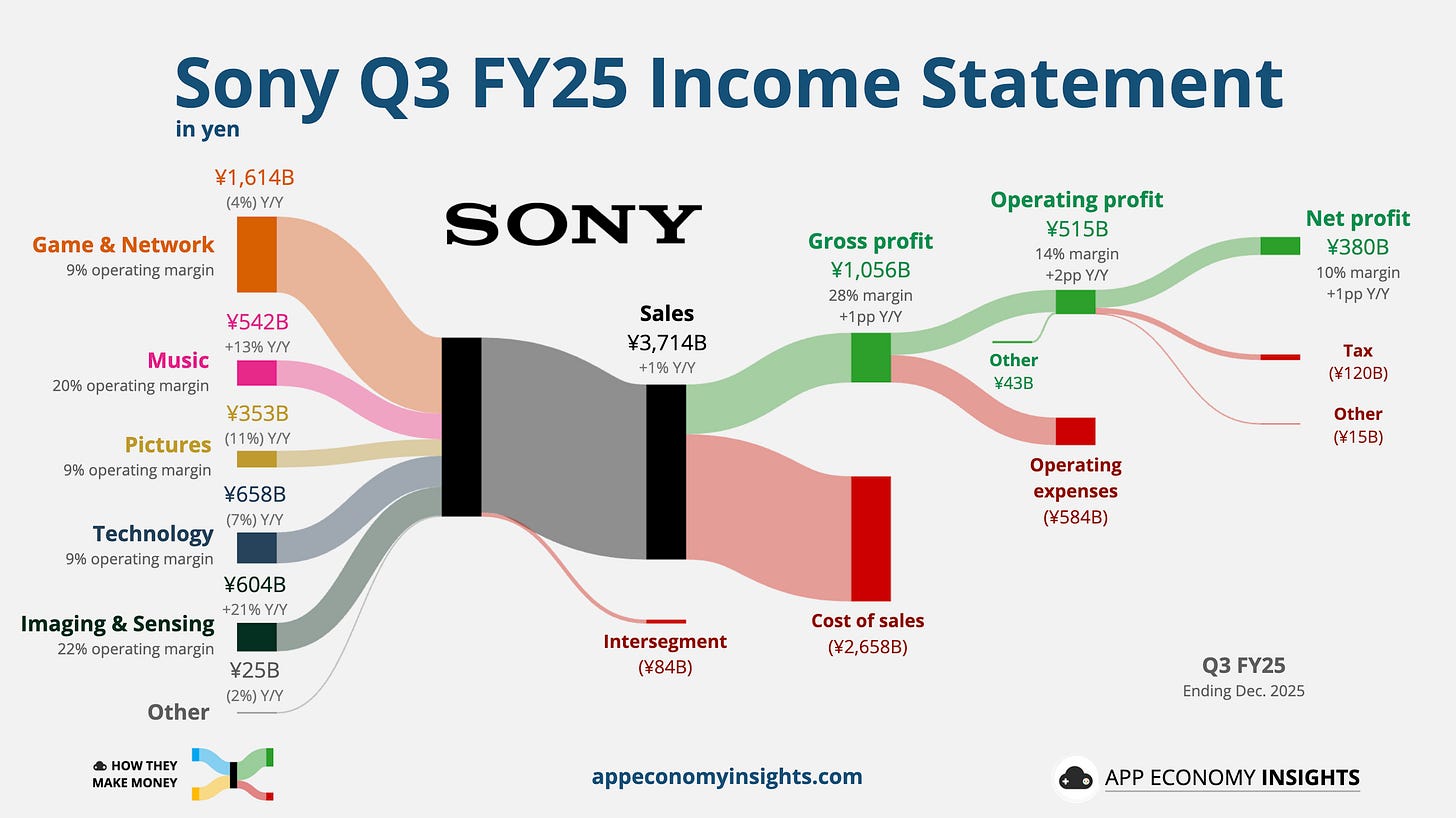

Sony delivered a record-high operating profit for the holiday quarter (Q3 of the fiscal year ending in March), even as hardware sales for its flagship gaming console began to soften.

Sales were up just 1% Y/Y to ¥3.71 trillion (¥44 billion beat), which is roughly $23.5 billion. Operating margin improved to 14% from 12% a year ago.

What you should know

1. Gaming Pivot

The PlayStation 5 is entering the mature phase of its life cycle. Sony shipped 8 million units this quarter, a 16% drop from the 9.5 million shipped a year ago. The console has sold a cumulative total of 92 million units.

While hardware units linger, record-high software revenue on the PlayStation Store and a 13% jump in network services revenue boosted the gaming division’s operating profit, which surged 19% Y/Y.

Digital downloads and subscriptions are the main drivers here. Ghost of Yōtei was a massive catalyst, selling 3.3 million copies in its first month and outpacing the early sales of its predecessor, Ghost of Tsushima. PlayStation Network (PSN) Monthly Active Users rose 2% Y/Y to 132 million, which includes players on PS4 and PC.

2. Memory Crunch

The global shortage of DRAM (memory chips), driven by investments in AI and data centers, is increasing manufacturing costs. Contract prices are projected to rise 90% to 95% this quarter.

CFO Lin Tao assured investors that Sony has secured the “minimum volume required” to mitigate the crunch. She has signaled an intentional extension of the PS5 life cycle, describing the console as being only at its “midpoint.” This aligns with rumors of a delay of the PlayStation 6, possibly into 2028 or 2029, to avoid launching at a prohibitively high retail price.

While supply is secure, higher costs will weigh on hardware margins. Sony plans to absorb these costs by leaning on its installed base of PS5 owners to buy more software and subscriptions. The company is pivoting toward a services-first model.

3. Image Sensor Momentum

Revenue in the Imaging & Sensing Solutions (I&SS) segment jumped 21%. This was largely driven by strong demand for high-end sensors in flagship smartphones, including the popular iPhone 17 we discussed here.

The great hardware retreat

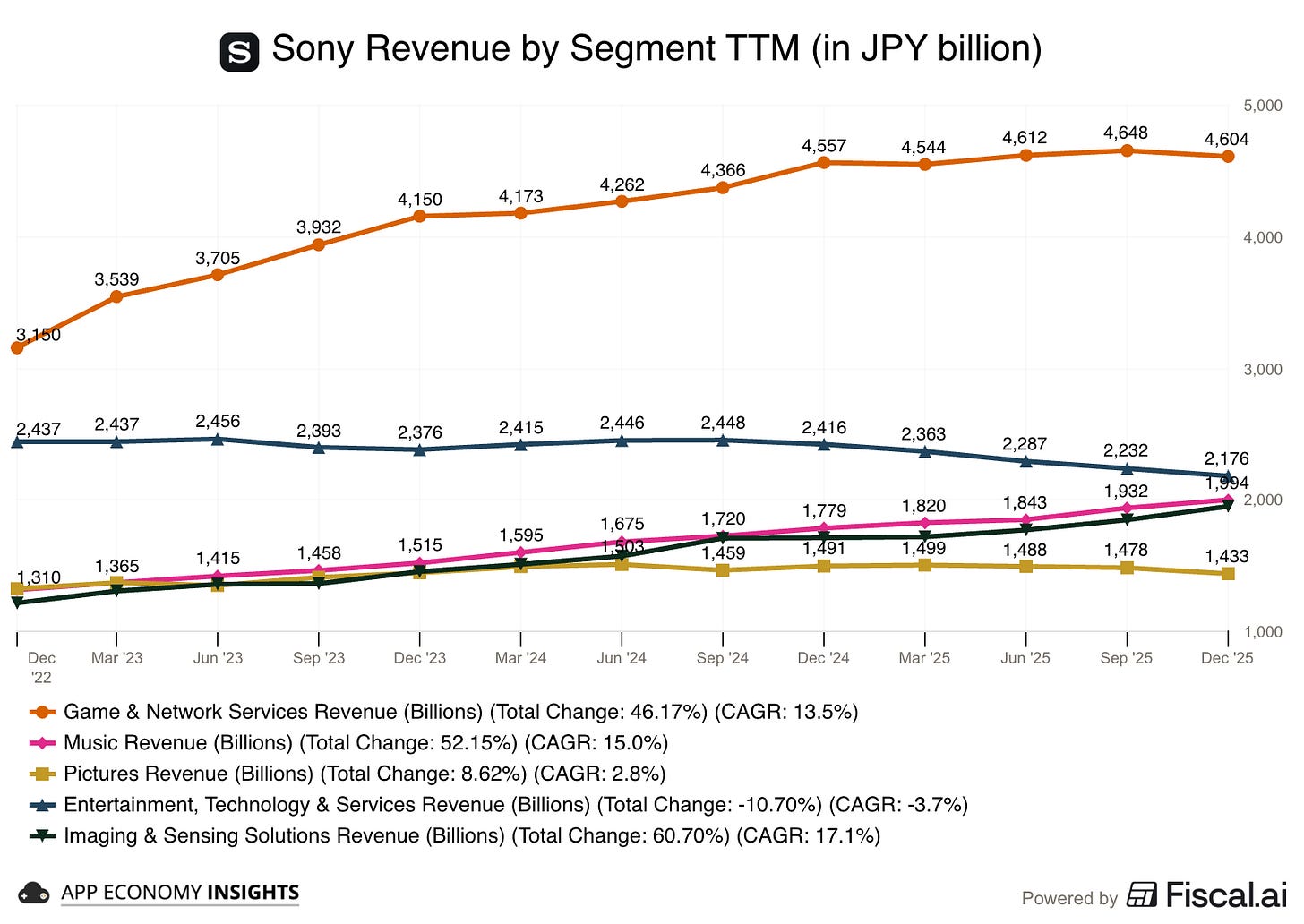

The recent pivot goes beyond the gaming segment. The company’s long-term strategy is to continue exiting low-margin manufacturing.

📺 Bravia-TCL deal: In a move that signals the end of an era, Sony is spinning off its TV business into a joint venture with TCL. The company will hold a 51% controlling stake, while Sony retains 49%. Sony will provide the “brains” (image processing and brand prestige), while TCL provides the “brawn” (manufacturing scale and supply chain efficiency). This move aims to turn the perennially struggling TV division (Entertainment, Technology & Services) into a stable, profitable entity.

🐶 Owning the IP: Sony is doubling down on content ownership. It recently increased its stake in Peanuts Holdings (Snoopy) to 80%, contributing a ¥45 billion gain to its forecast. By owning the IP, Sony ensures its music and film divisions remain essential to platforms like Netflix and Spotify.

💰 Financial streamlining: The partial spin-off of Sony Financial Group is now in effect. This allows Sony to focus its capital and attention entirely on its identity as a “Creative Entertainment Company.”

🔮 Looking forward: Sony raised its full-year operating profit forecast by 8% to ¥1.54 trillion (¥0.11 billion raise). The company may be moving fewer hardware units, but the unit economics are better than ever.