💻 Microsoft: Workflow Wars

And why the Redmond giant want to be a 'token factory'

Welcome to the Free edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

The Agentic Land Grab

For decades, Microsoft’s moat was the desktop. If you were working, you were inside a Microsoft app. Over the past few months, the battlefield has shifted from chatbots to agentic workflows, and the competition is now pushing closer to the file system itself.

The recent release of Claude Cowork puts that shift into focus. While Copilot is deeply embedded across Microsoft’s ecosystem, Claude’s new capability behaves more like a teammate with direct access to local files. At the same time, the viral rise of open-source Moltbot (formerly Clawdbot) demonstrates how quickly autonomous agents can spread when embedded in everyday communication tools.

This creates a strategic paradox. Microsoft is increasingly the foundry for its own competitors. By hosting these models on Azure, Microsoft wins on infrastructure even when it loses at the interface.

This quarter, Satya Nadella signaled a shift in focus toward optimizing for tokens per watt per dollar rather than just software seats. At the same time, he acknowledged rationing scarce GPU resources and prioritizing their 15 million Copilot subscribers over external Azure customers to maximize long-term value.

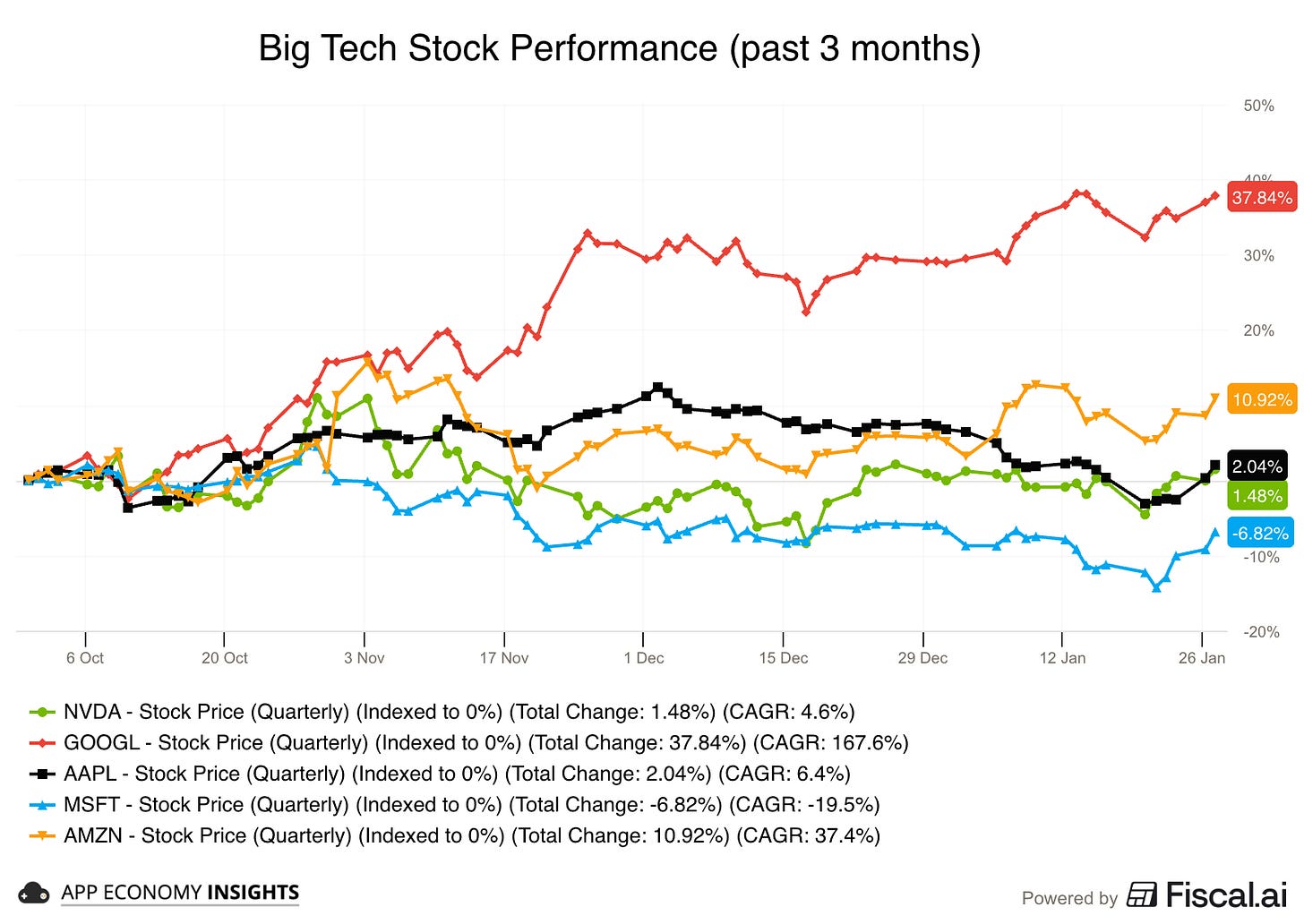

Despite this continued momentum, the stock has been a relative laggard in recent months. Is the market questioning the durability of Microsoft’s per-seat subscription business? Or has the stock become a public proxy for OpenAI sentiment?

Microsoft’s headline numbers beat estimates in the December quarter, but the stock fell post-earnings as investors likely focused on the long-term returns from surging CapEx and declining cloud margins.

Here’s what stood out.

Today at a glance:

Microsoft’s Q2 FY26.

The agentic stack.

Earnings call takeaways.

What moves the needle?

1. Microsoft’s Q2 FY26

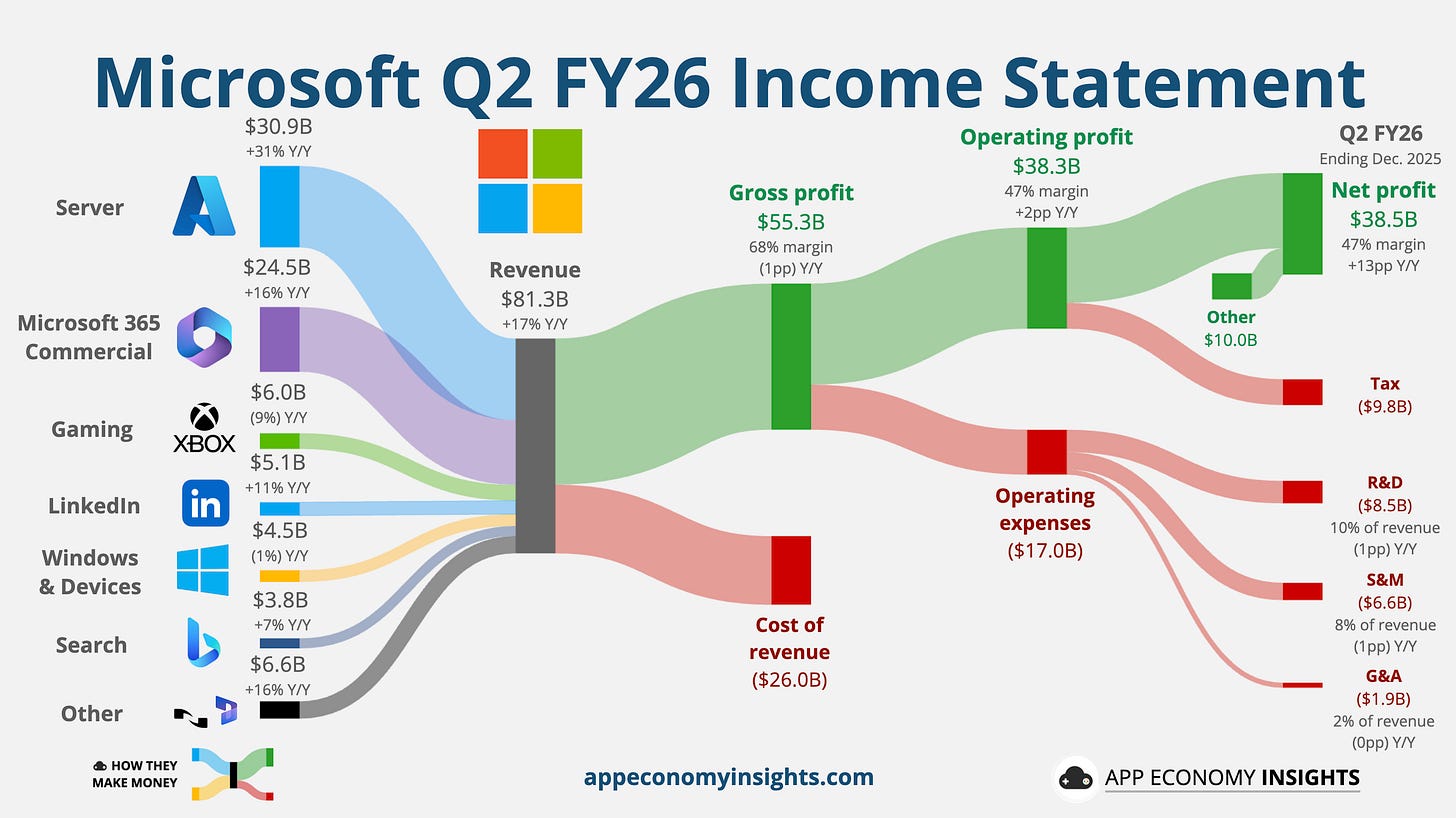

Income Statement:

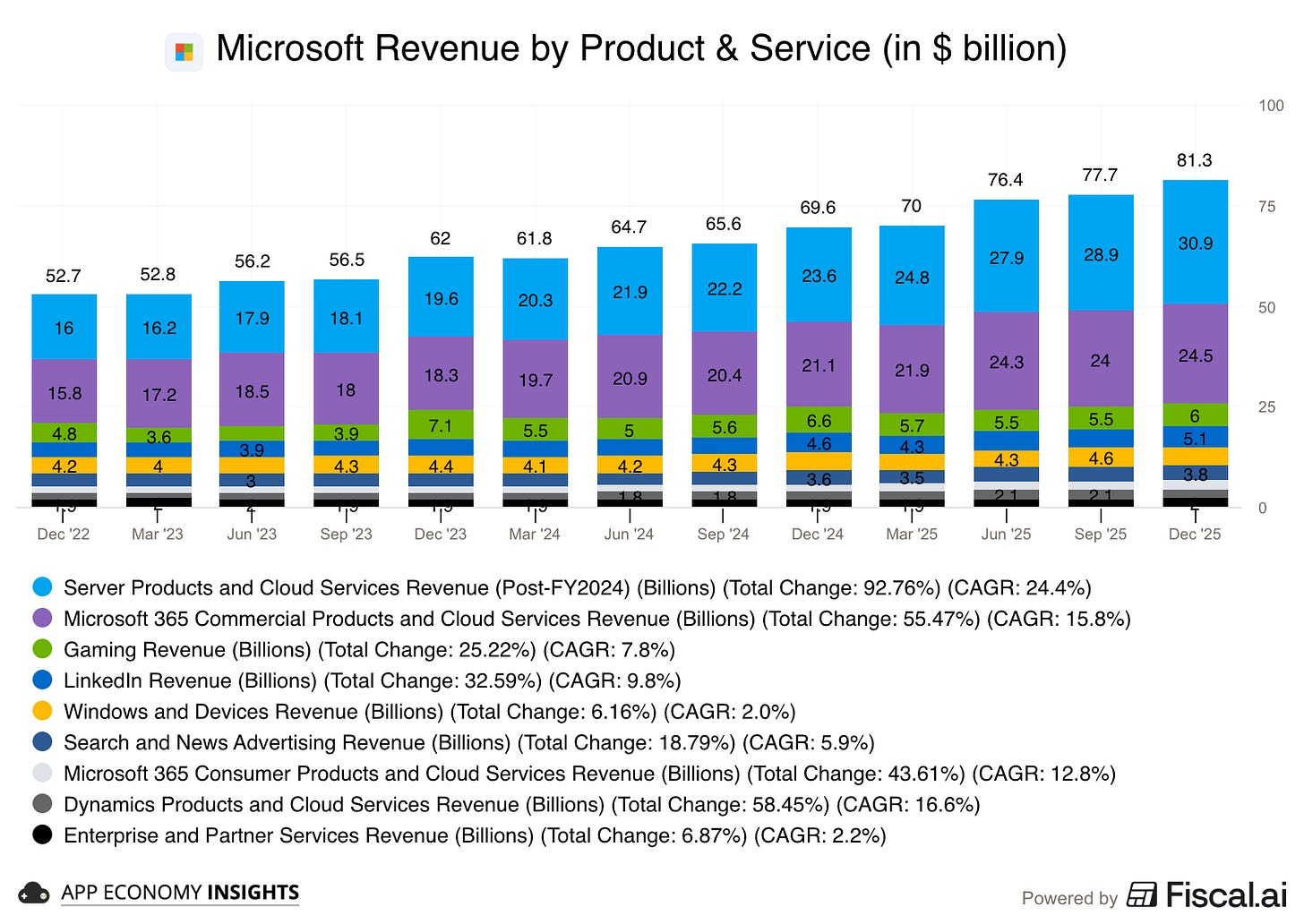

Revenue +17% Y/Y to $81.3 billion ($1.0 billion beat).

Gross margin 68% (-1pp Y/Y).

Operating margin 47% (+2pp Y/Y).

Non-GAAP EPS $4.14 ($0.22 beat).

Product and Services Breakdown:

☁️ Server products and cloud services $30.9 billion (+31% Y/Y).

📊 M365 Commercial products and cloud services $24.5 billion (+16% Y/Y).

🎮 Gaming $6.0 billion (-9% Y/Y).

👔 LinkedIn $5.1 billion (+11% Y/Y).

🪟 Windows and Devices $4.5 billion (-1% Y/Y).

🔎 Search and news advertising $3.8 billion (+7% Y/Y).

💻 Other $6.6 billion (+16% Y/Y).

Core business segments:

📊 Productivity and Business Processes grew 16% Y/Y to $34.1 billion ($0.7 billion beat), driven by M365 Copilot and E5 momentum.

☁️ Intelligent Cloud grew 29% Y/Y to $32.9 billion ($0.5 billion beat), driven by Azure across all workloads, customer segments, and geographies.

🎮 More Personal Computing declined by 3% Y/Y to $14.3 billion ($0.1 billion miss), with execution challenges for Search and underperforming Xbox content.

Key Trends:

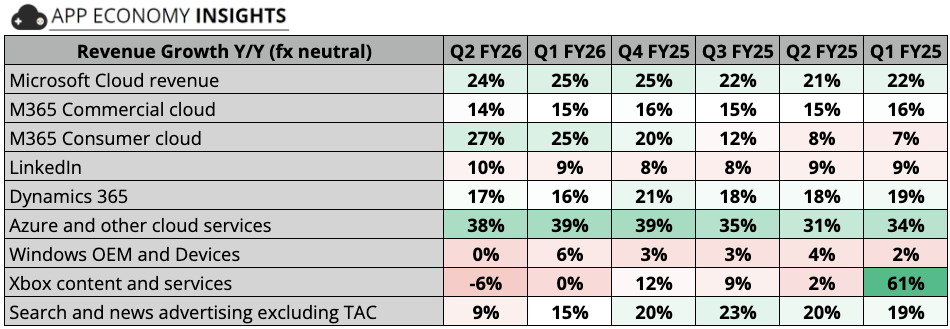

The table below compares growth year-over-year in constant currency. Some of the products and services overlap.

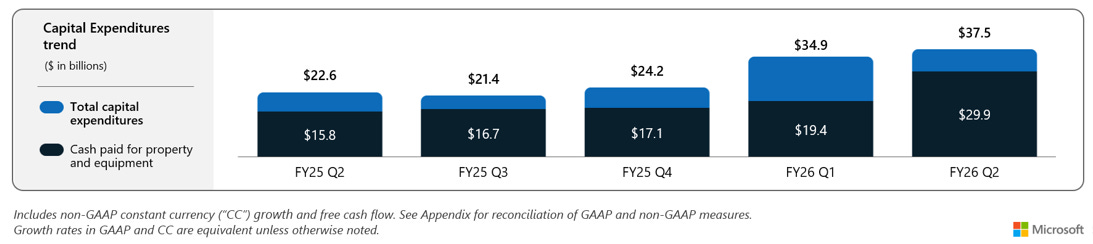

Cash flow:

Operating cash flow grew 60% Y/Y to $35.8 billion.

Free cash flow declined by 9% Y/Y to $5.9 billion.

Balance sheet:

Cash, cash equivalents, and investments: $89.5 billion.

Long-term debt: $35.4 billion.

So what to make of all this?

📉 Azure's slight deceleration: At 38% constant currency growth (vs. 39% in Q1), Azure is "bumping around" just as expected. Growth remains capped by supply rather than demand.

🤖 Copilot is scaling: Satya Nadella announced 15 million paying subscribers for M365 Copilot. While this is only a ~4% conversion of the 400+ million Office base, it represents a meaningful start for the $30/month service.

🎮 Xbox hits a wall: Total gaming revenue fell 9%, with hardware sales plummeting 32%. Most concerning was the ‘Xbox content and services’ falling 6% in constant currency (the first dip in over a year). Call of Duty: Black Ops 7 did not match the record-breaking performance of the previous year’s release.

🔮 Visibility with a catch: Commercial Remaining Performance Obligations (RPO) surged 110% Y/Y to $625 billion. However, 45% of that backlog ($281 billion) is now tied to a single multi-year deal with OpenAI, raising questions about concentration risk and circular revenue.

📉 Margin reality check: Intelligent Cloud gross margins fell over 4 percentage points Y/Y to 59%. Management acknowledged that while Azure is growing rapidly, the massive costs of AI infrastructure are scaling faster than revenue, leading to near-term margin compression.

🏗️ CapEx record-breaker: Capital expenditures jumped 66% Y/Y to $37.5 billion, with roughly two-thirds focused on AI chips. Microsoft is effectively doubling its data center footprint over two years to meet Azure demand.

🧠 OpenAI investments create noise: Microsoft reported a $7.6 billion GAAP net gain ($1.02 per share) from its OpenAI investment following its recapitalization. Microsoft’s 27% stake in the for-profit OpenAI group is worth roughly $135 billion.

💵 Capital allocation Despite the rising CapEx bill, Microsoft increased its shareholder returns by 32% Y/Y to $12.7 billion this quarter (via dividends and buybacks). Microsoft is the only hyperscaler building a generational AI infrastructure while simultaneously aggressively returning cash to shareholders.

2. The Agentic Stack

Microsoft Foundry and the Agent Factory

Microsoft recently rebranded Azure AI Foundry to Microsoft Foundry.

The rebranding marks a shift in how the company views its competitive moat. By dropping the “Azure” prefix, Microsoft is signaling that this is no longer just a cloud service, but the central “operating system” for the agentic era.

Why the rebranding matters:

Platform tax: Microsoft Foundry now hosts over 11,000 models, including direct competitors like Anthropic’s Claude 4.5 and Mistral. Microsoft is positioning itself to win regardless of which model dominates the LLM wars.

Consolidation of the stack: It unifies previously fragmented tools (Azure AI Studio, the SDKs, and the Agent Service) into a single Agent Factory. This reduces friction for enterprises moving from chatbots to autonomous agents.

Beyond the cloud: The new Foundry Local capability allows models to run on local Neural Processing Units (NPUs), extending Microsoft’s reach from the massive Iowa data centers directly onto the user’s laptop.

By becoming the Foundry for the world’s AI, Microsoft is attempting to replicate the TSMC model for software: providing the indispensable infrastructure that rivals and partners alike must use to build their future.

Maia and the silicon hedge

A major piece of the execution puzzle fell into place this week with the official launch of Maia 200, Microsoft’s second-generation custom AI accelerator. While the first generation signaled intent, Maia 200 is a performance powerhouse designed for the agentic era.

The chip is specifically optimized for inference, the phase where AI models generate responses. As agentic workflows increase compute intensity dramatically, owning the silicon can critically boost margins.

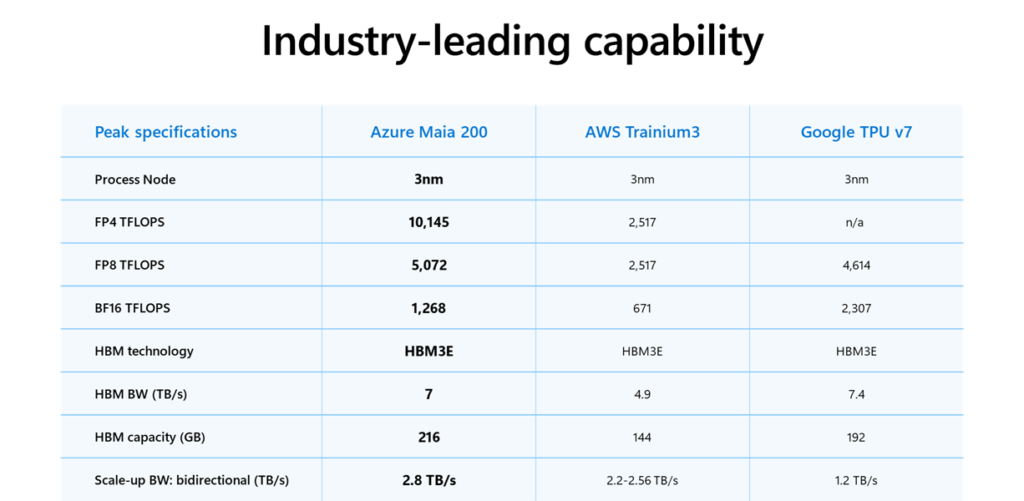

The numbers that matter:

Performance: Built on TSMC’s 3nm process with 140 billion transistors, it delivers 3x the performance of Amazon’s Trainium and edges out Google’s latest TPU.

Efficiency: Microsoft claims a 30% improvement in performance per dollar compared to its current fleet.

Memory: With 216GB of HBM3e memory, it’s designed to handle the massive reasoning models like GPT-5.2 without the bottlenecks that plague general-purpose GPUs.

By deploying Maia 200 first in its Iowa and Arizona data centers, Microsoft is beginning to vertically integrate its stack. It’s all about gaining the leverage to offer better pricing for Azure customers while protecting its own margins as Copilot usage explodes.

3. Earnings call takeaways

Check out the earnings call transcript on Fiscal.ai here.

Satya Nadella and Amy Hood shared critical milestones across Microsoft’s portfolio.

On AI scale & infrastructure efficiency:

“We added nearly 1 GW of total capacity this quarter alone. […] We connected both Atlanta and Wisconsin sites through an AI WAN to build a first-of-its-kind AI super factory. […] The key metric we are optimizing for is tokens per watt per dollar.”

Microsoft is networking data centers into “super factories” to bypass local power constraints. By shifting the focus to tokens per watt per dollar, management is signaling that software optimization (throughput) is now as critical as physical footprint for maintaining margins.

On the demand signals:

“Commercial RPO increased to $625 billion […] up 110% year-over-year. […] Approximately 45% of our commercial RPO balance is from OpenAI. […] 55% or roughly $350 billion is related to the breadth of our portfolio.”

Demand is heavily concentrated. While the OpenAI contract creates quarterly volatility in bookings, the non-OpenAI backlog is still growing at a robust 28%, proving that AI demand is diversifying across the enterprise base.

On custom silicon (Maia & Cobalt):

“Maia 200 delivers 10+ petaflops at FP4 precision with over 30% improved TCO (Total Cost of Ownership). […] Cobalt 200 is another big leap forward, delivering over 50% higher performance. […] We want the fleet at any given point in time to have access to the best TCO.”

Vertical integration is accelerating. By moving inferencing workloads to Maia 200, Microsoft can reduce its reliance on third-party silicon for its first-party apps (think Copilot). The goal is to protect gross margins despite rising CapEx.

On the agentic shift:

“You can think of agents as the new apps. […] Paid Microsoft 365 Copilot seats are up over 160% year-over-year. […] Average number of conversations per user doubled year-over-year. […] Usage intensity is record-breaking.”

We are moving from chatbot (simple Q&A) to macro-delegation (agents performing multi-step tasks). The doubling of usage intensity is bullish and runs counter to the narrative that no one uses Copilot. It justifies the seat expansion and suggests Copilot is becoming a daily utility rather than a novelty.

On CapEx ROI & capacity allocation:

Azure’s 38% growth (constant currency) was actually a choice, not a ceiling.

“If I had taken the GPUs that just came online in Q1 and Q2 […] and allocated them all to Azure, the KPI would have been over 40. […] We want to be able to allocate capacity […] to build the best LTV portfolio.”

Management is intentionally starving some Azure demand to feed higher-margin/higher-LTV (Lifetime Value) products like Copilot and GitHub. This is a sophisticated capacity arbitrage play to maximize the company's total profitability.

4. What moves the needle

🔌 OpenAI’s $281 billion backlog: The finalized $250 billion commitment from OpenAI effectively de-risks Microsoft’s massive capex, giving Azure a guaranteed floor for growth through 2032. However, with OpenAI now a Public Benefit Corporation, the execution risk shifts to how efficiently Microsoft can fulfill this demand. Oh, and we are assuming OpenAI can pay.

💸 Custom silicon leverage: If Microsoft can successfully shift inference workloads away from expensive third-party GPUs to their own 3nm silicon (Maia), they can protect Azure margins even as compute-intensive agentic tasks become the norm.

🧠 M365 pricing power: The announced price hikes for July 2026 (up to 33% for some tiers) are the next big catalyst. Microsoft is betting that the added value of Copilot and advanced security is now sticky enough to justify a significant lift for Average Revenue Per User (ARPU) across its 400+ million commercial seats.

⚖️ Regulatory interoperability: EU and UK pressure has moved beyond unbundling Teams to a focus on “interoperability.” New 2026 scrutiny is investigating whether Microsoft’s “gateway” position (via Windows and Entra) unfairly favors Copilot over independent agents like Moltbot or Claude.

Next up:

A massive PRO coverage tomorrow with nearly 30 companies visualized.

Deep dive into Google and Amazon’s earnings next week. We’ll visualize how the cloud race stacks up.

That’s it for today!

Stay healthy and invest on.

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Disclosure: I own AMZN, GOOG, and META in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.