📊 PRO: This Week in Visuals

JNJ PG ABT ISRG SCHW UAL

Welcome to the Saturday PRO edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

💊 J&J: Catapulting Growth

🧴 P&G: The Softest Quarter

🧬 Abbott: Growing Pains

🦾 Intuitive Surgical: da Vinci 5 Liftoff

🏦 Schwab: Asset Gathering Machine

🛩️ United Airlines: Cleared for Takeoff

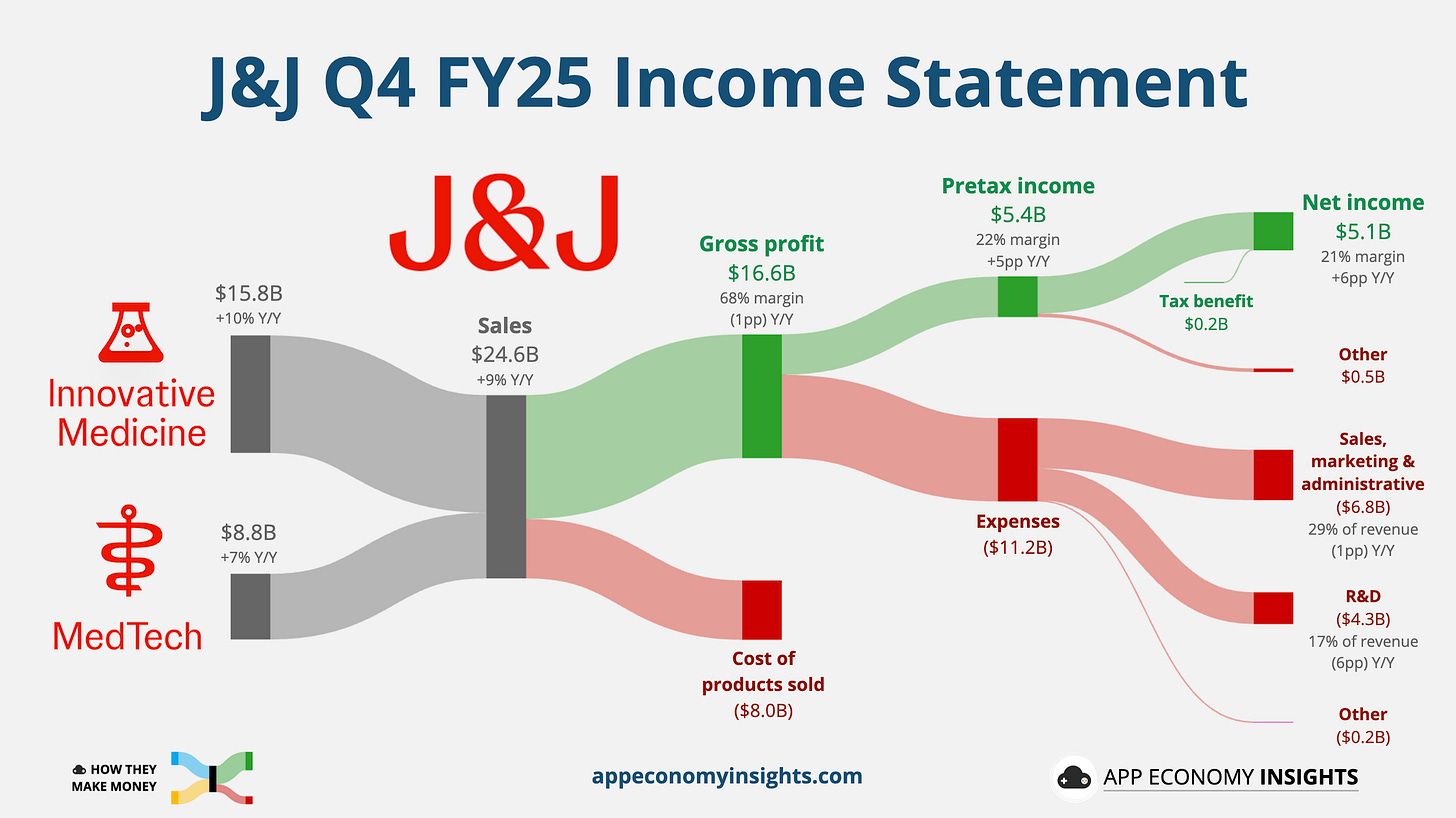

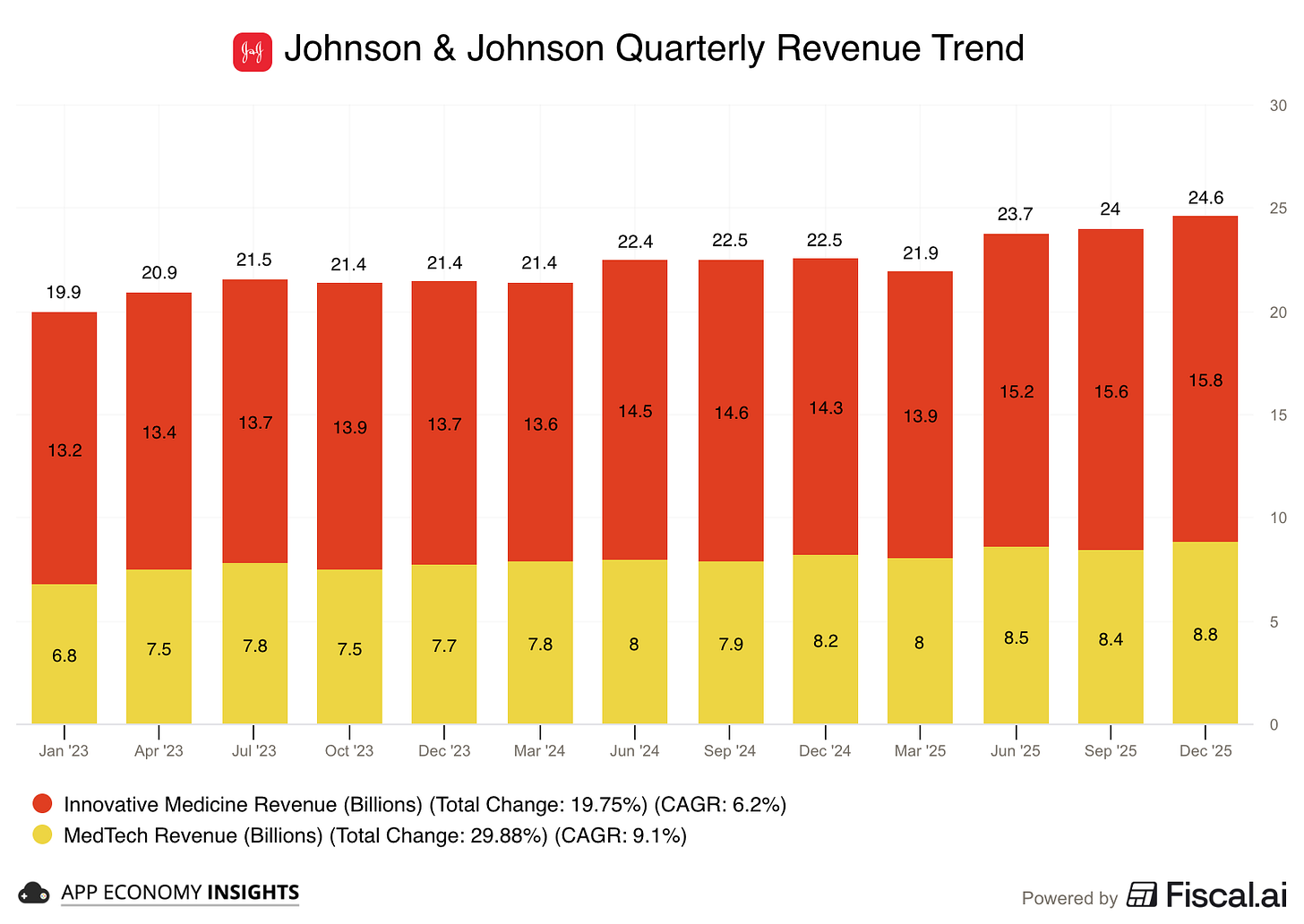

1. 💊 J&J: Catapulting Growth

Johnson & Johnson’s Q4 revenue rose 9% Y/Y to $24.6 billion ($440 million beat) and adjusted EPS came in at $2.46 (in-line). The results validated management’s declaration of 2025 as a “catapult year,” as robust performance in Innovative Medicine (+10%) and MedTech (+7%) helped the company successfully bridge its patent cliff.

The pharmaceutical portfolio executed a critical pivot. Soaring sales of Tremfya (+68%) and the oncology powerhouse Darzalex (+27%) more than offset a steep 48% decline in Stelara revenue caused by biosimilar competition.

In MedTech, the cardiovascular segment remained a standout, with Shockwave (+23%) and Abiomed (+20%) proving the value of recent high-profile acquisitions.

Looking ahead, J&J issued bullish FY26 guidance, projecting revenue to break the $100 billion barrier for the first time (midpoint $100.5 billion). Despite facing ~$500 million in expected tariff costs, a new drug pricing deal with the White House, and renewed volatility in talc litigation, management remains confident. J&J is targeting double-digit growth by the end of the decade as it finalizes the separation of its orthopedics business.

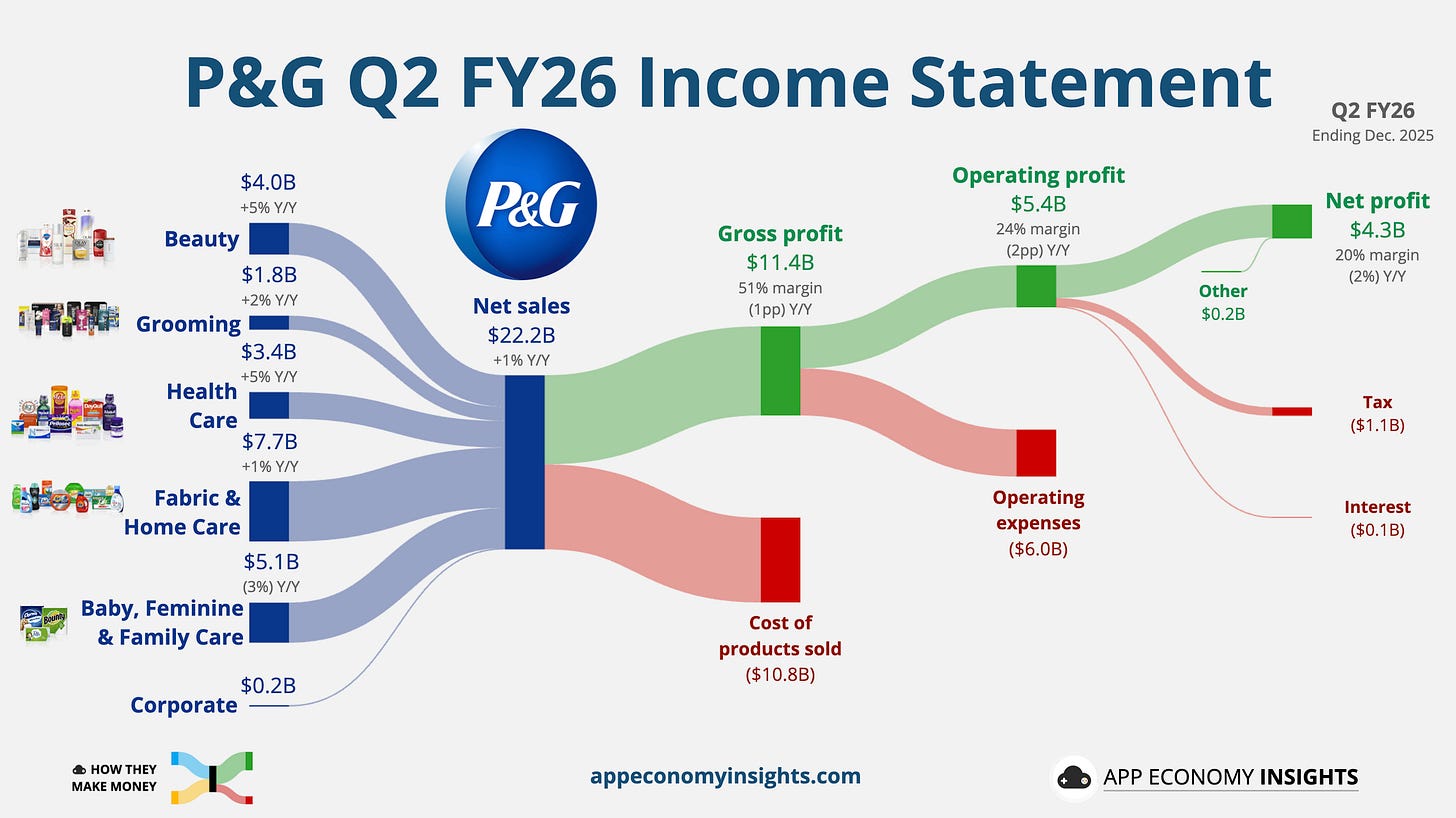

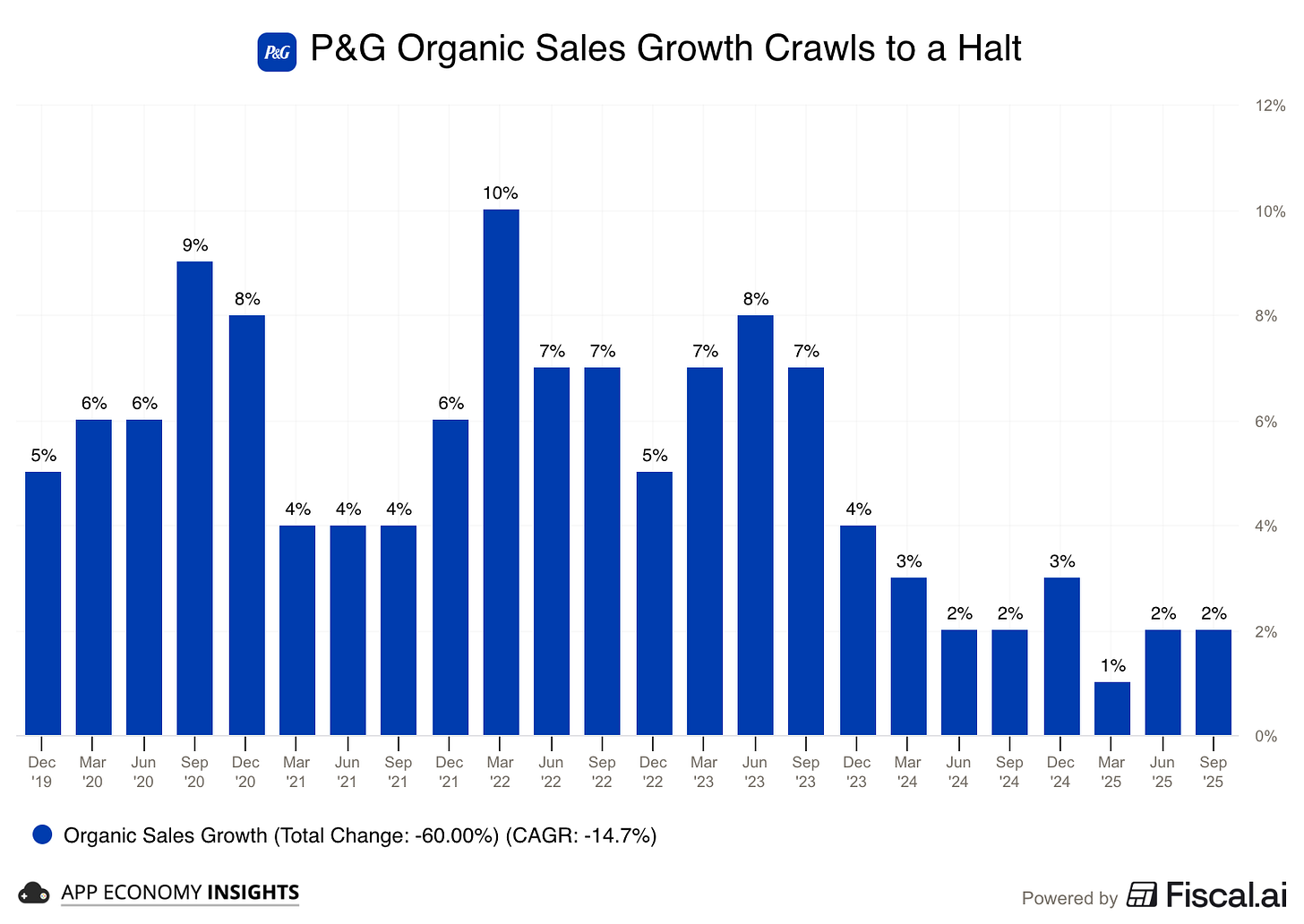

2. 🧴 P&G: The Softest Quarter

P&G hit a speed bump in Q2 FY26, reporting revenue growth of 1% Y/Y to $22.21 billion ($80 million miss) and core EPS of $1.88 ($0.02 beat). Organic sales growth stalled to flat (0%), as a 1% price increase was fully negated by a 1% decline in volume. This marks the slowest organic growth pace in a decade, driven largely by a 2% decline in the critical North American market.

Management attributed the volume weakness to tough year-over-year comparisons (consumers hoarded essentials last year ahead of port strikes) and temporary headwinds like the government shutdown. While the Family Care segment struggled (-3%), the International business remained a bright spot, with strong growth in Latin America (+8%) and Europe (+6%).

Despite the sluggish top-line, CFO Andre Schulten declared that P&G has “completed what we fully expect will be the softest quarter of the year.” The company maintained its full-year guidance for organic sales (0% to +4%) and Core EPS growth, betting on a second-half rebound driven by new product innovations and stabilizing US demand.