⚡️ OpenAI & the AI Power Grid

And the massive partnerships with NVIDIA and AMD

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

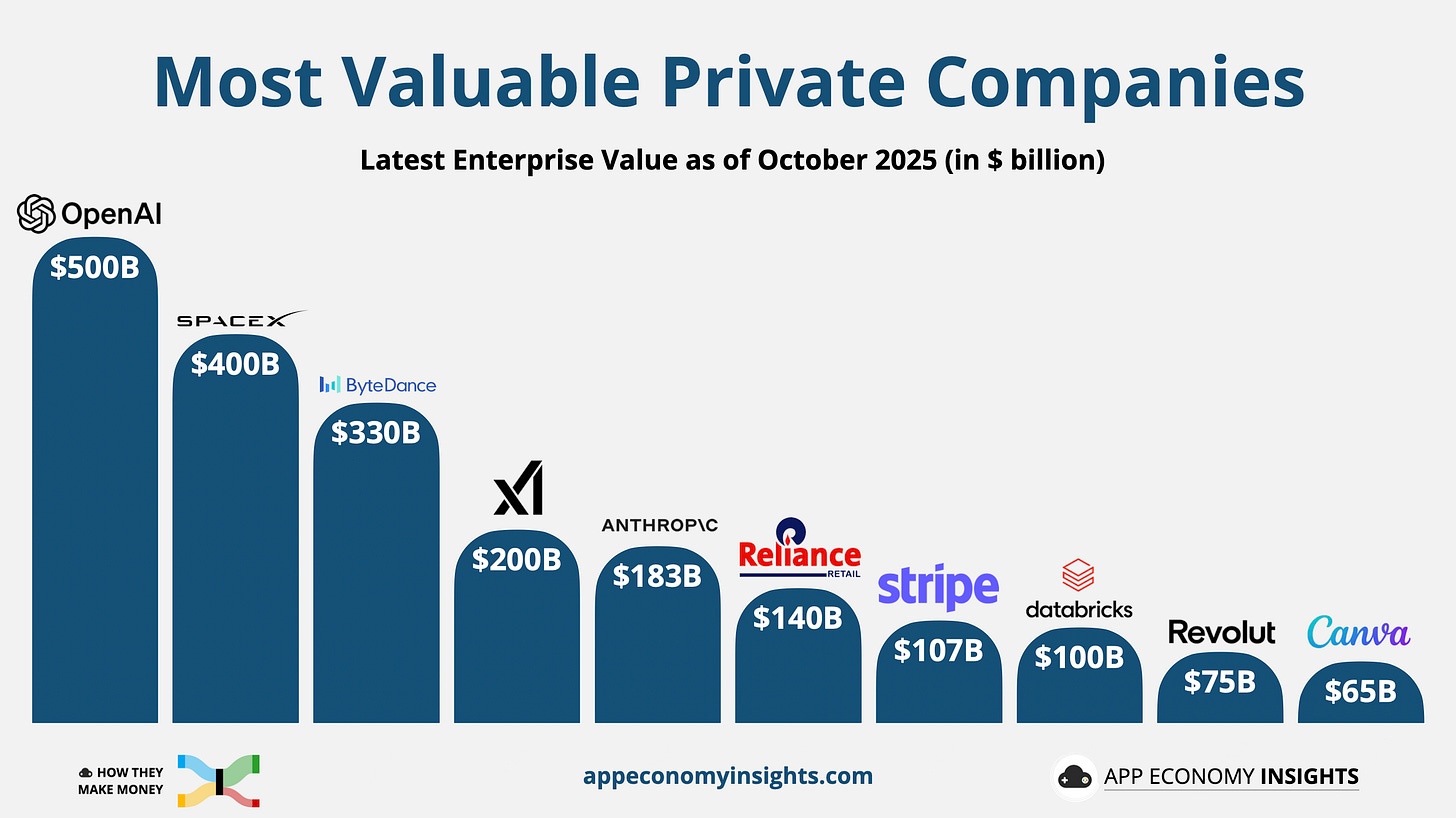

OpenAI reached a $500 billion valuation

That makes it the world’s most valuable private company, far ahead of Elon Musk’s SpaceX and TikTok’s parent ByteDance (as of October 2025).

The company’s ambition now extends far beyond paid seats. It is wiring a full-stack commerce engine into ChatGPT, aiming to convert conversational queries into direct purchases.

The goal is to master the journey from vague user intent to specific product, a place where today’s social discovery feeds still struggle. This could be a boon for Etsy and Shopify merchants that live in the long tail.

But this vision is gated by a brutal physical reality: it requires an AI power grid of unprecedented scale. This has forced a sophisticated and risky $100 billion partnership with NVIDIA, built on complex financial engineering and a high-stakes bet on the future of energy. Oh, and did we mention that new deal with AMD, where OpenAI will take up to a 10% stake?

This is a story about megawatts, money, and moats.

What’s inside:

ChatGPT goes after commerce

The OpenAI-NVIDIA deal

The OpenAI-AMD deal

Power is the moat

The cash reality of the AI bubble

Circular financing & accounting

NVIDIA’s Berkshire-sized problem

FROM OUR PARTNERS

Elon Musk: “Robots Will…Do Everything Better”

And it’s already happening.

Just look at fast food. Miso Robotics is already delivering an AI-powered fry-cooking robot that can cook perfectly 24/7. With the restaurant industry desperately grappling with 144% employee turnover rates and skyrocketing minimum wages, it’s no surprise major brands like White Castle are turning to Miso.

Now, after selling out the initial run of their first fully commercial Flippy Fry Station robot in one week, Miso is scaling production to 100,000+ U.S. fast food locations in need.

That’s accelerated by a brand new manufacturing partnership, joining established partners like NVIDIA, Amazon, and Uber.

And you can become an early-stage investor today and unlock up to 8% bonus stock. Just don’t wait. Invest before bonus shares change Thursday.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

1. ChatGPT goes after commerce

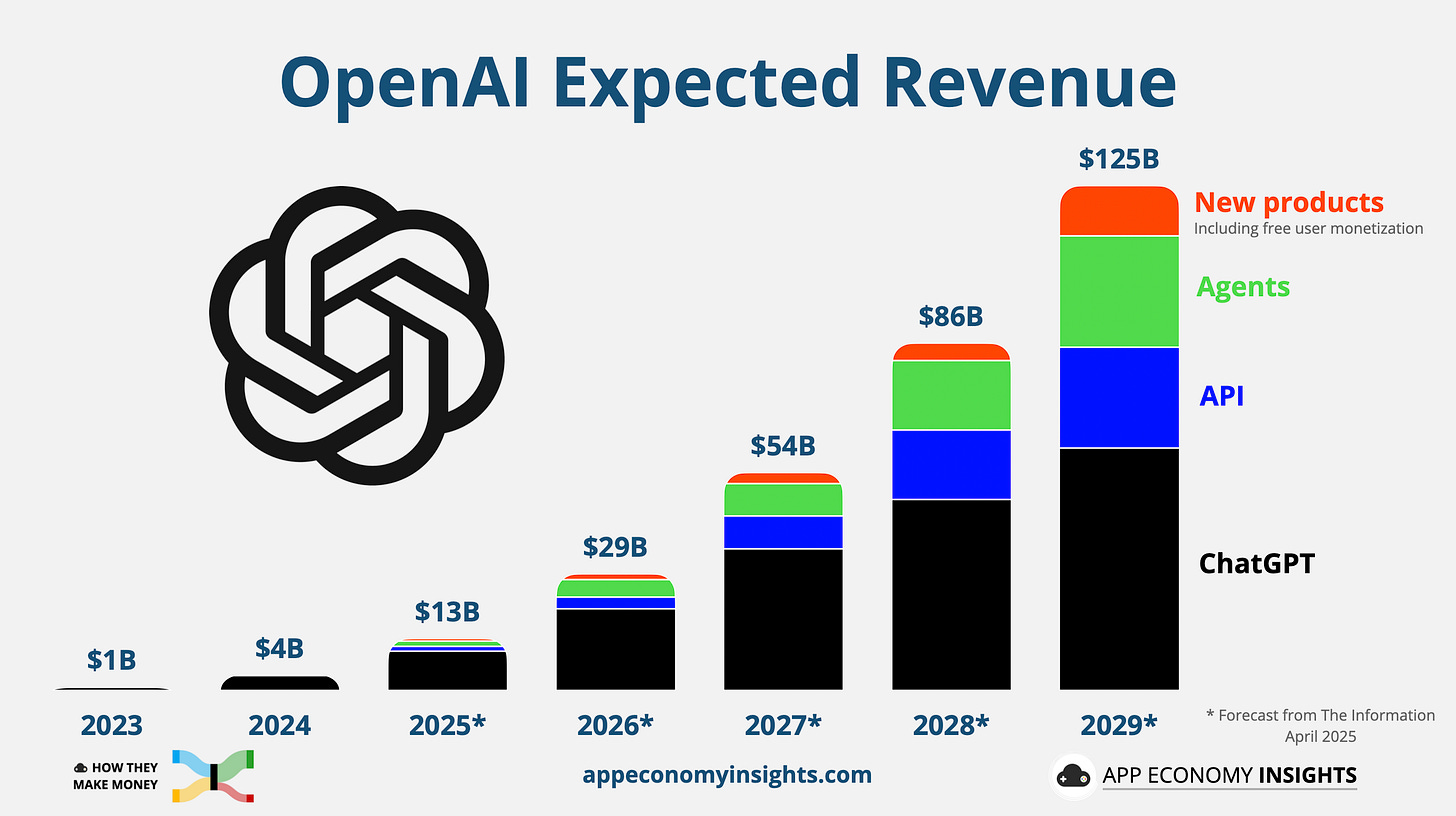

Based on an internal forecast reported by The Information in April, OpenAI targets $125 billion in revenue by 2029.

ChatGPT alone is expected to reach $60 billion in revenue by 2029, primarily from paid subscriptions (Plus, Pro, Business, and Enterprise). It’s not unprecedented if you use Microsoft’s Productivity & Business suite as a comp ($120 billion in revenue in FY25), but it would require universal adoption in the corporate world at a time when competition is fierce in agentic work.

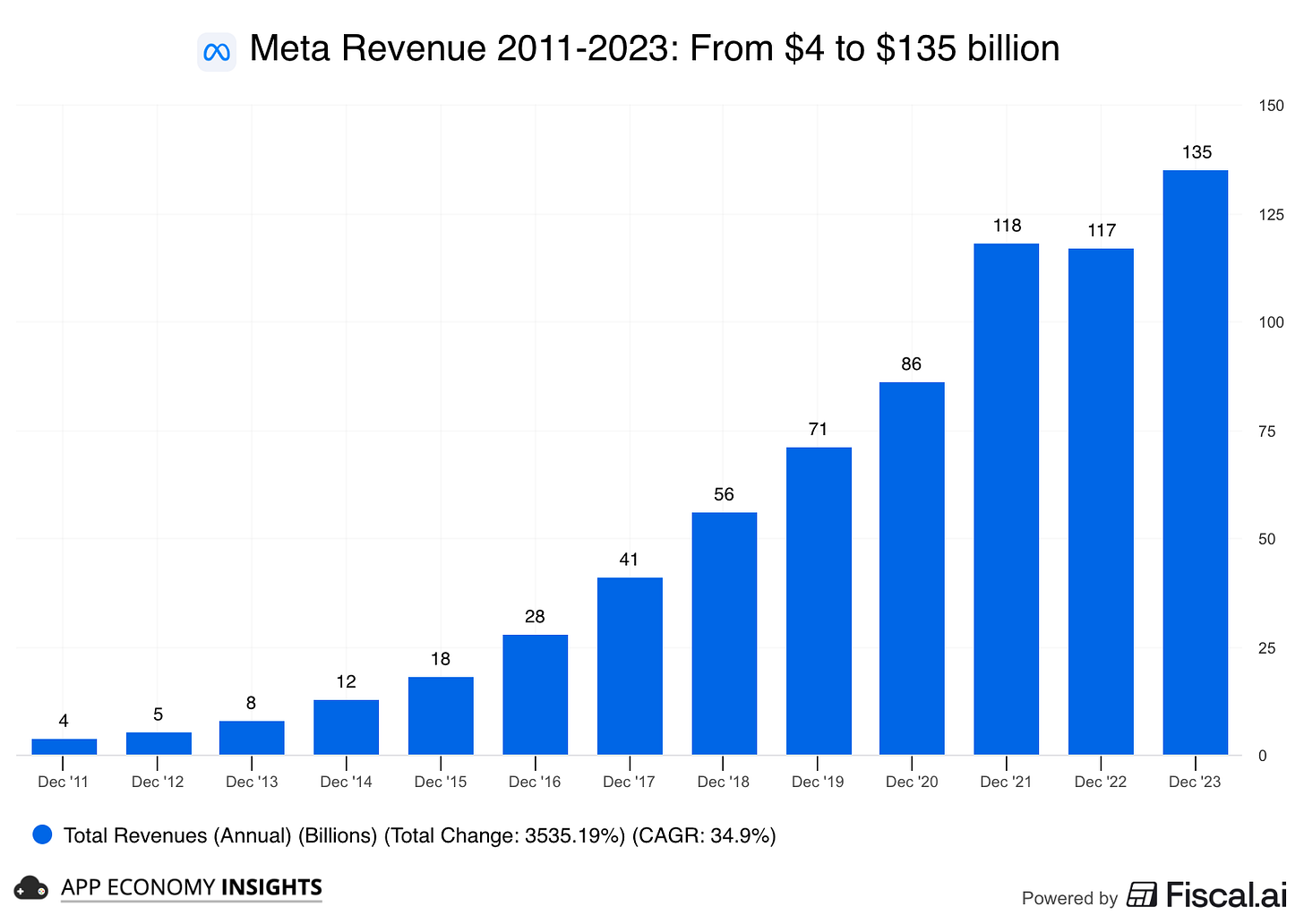

For perspective, Meta needed 12 years to go from ~$4 billion to ~$135 billion in annual revenue, across a family of apps used by 3+ billion people each month.

The bigger story is monetizing the free audience, starting with native shopping.

Why assistants can move the needle

Search and social feeds push you toward what’s already popular. An assistant starts earlier in the funnel. You describe a problem, not a brand. That’s where long-tail inventory wins. The assistant can surface a perfect niche product you didn’t know to search for, and then close the loop inside the chat.

What was announced so far

Instant Checkout inside ChatGPT: Users can discover and buy without leaving the assistant (rolling out with Etsy listings in the US, with Shopify next). Even if the first version of checkout is basic, ChatGPT would offer the shortest path to fixing a problem with a purchase. It’s the on-ramp to monetizing the free audience with commerce.

Merchant rails and payments: OpenAI published an open standard so sellers can make their products shoppable inside ChatGPT. When multiple merchants offer the same item, enabling Instant Checkout becomes the way to be the link that converts. OpenAI says results aren’t pay-to-play, but the incentive is clear: wire your catalog and let the agent complete the funnel.

Upstream supply & siting: OpenAI announced memory-supply letters in South Korea (Samsung, SK Hynix) and discussions about hosting data centers there. It’s a wafer-to-watt hedge. The goal is to lock HBM and locations so inference capacity actually shows up as adoption grows.

That brings us to the massive deal with NVIDIA.

2. The OpenAI-NVIDIA deal

OpenAI is building an AI factory of unprecedented scale, and NVIDIA is fronting the $100 billion bill. The two giants plan to deploy millions of GPUs, totaling at least 10 gigawatts of computing power, to train OpenAI’s next-generation models.