☁️ SaaSpocalypse Now

And a look at Intel's turnaround progress

Welcome to the Free edition of How They Make Money.

Over 280,000 subscribers turn to us for business and investment insights.

In case you missed it:

FROM OUR PARTNERS

Nuclear Power’s “Rediscovery” Has $10 Trillion Potential

Bank of America says nuclear energy could hold “the answer to the world’s power shortages,” creating a potential $10 trillion market. Big tech suppliers alone will produce enough nuclear energy to power 15 Hoover Dams.

Rare metals are critical to fueling nuclear plants, and that’s creating new demand for lithium. So when American startup EnergyX announced they plan to supply nuclear-grade lithium, investors noticed.

EnergyX already earned investment from General Motors and POSCO for their lithium recovery tech. However, with this new development, they’re preparing to fuel more than just lithium-ion batteries.

They already have a $1.1B/year revenue opportunity at projected market prices in Chile. Now, you can join 40,000+ people as an EnergyX shareholder before their share price increases after February 26.

See important partner disclosure below.

A Tale of Two AI Markets

If you have followed headlines to start 2026, you have likely noticed what investors and operators are calling the Great SaaS Meltdown, or more dramatically, the SaaSpocalypse.

What initially seemed like a short-term selloff is starting to look more durable. The market is reassessing how enterprise software should be valued in an AI-driven world.

While software searches for a floor, the hardware layer is seeing historic investment. Yesterday, we got a fresh look at whether Intel is finally capturing its share of that spend and how its turnaround is progressing.

Today at a glance:

☁️ The Great SaaS Repricing

🏭 Intel’s Supply Squeeze

1. ☁️ The Great SaaS Repricing

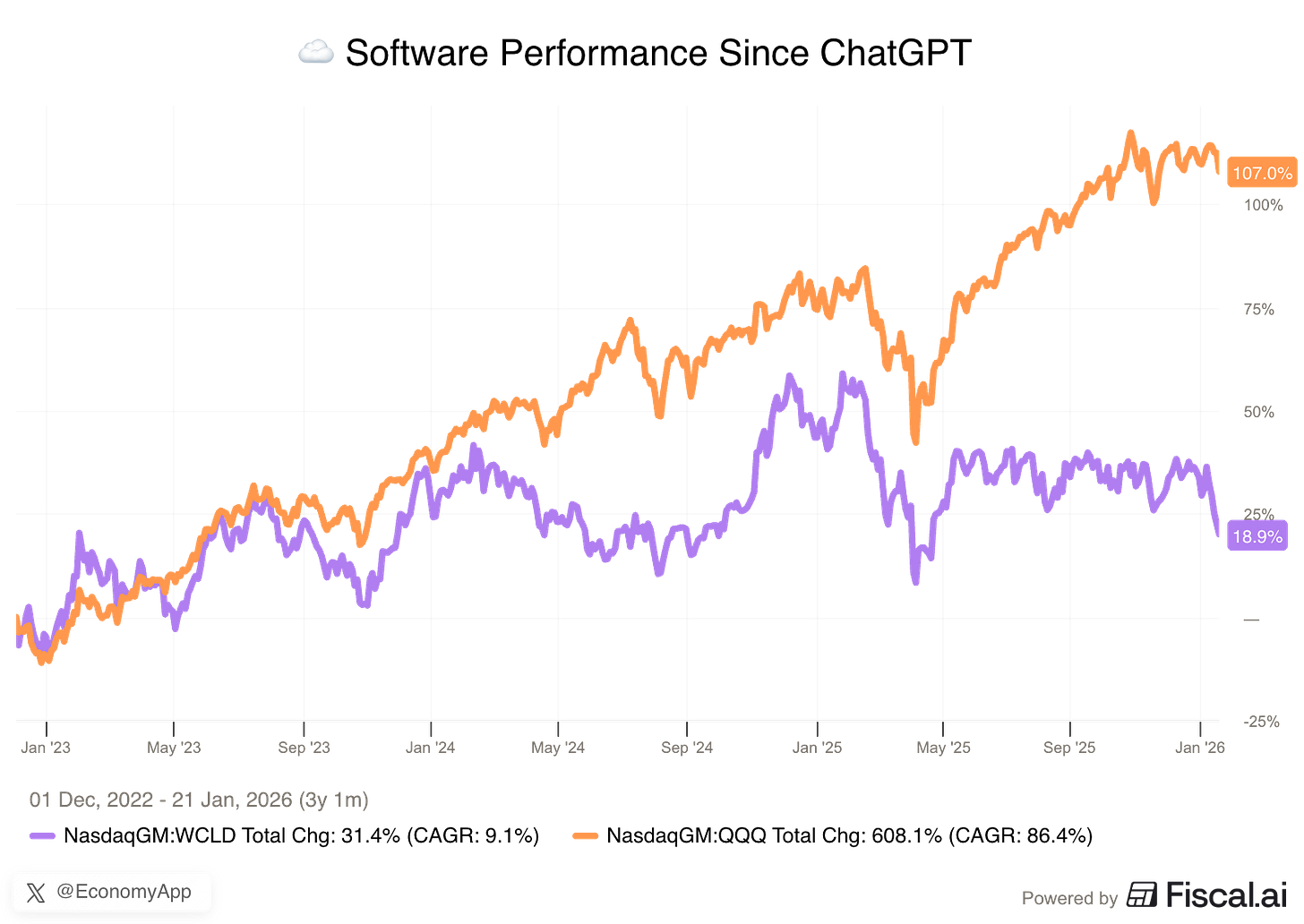

As AI agents and new autonomous tools gain traction, enterprise software stocks have materially underperformed. The WisdomTree Cloud Computing Fund, a diversified basket of SaaS companies, is down nearly 10% over the past month, while the broader market has been mostly flat.

Zooming out sharpens the contrast. Since the release of ChatGPT in late 2022, the Nasdaq 100 has more than doubled. Software stocks, by comparison, are up just 19% over the same period (see chart).

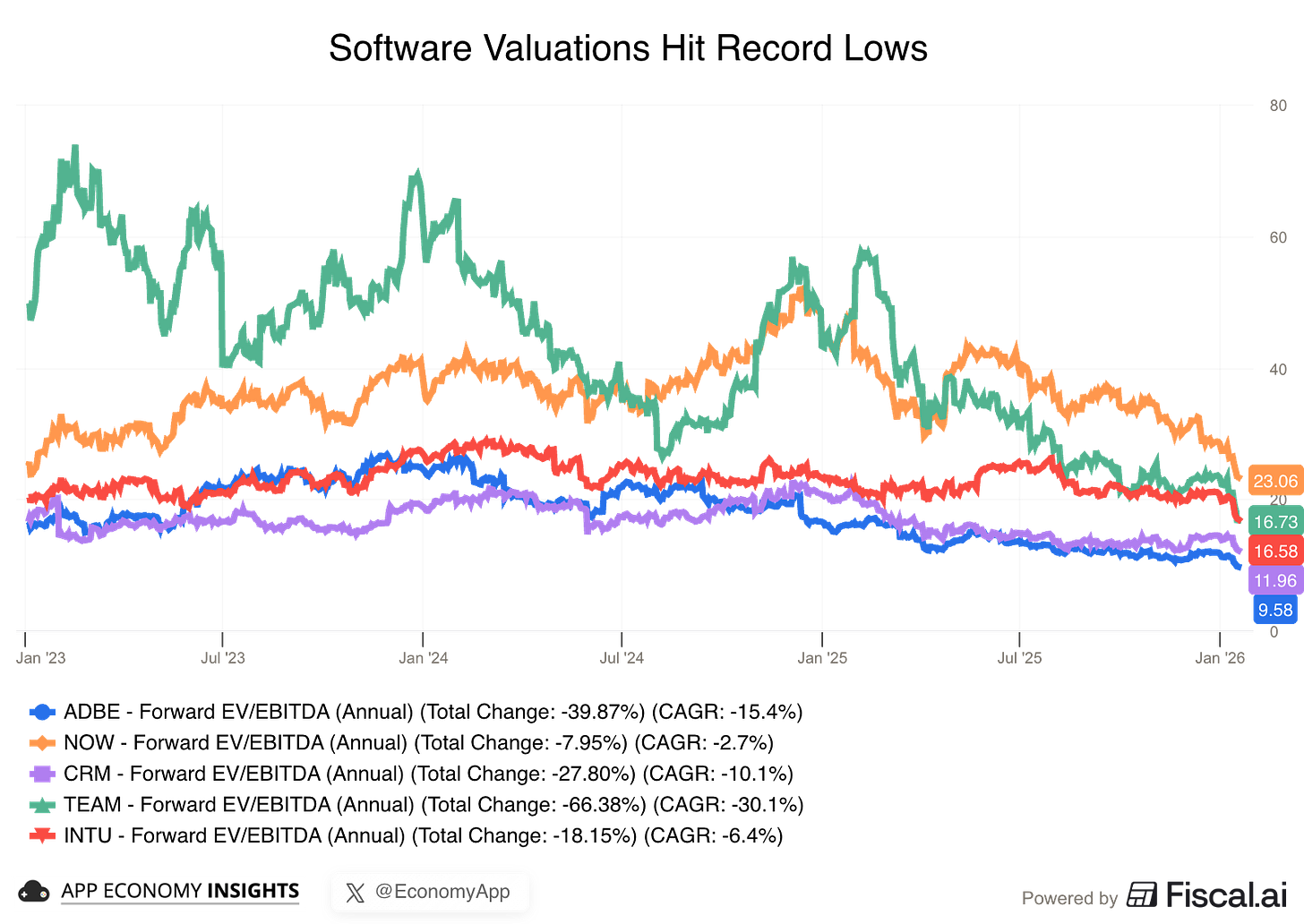

Valuations reinforce the message. Enterprise software multiples have compressed to near-historical lows, whether measured by revenue or earnings multiples.

Investors are increasingly questioning whether the traditional SaaS growth model still deserves the premium it once commanded.

So what changed?

📉 The S-Curve trap

It would be comforting to blame this entirely on AI or interest rates. But Jared Sleeper at Avenir Analysis points to a simpler, more uncomfortable truth: SaaS has passed the middle of its S-Curve.

The sector is maturing, and growth is getting structurally harder to find.

Sleeper’s data highlights a collapse in sales efficiency that predates the agentic panic. Between 2021 and 2024, the public software companies in his analysis increased their sales & marketing spend while generating less incremental revenue.

The era of “hire more sales reps to grow faster” was arguably over before agents even showed up. AI just accelerated the reckoning.

Meanwhile, most public software companies still rely heavily on stock-based compensation, with Avenir’s data showing a median of 16% of revenue, artificially inflating free cash flow margins and diluting shareholders.

🤖 The latest spark: Claude Cowork

On January 12, Anthropic released Claude Cowork, a tool that can autonomously build spreadsheets, browse the web, draft reports, and organize files. While Claude Code was a breakthrough for developers, Claude Cowork serves everyone else.

Anthropic reportedly built the tool in less than two weeks using its own AI. Claude Cowork served as a signal rather than a cause. It surfaced a fear that had already been building for years.

If a small team can assemble enterprise-grade workflows in days using AI agents, the moat around many legacy SaaS products looks thinner. Investors are beginning to view large portions of enterprise software as replaceable, especially products that solve narrow problems without deep integration.

💸 The death of seat-based pricing

For more than a decade, SaaS valuations relied on a simple assumption. As customers hired more employees, they purchased more software seats. Revenue scaled with headcount.

Agentic AI weakens that relationship.

We are moving toward a world where outcomes scale without adding humans. If an AI agent can perform the work of an entire marketing team, the buyer is no longer focused on the number of licenses. The focus shifts to the result delivered.

That shift challenges the core SaaS value proposition:

SaaS model: Software creates value by organizing human labor through tools like CRM and project management.

Agentic model: Software creates value by executing the work itself.

As buyers evaluate return on investment based on outputs rather than seats, per-user pricing becomes harder to justify. This helps explain why companies like Salesforce, Intuit, and Adobe have experienced sharp selloffs. Revenue that once appeared predictable now carries more long-term uncertainty.

🏗️ The “dumb database” risk

Pricing pressure is only part of the challenge. The other part is structural.

Altimeter’s Jamin Ball describes this shift as the rise of the platform of platforms, a change in where coordination and execution actually occur.

In the past, humans acted as the connective tissue. They checked Salesforce for pipeline data, opened NetSuite to review budgets, and sent emails to move work forward. Software lived in silos, and people supplied the logic between them.

Now, agents increasingly fill that role.

AI agents can pull data from one system, update another, and trigger actions across multiple tools without human intervention.

This creates a serious challenge for traditional systems of record. Products like Salesforce or Workday remain strong within their domains, but they are structurally constrained by their silos. A CRM cannot easily orchestrate workflows across ERP, HR, and finance.

Agents operate above the stack and execute the workflow.

As value shifts upward, underlying SaaS products risk becoming commoditized storage layers. Satya Nadella has warned that legacy software could be reduced to basic CRUD databases (Create, Read, Update, Delete) that store information while agents capture user attention and economic value.

🛡️ The new control points

Software remains essential, but the definition of investable software has changed. Market conviction has concentrated in three areas positioned for an agent-driven future:

Security & Identity: As AI agents proliferate, verification becomes critical. Enterprises must know who (or what) is accessing data. Names like CrowdStrike and Palo Alto Networks have held up relatively well.

Platforms: Systems where work is routed, audited, and executed. These act as operating layers that agents depend on rather than bypass. The market hasn’t yet separated these from simpler apps, explaining why stocks like Atlassian have sold off in sympathy.

Data Gravity: Businesses that control proprietary data loops that AI needs to function (including Palantir, Snowflake, Databricks).

The most exposed layer is the wrapper. These applications primarily provide an interface on top of a database. When an agent can query the data directly, the interface loses its value.

🔮 What happens next?

For some, this is a lasting repricing. For others, it is an opportunity to embed agents deeply and monetize outcomes instead of seats.

Software businesses must demonstrate that revenue can grow even as customer headcount remains flat. Until that evidence appears, multiples will stay compressed.

Ultimately, software businesses face a binary choice:

Financialize (cut costs to protect returns).

Embrace AI (cannibalize their own revenue with a new business model and likely lower margins).

Most management teams will try to do both. The winners will be the ones brave enough to choose the latter.

2. 🏭 Intel: Supply Squeeze

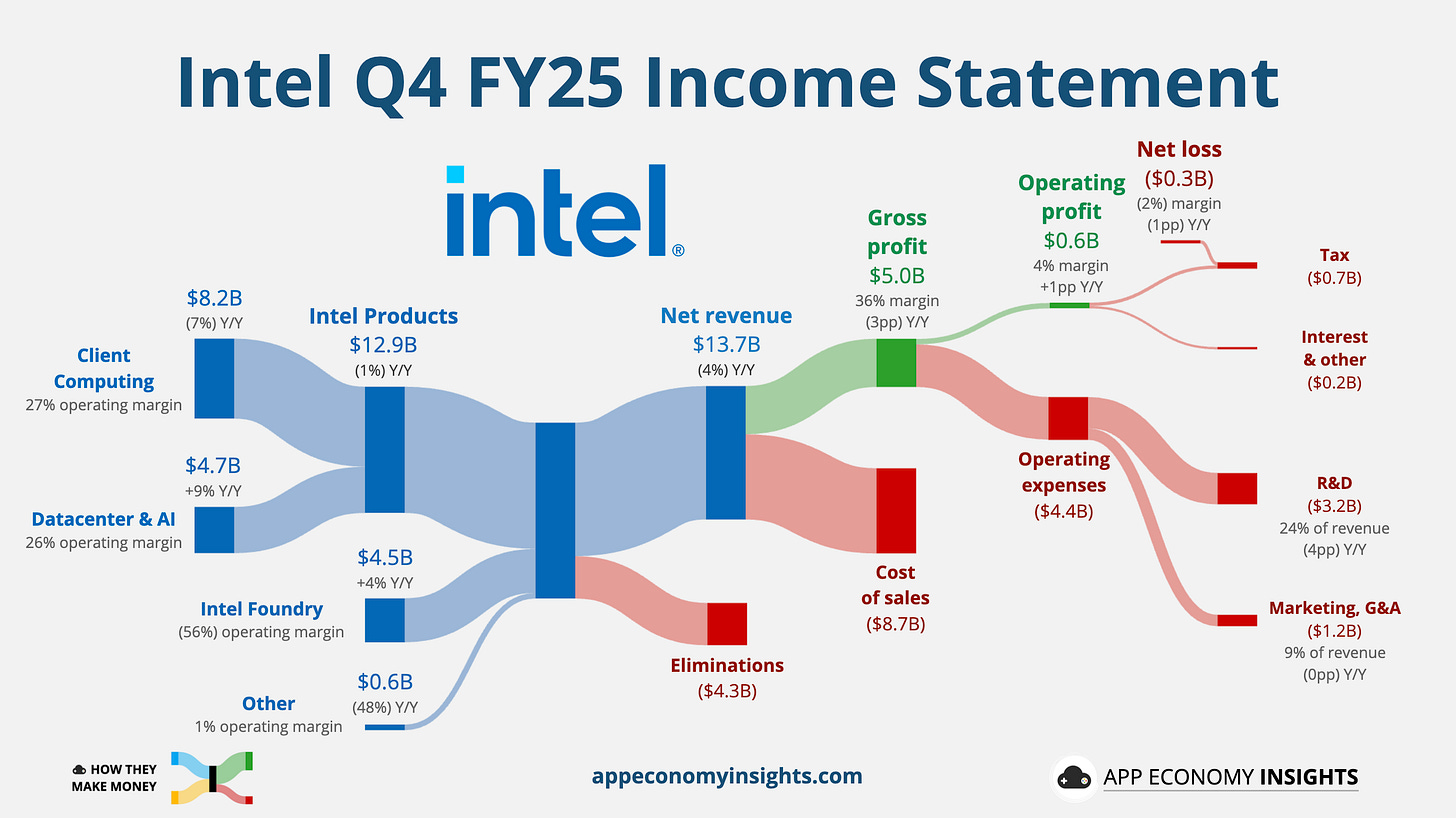

Intel’s Q4 revenue dipped nearly 4% Y/Y to $13.7 billion ($310 million beat), while non-GAAP EPS came in at $0.15, surpassing the $0.08 consensus estimate despite the company swinging to a GAAP net loss of $333 million.

Client Computing ($8.2 billion) missed estimates as inventory dried up.

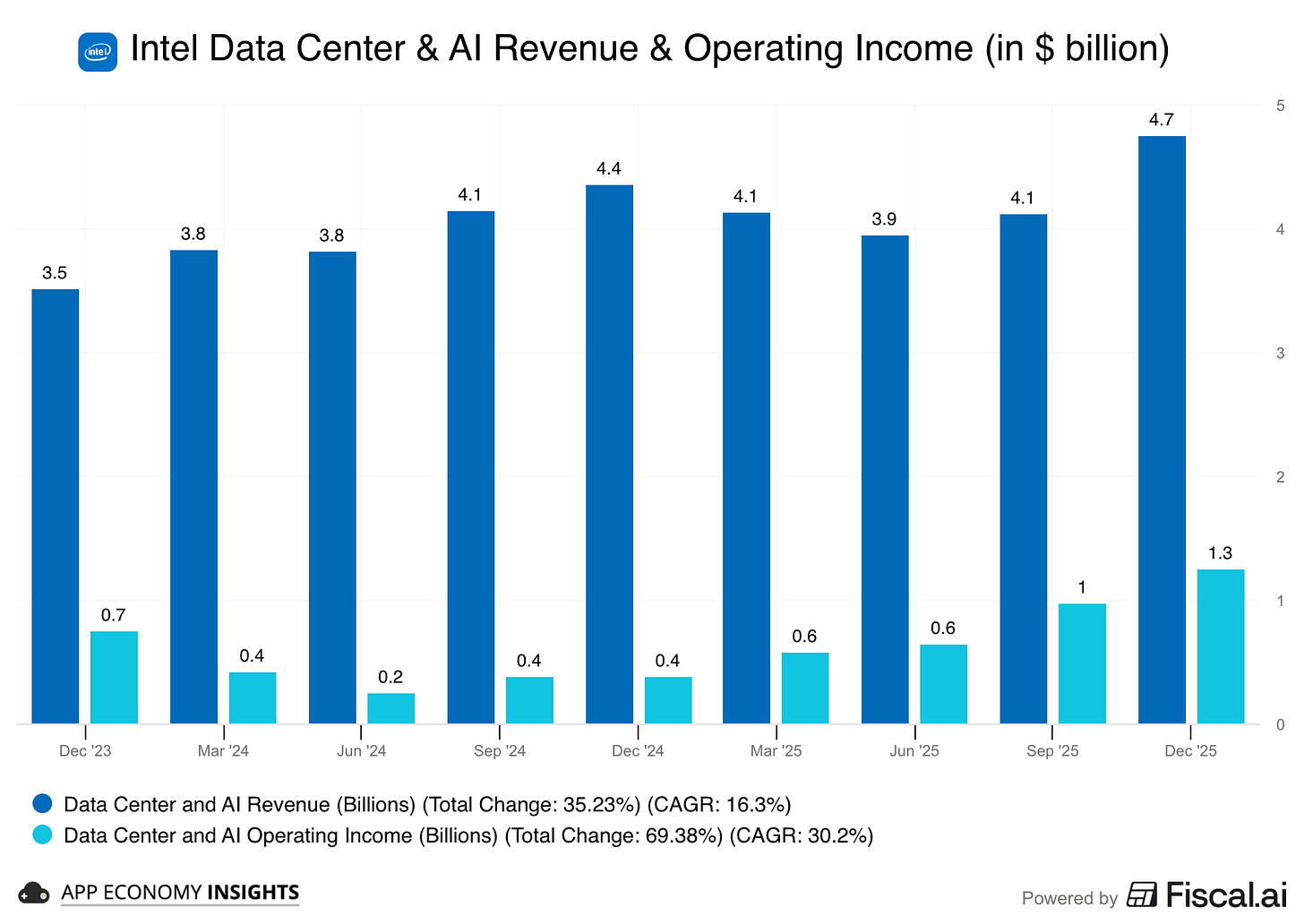

Data Center & AI ($4.7 billion) outperformed expectations, growing 9% Y/Y, driven by surging demand for AI compute.

Foundry revenue rose 4% Y/Y to $4.5 billion, with the custom ASIC business notably accelerating to an annualized run rate of more than $1 billion.

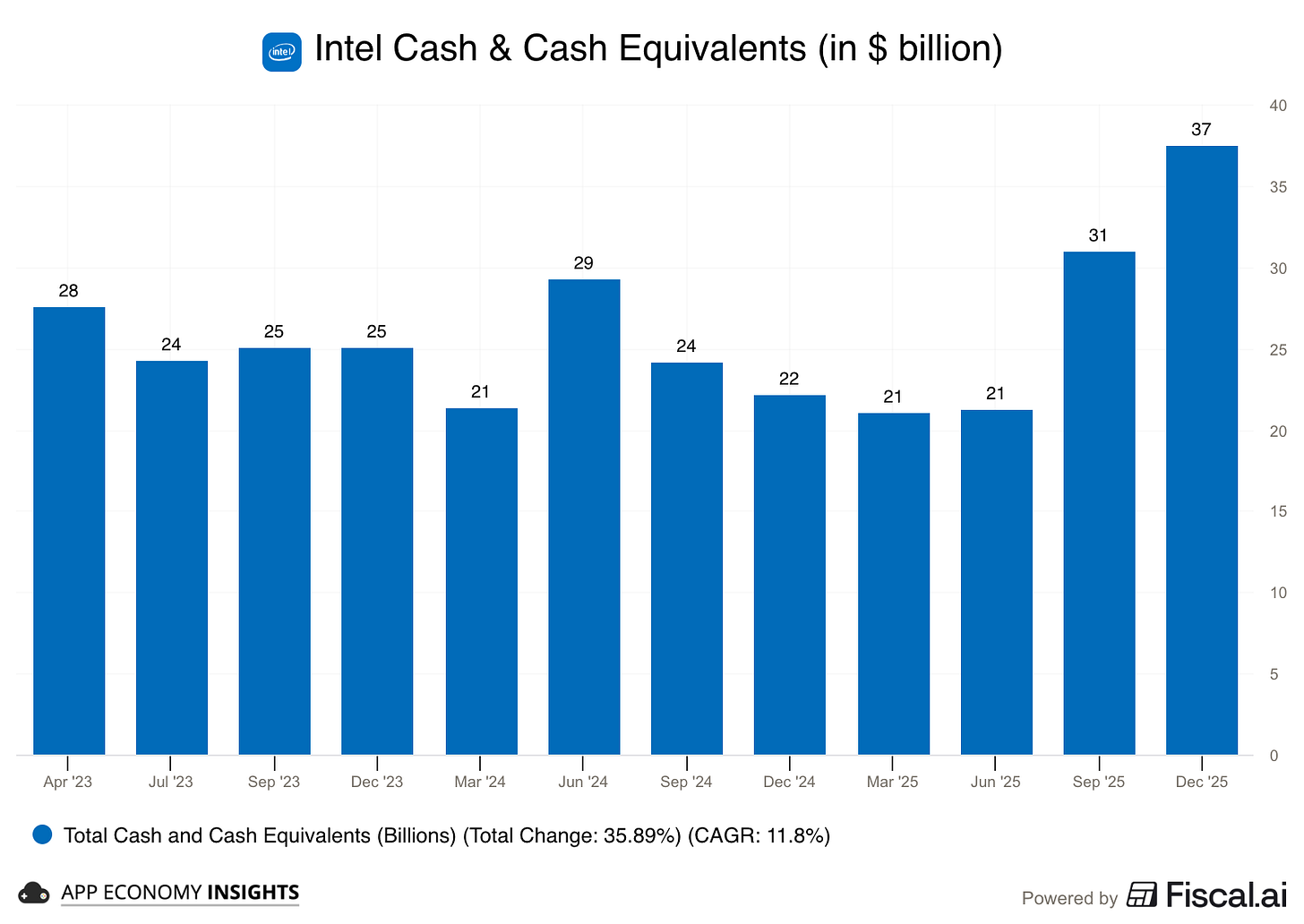

CEO Lip-Bu Tan stressed that the turnaround is a “multiyear journey” but celebrated a key milestone: the shipment of Panther Lake CPUs on the proprietary 18A process. The balance sheet remains a fortress, ending the year with $37 billion in cash and investments, bolstered further by a strategic $5 billion investment from NVIDIA.

However, the outlook weighed heavily on sentiment with the stock collapsing more than 10% in after-hours trading. Intel guided Q1 FY26 revenue to ~$12.2 billion (missing the $12.6 billion consensus) and expects break-even non-GAAP EPS.

Management warned that acute supply shortages and manufacturing yield challenges will peak in Q1 2026 before easing in the spring. These constraints are forcing a prioritization of server wafers over PC chips, which is expected to compress gross margins to ~34.5%.

Check out the earnings call transcript on Fiscal.ai here.

That's it for today.

Happy investing!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Disclosure: I own ADBE, CRM, CRWD, INTU, MDB, NOW, PANW, PLTR, SHOP, SNOW, and TEAM in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Partner disclosure: Energy Exploration Technologies, Inc. (“EnergyX”) has engaged App Economy Insights to publish this communication in connection with EnergyX’s ongoing Regulation A offering. App Economy Insights has been paid in cash and may receive additional compensation. App Economy Insights and/or its affiliates do not currently hold securities of EnergyX.

This compensation and any current or future ownership interest could create a conflict of interest. Please consider this disclosure alongside EnergyX’s offering materials. EnergyX’s Regulation A offering has been qualified by the SEC. Offers and sales may be made only by means of the qualified offering circular. Before investing, carefully review the offering circular, including the risk factors. The offering circular is available at invest.energyx.com/.