☁️ Micron is Officially Sold Out

And why ServiceNow is gobbling up companies

Welcome to the Free edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Amazon Plays Both Sides

Amazon is reportedly negotiating a $10 billion investment in OpenAI, effectively mirroring the strategy Microsoft executed just last month.

Microsoft went all-in on OpenAI first ($13 billion), then hedged by backing Anthropic ($5 billion).

Amazon bet big on Anthropic first ($8 billion), and is now potentially hedging by backing OpenAI ($10 billion).

The era of exclusive AI marriages is over. Cloud giants have realized that picking a single winner is too risky. Instead, they are becoming arms dealers. Whoever prevails in the model war, the underlying cloud infrastructure wins. That’s particularly critical for Amazon’s custom Trainium chip, which OpenAI reportedly plans to use.

Meanwhile, OpenAI needs to raise hundreds of billions to fund its CapEx ramp. It also reinforces the growing trend of circular financing in AI. Just last month, OpenAI signed a $38 billion multi-year deal with AWS.

OpenAI once again demonstrates its ability to secure commitments. Tech giants are effectively tying part of their success to OpenAI’s ability to scale.

The Information also reports that OpenAI and Amazon are discussing commerce partnership opportunities. Plot twist?

Today at a glance:

ServiceNow On a Buying Spree

Enterprise Software “Show Me” Era

Micron’s Shocking Guidance

ServiceNow On a Buying Spree

ServiceNow (NOW) shares plunged nearly 12% on Monday, wiping out $21 billion in market cap for the software giant, and have not recovered since.

So what happened? The trigger may have been a report that the company is in advanced talks to acquire cybersecurity firm Armis for $7 billion. But it was likely less about the news itself, and more about a sum of developments of late:

💰 M&A overload: Armis would be the fourth sizable acquisition this year. Critics worry this aggressive spree signals that organic growth is harder to come by and that management is scrambling to make moves.

Armis (rumored): ~$7 billion: Asset intelligence & cybersecurity.

Moveworks: $2.85 billion: AI agents for employee support.

Veza: ~$1.5 billion (estimate): Identity security & authorization.

Logik.io: $506 million: AI-powered Configure, Price, Quote (CPQ).

👔 KeyBanc downgrade: Analyst Jackson Ader raised concerns that AI could reduce IT back-office headcount, shrinking ServiceNow’s core total addressable market (TAM).

The reality check: Despite jittery sentiment, ServiceNow has been growing its top line by more than 20% (twice the pace of peers like Salesforce and Adobe), and cybersecurity remains a top priority for enterprise budgets. Management may simply be taking advantage of a more lenient regulatory environment for tech mergers.

Is the panic justified? Not if you look closely at the business momentum.

Here’s what we wrote for PRO members after the company’s earnings last month.

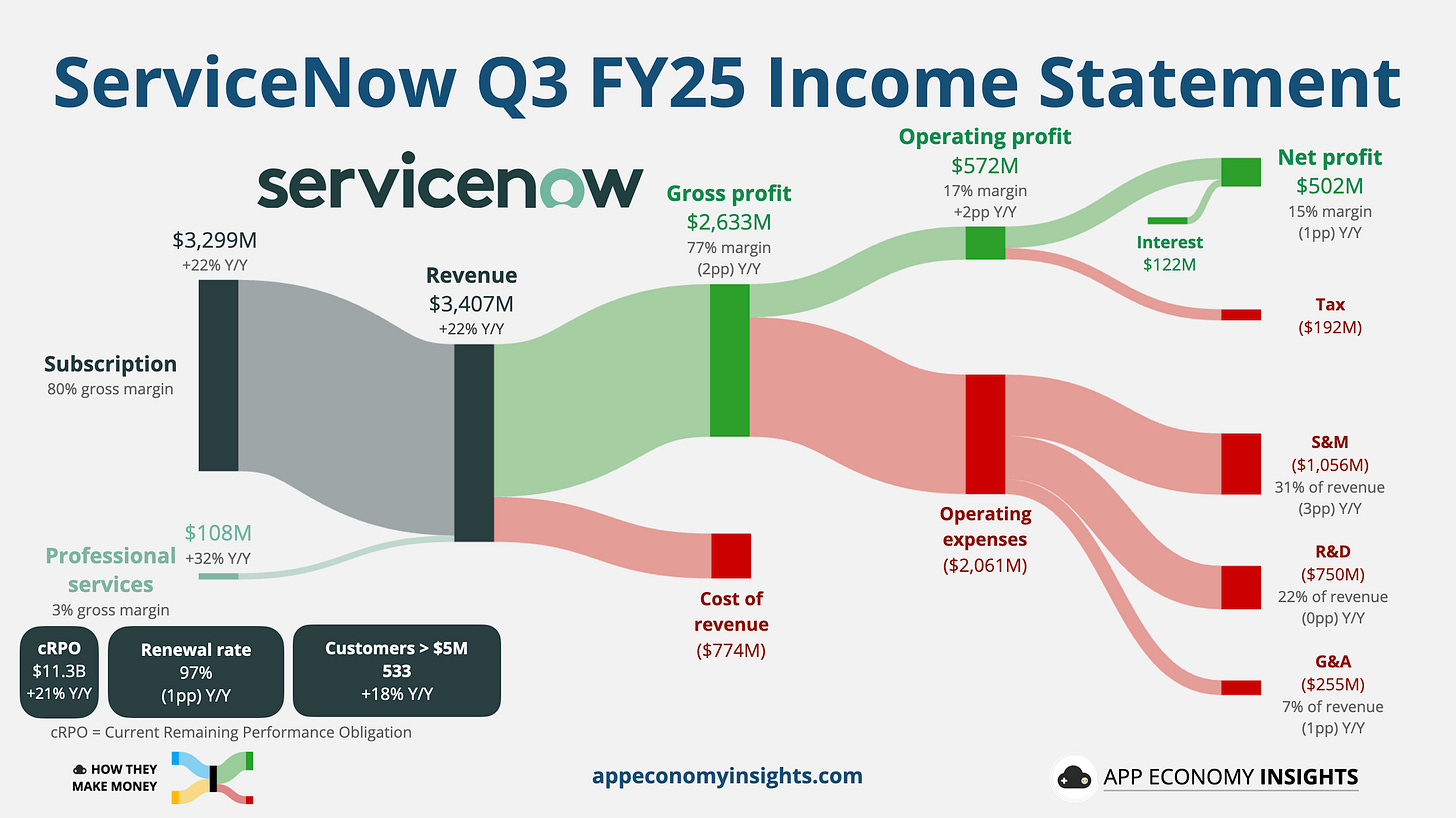

🧑💻 ServiceNow: AI Fuels Blowout

ServiceNow delivered another stellar quarter, with Q3 revenue rising 22% Y/Y to $3.4 billion ($50 million beat) and adjusted EPS soaring 30% Y/Y to $4.82 ($0.55 beat). The outperformance was driven by accelerating AI adoption and strong enterprise demand. Subscription revenue grew 22% to $3.3 billion, and cRPO climbed 21% to $11.3 billion. Large customer momentum continued, with customers spending over $5 million in ACV growing 18% Y/Y to 553.

Management highlighted exceptional AI traction, noting its AI products are on pace to exceed $0.5 billion in ACV this year, tracking ahead of plans. Reflecting this strength, ServiceNow raised its FY25 guidance significantly: Subscription revenue is now expected at ~$12.84 billion ($55 million midpoint raise), operating margin guidance was lifted 50bps to 31%, and free cash flow margin guidance jumped 200bps to 34%. Q4 guidance also points to continued strong growth (~19.5% subscription revenue).

ServiceNow’s board authorized a five-for-one stock split, pending shareholder approval. While management prudently factored potential government deal timing delays into Q4 guidance, the beats put the company on a strong trajectory.

Enterprise Software “Show Me” Era

The market has spent the last year punishing software stocks that promised an AI revolution but delivered only incremental features. Investors have largely dumped shares of any company that couldn’t draw a direct line between GPU spend and ARR growth, while OpenAI and Anthropic are sucking all the air in the room.

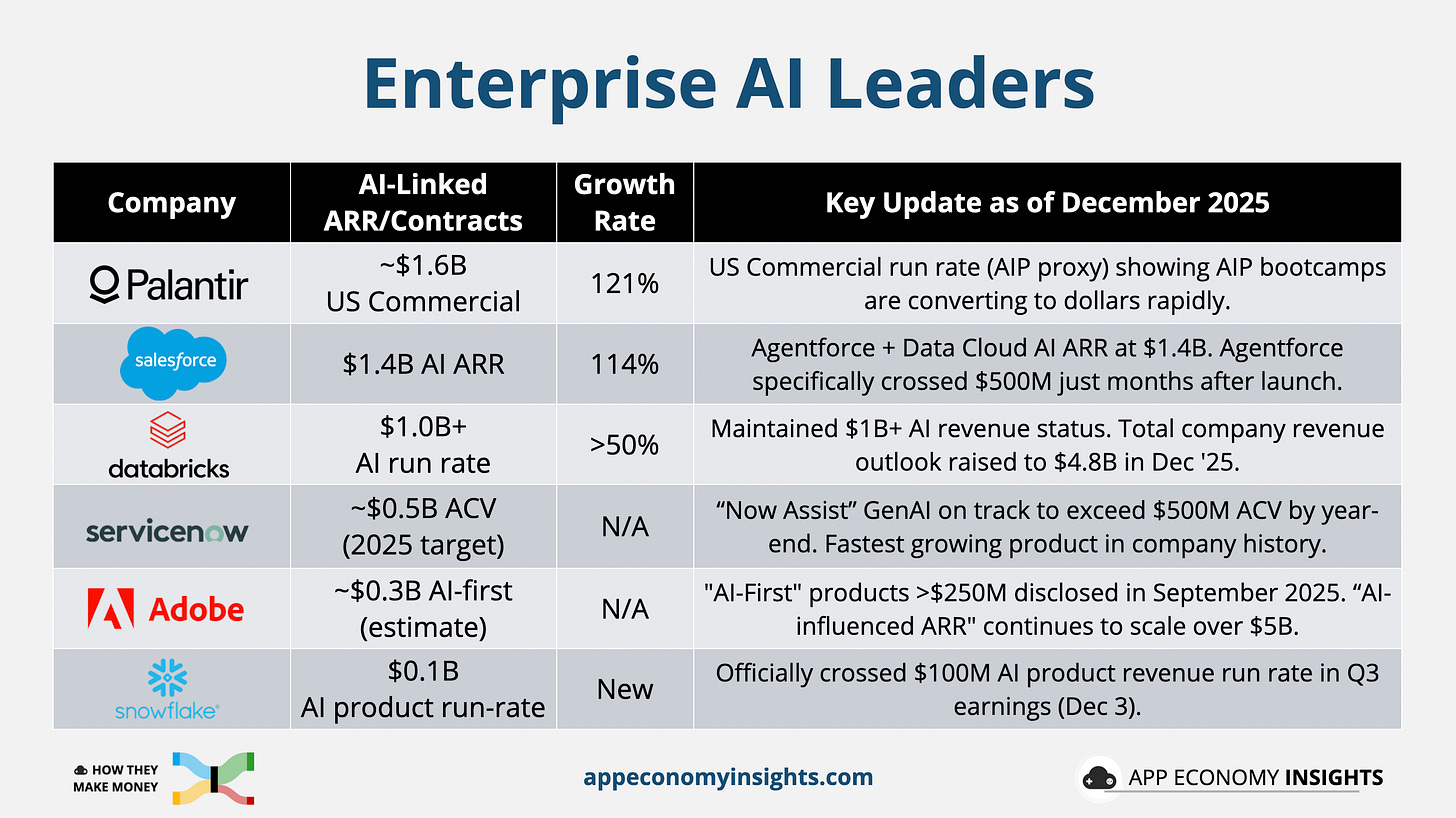

The billion-dollar club

While hyperscalers (Microsoft, AWS, Google, Meta) have captured most of the upside (as reflected in growth acceleration), some pure-play companies in the platform and apps categories have emerged. Notably, Palantir, Salesforce, and Databricks have all crossed the $1 billion AI revenue run rate milestone.

Palantir ($1.6 billion US Commercial run rate): The standout performer. Their AIP Bootcamps strategy has successfully converted pilot programs into committed revenue, driving US Commercial growth to 121%.

Salesforce ($1.4 billion Agentforce + Data): By bundling their new Agentforce with the less glamorous but essential Data Cloud, they generated $1.4 billion in annualized AI-related ARR, growing 114%. However, the market has focused on the overall organic growth (now at 9% excluding Informatica) and remains skeptical.

Databricks (>$.1.0 billion run rate from AI products): The Data and AI company just announced a $4 billion Series L investment, valuing the company at $134 billion. They crossed $4.8 billion in overall revenue run-rate in Q3, growing over 55% Y/Y.

Here’s a look at the other large movers.

As you can see, the aforementioned ServiceNow follows, alongside Adobe. The latter has been deemed the ultimate AI victim, though the jury is still out.

Can incumbents also win after all?

The data highlights a critical divergence: software incumbents are not building flashy models. Instead, they are capturing the “boring” enterprise context that makes those models useful.

Companies like ServiceNow and Salesforce are executing a small-ball M&A strategy by acquiring niche tools to feed their agents.

Massive acquisitions like Warner Bros. are essentially focused on the old economy.

Smaller AI acquisitions are happening weekly. They may not capture headlines, but they focus on what comes next, from data management to cybersecurity. Those are the acquisitions that can be overlooked and still deliver massive returns if integrated properly.

This unsexy integration is fueling the trifecta of software economics:

Acquisition: AI as the hook to get in the door (see Palantir Bootcamps).

Retention: Embedded agents that learn enterprise context, making them painful to rip out.

Monetization: Usage-based pricing (Databricks/Snowflake) or premium agent consumption (Salesforce) that scales with value.

If we judge the AI revolution solely by the few billions here and there directly attributed to AI products, the math looks broken. But this view misses the massive, invisible uplift in core businesses. For giants like Google and Meta, AI is the algorithm making their existing ad machines smarter, boosting revenue lines that are part of the core business. In fact, having an existing business that can be significantly enhanced by AI may be the fundamental aspect of the AI boom that favors incumbents.

Micron’s Shocking Guidance

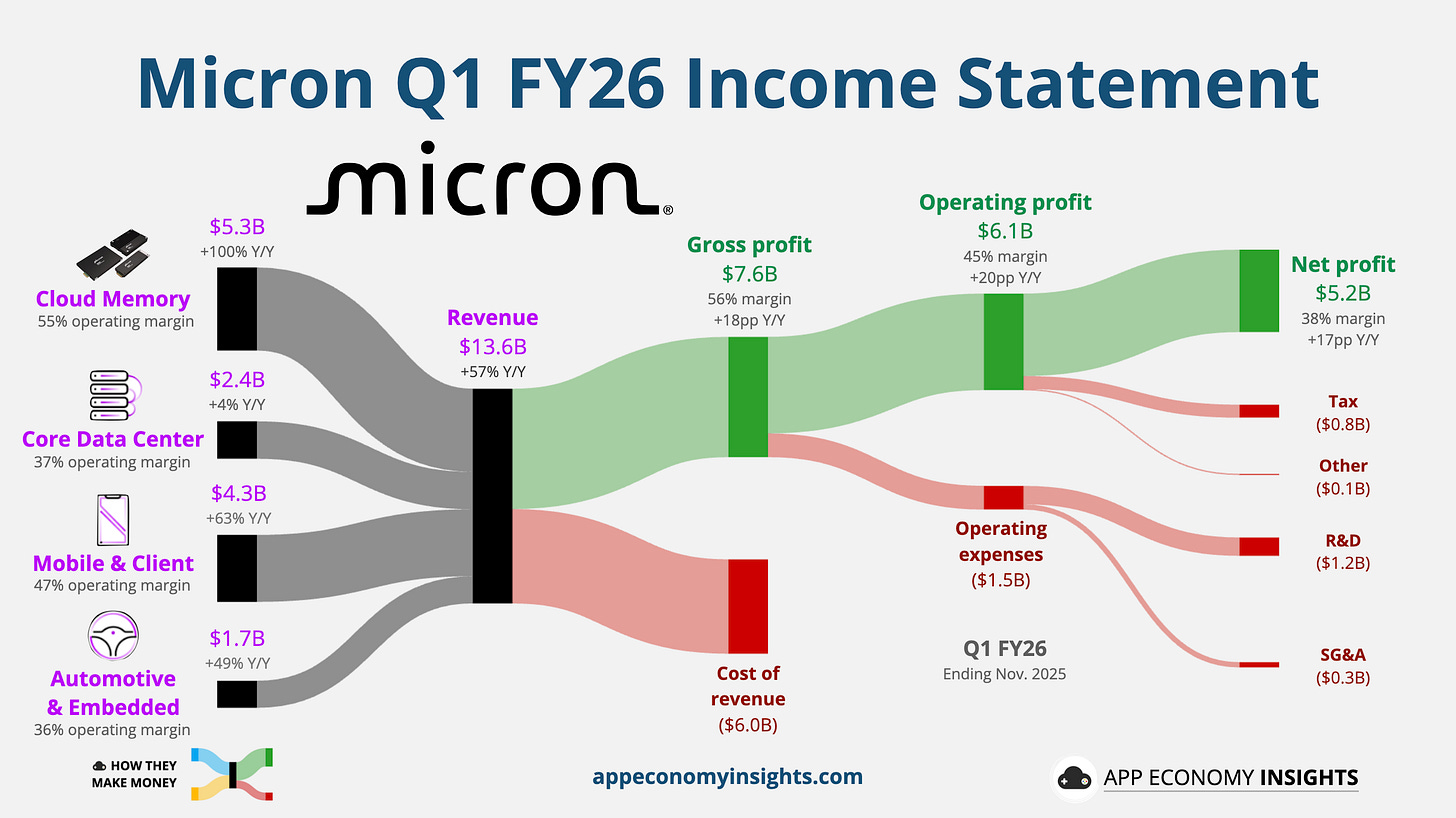

Last quarter, we discussed how Micron’s reorganization revealed the HBM-powered recovery (High-Bandwidth Memory).

The company just released its Q1 FY26 earnings (ending November 2025), and the numbers shattered estimates. The story has moved from recovery to what management calls the “most significant disconnect between supply and demand in 25 years.” And while Q1 results were strong, the market was stunned by the Q2 forecast.

Wall Street expected a steady climb, but Micron delivered an explosion. The Cloud Memory unit generated $5.3 billion, a 2x year-over-year increase.

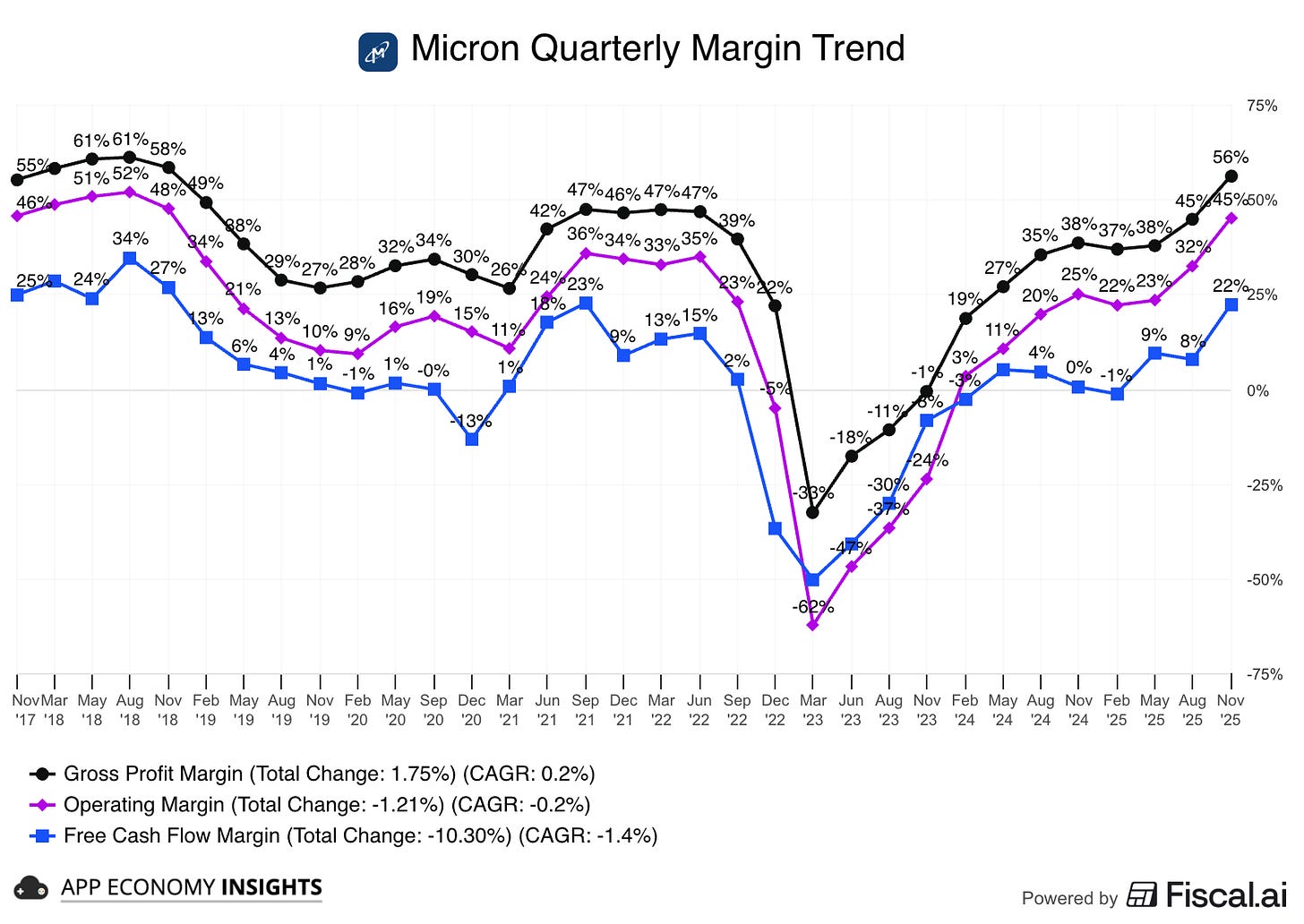

Revenue surged 57% Y/Y to $13.6 billion ($0.8 billion beat), and EPS was $4.78 ($0.82 beat). Margins continued to expand to their highest level since 2018, marking a historic expansion in profitability driven by pricing power.

Guidance shocker

Q2 revenue forecast: ~$18.7 billion ($4.5 billion beat).

Q2 EPS forecast: ~$8.42 ($3.93 beat).

Micron’s revenue guidance was 31% higher than expectations. The forecast implies a staggerring 38% sequential revenue growth and nearly 59% operating margin. This P&L is starting to look like NVIDIA’s!

Why is guidance so high? We are officially out of chips. Executive VP Manish Bhatia described the current environment as the most severe supply/demand imbalance he has seen in his career.

HBM is sold out: Micron is sold out of HBM chips for 2026.

Rationing: CEO Sanjay Mehrotra admitted they can currently meet only 50% to 66% of demand for key customers.

What it means for Micron

As Micron shifts production lines to build complex HBM chips for AI, there is now a shortage of standard memory for PCs and smartphones. This allows Micron to raise prices across the board, not just in AI.

Despite 25 upward revisions heading into the print (usually a setup for disappointment), Wall Street still dramatically underestimated the reality.

What to watch next

CapEx: Micron raised its fiscal 2026 CapEx forecast to $20 billion (up from $18 billion). They are spending aggressively to build capacity in Idaho and New York.

Consumer Impact: Watch for price hikes in consumer electronics (PCs, phones) as commodity memory becomes scarce.

HBM4: Production is slated for early 2026. With current generation chips sold out, the race for next-gen allocation has already begun.

The shortage is real, the margins are historic, and the cycle is accelerating. We’ll find out next quarter if Micron was still conservative with its $18 billion promise.

Just don’t forget: memory remains the quintessential cyclical business.

That's it for today.

Happy investing!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Save 15% with this link.

Disclosure: I own ADBE, AMD, AMZN, CRM, GOOG, META, NOW, PLTR, and NVDA in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.