⚡️ TSMC: AI Arsenal Builder

And why Apple picked Gemini to power Siri

Welcome to the Free edition of How They Make Money.

Over 270,000 subscribers turn to us for business and investment insights.

In case you missed it:

FROM OUR PARTNERS

🎨 Export Charts Your Way

Fiscal.ai just made exporting charts dramatically better.

You can now fully customize any chart before downloading it:

Line thickness and colors.

Data labels and background.

Title, dimensions, and resolution.

Optimized for newsletters, slides, or social.

Ideal if you share visuals regularly and care about presentation quality.

Pricing update:

Fiscal.ai just cut the price of its highest tier (Fiscal Max) from $199 to $79/month (billed annually). That’s a 60% reduction to make the product more accessible.

As an HTMM reader, you get an extra 15% off that reduced price via this link.

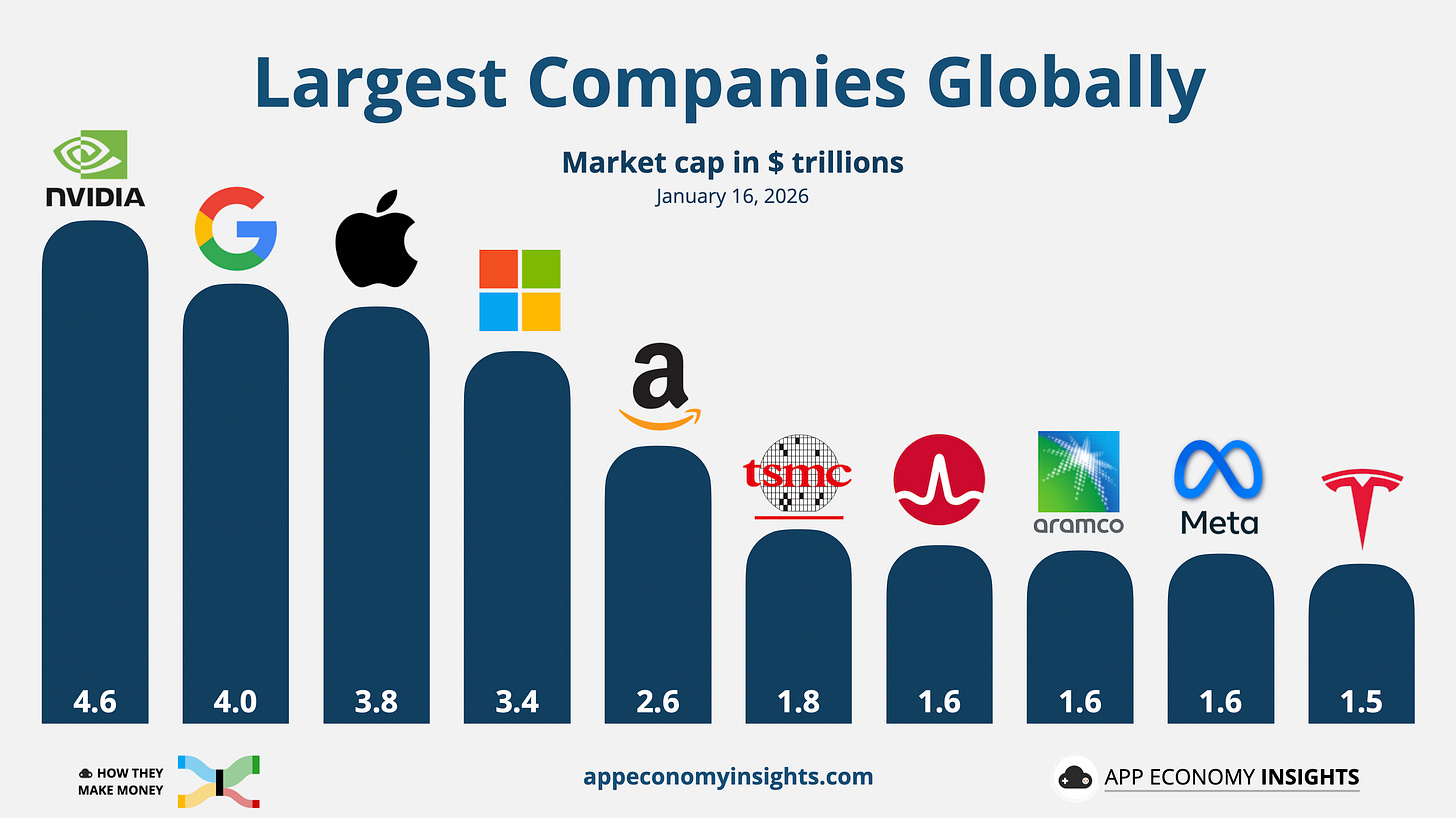

If the AI era is an arms race, TSMC is the arsenal builder everyone depends on. It has now become the 6th most valuable company in the world, right behind Amazon.

In Q3, the narrative was about conviction. In Q4, that conviction translated into the largest capital expenditure plan in the company's history: $52 billion to $56 billion for 2026 (up 30% year-over-year).

When asked if the demand is real, CEO C.C. Wei highlighted the stakes:

“If we don’t do it carefully, that’d be a big disaster.”

You don’t spend $56 billion on a hunch. A misstep here would result in empty factories and massive losses. By pulling the trigger, management signals they have clear visibility. They are building because the orders are already there.

With 2nm production online and gross margins hitting new highs, the foundry is cementing its lead with hard assets.

Disclosure: I own TSM in App Economy Portfolio. It was the January 2023 Stock Idea, and the stock has more than quadrupled since then.

Today at a glance:

⚙️ TSMC’s $56 billion bet

📱 Apple picks Gemini for Siri

🤖 Zuck launches Meta Compute

1. ⚙️ TSMC’s $56 billion bet

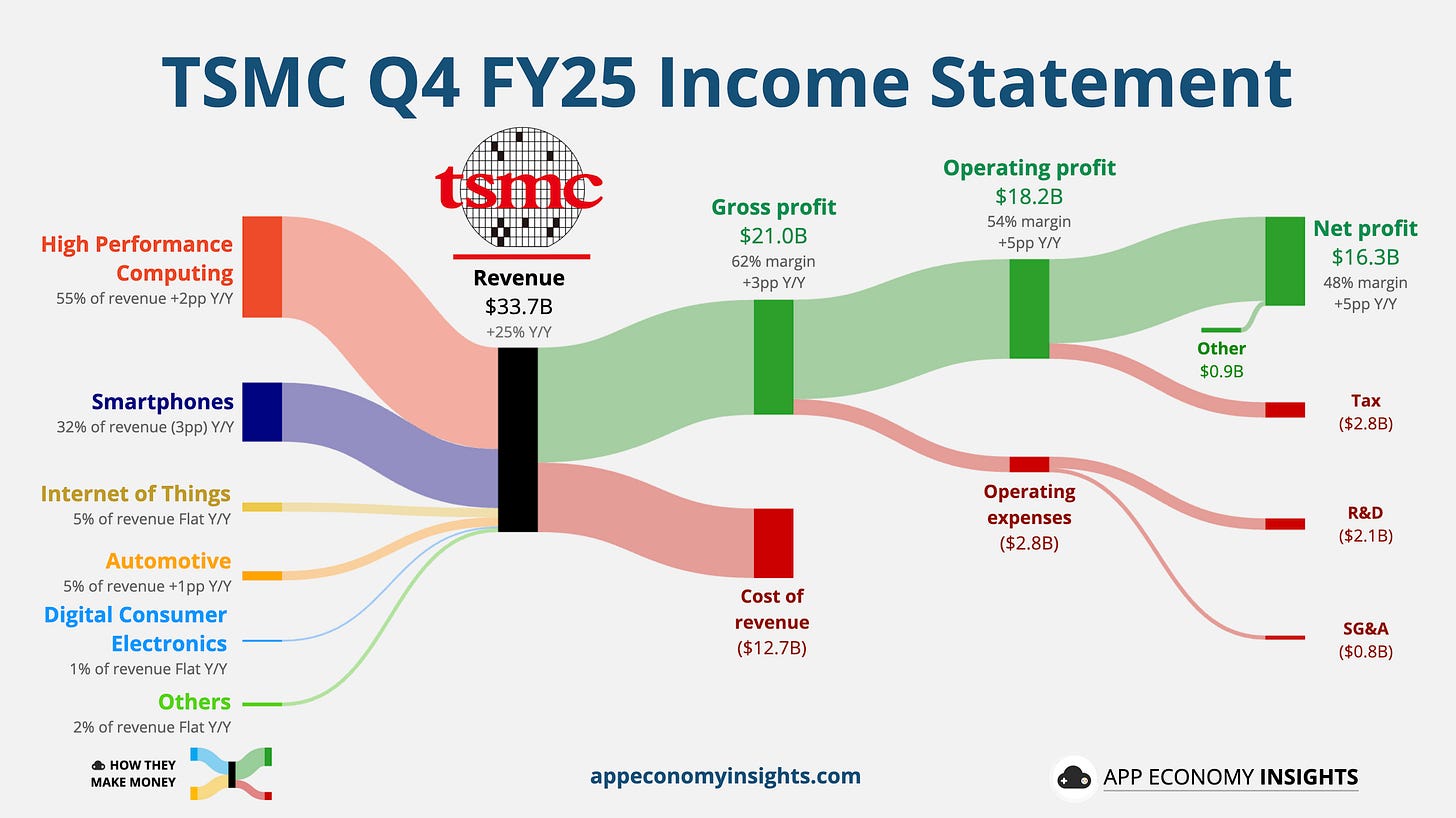

Income statement:

Revenue rose +25% Y/Y to $33.7 billion ($1.0 billion beat).

Gross margin was 62% (+3pp Y/Y).

Operating margin was 54% (+5pp Y/Y).

EPADR (American Depositary Receipt) was $3.14 ($0.16 beat).

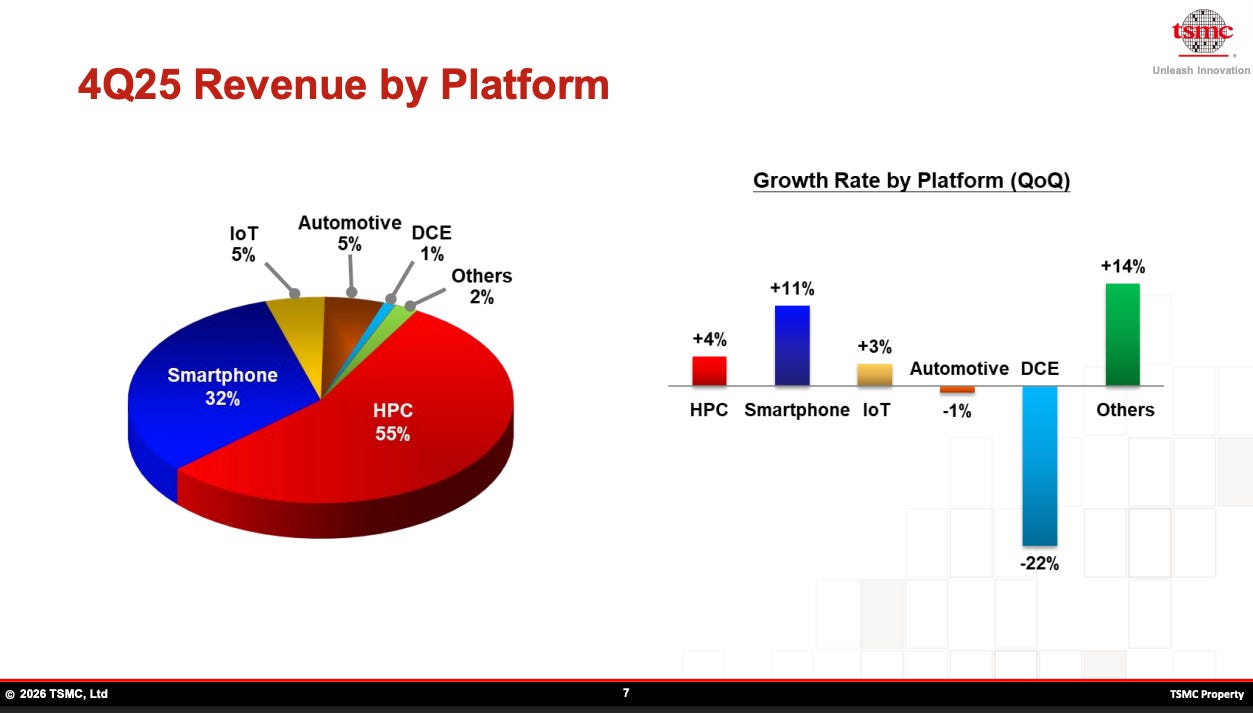

Revenue by platform:

💻 High-Performance Computing (55% of revenue, +2pp Y/Y).

📱 Smartphone (32% of revenue, -3pp Y/Y).

💡 IoT (5% of revenue, flat Y/Y).

🚘 Automotive (5% of revenue, +1pp Y/Y).

🎮 Digital Consumer Electronics (1% of revenue, flat Y/Y).

Others (2% of revenue, flat Y/Y).

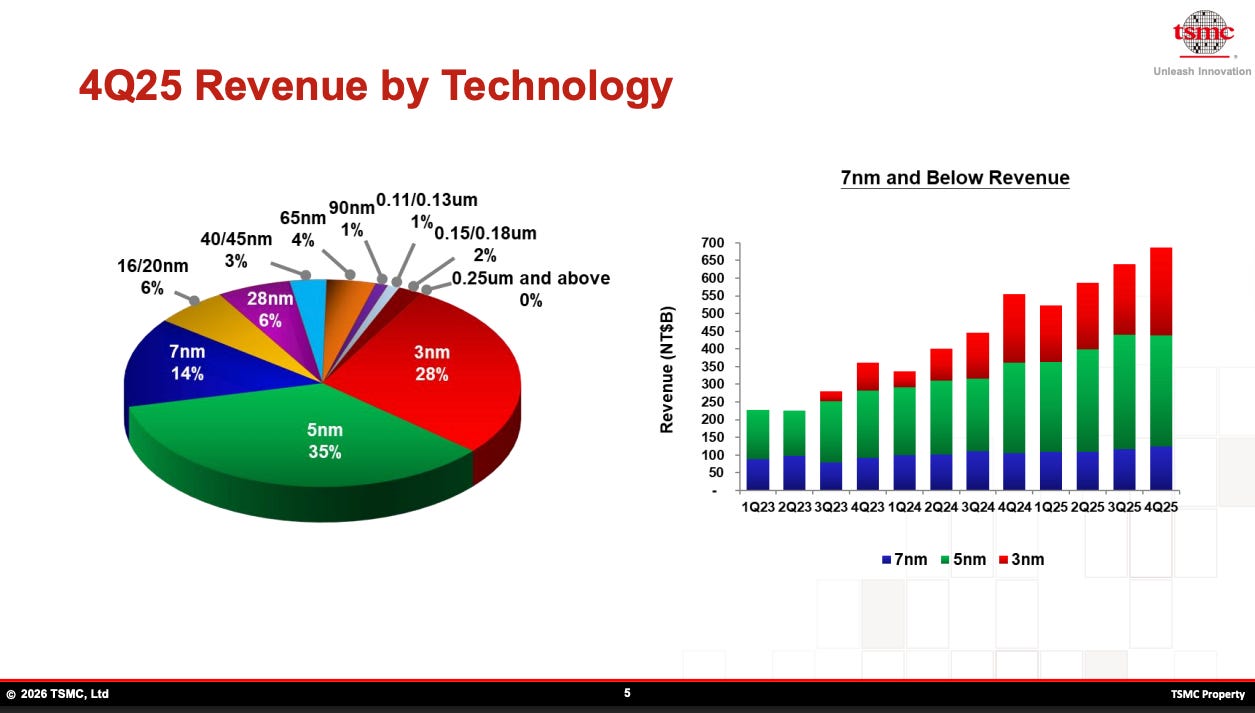

Revenue by technology:

3nm (28% of revenue, +2pp Y/Y).

5nm (35% of revenue, +1pp Y/Y).

7nm (14% of revenue, flat Y/Y).

16nm and above (23% of revenue, -3pp Y/Y).

Cash flow:

Operating cash flow margin was 69% (-2pp Y/Y).

Free cash flow margin was 35% (+5pp Y/Y).

Balance sheet:

Cash, cash equivalents, and short-term investments: $97.6 billion.

Long-term debt: $27.2 billion.

Q1 FY26 Guidance:

Revenue ~$35.2 billion ($2.7 billion beat).

Gross margin ~64% (~60% expected).

Operating margin ~55% (~51% expected).

So what to make of all this?

💥 Another double beat: The top-line beat was driven by “insane” AI demand. But the real story is profitability. Gross margin expanded to 62% (up from 60% last quarter), underscoring TSMC’s significant pricing power as customers compete for limited capacity.

🔮 Guidance implies acceleration: Management isn’t seeing a slowdown. For Q1 2026, they expect revenue between $34.6 and $35.8 billion. That’s a massive 38% year-over-year increase at the midpoint. For full-year 2026, they expect revenue to grow by nearly 30% (in USD), significantly outpacing the broader industry forecast of 14%.

🏗️ The $56 billion bet: TSMC raised its 2026 capex budget to $52–$56 billion (up from $41 billion in 2025). About 80% of this is allocated to advanced process technologies. This aggressive spending signals that their customer checks for AI demand over the next 2-3 years are rock solid.

⚙️ The 2nm era begins: While 3nm and 5nm are the current cash cows (combined 63% of revenue), TSMC confirmed that N2 (2nm) entered high-volume manufacturing in Q4 2025 with good yields. They expect a fast ramp in 2026, maintaining their lock on technology leadership against competitors like Intel and Samsung.

🤖 HPC is now the dominant force: High-Performance Computing (AI + 5G) now represents 55% of total revenue, widening the gap with Smartphones (32%). While consumer electronics face headwinds from a memory chip supply crunch, TSMC notes that high-end AI smartphones remain resilient.

🇺🇸 Doubling down on Arizona: The Gigafab plan is expanding. TSMC confirmed the purchase of a second large parcel of land in Arizona to support an independent gigafab cluster. Fab 1 is in high-volume production, and Fab 2 is pulled forward to 2027.

🗣️ The bubble verdict: Addressing fears of overspending, CEO C.C. Wei noted that the capex hike comes after rigorous verification with customers. He stated the silicon supply remains the bottleneck for AI infrastructure, not power, and that the company is working to “close the gap” between supply and demand.

Check out the earnings call transcript on Fiscal.ai here.

2. 📱 Apple picks Gemini for Siri

Apple has officially selected Google’s Gemini to power the next generation of Siri.

This is a multi-year partnership in which Google’s models and cloud infrastructure will serve as the foundation for Apple’s AI features. Unlike the existing integration with OpenAI (which acts like a “phone a friend” chatbot when Siri is stumped), this deal puts Gemini deep inside Siri’s operating logic.

💰 A reverse financial flow

For over a decade, the money has flowed one way: Google pays Apple (an estimated $20+ billion annually) to be the default search engine on the iPhone.

This deal flips the script, albeit on a smaller scale. Reports suggest Apple will pay Google ~$1 billion per year. For a company like Apple, $1 billion is a rounding error. But it signals a massive strategic pivot. Apple has effectively decided that spending tens of billions on CapEx to train a frontier model from scratch isn’t the best use of its cash.

🏗️ Aggregation vs. creation

This is a classic “buy vs. build” decision. By white-labeling Gemini:

Apple (the aggregator): Keeps the direct relationship with the user and the privacy layer (Private Cloud Compute). They capture the value of the interface.

Google (the supplier): Gets massive validation and scale for its models but operates in the background.

You likely won’t see the Gemini logo when you use Siri. Apple is treating Google’s model like a component supplier, similar to how it buys screens from Samsung or camera sensors from Sony. It’s Apple Intelligence on the outside, powered by Google on the inside.

📉 ‘Good-enough’ strategy

Apple is betting that it doesn’t need to have the smartest model in the world at any given time. It just needs one that is reliable.

Risk: Apple is now dependent on a rival for a core AI competency.

Reward: Siri will finally become usable for complex tasks without Apple torching its margins on training frontier models.

Reports from the Financial Times suggest OpenAI declined the deal. Sam Altman reportedly refused to become a white-label utility, prioritizing compute for OpenAI’s own future hardware with Jony Ive. This leaves Google to serve as Apple’s invisible backend.

🔮 What to watch Google recently surpassed Apple in market cap for the first time since 2019. With this deal, Google secures its place as the AI utility layer for the world’s most premium hardware. The frenemies remain closer than ever.

3. 🤖 Zuck launches Meta Compute

While Apple is outsourcing its AI brain to Google to stay asset-light, Meta is going asset-heavy on a scale that is hard to comprehend.

Meta has established Meta Compute, a new top-level division dedicated to building the physical backbone of the AI era.

🏗️ What is Meta Compute?

Zuckerberg is splitting his infrastructure strategy into two clear lanes:

Technical (now): Led by Santosh Janardhan, focusing on the actual data center architecture, silicon, and day-to-day operations of the fleet.

Supply Chain (future): Led by Daniel Gross (who co-founded Safe Superintelligence with Ilya Sutskever), focusing on securing the supply chain and business models needed to build at this scale.

☁️ Build to survive

Crucially, Meta is not trying to become AWS. Zuck isn’t building these data centers to rent servers to startups (a low-margin game where AWS, Azure, and GCP already won).

Zuck might have PTSD from Apple's App Tracking Transparency, which nearly derailed his business. He is looking far ahead to ensure history doesn’t repeat itself.

Meta is betting that compute (not models) will be the scarce resource of the next decade. By owning the power plants and the silicon, Meta ensures it never has to beg Google or Microsoft for capacity to run its Personal Superintelligence features.

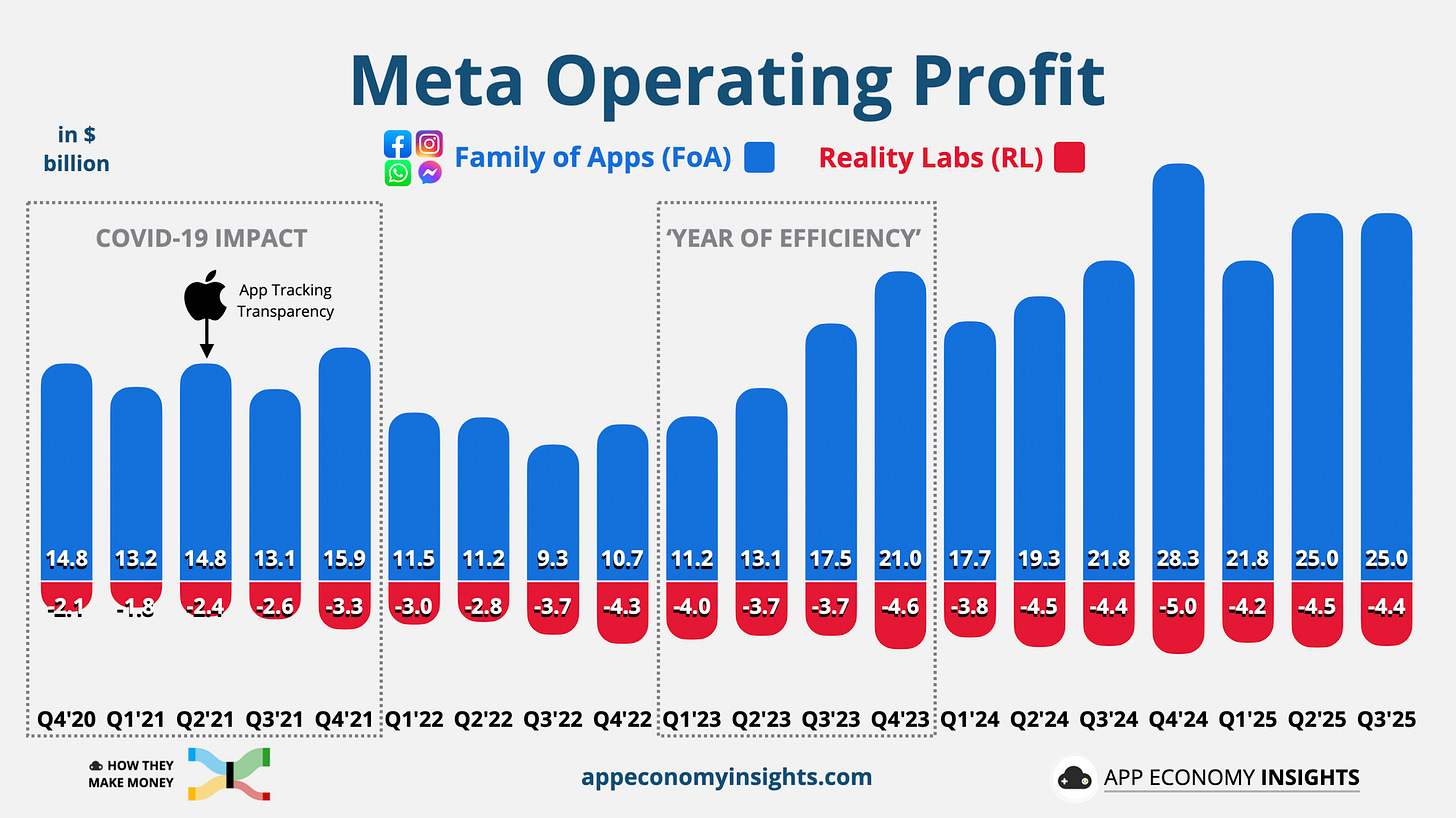

🩸 Reality Labs as a blood sacrifice

Wall Street generally hates it when Zuckerberg spends billions on sci-fi projects. To buy their patience for this new AI splurge, he had to offer a sacrifice.

Meta is cutting ~10% of Reality Labs (the Metaverse division) and closing studios like Twisted Pixel and Sanzaru.

This is the official pivot from Metaverse to AI. The dream of living in VR isn’t dead, but it is being deprioritized to fund the Gigawatt buildout.

Meta has a critical advantage over OpenAI because the ad business already generates massive free cash flow. By refocusing his effort on AI, Zuck can afford to burn billions on GPU clusters while his core business pays the bills.

☢️ The gigawatt obsession

You will hear this term a lot. Zuckerberg stated Meta plans to build “tens of gigawatts” of capacity this decade.

What is a Gigawatt (GW), you ask? It’s roughly the output of a standard nuclear power plant. That’s enough energy to power ~750,000 homes.

Meta is effectively trying to build the equivalent of 10 to 50 nuclear power plants’ worth of compute capacity.

👩💼 The nuclear diplomat

To execute this, Zuckerberg just hired Dina Powell McCormick as President and Vice Chair. She was previously a partner at Goldman Sachs and a Trump Deputy National Security Advisor.

Why? Because you don’t build all this nuclear power by writing code. You do it by navigating complex government regulations and sovereign wealth deals. She is the political bridge to the physical power Meta needs.

Meta also announced huge deals with three nuclear energy providers this week: Vistra, TerraPower (Bill Gates-backed), and Oklo (Sam Altman-backed). The goal is to add 6.6 GW of nuclear capacity by 2035.

This is a race against physics and regulation. By hiring a Trump-era diplomat, Zuck wants to ensure the regulatory environment is favorable to this massive buildout.

That's it for today.

Happy investing!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Start an account for free and save 15% on paid plans with this link.

Disclosure: I own AAPL, AMZN, GOOG, META, NVDA, and TSM in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.