🤖 The Great AI Bifurcation

AI victims vs. AI enablers (CRWD, MDB, GTLB)

Welcome to the Premium edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Enterprise software joins the AI party

Google’s TPUs and NVIDIA’s GPUs are dominating the conversation.

But remember, AI is a stack:

📱 Apps: User-facing tools like ChatGPT, Shopify, and Copilot.

☁️ Cloud: The developer platforms and infrastructure underneath.

⚡️ Silicon: The compute hardware powering everything at the bottom.

And the real story this earnings week is happening above the chips.

We are seeing a historic bifurcation in the sector:

AI victims like Adobe are trading at their lowest valuation multiples in a decade (20x earnings) as investors fear generative AI will cannibalize their seat-based pricing.

AI enablers like Palantir are commanding premiums not seen since 2021 (over 100x revenue).

Three companies just reported results that hint at where this cycle is heading next.

I’m talking about the databases, security layers, and operations pipelines where AI workloads actually run.

And the patterns are worth a closer look.

Today at a glance:

🌱 MongoDB: Breakout Momentum.

🦅 CrowdStrike: AI Adoption Rises.

🛠️ GitLab: The Copilot Reality Check.

Disclosure: MDB, CRWD, and GTLB are holdings in App Economy Portfolio.

FROM OUR PARTNERS

Should I do a backdoor Roth IRA if I make over $250k?

Probably, yes.

The IRS sets 2025 Roth IRA income limits: $150k-$165k (single) and $236k-$246k (married).

With backdoor conversions, these limits disappear, unlocking tax-free growth. For high earning households, this strategy is essential for long-term wealth building.

Range helps optimize your backdoor Roth timing and implementation.

Book your free demo with Range to learn how to take advantage of this strategy as well as more to maximize your wealth.

Disclosure: Not investment advice. Visit www.range.com for details.

1. 🌱 MongoDB: Breakout Momentum

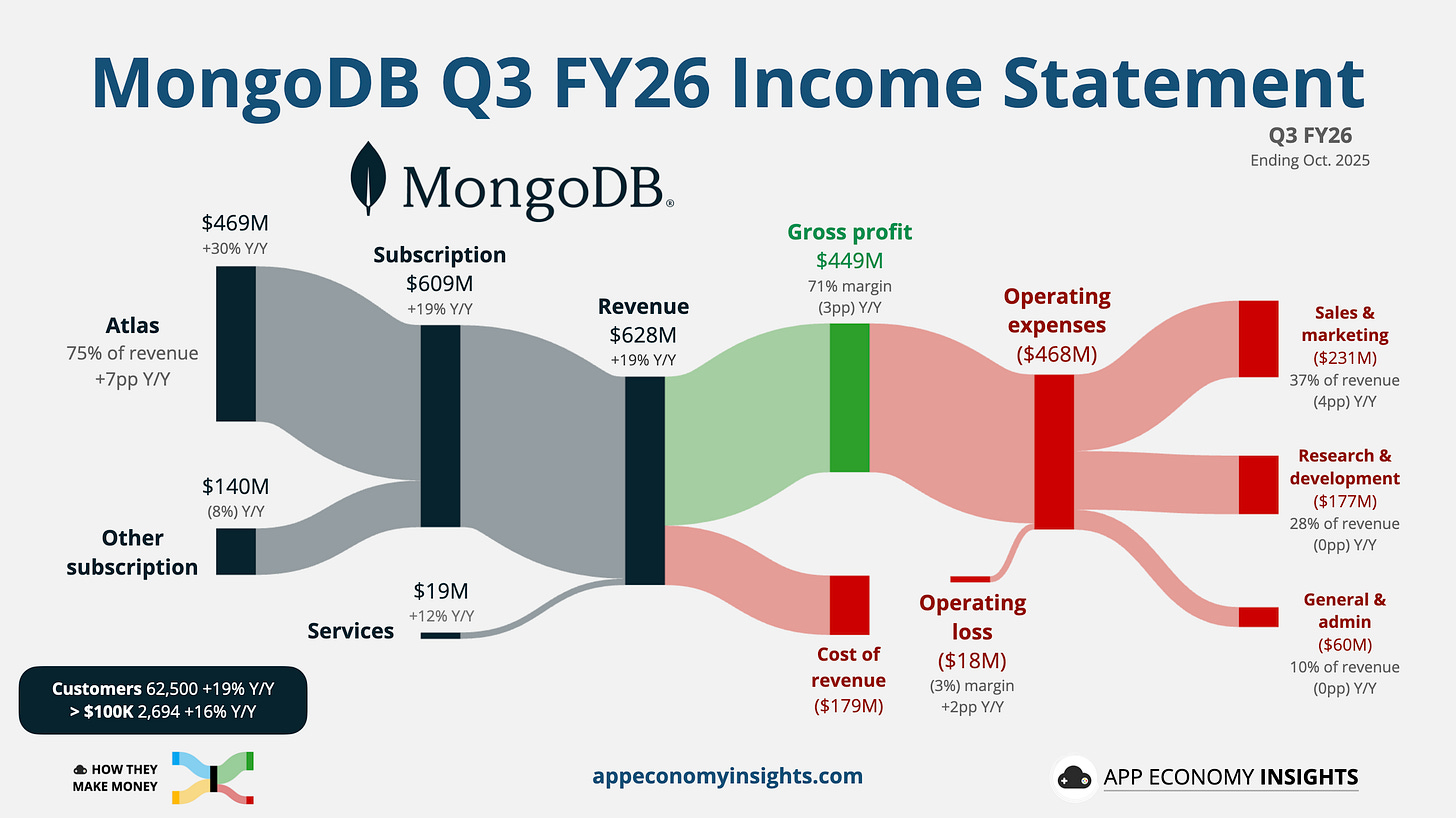

MongoDB delivered another standout quarter, with the stock jumping over 22% after earnings. Revenue grew 19% Y/Y to $628 million ($35 million beat), and non-GAAP EPS hit $1.32 ($0.53 beat).

Gross margin has been compressing as the revenue mix shifts toward cloud consumption. On the bright side, stock-based compensation was nearly flat Y/Y, helping push the operating margin close to breakeven. Free cash flow hit $140 million, a 4× increase from last year.

The highlight: Developer data platform Atlas accelerated to 30% Y/Y, its fastest pace in six quarters (up from 29% Y/Y in Q2). Atlas now represents 75% of revenue, up from 68% a year ago, driven by strong enterprise demand, healthy developer adoption, and broad-based strength across geographies.

Broad strength across key metrics

Net ARR expansion: 120% (up from 119% in Q2).

Total customers: +17% Y/Y to 62,500+ (accelerating from 16% Y/Y in Q2).

$100K+ ARR customers: +16% Y/Y to 2,694.

Existing customers are expanding, new logos remain steady, and the go-to-market engine continues to hum.

Guidance raised again

Management lifted both Q4 and full-year expectations:

Q4 revenue: $665–$670 million (+22% Y/Y, and a $42 million beat).

FY26 revenue: $2.44 billion ($87 million raise in the mid-range)

FY26 EPS: $4.78 ($1.09 raise in the mid-range).

Atlas is expected to grow 27% next quarter, with non-Atlas in the upper single digits. Free cash flow conversion should exceed 100% for the year.

The magnitude of the FY26 raise caught the market off guard. MongoDB already raised FY26 revenue guidance by $80 million in Q2, but this second upward revision (with only one quarter left) signals real momentum. Earlier in the year, management missed Wall Street’s expectations by $70 million when setting FY26 guidance. It’s now clear that it was simply a conservative setup rather than weakening fundamentals.

Building for the AI era

New CEO CJ Desai (formerly President & COO at ServiceNow and President of Product and Engineering at Cloudflare) is pitching a clear vision. MongoDB is the modern data platform for AI.

The memory advantage: AI agents require “long-term memory” to function effectively. MongoDB’s document model naturally fits this unstructured data better than rigid SQL tables.

Vector leadership: Their Vector Search ranked #1 on Hugging Face benchmarks, signaling they can compete with niche vector databases on performance.

Hybrid power: Key AI features are now available on-prem, allowing regulated industries to build AI applications without data ever leaving their secure environment.

MongoDB’s unified document model, combined with search and vector architecture, is becoming a compelling foundation for AI workloads.

Takeaway: The slowdown fears from early 2025 are officially dead. Under new leadership, MongoDB has delivered accelerating cloud growth, rising profitability, and early momentum in AI workloads. With Atlas back at 30% growth and guidance moving higher, the company has successfully positioned itself as the “memory layer” of the AI stack.

2. 🦅 CrowdStrike: AI Adoption Rises

If there were any lingering doubts about CrowdStrike’s post-outage recovery, Q3 put them firmly in the rearview mirror. Revenue grew 22% Y/Y to $1.23 billion ($10 million beat), and non-GAAP EPS landed at $0.96 ($0.02 beat). Margin stayed relatively flat, with free cash flow margin at 24%.