🤖 NVIDIA: Bubble Talk Meets Reality

Three platform shifts keep visibility on a $500B+ pipeline

Welcome to the Free edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights

In case you missed it:

AI skepticism is everywhere.

Concerns about runaway spending, circular financing, and shaky startup economics dominate the headlines. But NVIDIA’s quarter tells the other side of the story.

CEO Jensen Huang set the tone:

“There has been a lot of talk about an AI bubble. From our vantage point, we see something very different. As a reminder, NVIDIA is unlike any other accelerator. We excel at every phase of AI, from pre-training and post-training to inference. [...] The world is undergoing three massive platform shifts at once, the first time since the dawn of Moore’s Law.”

Those three shifts matter:

⚡️ Accelerated computing replaces CPUs.

🧠 Generative AI reshapes hyperscale workloads.

🤖 Agentic and physical AI create entirely new categories.

Because all three run on the same architecture, NVIDIA captures the compounding effect of the entire AI stack expanding at once.

With overwhelming demand through 2026, the near-term “AI bubble implosion” narrative looks increasingly disconnected from reality.

Let’s break down the quarter.

Today at a glance:

NVIDIA’s Q3 FY26.

Business highlights.

Key quotes from the call.

What to watch moving forward.

1. NVIDIA Q3 FY26

NVIDIA’s fiscal year ends in January, so the October quarter was Q3 FY26.

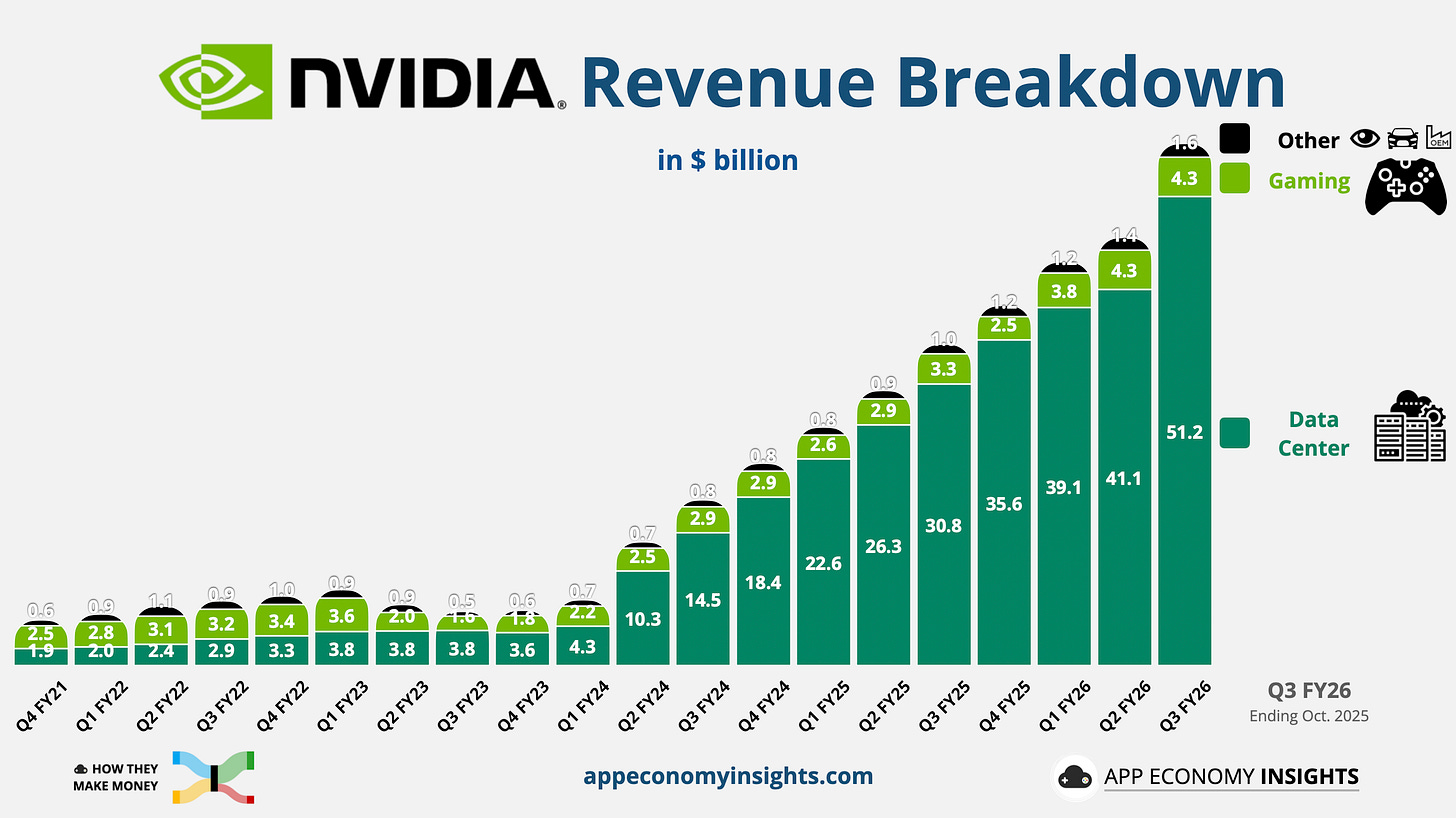

Huang said Blackwell sales were ‘off the charts.’ The chart below makes the point.

Income statement:

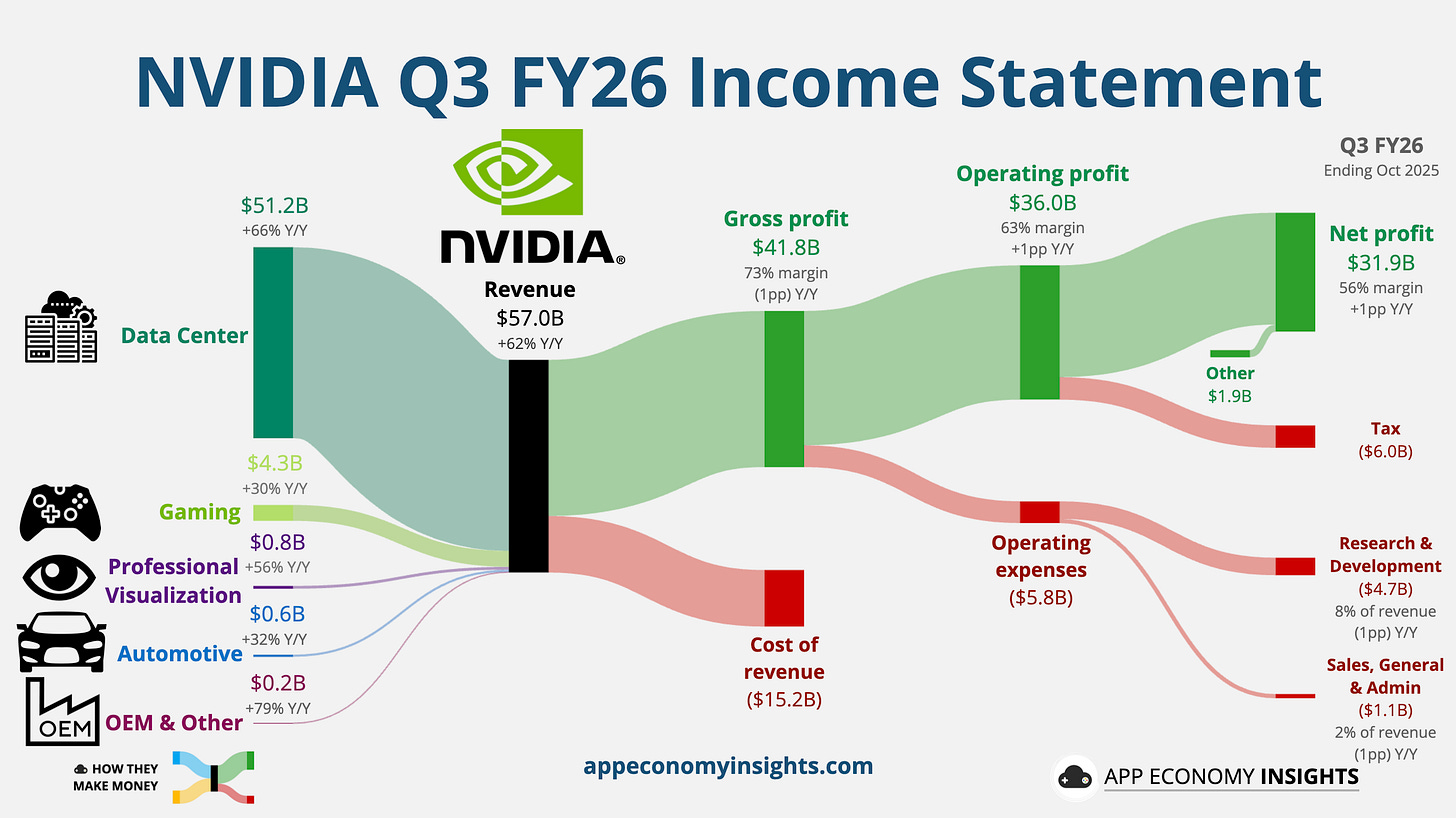

Revenue jumped +22% Q/Q and 62% Y/Y to $57.0 billion ($1.9 billion beat).

⚙️ Data Center +25% Q/Q and +66% Y/Y to $51.2 billion.

🎮 Gaming -1% Q/Q and +30% Y/Y to $4.3 billion.

👁️ Professional Viz +26% Q/Q and +56% Y/Y to $0.8 billion.

🚘 Automotive +1% Q/Q and +32% Y/Y to $0.6 billion.

🏭 OEM & Other +1% Q/Q and +79% Y/Y to $0.2 billion.

Gross margin was 73% (-1pp Y/Y).

Operating margin was 63% (+1pp Y/Y).

Non-GAAP operating margin was 66% (flat Y/Y).

Non-GAAP EPS $1.30 ($0.04 beat).

Cash flow:

Operating cash flow was $23.8 billion (42% margin).

Free cash flow was $22.1 billion (39% margin).

Balance sheet:

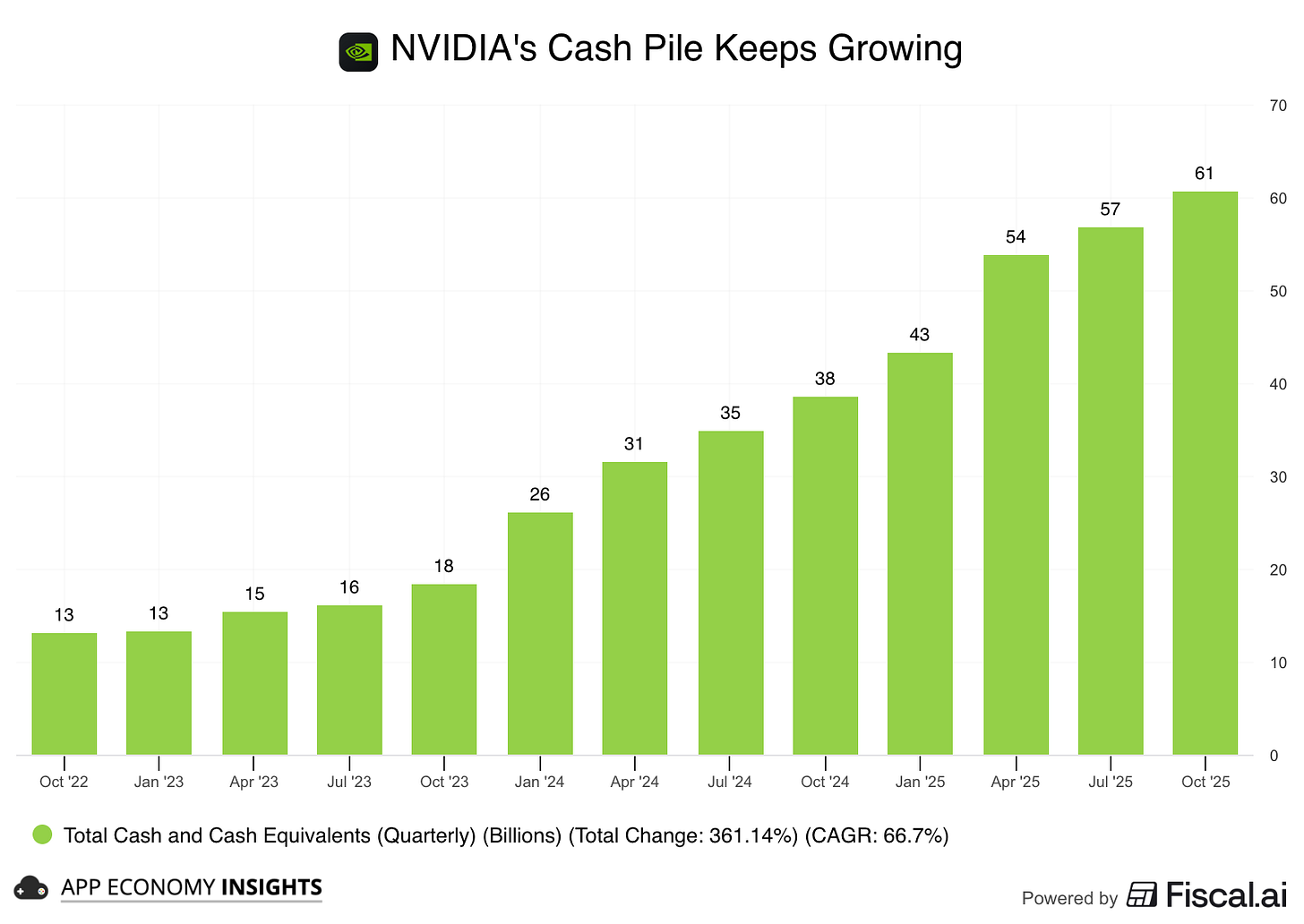

Cash and cash equivalents: $60.6 billion.

Debt: $8.5 billion.

Q4 FY26 Guidance:

Revenue +14% Q/Q and +65% Y/Y to $65.0 billion ($3.2 billion beat).

Gross margin 75% (+1.4pp Q/Q).

So, what to make of all this?

⚙️ Data Center hit 90% of total revenue, growing 25% Q/Q to $51.2 billion, a massive acceleration. The Blackwell ramp broadened again, with hyperscalers, sovereign customers, and large enterprises all increasing deployments. Management noted strong adoption across training, inference, and early agentic workloads. Supply remains the gating factor, not demand:

⚡ Compute revenue surged 27% Q/Q as Blackwell availability improved and large projects moved into production. The absence of China revenue is now fully baked into the baseline. The growth you’re seeing is entirely ex-China, an important signal that the AI cycle no longer depends on China at the margin.

🔌 Networking rose 13% Q/Q, reflecting the build-out of AI factories. CFO Colette Kress highlighted continued strength in Spectrum-X Ethernet, InfiniBand, and NVLink as clusters get denser and model complexity rises. Networking is becoming a structural growth engine.

🎮 Gaming was mostly flat Q/Q at $4.3 billion, lapping the Blackwell-powered GPU launch last quarter but still up 30% Y/Y. GeForce maintains strong demand, even as the company reallocates more supply toward Data Center.

👁️ Professional visualization grew 26% Q/Q, benefiting from workstation upgrades and AI-accelerated design workflows. This segment continues to recover as enterprises modernize their tooling.

🚘 Automotive was steady, up 1% Q/Q, reflecting gradual adoption of NVIDIA’s autonomous driving and digital cockpit platforms.

📉 Margins expanded again, with gross margin climbing sequentially to 73% and Q4 guided even higher to 75%. The mix continues to improve as networking scales and Blackwell availability normalizes.

🔮 The outlook is exceptional: Q4 revenue is guided up another 14% sequentially to $65 billion ($3.2 billion ahead of estimates) despite assuming zero shipments to China.

Big picture: NVIDIA is growing at breakneck speed, and the ramp is now powered by two engines: Blackwell compute and the networking fabric behind AI factories. The China reset is already absorbed, and the cycle is being driven by global AI infrastructure demand that continues to broaden, deepen, and compound.

2. Business highlights

🤝 So. Many. Partnerships.

The past quarter was a blur of mega-partnerships, each one expanding NVIDIA’s reach deeper into the AI stack.

OpenAI: Working with NVIDIA to build and deploy at least 10 GW of AI data centers. NVIDIA plans to take an equity stake and invest up to $100 billion over time as part of the multi-year buildout.

Anthropic: Signed a deep platform deal to run up to 1 gigawatt of Grace Blackwell and Rubin systems, alongside a planned $10 billion investment from NVIDIA. Anthropic will purchase $30 billion of compute from Azure and collaborate with NVIDIA on model training and hardware optimization, turning a prior non-customer into a full-stack NVIDIA partner.

xAI: xAI is building gigawatt-scale Colossus 2 AI factories anchored on Blackwell, including a 500 MW flagship site with Humane. AWS will supply up to 150,000 NVIDIA accelerators to power these workloads.

Saudi Arabia (KSA): Framework agreement for roughly 400,000 to 600,000 GPUs over three years.

Palantir: Bringing CUDA X into Ontology, with customers like Lowe’s already using it for supply chain and analytics workflows.

Fujitsu, Intel, and Arm: Announced NVLink integrations that wire their CPU roadmaps directly into NVIDIA’s ecosystem.

The combined commitments of Microsoft, OpenAI, and Anthropic effectively ensure multi-year visibility for NVIDIA’s systems and keep demand anchored in the hyperscaler ecosystem.

Jensen Huang touched on the circular financing of customers:

“No company has grown at the scale that we’re talking about and have the connection and the depth and the breadth of supply chain that NVIDIA has. The reason why our entire customer base can rely on us is because we’ve secured a really resilient supply chain, and we have the balance sheet to support them.”

NVIDIA now has a Berkshire-style challenge to put its money to work. With a fast-growing pile of $61 billion in cash, the company is investing in the most important players in AI to secure future offtake and expand the CUDA ecosystem. These deals ensure that the fastest-growing AI companies have the resources to scale, which reinforces NVIDIA’s long-term demand rather than propping it up.

🏗️ Customers build chips and still buy NVIDIA

Custom silicon is rising across cloud providers: TPUs at Google, Trainium at AWS, Maia at Microsoft, and Meta’s internal accelerators. These chips target specific workloads, not the frontier or the broad platform layer.

Blackwell remains the default for large-scale training, inference, and agentic systems. Even alternative accelerators often rely on NVIDIA’s networking stack, reinforcing the systems moat rather than weakening it.

Customer ASICs shift negotiating leverage at the edges, but they expand the total compute pie, and NVIDIA remains essential at the center.

🇨🇳 From Great Wall to Firewall

China has moved from a swing factor to a structural constraint. Q3 confirmed what the last two quarters hinted: H20 demand never materialized, B-series chips face fresh US scrutiny, and China’s regulators are directing state-backed data centers toward domestic accelerators. NVIDIA shipped just $50 million of H20 this quarter, effectively zero.

Management now assumes no China revenue in both Q4 and FY27 guidance. The real risk is long-term. China is racing to build a full domestic AI stack that bypasses CUDA entirely. If successful, a market Jensen once pegged at ~$50 billion becomes structurally closed. For now, the rest of the world is more than compensating.

3. Key quotes from the earnings call

Check out the earnings call transcript on Fiscal.ai here.

CFO Colette Kress:

On demand and long-term visibility:

“We currently have visibility to $500 billion in Blackwell and Rubin revenue from the start of this year through the end of calendar year 2026. [...] We believe NVIDIA will be the superior choice for the $3 trillion-$4 trillion in annual AI infrastructure build we estimate by the end of the decade. Demand for AI infrastructure continues to exceed our expectations.”

This anchors the growth looking forward and frames the $500 billion Blackwell–Rubin pipeline inside a multi-trillion-dollar decade-long build-out.

CEO Jensen Huang:

On power limits and performance per watt:

“In the end, you still only have one gigawatt of power, one gigawatt data centers, one gigawatt of power. Therefore, performance per watt, the efficiency of your architecture, is incredibly important. [...] Your performance per watt translates directly to your revenues, which is the reason why choosing the right architecture matters so much now.”

Power is the binding constraint, and that perf-per-watt is the real battleground for economics that could favor NVIDIA over the long haul.

On the ecosystem and running every model:

“NVIDIA’s architecture, NVIDIA’s platform is the singular platform in the world that runs every AI model.[...] We run OpenAI. We run Anthropic. We run xAI [...] We run Gemini [...] We run science models, biology models, DNA models, gene models, chemical models [...] AI is impacting every single industry.”

Huang’s ecosystem argument is simple: one architecture, every major model, across consumer apps, enterprises, and science. It reinforces CUDA as the default AI operating layer.

4. What to watch moving forward

Depreciation anxiety

A growing concern on Wall Street is the useful life of high-end AI hardware.

Every new GPU generation makes the previous one look older faster, raising fears that hyperscalers will be forced to accelerate depreciation, pressuring long-term margins and EPS projections.

Colette Kress pushed back. She emphasized that software updates extend the useful life of NVIDIA GPUs and that the shift from simple chatbots to agentic AI dramatically increases compute intensity, keeping older clusters fully utilized even as Blackwell and Rubin ramp. The worry is real, but NVIDIA’s argument is that the demand curve determines effective lifespan.

Who’s buying?

Many super investors dialed back their NVIDIA enthusiasm in the latest 13F filings covering Q3 2025. It’s not entirely surprising with the stock hitting new highs. NVIDIA remains one of the most widely held names, yet many funds are still underweight relative to its nearly 8% weight in the S&P 500.

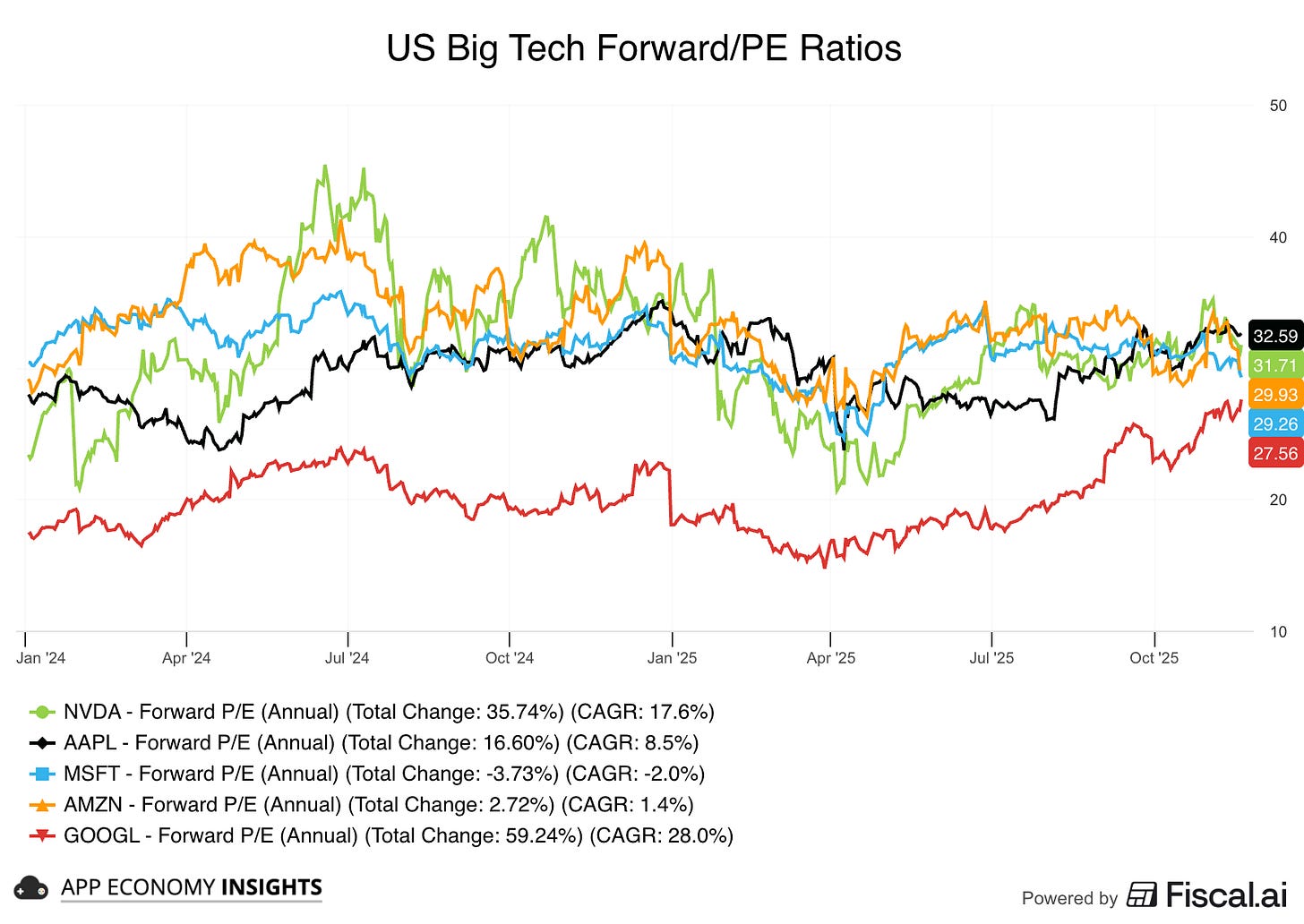

At ~32x forward earnings, NVIDIA trades mostly in line with the rest of Big Tech. But with EPS surging 67% Y/Y, you could argue NVIDIA looks cheap. NVIDIA’s growth is supply-constrained. That means quarter-to-quarter noise matters less than understanding how long this cycle can run and what the business looks like when demand normalizes.

What to watch next

If you’re a regular reader, you already know what to watch:

Cycles boom and bust: Like every major tech cycle, demand will eventually plateau or reset, and it will inevitably create volatility. However, in the words of Arya Stark: “Not today.”

Networking vs. compute mix: Is networking going to make a larger share of Data Center as AI factories scale?

Sovereign AI momentum: Are more countries committing to large, multi-year infrastructure builds?

China visibility: Does NVIDIA maintain a zero-China baseline, or is there any sign of reopening?

Hyperscaler silicon adoption: How quickly are cloud providers shifting toward in-house chips, and does it eventually impact NVIDIA's margins?

Power constraints: Energy efficiency and performance-per-watt remain the next competitive frontier, with many moving pieces.

Rubin cadence: Rubin is already in the lab. Any clarity on sampling, production, or deployment timing for the next platform will move the stock.

NVIDIA sits at the center of the most important computing cycle in decades. The details will shift (China, custom silicon, financing), but the direction hasn’t changed. As long as AI factories keep scaling, NVIDIA remains the one building the rails.

That’s it for today!

Happy investing!

Want to sponsor this newsletter? Get in touch here.

Thanks to Fiscal.ai for being our official data partner. Create your own charts and pull key metrics from 50,000+ companies directly on Fiscal.ai. Save 15% with this link.

Disclosure: I own AAPL, AMD, AMZN, GOOG, META, and NVDA in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Thoughtful and useful information. Thank you.

https://substack.com/@techitalt/note/p-180037292?r=5jmutn&utm_source=notes-share-action&utm_medium=web