🤝 Intel × NVIDIA Pact Explained

A $5 billion stake and co-design pact reshape AI capacity

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Intel just got a much-needed $5 billion boost

Years of missed timelines and swelling capex turned Intel’s foundry ambitions into a cash drain, and confidence in a quick catch-up faded.

On the latest earnings call, CEO Lip-Bu Tan said the next-generation chip node (14A) would only work with a “meaningful external customer” to share the spend. That warning served as leverage. Either put real capital behind Intel’s foundry, or accept a future where Intel designs chips but gets them built at TSMC.

The US government steps in: Because leading-edge capacity is strategic, Washington said in August it would take a 10% stake in Intel for nearly $9 billion, converting part of previously awarded CHIPS Act funding into equity. That put the federal government on Intel’s cap table and bought time to land an external anchor customer.

NVIDIA follows: Last week, NVIDIA announced a $5 billion investment in Intel and a multi-year product collaboration.

That one-two punch (policy support and a new marquee partner) doesn’t fix execution overnight, but it resets the board for America's AI ambitions.

Meanwhile, in a move to secure its own ecosystem, Europe saw lithography leader ASML take a strategic 11% stake in Mistral AI to integrate AI across its product portfolio and accelerate the chip design process.

Let’s break it down.

Today at a glance:

The Race for AI's Foundation

🇺🇸 Intel + NVIDIA

🇪🇺 ASML + Mistral AI

FROM OUR PARTNERS

An AI ‘Breakthrough’ with FDA Submission on the Horizon

FDA clearance is a major milestone for any medical innovation. Investors watch for this, because passing FDA trials can be a potential major milestone opening greater opportunities for growth and even acquisition.

For HeartSciences (Nasdaq: HSCS), they’ve already received an FDA Breakthrough Device Designation, and their FDA submission is next.

The company has also created a software platform which is expected to offer an AI algorithm “app store” to help radically upgrade the ECG, a common heart test used by frontline healthcare workers, to detect a broader range of heart disease, earlier. The ECG is performed up to 1 billion times on patients annually, and the ECG market is projected to reach $30B by 2034.

That’s why one Wall Street analyst has a price target of $15 for HeartSciences’ stock. But today, you can invest at just $3.50 per unit (convertible preferred stock + warrant).

With the analyst target, this represents more than 500% potential upside.

Learn more and invest in HeartSciences.

This is a paid advertisement for HeartSciences Regulation A+ offering. Please read the offering circular at https://invest.heartsciences.com/

1. The Race for AI's Foundation

Before we break down the Intel-NVIDIA deal, we need to map the handful of companies that control the world's supply of AI chips.

The AI tech stack has 3 layers:

📱 Top: Apps (ChatGPT, Gemini, Copilot).

🧠 Middle: Models (GPT-5, Llama, Mistral).

🤖 Bottom: Compute (chips, memory, packaging).

Let’s focus on the foundational bottom layer: the world of compute.

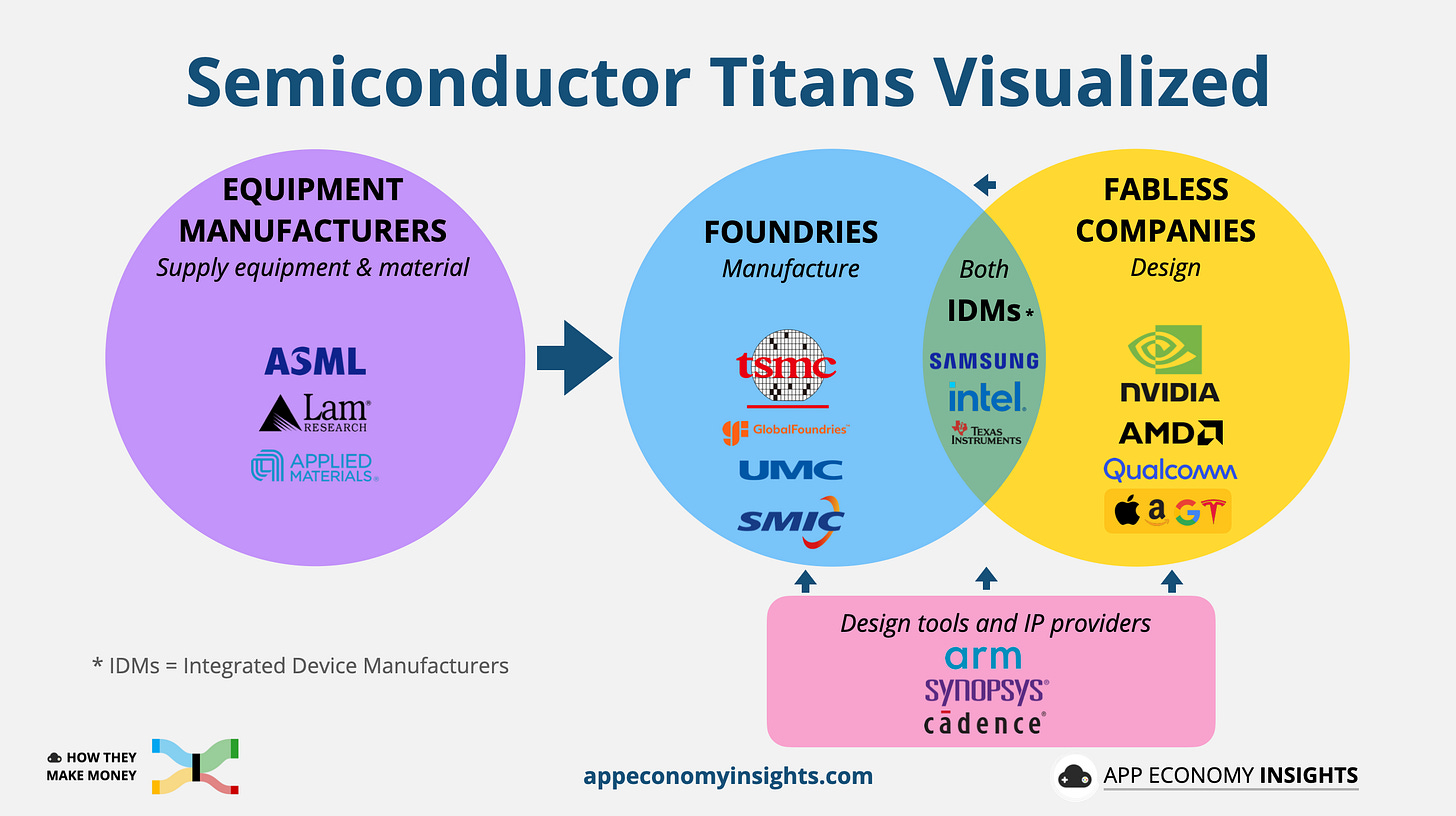

🌐 Equipment makers → ASML, Lam Research, Applied Materials. They sell the essential tools and machinery for chip production (EUV/DUV, deposition, etch) that set the pace of progress.

🌏 Foundries → TSMC, GlobalFoundries, UMC, SMIC. They manufacture chips for others. Their business is wafer volume, yield, and packaging.

💡 Fabless designers → NVIDIA, AMD, Qualcomm (and Big Tech in-house). They design, outsource manufacturing, and focus R&D on architecture and software.

🔄 Integrated Device Manufacturers (IDMs) → Intel, Samsung, Micron, Texas Instruments. They both design and manufacture. Intel is the only US-headquartered player still pushing for leading-edge logic at scale.

⚙️ Design tools and Intellectual Property (IP) providers → Arm, Synopsys, Cadence. They provide the instruction sets, libraries, and design tools that make everything else possible.

Why it matters

Most leading-edge logic for AI training/inference is built at Taiwan Semiconductor Manufacturing Company, or TSMC for short (with Samsung a distant second). Concentrating that capability in one company on one island creates national security and supply chain risk for the US.

Intel is the only domestic path to on-shore leading-edge logic and advanced packaging at meaningful scale, which is why policymakers treat it as strategic infrastructure.

Intel vs. TSMC

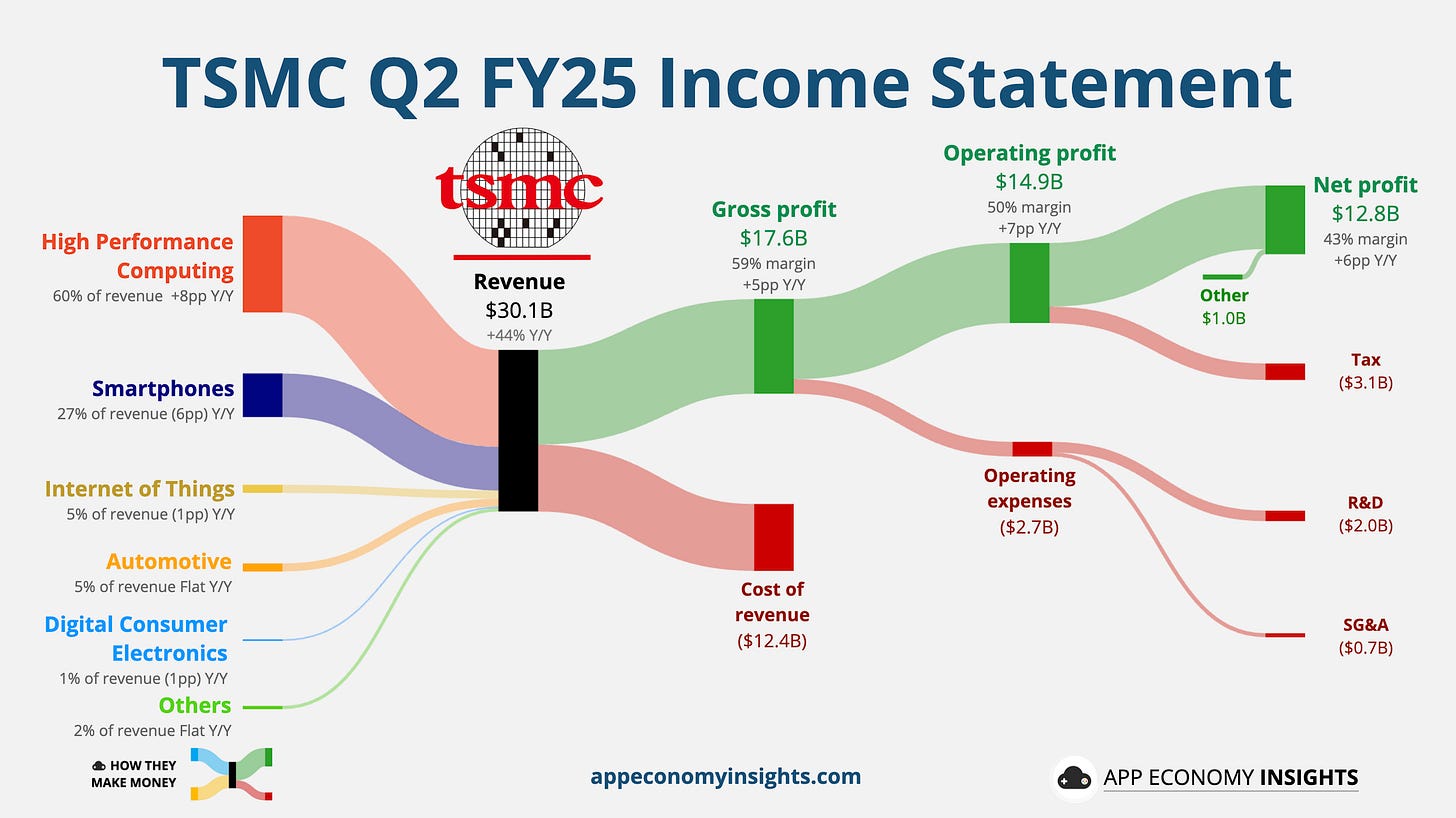

TSMC is a pure-play foundry with unmatched yield, customer mix, and advanced packaging that binds multiple chips and high-bandwidth memory (HBM) into one tightly connected module. That’s exactly what modern AI accelerators need. It already carries the bulk of AI accelerator volume. TSMC crossed $30 billion in revenue in Q2 and is growing at a breakneck speed.

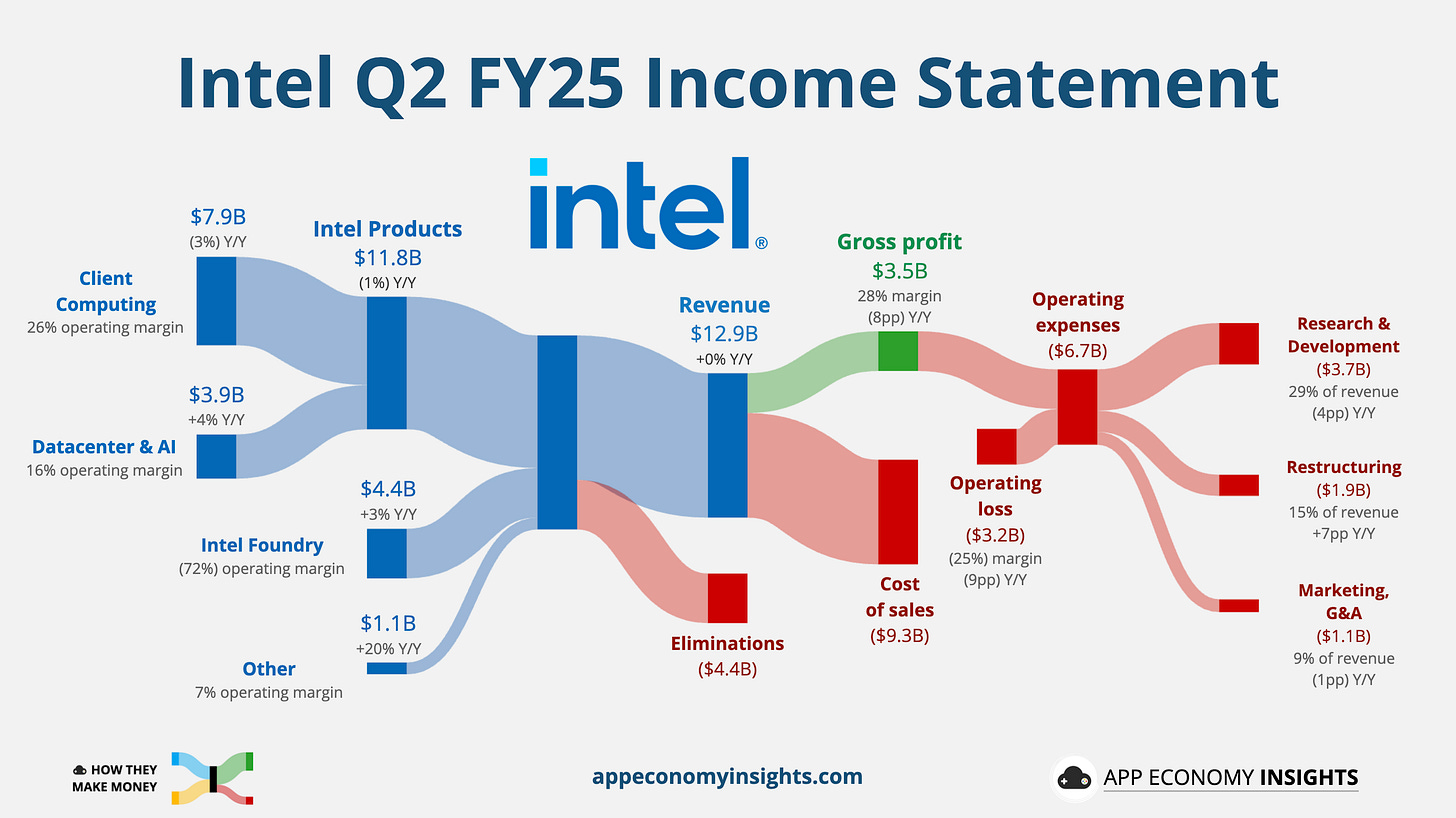

Intel is an IDM trying to stand up a foundry-for-others business alongside its own products. If it succeeds, the US gets a second, on-shore source for cutting-edge logic and packaging, which would be critical for AI supply and bargaining power. In Q2, Intel Foundry represented $4.4 billion in revenue, a segment operating at a deep loss.

How we got here

Intel delayed broad EUV adoption: In the mid-to-late 2010s, the company tried to squeeze more from DUV with complex multi-patterning at 10nm.

That choice created problems: Yield, timeline slips, and cost blow-outs, just as TSMC and Samsung leaned into EUV at 7nm/5nm, pulling decisively ahead.

Intel has since pivoted: Its 18A node is EUV-based, and it’s an early backer of High-NA EUV. But the years of delay left a gap in customer trust and capacity that policy (CHIPS Act) and partnerships must now help bridge.

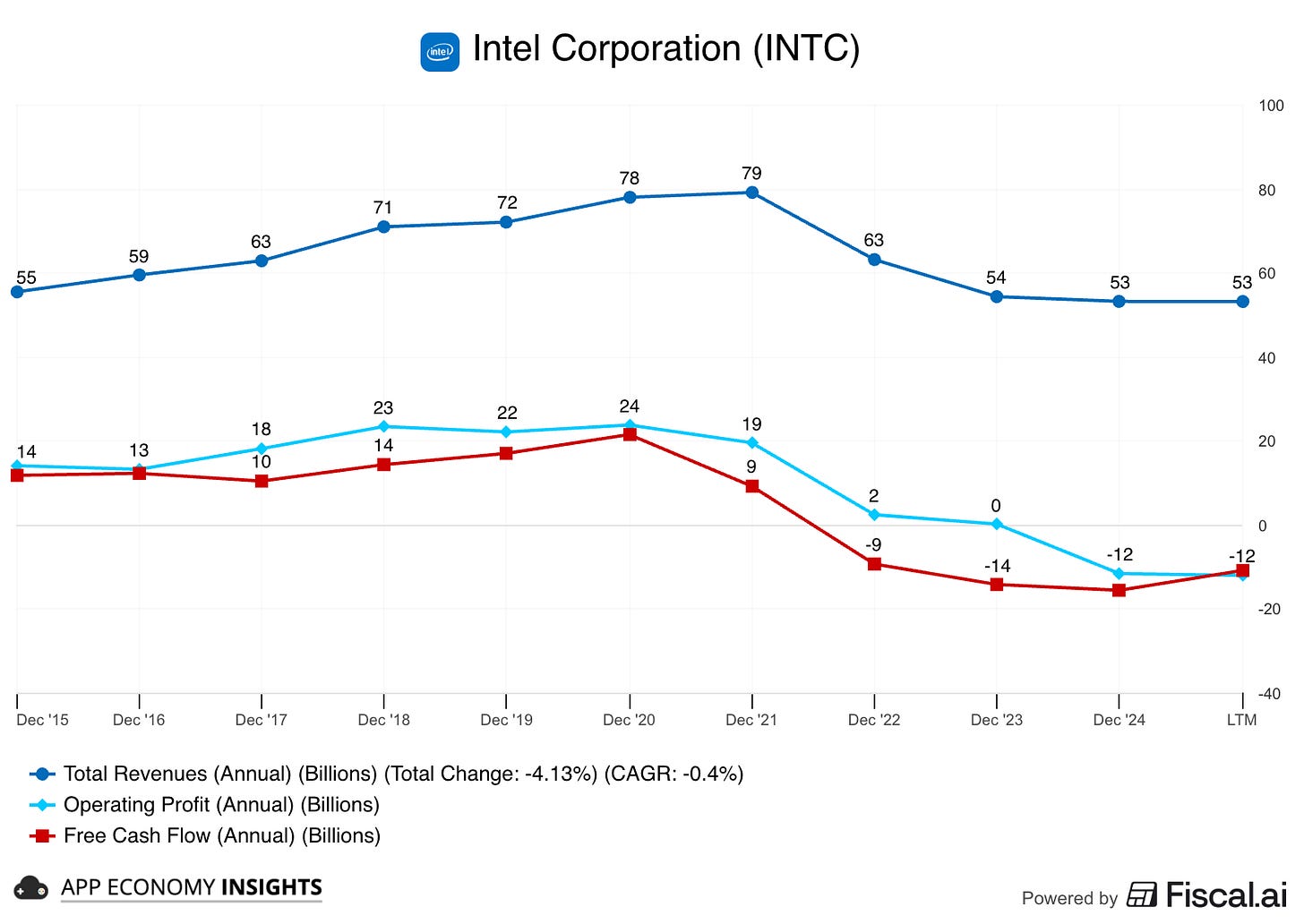

Deteriorating financials: Operating profit peaked around $24 billion in 2020 and has turned negative since last year. Free cash flow has swung negative exactly when capex needs have surged.

The AI sovereignty crisis

The reason for the urgency is simple: the entire AI revolution, from training efficiency to memory bandwidth, is built on the most advanced chips available. As this technology becomes critical infrastructure for both the US industry and its national defense, relying on a single, overseas point of failure becomes an existential threat.

Now, let’s look closer at the one-two punch designed to break the bottleneck.

2. Intel + NVIDIA

NVIDIA put $5 billion into Intel (at $23.28/share), and the two agreed on a multi-year product collaboration. For Intel, that’s outside demand and credibility it badly needs. For NVIDIA, it’s a critical second source for advanced packaging and a new partner for custom silicon, reducing its dependency on a single supplier

Three product updates at Intel

NVLink everywhere. Intel will incorporate NVLink across its stack, giving NVIDIA’s solution a stronger enterprise foothold versus Ethernet.