🌀 Oracle's NVIDIA Moment

Stargate and new multi-billion deals fuel OCI growth

Welcome to the Free edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Larry Ellison briefly became the world’s richest person.

Not because he launched a new rocket or a buzzy AI wearable, but because Oracle, his 48-year-old enterprise software giant, started acting like NVIDIA.

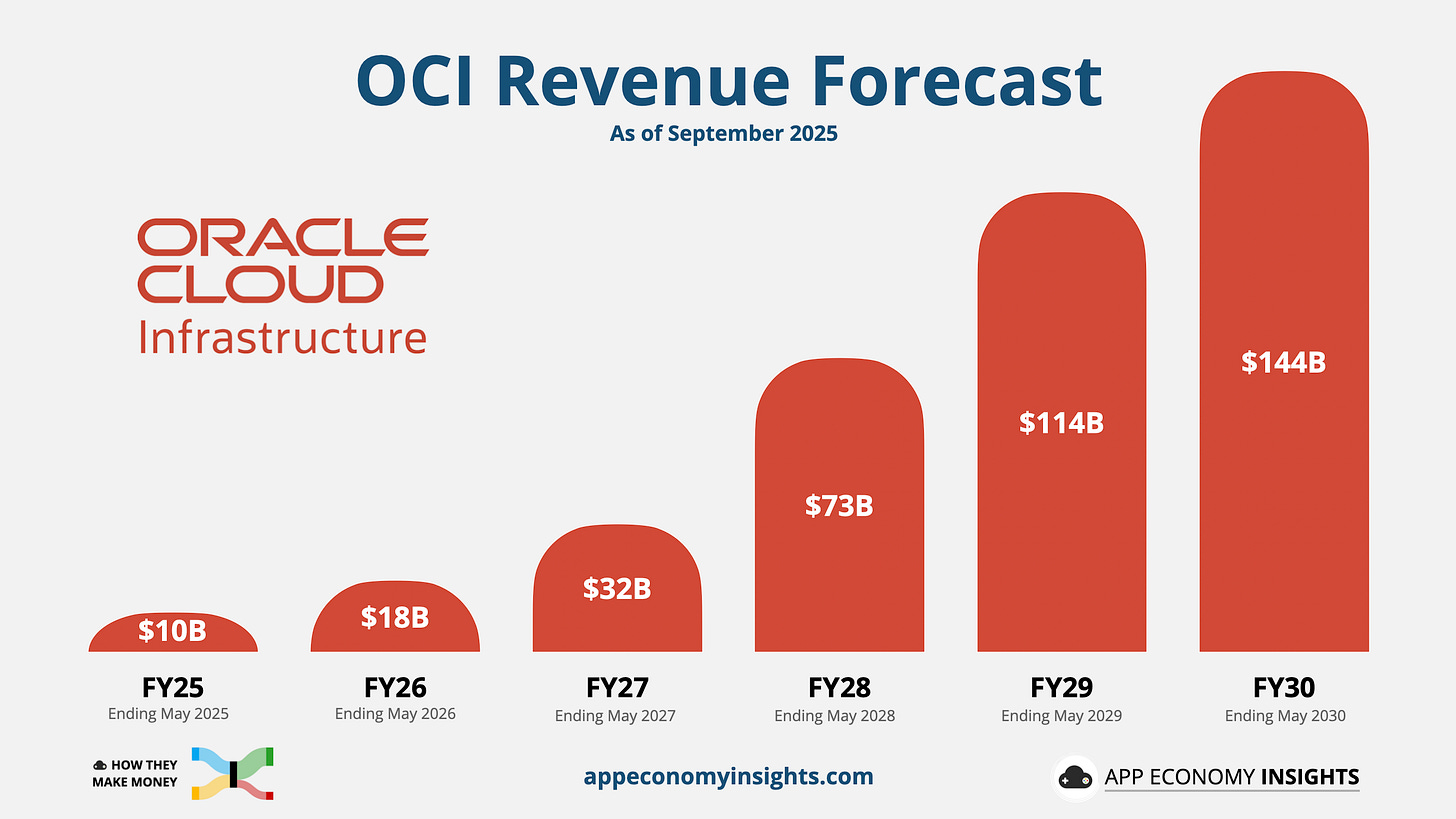

Shares surged 36% after the company revealed a jaw-dropping forecast. Oracle Cloud Infrastructure (OCI) revenue is set to grow 14× in 5 years, a move that will make it the dominant force in Oracle's entire business.

Let’s review what changed and why Wall Street is so excited.

Today at a glance:

Oracle’s Q1 FY26

OCI Surge Explained

Key quotes from the call

What to watch moving forward

1. Oracle Q1 FY26

Key metrics:

The $455 billion RPO shocker: RPO (future revenue from existing contracts signed) is a critical leading indicator of cloud revenue growth. It accelerated to a staggering 359% Y/Y (from 63% Y/Y in the prior quarter). Conversion from RPO to revenue primarily depends on the live data center count and power capacity.

Project Stargate was added to Oracle’s RPO for the first time. It’s a multi-billion-dollar AI infrastructure initiative to build some of the largest AI data centers in history, potentially scaling to $500 billion over four years. It involves Softbank, OpenAI, NVIDIA, MGX, and Oracle.

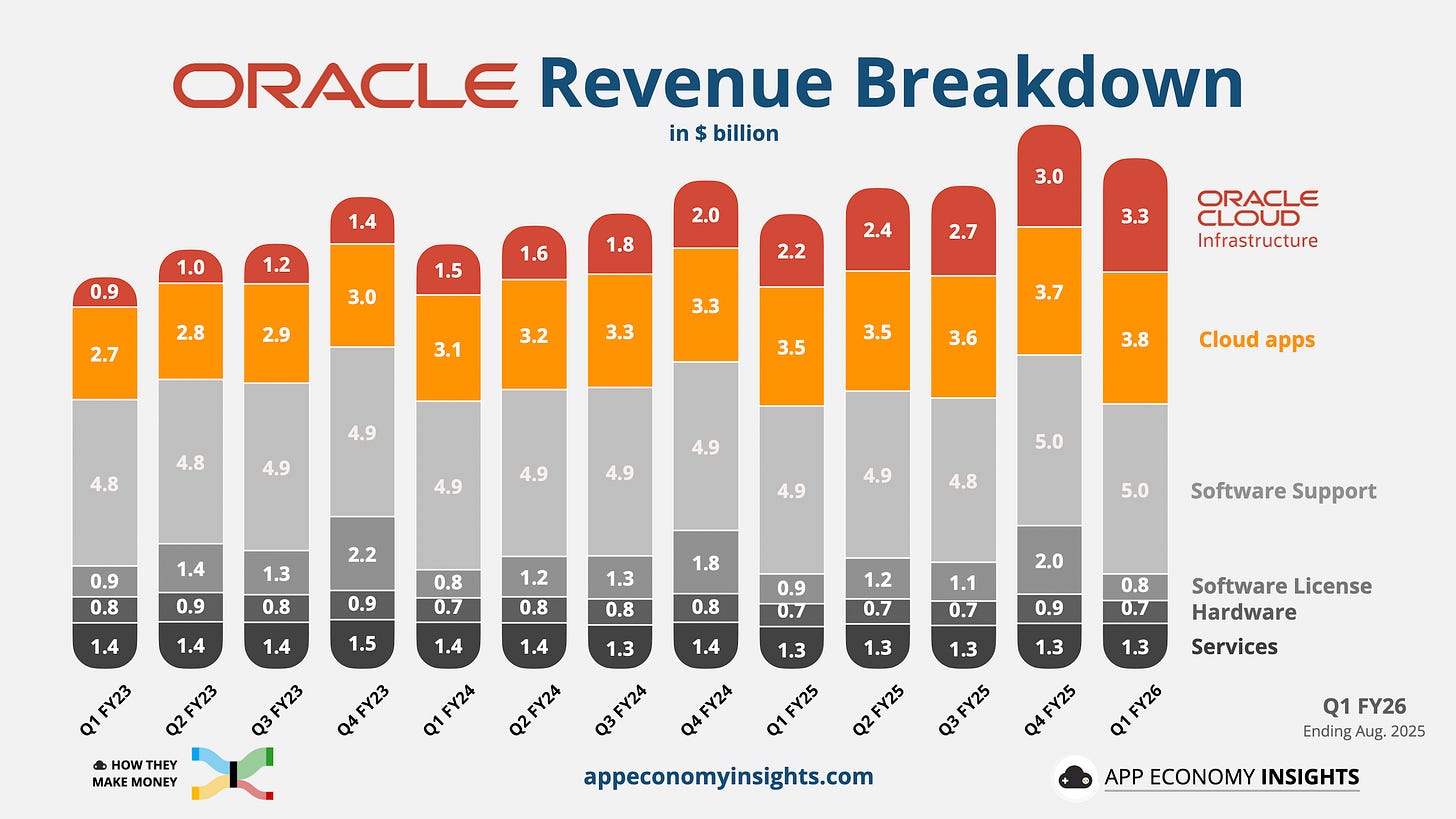

Cloud: Oracle's growth engine rose 28% Y/Y to $7.2 billion.

Cloud Infrastructure (IaaS) focuses on providing compute, storage, and networking services. It grew +55% Y/Y to $3.3 billion (accelerating from 49% in Q4), driven by increased adoption of OCI for high-performance workloads and multi-cloud deployments. This is where RPO is expected to convert into revenue over time.

Cloud Application (SaaS) focuses on delivering Oracle's suite of enterprise applications. It grew 11% Y/Y to $3.8 billion, driven by demand for cloud-based ERP, HCM, and CRM solutions.

The visual below makes it clear: The majority of Oracle’s revenue is no longer growing. The real magic is coming from OCI.

Income statement:

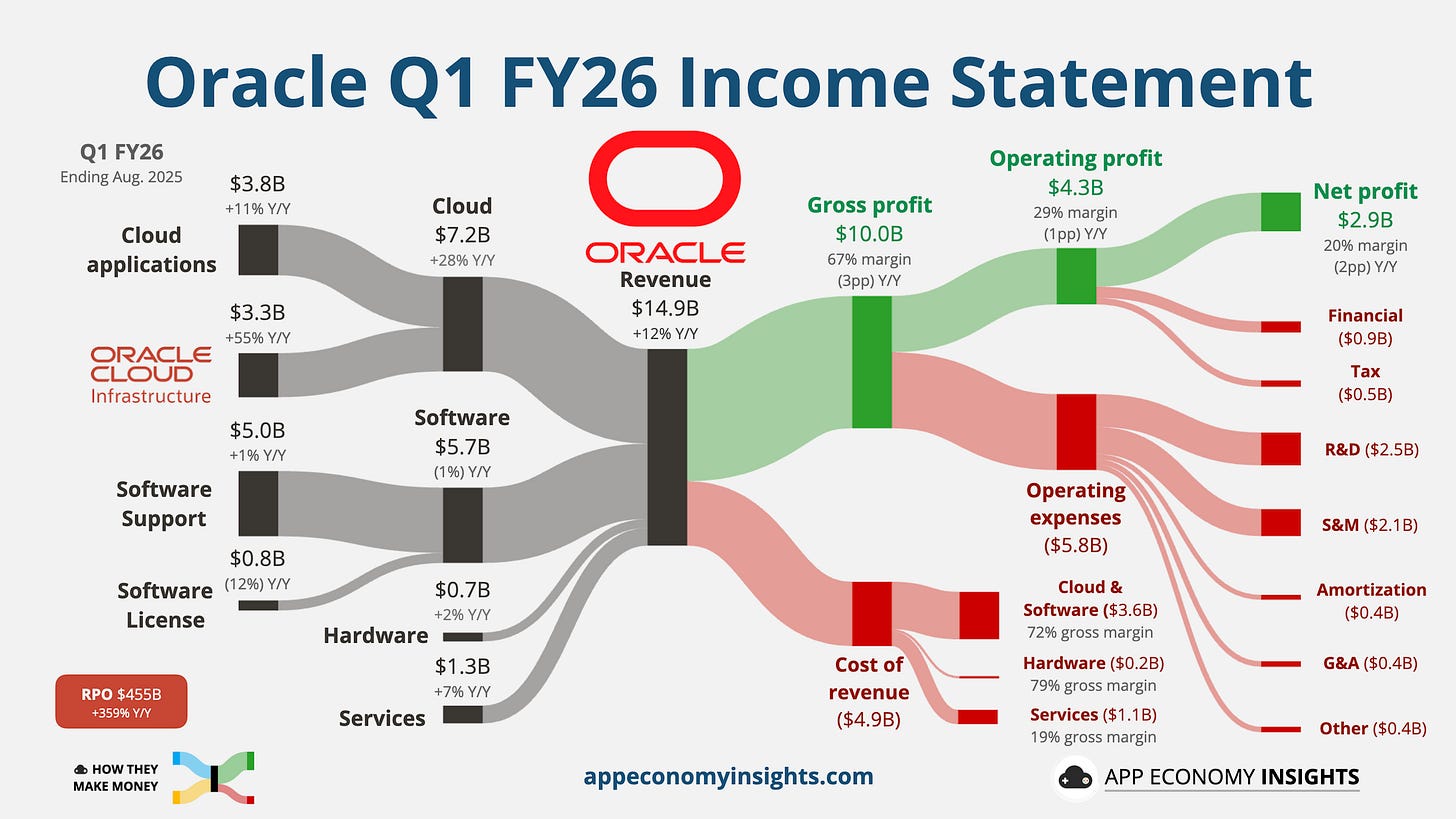

Revenue grew +12% year-over-year to $14.9 billion ($260 million miss).

☁️ Cloud grew +28% Y/Y to $7.2 billion.

🌐 Software declined by 1% Y/Y to $5.7 billion.

🖥️ Hardware grew 2% Y/Y to $0.7 billion.

💼 Services grew 7% Y/Y to $1.3 billion.

Gross margin was 67% (-3pp Y/Y).

Operating margin was 29% (-1pp Y/Y).

Non-GAAP EPS $1.47 ($0.01 miss).

Cash flow:

Operating cash flow TTM was $21.5 billion (+13% Y/Y).

Free cash flow TTM was an outflow of ($5.9) billion, impacted by a massive surge in CapEx to $27.4 billion (from $7.8 billion a year ago).

Balance sheet:

Cash and short-term investments: $11.0 billion.

Debt: $91.3 billion.

So what to make of all this?

📦 Backlog shock: Oracle’s remaining performance obligations jumped on 4 multi-billion-dollar contracts across 3 customers. Conversion to revenue over time will depend on data-center capacity and power coming online.

☁️ OCI is the engine: Cloud infrastructure still represents a small share of total revenue today (22% of the top line). But growth is now expected to accelerate to 77% Y/Y in FY26 (previously 70%) to $18 billion.

🔗 Multicloud flywheel: Revenue tied to hyperscaler partners surged 1,529%, with plans to activate dozens more regions. Oracle’s database and OCI are riding the installed footprints of AWS, Azure, and Google Cloud.

⚡ Execution bottleneck: Oracle signed the contracts, but now it has to actually build the data centers with a FY26 CapEx guide of $35 billion (up from $25 billion previously). The only things holding back this mountain of cash are finding enough power and pouring enough concrete, fast.

🎯 Concentration risk: A few mega-customers, including the Stargate/OpenAI program, likely account for a large share of the surge, so any slippage of the project would slow backlog conversion.

⚖️ Heavier leverage than peers: Oracle isn’t sitting on a cash hoard like the rest of Big Tech. The company has a net debt of over $80 billion. It paid over $5 billion in dividends in the past year, despite free cash flow turning negative. That mix trims financial flexibility if the cycle wobbles.

🔮 OCI guidance got (a lot) bigger: The multi-year preview for OCI implies revenue rising to $18 billion in FY26, then $32 billion, $73 billion, $114 billion, and $144 billion over the following four years. Yes, that's a 14x from FY25 to FY30. Let’s review why.

2. OCI Surge Explained

Before we get carried away by that $455 billion backlog figure, let's be clear: RPO isn't cash in the bank. Here's how to think about it:

What RPO is: Contracted, non-cancelable future revenue not yet recognized.

Total vs. current: Current RPO converts within twelve months, while total RPO can span years, so headline RPO says little about near-term revenue.

Why RPO can mislead: A few multi-year mega-deals can swell RPO overnight, but revenue lands only as capacity is delivered and usage ramps.

One-offs vs. run-rate: Don’t annualize this quarter’s signings. Heavy contract concentration means the surge isn’t a steady cadence. That’s even more true with the massive Project Stargate.

In short, OCI revenue, utilization, and CapEx progress all offer a better compass than RPO to gauge the upcoming revenue growth and its magnitude.

How much is Project Stargate alone?

The Wall Street Journal reports that OpenAI signed a $300 billion, roughly five-year compute purchase with Oracle beginning in 2027.

Oracle’s RPO rose $317 billion sequentially.

If the enforceable, non-cancelable portion of the OpenAI agreement was booked at signing—as Oracle describes RPO—Stargate likely represents the vast majority of the jump in RPO, and is therefore reflected in the OCI revenue forecast.

The context in Q1 FY26

Management previewed a multi-year OCI ramp to $144 billion within five years. That’s the kind of epic growth we’ve seen for NVIDIA’s Data Center revenue.

For context, Oracle previously shared a goal for FY29 of $104 billion in revenue for the entire company at the Financial Analyst meeting last year. That FY29 revenue number is now likely over $160 billion based on the new OCI forecast, even assuming other segments remain flat-ish.

Management did not share an OCI revenue amount previously, so the magnitude and specificity of the plan were both noteworthy.

Who are the other customers?

Oracle won't name names, but the list of suspects for these multi-billion-dollar deals is short and star-studded. Let's play detective:

OpenAI (via Project Stargate): Again, Oracle and OpenAI publicly announced a 4.5-gigawatt US expansion for Stargate on Oracle, and multiple outlets report a mega-contract underpinning capacity.

xAI: Oracle and xAI announced Grok models on OCI for training and inference in June. The scale and timing fit a multi-billion-dollar commitment.

Meta: Zuck is in the midst of an aggressive AI CapEx ramp ($66–$72 billion in 2025, with a further step-up flagged for 2026). That profile fits a multi-billion, multi-year OCI commitment

In addition, Oracle said in August it would offer Gemini models via OCI alongside the Database@Google Cloud expansion. Oracle also highlighted plans to deliver more multicloud datacenters for AWS/Azure/Google.

3. Key quotes from the earnings call

CEO Safra Catz

On AI demand & who’s buying:

“Oracle has become the go-to place for AI workloads. We have signed significant cloud contracts with the who's who of AI, including OpenAI, xAI, Meta, NVIDIA, AMD and many others.”

The demand side is real and very concentrated. That explains the backlog spike, but it also means delivery and timing for a few mega customers will drive conversion.

On multicloud database momentum:

“Multi-cloud database revenue […] grew 1,529% in Q1… [We have] 34 multi-cloud data centers now live […] and we will deliver another 37 for a total of 71.”

Database is the distribution engine. Embedding Oracle inside AWS, Azure, and Google Cloud broadens reach and shortens time-to-value for enterprise migrations.

On the CapEx model (asset-light bias):

“We do not own the property […] What we do own […] is the equipment […] we put in that equipment only when it's time [and are] already generating revenue right away […] I don't want to call it asset-light […] but it's asset pretty light.”

The model tilts toward rapid turns from CapEx to revenue, giving strong visibility and financial manoeuvrability.

Chairman and CTO Larry Ellison

On inferencing vs. training

“The AI inferencing market will be much, much larger than the AI training market.”

If Oracle’s bet on enterprise inferencing lands, mix should tilt toward higher-frequency, data-adjacent workloads, supportive for margins over time.

On the core cost/performance moat:

“Our networks move data very, very fast […] if we're twice as fast, we're half the cost.”

The pitch is simple: faster clusters lead to lower unit economics for customers. That’s the competitive wedge in GPU-heavy deals.

On the AI database & vectorization:

“With the introduction of our new AI database […] you can vectorize [all your data] and […] directly connect [...] to […] ChatGPT, Gemini, Grok, Llama […] uniquely available in the Oracle Cloud.”

Tying private enterprise data to top-tier models, without losing custody, is the stickiness play for Oracle’s database franchise.

On ‘Butterfly’ private cloud:

“We have gotten the entire Oracle Cloud, the whole thing, every feature, […] into […] 3 racks, we call it Butterfly. That costs $6 million.”

A full-feature private region at a relatively low entry ticket expands the addressable market for regulated and sovereignty-sensitive workloads.

4. What to watch moving forward

The headlines are euphoric, so the checklist should be sober.

From here, the story is less about new deals and more about conversion. How quickly can Oracle turn backlog into revenue and cash?

Can the cash keep up with Capex? Oracle is front-loading spend and burning cash near term as capex rises. The tell will be free cash flow inflecting as new data-center capacity comes online and billing starts. Heavier leverage and steady dividends mean less wiggle room than Big Tech peers, so pace matters.

Will they hit the target? Treat the five-year OCI ramp as a scoreboard. Now that the new forecast (with Stargate) is official, the downside risk is real. Utilization of new regions is the quiet metric that makes the math work. But to be clear, management appears confident that there are many more deals on the way.

How long will this cycle last? Execution now is about power, GPUs, and the cadence of embedded regions with AWS, Azure, and Google. If enterprise AI demand cools, conversion slows, and Oracle doesn’t have the same cash cushion as larger peers. The relative “asset light” approach helps soften the potential challenges.

What if the mega-customers flinch? A few massive customers (Stargate/OpenAI, xAI, and a handful of Mag7) are carrying outsized weight. Any slip in milestones, power timelines, or contract terms would delay revenue.

Bottom line: Like NVIDIA, Oracle is plugged directly into Big Tech’s arms race. Oracle is now a CapEx beneficiary, not a discretionary vendor. As long as the AI build-out lasts, OCI’s runway for exceptional growth stays open.

📊 Want to see how AMD and NVIDIA recently performed? Check out our latest monthly Earnings Visuals report.

That's it for today.

Happy investing!

Want to sponsor this newsletter? Get in touch here.

Disclosure: I own AMD, AMZN, GOOG, META, and NVDA in App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.