☁️ Amazon: The $50B Kingmaker

Why Andy Jassy wants to level the playing field

Welcome to the Free edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

Amazon (AMZN) is no longer just providing the picks and shovels for the AI gold rush. It is now funding the whole mine.

CEO Andy Jassy explained:

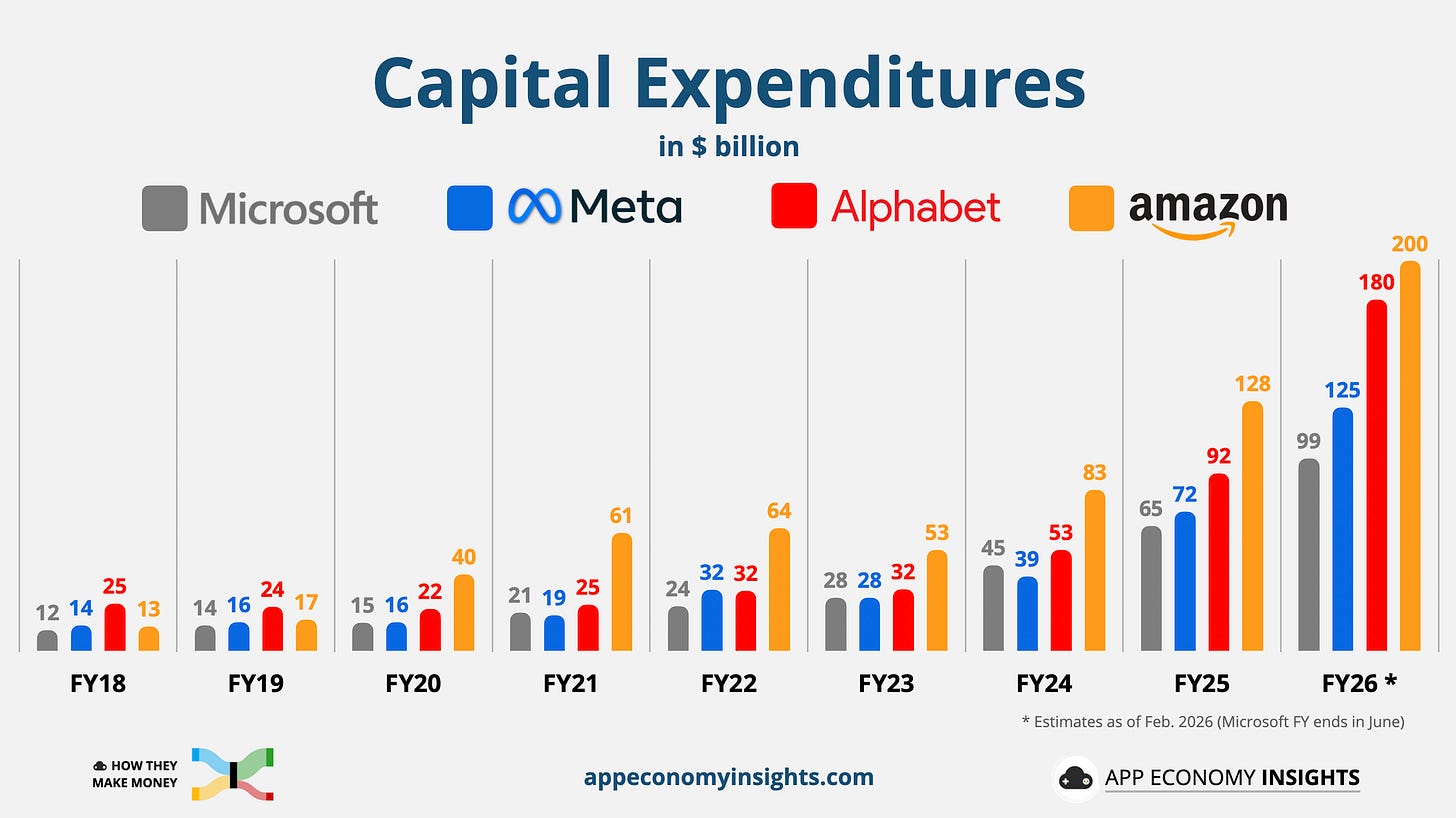

“With such strong demand for our existing offerings and seminal opportunities like AI, chips, robotics, and low earth orbit satellites, we expect to invest about $200 billion in capital expenditures across Amazon in 2026 and anticipate strong long-term return on invested capital.”

With Google announcing ~$180 billion in CapEx for FY26 on Wednesday, it was safe to expect Amazon to come out with an even bigger number. After all, Amazon doesn’t spend a penny on stock buybacks or dividends. As a result, the company can plow even more toward future growth.

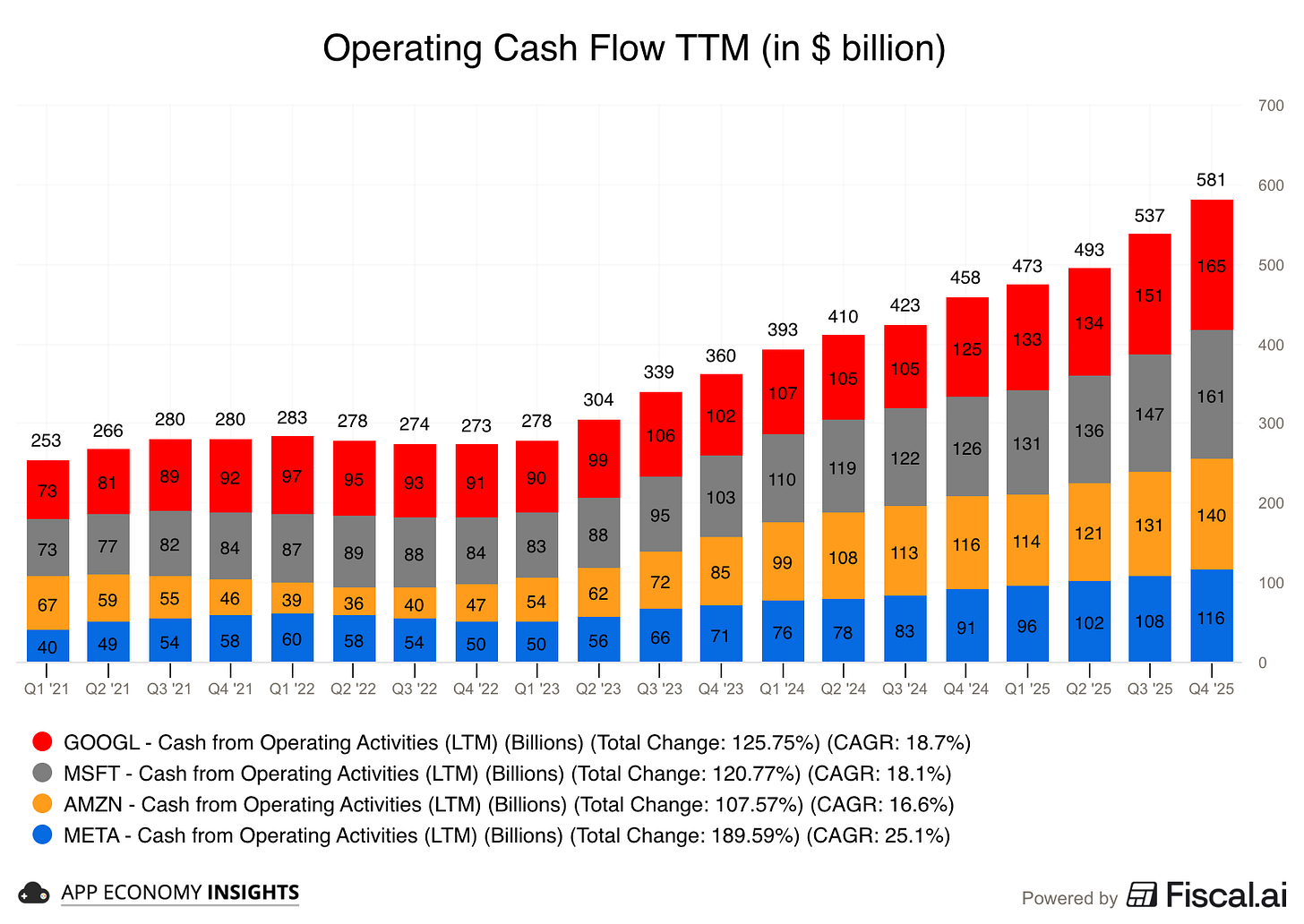

Amazon has the luxury of having a business that generated nearly $140 billion in operating cash flow in 2025 and has a stellar balance sheet. Funding this CapEx ramp is not a problem.

That doesn’t change the fact that these numbers are truly staggering. The market is increasingly anxious about how these investments will play out, as their impact will take many years to materialize. Though, to be fair, the 'Day 1' company has earned the benefit of the doubt.

But wait, there’s more!

Reports surfaced last week that Andy Jassy is in advanced talks to lead a $50 billion investment in OpenAI. If finalized, this would be the largest single check to a private company in tech history, marking a definitive end to the Microsoft-OpenAI monogamy. It would represent half of OpenAI’s massive $100 billion round at a $830 billion valuation reported by The Wall Street Journal.

The strategic logic is a two-fer for Jassy:

Guaranteed AWS boost: OpenAI’s insatiable hunger for cash gives Amazon a unique opening to migrate some of the world’s most high-profile AI workloads onto AWS. This would fund the $38 billion infrastructure deal signed in late 2025, and then some.

Arming the competitor’s competitor: If AGI is the future, Jassy cannot afford to let Gemini get too far ahead. Since OpenAI's greatest needs are liquid capital and specialized compute, Jassy is happy to provide both. He’s effectively ensuring that the next generation of intelligence also runs on Amazon’s custom silicon.

By funding OpenAI’s vision, Amazon ensures OpenAI has the capital to compete for the foreseeable future. But it doesn’t guarantee commercial success for Sam Altman & Co. When the bill comes due, OpenAI will still need a business that can spew tens of billions in profit to make it all worthwhile.

Today at a glance:

Amazon Q4 FY25.

Latest business moves.

Key quotes from the call.

What to watch moving forward.

1. Amazon Q4 FY25

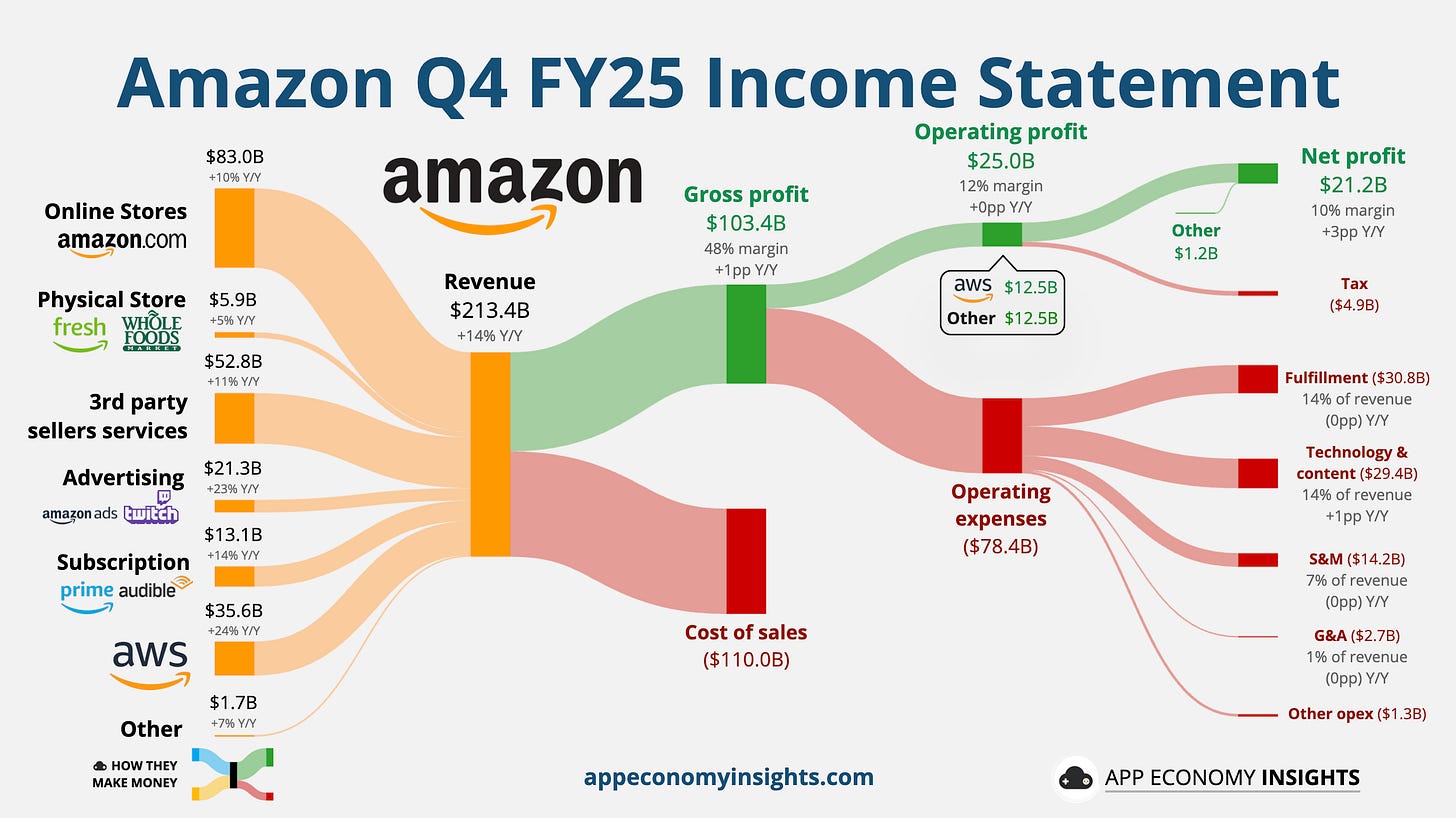

Income statement:

Revenue breakdown:

💻 Online stores (39% of overall revenue): Amazon.com +10% Y/Y.

🏪 Physical store (3%): Primarily Whole Foods Market +5% Y/Y.

🧾 3rd party (25%): Commissions, fulfillment, shipping +11% Y/Y.

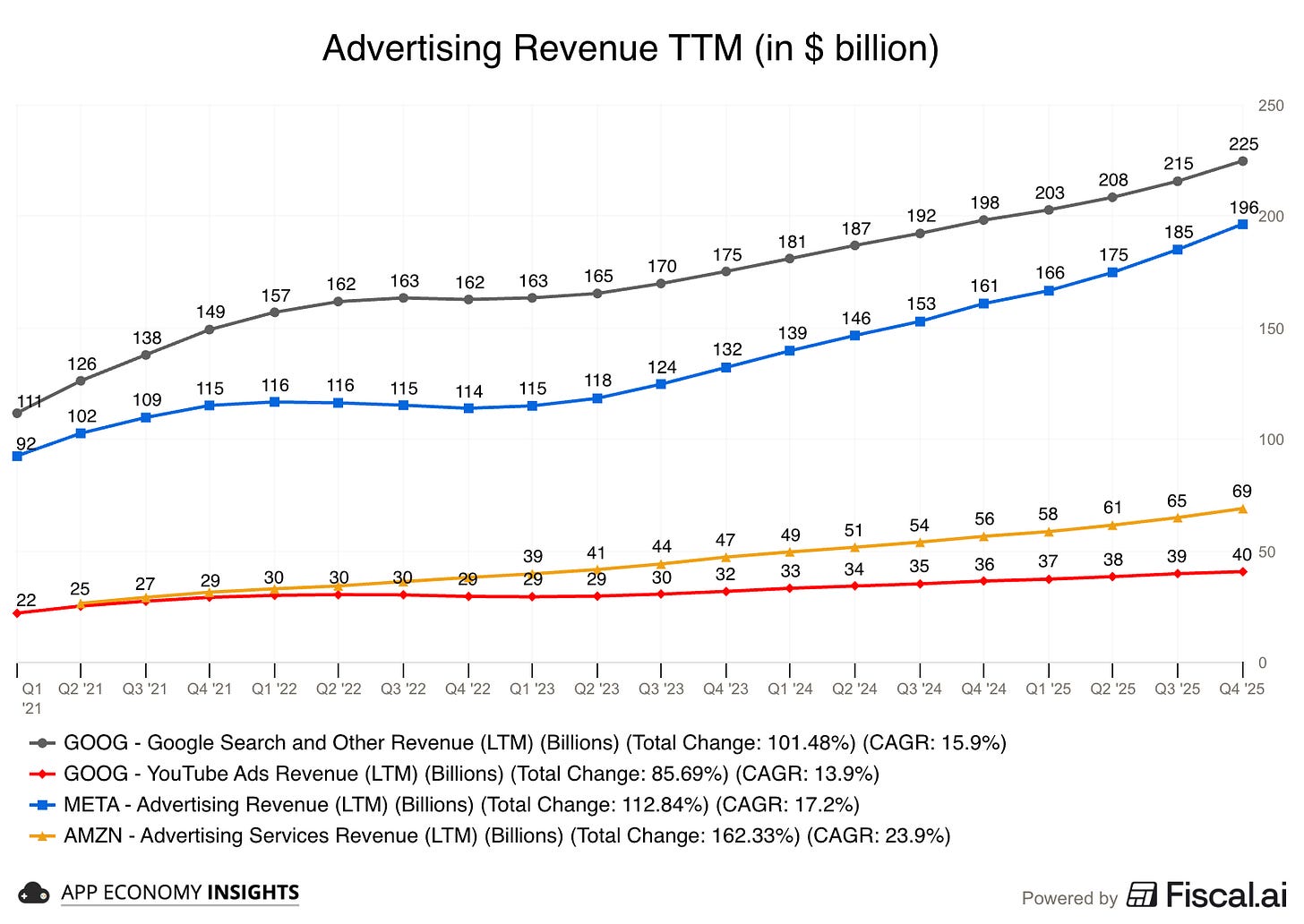

📢 Advertising (10%): Ad services to sellers, Twitch +23% Y/Y.

📱 Subscription (6%): Amazon Prime, Audible +14% Y/Y.

☁️ AWS (17%): Compute, storage, database, & other +24% Y/Y.

Other (1%): Various offerings, small individually +7% Y/Y.

Revenue rose +14% Y/Y to $213.4 billion ($2.2 billion beat).

Gross margin was 48% (+1pp Y/Y).

Operating margin was 12% (+0pp Y/Y).

AWS: 35% margin (-2pp Y/Y).

North America: 9% margin (+1pp Y/Y).

International: 2% margin (-1pp Y/Y).

EPS $1.95 ($0.01 miss).

Cash flow:

Operating cash flow TTM was $139.5 billion (+20% Y/Y).

Free cash flow TTM was $11.2 billion (-71% Y/Y), driven by the operating cash flow growth, offset by a 65% rise in Capex to $128.3 billion.

Balance sheet:

Cash, cash equivalent, and marketable securities: $123 billion.

Long-term debt: $66 billion.

Q1 FY26 Guidance:

Revenue ~$176 billion or +13% Y/Y in the mid-range ($0.8 billion beat).

Operating income ~$19 billion or +3% Y/Y in the mid-range ($22 billion expected).

So, what to make of all this?

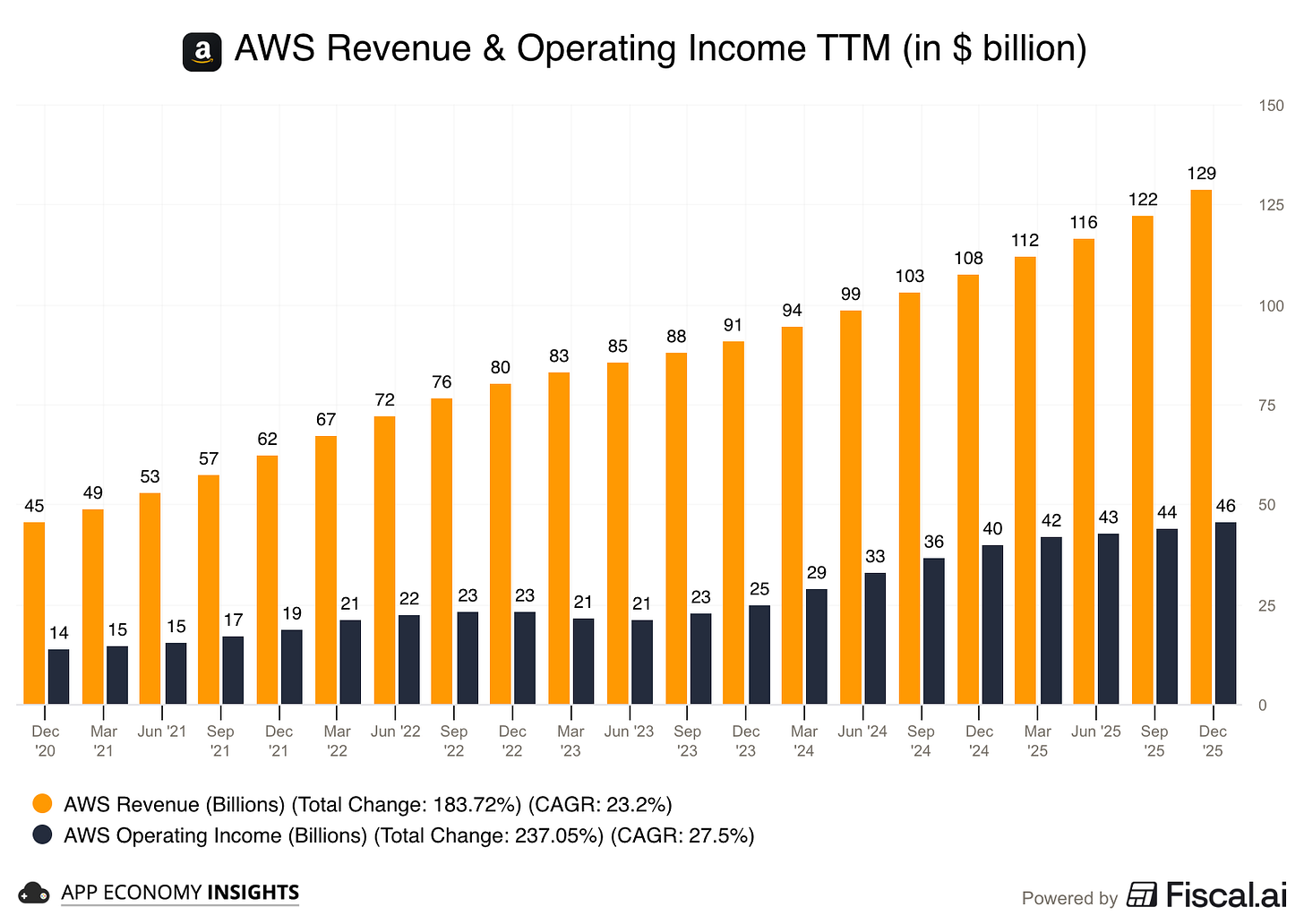

☁️ AWS hits the gas: AWS revenue surged 24% Y/Y, its fastest acceleration in over three years. While it still trails the growth rates of Azure (38% in constant currency) and Google Cloud (48%), it’s from a much larger revenue base. Jassy noted that Amazon's own AI chips are seeing triple-digit growth as customers seek price-performance alternatives to NVIDIA.

📦 Retail efficiency paying off: North America margins expanded to 9% following a large restructuring effort. However, the retail story is now one of ruthless prioritization. Amazon is officially closing all Amazon Fresh and Amazon Go locations (72 stores) and sunsetting the Amazon One palm-payment system by June. If an experiment doesn't have a path to massive scale, it gets cut to fund the AI war chest.

📢 Advertising as a margin pillar: Ad revenue grew 23% to roughly $21 billion this quarter, continuing to outpace retail growth. The high-margin nature of this segment—boosted by Prime Video's new ad tiers—is the secret sauce keeping company-wide operating margins at 12%.

🔮 Guidance for a new scale: Q1 operating income guidance of ~$19 billion came in below analyst estimates. The company expects to absorb a $1 billion incremental cost headwind for Amazon Leo (the rebranded Project Kuiper) in the first quarter alone. While Leo offers huge upside potential, it will weigh on profitability throughout 2026.

2. Latest business moves

📉 Project Dawn: The 30,000-Role Restructuring

Q4 included roughly $1.8 billion in severance costs from the Project Dawn layoffs.

In January, Amazon moved to aggressively flatten its corporate hierarchy, confirming a second wave of 16,000 job cuts. This brings the total reduction to roughly 30,000 corporate roles since October (~10% of the corporate workforce).

Jassy is framing Project Dawn as a move to remove layers of middle management and bureaucracy to return to a “startup” culture. Management explicitly noted that efficiency gains from generative AI are allowing the company to operate with a smaller corporate headcount.

🏥 Amazon One Medical “Health AI” Launch

In January, Amazon expanded its healthcare footprint by launching an agentic Health AI assistant within the One Medical app.

The assistant is designed to handle agentic tasks like managing medications, explaining lab results, and booking appointments based on a patient’s specific medical history.

This creates a tighter link between Amazon’s primary care services and its pharmacy delivery, aiming to make healthcare a frictionless part of the Prime ecosystem.

📢 Unified Ad Stack

At the November 2025 “unBoxed” conference, Amazon officially merged its Demand Side Platform (DSP) and Sponsored Ads into a single, unified Campaign Manager.

The update removes the friction between upper-funnel (streaming/display) and lower-funnel (search) ads, giving advertisers a holistic view of ROAS.

A new AI-powered “Ads Agent” now allows marketers to query performance data using natural language, democratizing complex data analysis for smaller sellers.

3. Key quotes from the earnings call

Check out the earnings call transcript on Fiscal.ai here.

Andy Jassy on AWS:

“AWS is now a $142 billion annualized run rate business [...] As fast as we install this AI capacity, we are monetizing it. So it’s just a very unusual opportunity.”

Jassy is refuting any market-share anxiety and has highlighted that AWS is adding more absolute dollars than rivals. He sees the current AI boom as a structural shift that justifies the massive CapEx ramp.

On custom silicon:

“Our chips business, inclusive of Graviton and Trainium, is now over $10 billion in annual revenue run rate [...] Trainium is the majority underpinning of Bedrock usage today.”

The $10 billion milestone proves that Amazon’s vertical integration is a massive commercial reality. By offering a cost advantage, Amazon is creating a gravity well that makes it attractive for high-burn partners like OpenAI or Anthropic. The cheaper the compute, the stickier the ecosystem.

On the barbelled AI market demand:

“On one end, you have the AI labs who are spending gobs and gobs of compute right now [...] And then at the other side of the barbell, you've got a lot of enterprises who are getting value out of AI in doing productivity and cost avoidance types of workloads.”

Jassy sees the AI labs as the immediate “anchor tenants” while waiting for the middle of the barbell (enterprise production workloads) to mature.

On agentic shopping (Rufus):

“Customers who used Rufus are about 60% more likely to complete a purchase. [...] Rufus can research products, track prices, and auto-buy, purchasing a product in our store when it reaches your set price.”

If agentic commerce increases conversion by 60%, the massive AI spend starts to pay for itself through the retail flywheel. Rufus is a high-velocity sales closer.

4. What to watch moving forward

☁️ AWS market share and margins

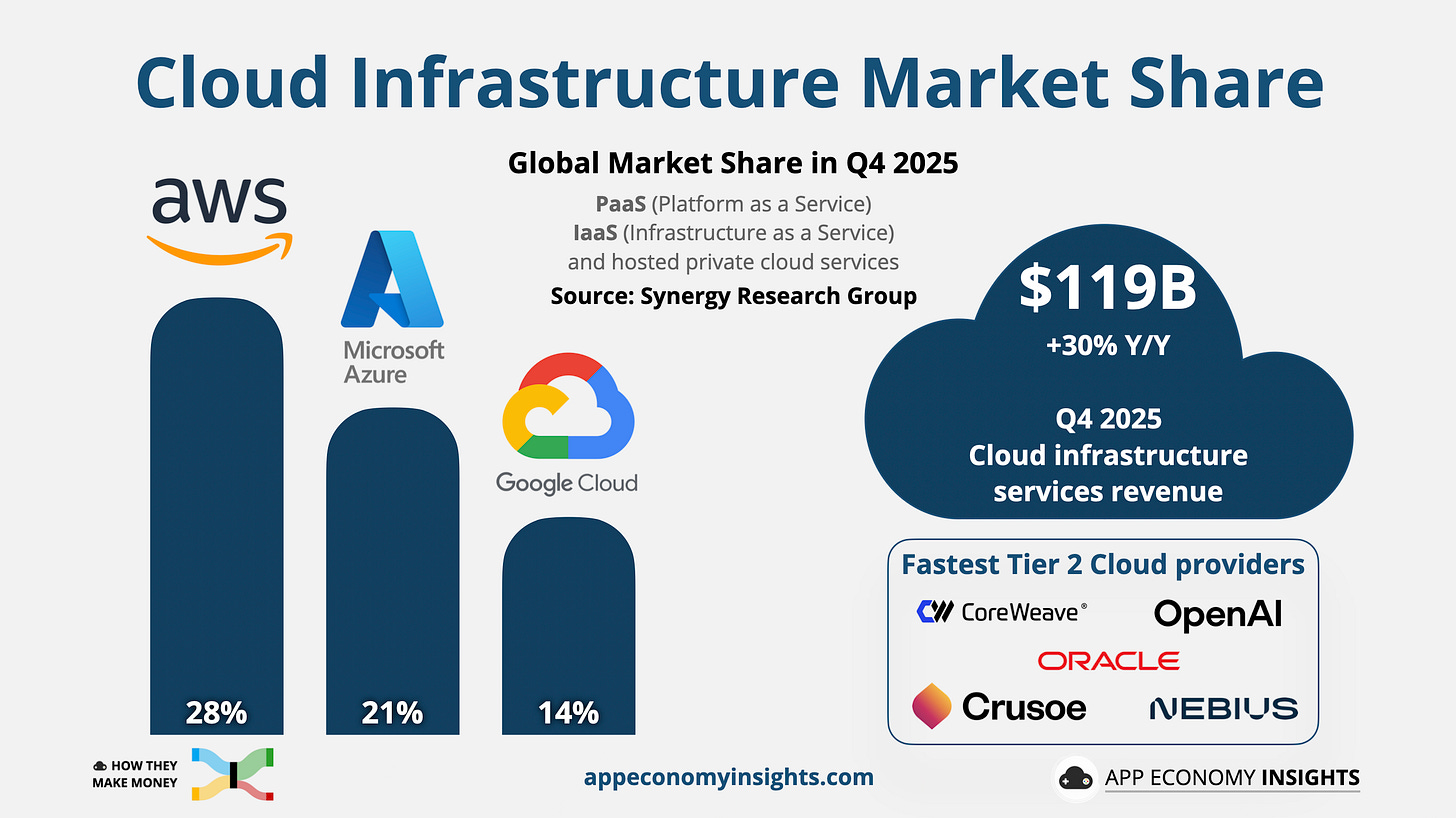

Total cloud infrastructure market spending grew by 30% Y/Y to $119 billion in Q4 2025, the ninth consecutive quarter of accelerating growth. Synergy Research Group projects growth above 20% for the next 5 years, with enterprise cloud services, social media, and search expanding.

AWS had a commanding 28% market share, compared to 21% for Microsoft Azure and 14% for Google Cloud.

What about margins? AI-driven CapEx and stock-based comp trimmed AWS margins by 2 points to 35%. Management had warned margins could fluctuate as AI investments flow through the P&L. AI is a short-term headwind on margin, but management expects the AI margin to match that of the non-AI business over time.

🛰️ Amazon Leo Pivot (formerly Kuiper)

In recent months, Amazon’s satellite internet ambitions hit a regulatory bottleneck.

Rebrand to Amazon Leo: Amazon officially rebranded Project Kuiper to Amazon Leo in November, launching a public beta waitlist. The company aims to launch its service in 2026.

FCC Extension Request: Amazon just filed for a 24-month extension with the FCC. They are now asking for until July 2028 to meet the “half-constellation” milestone (1,618 satellites), citing a global shortage of heavy-lift rockets.

Production vs. Launch Gap: While Amazon has hundreds of flight-qualified satellites ready in their Kirkland facility, they only have roughly 180 satellites in orbit as of early 2026. This bottleneck is the primary risk to watch, though they have secured 10 additional Falcon 9 launches from SpaceX to bridge the gap.

Jassy explained:

“Leo will offer enterprise-grade performance [...] connecting directly to AWS. [...] we expect to launch commercially in 2026. We have dozens of commercial agreements already signed, including with AT&T.”

He’s pitching Leo as a specialized AWS feature rather than a consumer ISP. By bypassing the public internet, Amazon is creating a secure, space-based “private lane” for government and corporate data.

🧠 The Nova 2 & Nova Forge Era

Amazon is moving beyond hosting models to pioneering “pre-training” as a service.

Custom models: Through Nova Forge, enterprises can bake their proprietary data into a model’s foundation at the start. Jassy calls these custom variants "Novellas." He likened the process to "teaching a child a language early in life," so it becomes part of their permanent learning foundation.

Move to action: With Nova Act, AWS is pivoting from providing models to providing autonomous agents. The goal is to move browser-based task reliability from 60% to 90%, turning Rufus (and enterprise bots) from search assistants into execution engines.

This is Amazon’s data moat. By building a Novella on AWS, an enterprise is anchoring its intellectual property to the Amazon ecosystem.

🏗️ The CapEx Payoff

In short, Big Tech is using all the cash generated by current operations to invest in AI. Even Microsoft’s CapEx was nearly $73 billion in the past six months and will likely be far ahead of Wall Street’s estimates.

The chart below essentially shows the purchasing power of these giants. They can reinvest all of this into AI without raising external capital.

Amazon’s unique advantage has been its ‘Day 1’ posture, implying no buybacks or dividends. Every dollar is plowed into future growth. Now it’s possible the rest of Big Tech will adapt its capital allocation strategy to seize the moment.

No one is as aggressive as Amazon right now. They have proven time and again that reinvesting in future growth is money well spent.

With $200 billion lined up for FY26, the stakes and the potential rewards have never been higher. But it might be getting a little too hot, even for long-term-minded AMZN shareholders.

That’s it for today!

Stay healthy and invest on!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Disclosure: I am long AMZN, GOOG, and META in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Amazon plans to spend $200 billion on infrastructure next year. To put that in perspective, that is nearly half the entire annual budget of the Government of Canada. We rely on Amazon Web Services to host sensitive federal data. But when a vendor has pockets that deep, the power dynamic shifts. It raises tough questions for Parliament about who really holds the keys to our digital sovereignty.